We may have seen the last of the rises - but are we going to see the start of the falls? Unemployment has likely stopped going up. However, it could be too much to hope it's now starting to go down. Not yet. Although, you never know...

Labour market figures for the December 2025 quarter due to be released next Wednesday, February 4, come at quite a psychologically important moment.

At a time when we are looking for the economy to start to pick up any 'good news' in the unemployment data would help to give confidence and to get people out spending, and therefore help to lift the economy. It's the old, good news leading to better news thing.

The reverse of that of course would be if the labour market figures are not so good, and what impact that could have on a still very fragile economic recovery.

So, where are we with this, and what's expected?

Well, first just a quick bit of recent history.

Going back to the pandemic times our unemployment virtually disappeared. The border closures meant businesses couldn't bring in labour from overseas, so every NZ-domiciled human resource possible was vacuumed up, even anecdotally a fair few people who were not in the workforce, didn't need to be in the workforce, but were dragged in as a favour.

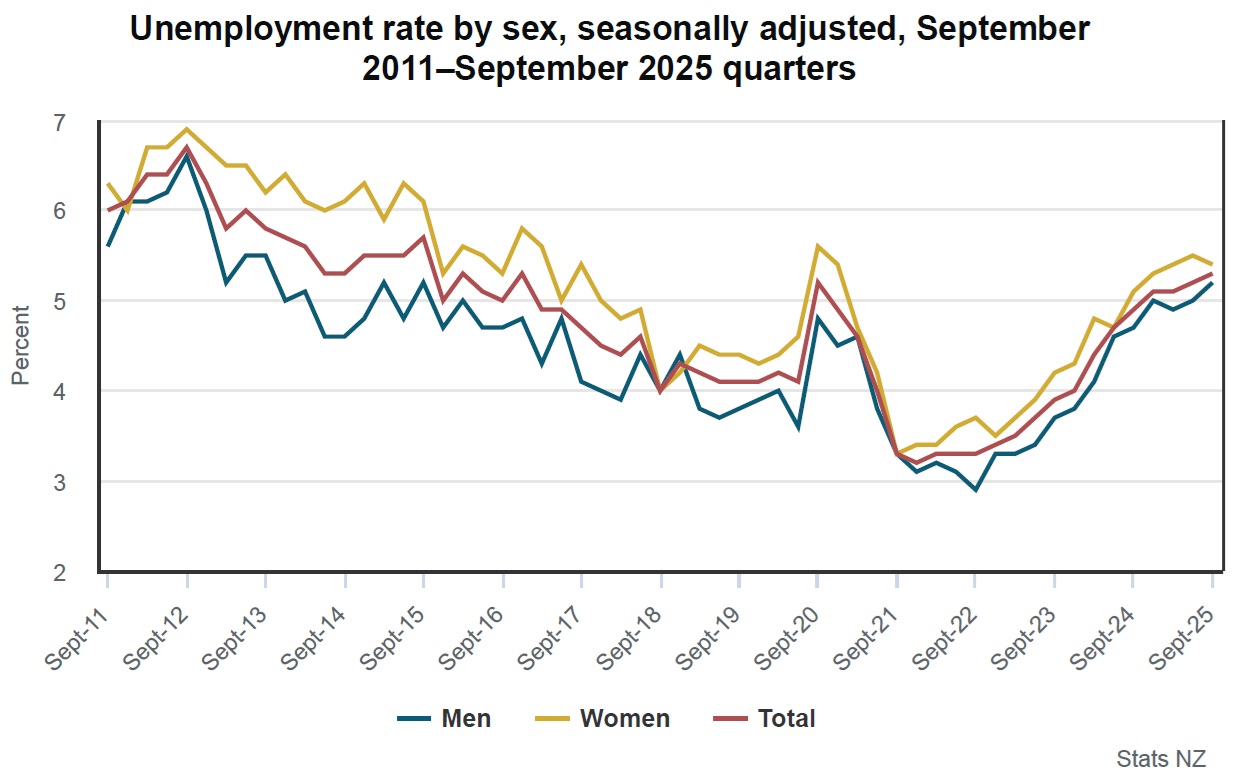

The upshot was that our unemployment rate bottomed out at just 3.2% in the December 2021 quarter, rose very slightly to 3.4% by December 2022, rose a little more - to 4.0% by December 2023, then rose quite quickly to 5.1% by December 2024.

And so, 2025 to date? Well, the March quarter figure was steady at 5.1%. However, in the June quarter the unemployment rate rose to 5.2% and then in the September quarter it reached the highest level in nearly nine years, at 5.3%.

The Reserve Bank is not offering too much encouragement. In its latest forecasts made in November 2025 it forecast the unemployment rate would stay 5.3% for the December quarter AND stay the same again in the March 2026 quarter before reducing slowly to 5.2% in the June 2026 quarter, 5.1% in the September quarter and ending 2026 at 5.0%. The rate is seen further declining to 4.5% by the end of 2027.

That's a pretty slow recovery.

The rise in the unemployment rate has of course been prompted by the RBNZ-caused recession stemming from the sharp rise in interest rates between late 2021 and mid-2023 as our central bank looked to rein in spending and reduce heat in the economy (heat which in some part was being generated by a then very tight jobs market). Eventually this led to reduced spending and inflation did come back down from a high of 7.3% in mid 2021 to within the targeted 1% to 3% range - though as we well know it has now once again headed north of 3%.

