By Jenée Tibshraeny

In the lead up to last week’s Official Cash Rate (OCR) cut I wrote a piece noting how the Reserve Bank (RBNZ) using its tools to stimulate the economy would put pressure on the Government to do its bit.

I said that while RBNZ Governor Adrian Orr is known to sport an undone top button, Finance Minister Grant Robertson would be the one getting a bit hot around the collar.

Given the RBNZ doubled-down and cut the OCR by twice as much as expected, Robertson may need to undo two buttons.

Orr’s message was explicit: “Wake up and go and spend.”

Yet with households already heavily indebted, playing their parts to prop up New Zealand’s $1.1 trillion housing stock, his message was more urgently directed towards businesses and government.

Govt spending plans won't have stimulatory effect

There’s been much debate over whether the Government should be doing more to get Shane Jones’ “nephs” off the couch, so it can borrow more to ramp up infrastructure investment.

There’s also been discussion around whether creating a lower tax-free income tax threshold and/or spending more on welfare could be ways to put more money in the pockets of those who are most likely to spent every extra dollar they get.

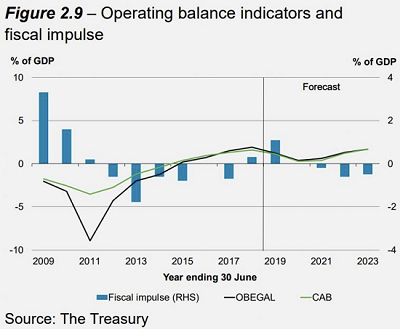

While the Government allocated more money towards new initiatives in Budget 2019 than it previously planned, Treasury’s fiscal impulse shows that from 2020 government spending will have a relatively contractionary impact on aggregate demand.

Orr told TVNZ’s Q + A on Monday he wanted the Government to “keep going on its planned expenditure”.

He said he’d be “watching closely to see whether the impulse is coming through” and was “comfortable” knowing the Government’s aware there’s “no electric fence” at the point net Crown debt hits the 20% of GDP mark.

Robertson is under pressure to create the capacity and capability to spend more… all the while spending wisely, particularly in the face of the criticism that Labour governments are bad with money.

Business investment muted since the GFC

Yet he is equally under the pump to pull businesses out of doldrums so they open their wallets.

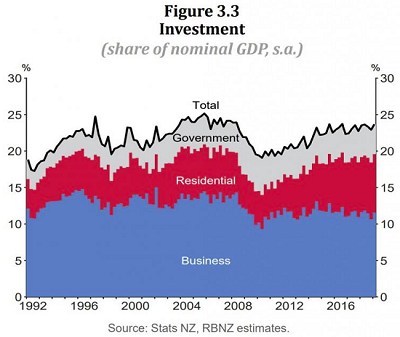

This graph from the RBNZ’s latest quarterly Monetary Policy Statement shows how business investment has failed to rebound since the 2008 global financial crisis.

The RBNZ noted: “Business investment has been weaker than capacity pressure in the economy would suggest.”

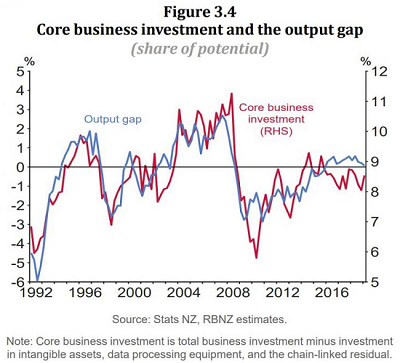

This graph shows that while demand over the last few years has been high compared to what firms are capable of producing (IE the output gap is above zero), business investment has been unusually low.

The RBNZ attributed this to scenario to "elevated global uncertainty", slower domestic GDP growth since 2016, and a move since the mid-1990s towards more services production, which is generally less capital intensive than manufacturing.

“We expect business investment to increase over the projection period as capacity pressure builds. However, this increase may be tempered by structural shifts and elevated global uncertainty," the RBNZ said.

"Total investment is expected to be supported by strong construction activity.”

Robertson talking to businesses ‘all the time’

So firms weren’t investing during a low interest rate environment when business bigshot John Key was at the helm of the country.

Will they invest when the cost of borrowing is even lower but confidence is rock bottom?

Robertson should be worried about low confidence - that “elephant in the room” Prime Minister Jacinda Ardern spoke of in one of her first formal addresses to the business community in February 2018 - becoming more destructive.

Asked by interest.co.nz what he was doing to help businesses perk-up so that OCR cuts are in fact stimulatory, he said:

"We’re talking to the business community all the time about the investment opportunities that are out there.

