Businesses' expectations of inflation have risen sharply in a move that will prompt more serious thinking for the Reserve Bank one day out from its first Official Cash Rate decision of 2026.

The results are now in from all of the latest round of three surveys conducted for the RBNZ that take a reading on expectations of future inflation.

The survey of 'experts' released last week including economists and forecasters showed a disconcerting rise in expectations for inflation across all the timelines surveyed - one-year, two-year, five-year and 10-year.

On Monday there was release of the households' survey, which in some respects was encouraging in that the expectations of inflation had reduced compared with the previous quarter. The downside to that was that households on average thought current inflation was more than double what it is.

For the record annual inflation as measured by the Consumers Price Index (CPI) came in at 3.1% in December. That's above the RBNZ's inflation target range of 1% to 3%.

So, then on Tuesday we had release of the latest quarterly Tara-ā-Umanga Business Expectations Survey. This one's only been running since last year and a lot of effort has gone into it. Clearly over time the RBNZ would want to see this become its main survey for testing the mood of the country regarding inflation.

Given that the survey is still 'new' the RBNZ may or may not be putting a great deal of weight on it yet - but there's no doubt the results from the latest quarter are not encouraging.

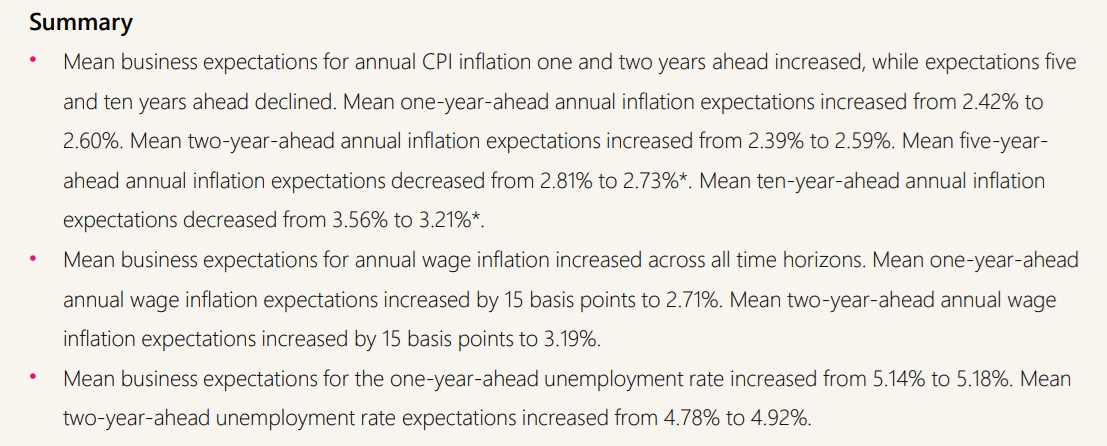

This is the key summary of the results from the business survey as released by the RBNZ:

The RBNZ tends to look most closely at the two-year timeframe, and the latest result is definitely not good, with the (mean) expectations of inflation in two-years' time having blown out from 2.39% in the previous quarter to 2.59% now.

The RBNZ likes to see inflation expectations 'anchored' around 2.0% -since that's actually the specific level of inflation it explicitly targets achieving.

At 2.59%, we could argue that's becoming a bit un-anchored.

Importantly, this result was achieved from a substantial sample size.

RBNZ says the data for this quarter were obtained from 739 businesses by Research New Zealand – Rangahau Aotearoa on behalf of RBNZ. Field work for the March quarter survey was run between January 26 and February 2, 2026 after the results of the December quarter inflation were known.

With Selected Price Indexes data released earlier on Tuesday by Stats NZ showing that January had the biggest monthly food price rise in four years, there's plenty for the RBNZ's Monetary Policy Committee to discuss on Wednesday.

It's universally expected that the OCR will be left unchanged at 2.25%, but the committee will definitely be concerned about the way in which inflation expectations are on the rise again, since potentially this could fuel a further wave of inflation later in the year, which in turn could force the RBNZ to raise the OCR once more, earlier than it might want.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.