As is said often, the labour market figures are a 'lagging indicator'. The labour market tends to be at its most down point just as the economy is actually reviving. And obviously we are hoping that's what we are seeing at the moment. So, the labour market figures are an indicator of what HAS been happening in the economy rather than what will.

If we talk briefly about the economy, Stats NZ figures for the September quarter showed a 1.1% quarterly rise in GDP, after a revised 1.0% fall in June. I would say both those figures are over stated and ultimately we will see the 1.0% June fall revised up, while the September rise will be revised down.

Expanding again

But clearly the economy did start to grow again in September. Now some more recent data is backing that up. In the past year the BNZ – BusinessNZ Performance of Services Index (PSI) and BNZ –BusinessNZ Performance of Manufacturing Index (PMI) have both been good indicators of where the economy is going - and in a much more timely fashion than our GDP figures.

The December results for both of those indexes were much stronger and in fact the PSI broke 21 months of consecutive falls, remembering that the services sector accounts for roughly two-thirds of GDP.

All things being equal, this should see more jobs available, though life is seldom so simple. The RBNZ noted on several occasions during its recent interest rate hiking cycle that after the experience of the pandemic staff shortages a fair few employers had been 'hoarding' staff and it appeared were reluctant to let them go even as financial performance of the business perhaps suggested this should be done.

What that means of course is that improved economic performance will not necessarily immediately lead to more jobs - that lagging thing again.

Signs that more jobs are opening up are there though. Latest Statistics NZ Monthly Employment Indicators (MEI) figures were officially described as 'flat' (IE 0.0%) for December, although there was a very small fall in the numbers. This was largely expected. What was not expected was a very sharp upward revision to the November figures. The recent history of this data is that the figures are almost always revised DOWN after the initial month in which they are released.

However the November figures, which had first come in showing a strongish 0.3% growth in jobs were revised UP to a 0.5% growth - the strongest monthly figure since April 2023.

Oh, go away, inflation

A potential spanner in all these works is inflation. After the release on Friday, January 23, of figures showing annual Consumers Price Index (CPI) inflation rising to 3.1%, the financial markets have been quick to bring forward the time they expect rate hikes to start again. At time of writing a 25 basis point rise in the OCR from its current level of 2.25% is fully priced in for September of this year.

So, okay, given all this, what are the major bank economists saying about the labour market figures on Wednesday, and the potential ramifications?

Most of the few picks I had seen at time of writing suggested that the unemployment figure would stay at 5.3%.

ASB senior economist Mark Smith, however, thinks not. He's picking a drop to 5.2%.

"We expect the [fourth quarter] labour market data to confirm we have passed the turning point for the labour market," he said.

"Employment is expected to register its strongest growth in around 2 years, although numbers are still more than 30,000 shy of late 2023 peaks. Increases in the working age population and an increase in labour force participation from 5-year lows should generate the first climb in annual labour force growth in more than a year. In combination, this should result in the Q4 unemployment rate actually falling for the first time in four years, although at 5.2% it remains well above the 4-4.5% Goldilocks zone," Smith said.

"Labour cost growth is expected to remain slightly above the midpoint of the 1-3% inflation target band. But, with the demand for labour stirring and spare labour market capacity eroding, conditions are in place that will see a pick-up in wage inflation over 2026. Reducing labour market slack suggests the need to normalise OCR settings. We expect a 25bp hike in December and a 3.0% OCR endpoint, but note the risks are pointing to a larger and more frontloaded pace of OCR hikes.

A peak, but not yet a fall

Westpac senior economist Michael Gordon does believe the unemployment rate has peaked, but doesn't see it dropping yet and has picked the figure to stay at 5.3%.

"We think the unemployment rate is at its peak for this cycle, if not very close to it. As lower interest rates help to drive a pickup in activity over 2026, we expect unemployment to come down as well, albeit not that quickly at first. The September quarter saw a strong lift in hours per worker, and indeed that’s where we’d expect to see the initial response to an economic upturn – employers have scope to get more out of their existing workers, before resorting to new hiring. We’re forecasting the unemployment rate to be only slightly below 5% by the end of this year."

Gordon thinks that given "the unusual volatility" of the GDP figures in recent times, the RBNZ will be looking more to the labour market data to gauge the degree of spare capacity in the economy.

"While next week’s results are unlikely to drive the OCR decision itself at the February MPS – an on-hold decision looks very likely – they will have a bearing on what the RBNZ is prepared to signal in terms of the timing and extent of future rate hikes."

ANZ senior economist Miles Workman is also picking 5.3%.

"Overall, the Q4 labour market data are expected to show that the economy is still operating with a considerable degree of spare capacity, indicating little risk of wage growth becoming a renewed source of CPI inflation pressure any time soon," he said.

"However, despite the unemployment rate holding up in Q4, the details should signal that labour market conditions are gradually improving, with positive employment growth, a stabilisation in the participation rate, and a continued recovery in hours worked. Looking forward, typical lags between economic activity and the unemployment rate suggest the unemployment rate should gradually decline over 2026."

So, there we have it. Things appear to be improving, albeit slowly, in the economy. And whether that improvement will flow through fast enough to the labour market for us to see a drop in the unemployment rate in the data out on Wednesday, well, we shall have to wait and see.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.