"We’ve been doing a lot of work around different kinds of funding and financing vehicles for infrastructure investment and we’re making good progress with that…

"We have a reasonably settled framework around industrial relations. We’ve passed some legislation there.

"People are aware we’ve got the business community involved in the various working groups that have been in place…

"They’re working with us in the Future of Work forum around skills and how we lift the opportunities for in-work training, as we are doing with changes in the polytech and industry training sector.

"We are working with them and doing the things we can to build that confidence. You and I have discussed on many occasions the nature of those confidence surveys. The real data we saw shows there is investment going on. That’s how 21,000 more jobs were created in the [June] quarter.

"We’ll keep working with them. We understand there are concerns around certainty with the international environment and policy issues where they’ll differ from us.

"We think the environment’s really good for investing at the moment. We can only back the Governor in what he said on that account."

Good intent needs to result in pragmatic policy that isn't watered down

The “policy issues” concerning businesses, which Robertson mentioned, aren’t minor.

The highly indebted agricultural sector, burdened by Fonterra’s woes, doesn’t’ want to start paying for its emissions.

Banks, their investors and their most high-risk customers (IE farmers and small business owners) are fuming over the RBNZ’s proposal to make them hold more capital.

The new oil and gas exploration ban is putting the security of New Zealand’s energy supply at even greater risk, while giving the impression the Government is willing to rip the rug out from beneath a sector.

Minimum wage hikes are adding to businesses’ cost pressures.

Measures introduced to curb rampant house price growth are making consumers feel poorer and are reducing business owners’ abilities to leverage off their houses.

The intentions behind these policy changes are good, even though those still being consulted on need refining. Key even admitted in July last year that his government’s recipe for growth (population and house price growth) needed replacing.

The Government and the RBNZ are right in taking an intergenerational approach to make some structural changes.

The price of carbon emissions needs to rise to a point where businesses are incentivised to invest in research and technology to clean up their processes.

The Aussie banks have fat enough margins to build larger buffers for a rainy day.

High housing costs mean low wage workers are struggling to get by so need a hand.

Closing off our housing market to overseas investors while we try to plug a shortage, and curbing speculation, are sensible moves.

The risk the Coalition Government faces, particularly when it comes to thing likes Emissions Trading Scheme and Resource Management Act reform and the Zero Carbon Bill, is that its policies end up being watered down to please all parties to the point they're rendered ineffective.

It's vital good intentions translate into evidence-based policy.

Certainty key

Change comes at a cost and creates uncertainty, so needs to be justified.

While the Government’s ability to control those costs might be limited, it can smooth out the bumps. This is where it’s falling short.

It's refusing to wade into contentious political territory and create a population strategy. It's changing policies to match migrants with regionalised skills shortages and clamping down on dodgy education providers, but won't talk numbers - despite the capacity constraints the economy is grappling with.

On the transport front, it’s scrapping new road developments the previous government got in motion.

It spoke out in support of extending the taxation of capital, commissioned a tax working group, then completely pulled the pin and has since shown signs of being too scared to go anywhere near tax reform.

The Government’s move to put a lid on oil and gas exploration without consultation and against officials’ advice, was the ultimate kick in the shins.

And further to campaigning hard on addressing the housing crisis, we have a new Housing Minister trying to get her head around the issues and are still waiting to hear what the housing “reset” will look like.

Businesses can deal with change, even if they don't like it. They just need to know what’s coming.

As the waters get stormy, the country needs an even-keeled government.

However as the election approaches, and Labour, NZ First and the Greens start pinning their colours to the mast while eyeing the rudder of the ship, businesses might not get the steadiness they need to follow Captain Orr’s orders and spend.

35 Comments

"So firms weren’t investing during a low interest rate environment when business bigshot John Key was at the helm of the country".

yeah the great financial wizard oversaw all of that bank credit was being pumped into housing- and not the productive sector. Outcome was entirely predictable....and yet the key supporters will stick it to Robertson.

The legacy of a banksters prime minister becoming more evident by the day.

John Key was all about short-termism. I don't think he had any interest in the long-term economic health of the country, he just wanted an easy ride off the back of a credit bubble and the resultant asset inflation. He knew exactly when it was time to flee the sinking ship too.

John Key was all about short-termism. I don't think he had any interest in the long-term economic health of the country, he just wanted an easy ride off the back of a credit bubble and the resultant asset inflation. He knew exactly when it was time to flee the sinking ship too.

In JK's defensse, he did what worked for him in his pre-political career: satisfy his stakeholders. Most people would do the same I suspect. OTOH, he is no great visionary.

He may have to weather the storm as chair of ANZ, unless he jumps ship there too before it really hits. Being a successful market guy for decades, I’m pretty damn sure he knew a bubble was brewing under his watch.

John Key just carried on what HC was doing: Keep house prices high so people feel rich and keep spending money they don't have. For the most part it worked. The problem is we are a tiny pebble in a massive stream - we are too small to control our own destiny and even if there was political will, there's an increasingly ideological public sector and entrenched opposition-for-opposition's-sake that has spread to all parties that makes meaningful change impossible.

Look at the asset selldowns, Kiwibuild, NZTA infrastructure delivery; all bogged down in cynical opportunism. We've forgotten how to be responsive and adapt because we haven't had to be responsive or adapt for yonks.

Then what happened GV, was that house price inflation continued to the point where a significant chunk of people feel very poor. Young people are really in a financial jam now like we have not seen previously.

They've been thrown under the bus basically. Look at what they face; sky-high house prices or rent, student loans garnishing 12% of their pre-tax income, increasing cost burden associated with boomer super / health costs and the infrastructure deficit and largely stagnant wages thanks to our 'low wage' economy and love affair with importing cheap immigrant labour.

"B-b-b-b-but in my day we had fiffffteeeen percent interest rates"

He was a quarterly bottom line oriented PM.

That is why when he knew the next quarter would not be good, he quit.

"As the waters get stormy, the country needs an even-keeled government. However as the election approaches, and Labour, NZ First and the Greens start pinning their colours to the mast while eyeing the rudder of the ship, businesses might not get the steadiness they need to follow Captain Orr’s orders and spend."

Lovely tide of Maritime Metaphors there, Jenée.

The issue really is, to continue the flow, that wrenching the rudder to and fro in the face of a stiff head-wind will, as any experienced small-boat sailor will confirm, simply result in the vessel lying, stalled, head-to-wind, sails flapping uselessly, and making negative speed over ground. Possibly towards the sound of surf on the approaching lee shore....

And that rudder-wrenching is exactly what we are seeing:

- Roading $ diverted to Future Trams in Awkland and cycleways in Wellington even as congestion mounts in the former and PT fails yet again in the latter

- O&G goneburger, yet zero plans for the future LNG import needed, and the prospect of stranded assets between 'Naki and Awkland

- A distinct animus towards Farmers and Small Business - 'if they cannot weather the storm we're complicit in summoning, let 'em founder on the Rocks' is the mantra.

- A Feelz-based measurement (Well-being) taking precedence over tested (if admittedly incomplete) measures like GDP - bathwater tipped out - whoops, where's Baby?

- An activist RBNZ Guv'nor - urging Gubmint to Do Something, urging Banks to Hold Mo' Capital without much evidence but plenty of Feelz, guided by an MPC with an academic, a unionista and a nonentity as members.

Not much chance of Certainty (of any positive kind - after O&G, what's next?) outta this sorry crew...

Quick question: SH16 has expanded to fill the entire corridor in West Auckland, there's no more room for more lanes and the lanes can't move enough traffic per hour to keep up. How is MOAR ROADZ logic going to work here without reverting to double-decking the entire North-Western? Could the congestion that doesn't go away no matter how many lanes you add and lack of rapid transit be related?

Hey, I'm only a Lowly Cabin-boy. Go ask the Cap'n.....

Roger the cabin boy?

All of that but while we are all at sea may as well consider the state of the two commercial flag ships, dreadnoughts if you like. Fonterra & Fletchers. Here we have the spectacle of government created dominance of the seas, self indulged party in the splendid wardroom, nobody on the bridge, rusty hull, engines and running gear rundown and unreliable, crew unpaid, unhappy, rats jumping.How many years in a leaky boat, was it?

“Even keeled and evidence based" needed because "….business investment has failed to rebound since the 2008 global financial crisis..”.

Thanks to audaxes for this link https://professorwerner.org/blog/ to Prof Werner’s analysis showing central bank interest rate reduction does not stimulate productive investment and why. For a concise and informative video of the same see here https://www.youtube.com/watch?v=EvXROXiIpvQ.

It's simpler than that and traces back a lot further than 2008. Accumulating "wealth" and spending in the economy, ie the flow of energy, are competing interests. It's why credit/debt has taken over, money isn't flowing freely through the economy.

There's a number of factors why but mostly it comes down to human emotions and nature vs nurture.

It doesn't help that we've squandered our energy on baubles and trinkets for the sake of status.

Interest rates in NZ are low only for businesses that have assets to pledge as collateral against loans. However, these businesses also tend to have monopolistic positions in their respective industries, therefore there's not enough return on additional investment or innovation for them.

NZ doesn't have the well-functioning capital markets for smaller, asset-poor businesses to raise money; our VC/angel ecosystem is too marginal and risk-averse in NZ.

Our tax system barely favours capital investment and innovation in the name of simplicity. We prefer keeping our top position on the "Ease of Doing Business" index at the expense of R&D, business investment and innovation.

It would be interesting to see how many SME's are funded through leveraging the family home. A large % I would guess.

"The Government’s move to put a lid on oil and gas exploration without consultation and against officials’ advice, was the ultimate kick in the shins".

This was the defining moment when business confidence turned. It wasnt the stopping of oil and gas exploration it was the way she did it. If she can do this with no consultation or future plan for the region then businesses wonder what else will she implement on a whim.

I'm no fan of any party but for the 2020 election lets M.A.G.A (Make Ardern Go Away).

Or it could have been when they cut the East West Link because the business case didn't make sense. Whereas under the previous government the businesses out there who would benefit from it were going to get it despite the business case. She's just not giving enough favour to the right people!

She doesn’t need to give favours she just needs to stop giving surprises to the right people.

This graph from the RBNZ’s latest quarterly Monetary Policy Statement shows how business investment has failed to rebound since the 2008 global financial crisis.

Hmmm... The graph is self explanatory: fiscal expansion funded by government bond issuance is likely to crowd out private demand, especially when there is no low RWA collateral such as residential property to lend against.

Furthermore, isn't the majority of bank credit creation in NZ not even used for transactions that contribute to and are part of GDP, but instead is used for asset transactions? They are not part of GDP, since national income accountants require a ‘value added’ for inclusion in GDP, not just the shifting of ownership rights from one person to another. - credit Richard Werner.

This present Gov't will do too little, too late and most likely fail at anything & eveything they set out to do if their track record is anything to go by.

Labour, the Greens and NZF don't have the nous to lead in the current enviroment.

Hang onto your steak and cheese, this is about to go Sth fast.

The injustice and inequality of NZ's society today can be summed up in just two words "Sir Key". Even Putin has not endowed himself with such a title.

You give the man too much credit.

Credit?

Well, now there's a financial instrument you could pin the blame on.

Even at low interest rates Jenee there is still the millstone of the debt. It can lock you in a vise even at low rates.

Why would anyone borrow and invest , when we have a TAX-AND-SPEND Government in office ?

There is enough risk in just investing , growing , expanding or acquiring machinery or equipment , without a Government that intensely dislikes and mistrusts business sitting like a snake in its hole ready to strike as soon as you show a small profit

These comments have the depth of a fine skillet.

Exactly the implement to fry a Flounder - the requisite adjective for this Gubmint in its Year of Delivery...

Unlike the previous government whose mantra was "BORROW-AND-SPEND"?

One is self funded. One sets up future liabilities. I assume if you are a great supporter, you buy heaps of day to day stuff on credit cards because you cut your income for no real reason? And then force the kids into rent servitude and blame them for the position they are in?

This is basically what the last government did (cut taxes for high earners, dramatically increased living costs for the poor forcing them to endure serious hardship, ensured owners of assets were wealthy, while borrowing $70b just to pay the bills).

Er, banks make most profits and government is not taxing them more, just trying to get them to have enough reserves so taxpayer does not get bailed in. Poor old business and wealth holders, had such a hard time since 1987 in NZ ain't they??

NZ businesses investing to increase productivity...far out that could be a stand up comedy act right there...its easier to be like Comvita and allow all your contractors to resort to human trafficking and slavery to boost productivity than it is to develop and patent and get rich off producing fruit picking robots...

I do appreciate the nautical flavour of the article. A brief cast for related memes hauls in a rich catch:.

- The O&G Captain's Call - more of an Accidental Gybe

- The fate of the 'Naki as a consequence - slowly being keel-hauled

- The state of the Good Ship Godzone: wallowing in the trough, in danger of broaching-to

- The general competence of the crew: Ship of Fools

Excellent article and points.

Business did not invest enough because chased wage cuts instead.

Business failure to invest has bene around as an issue for Western societies since mid 1970s. Leads to poor productivity. Japan and Germany soared because their business sector DID invest heavily in innovation.

Government and Treasury are pitifully conservative. Rock bottom interest rates and they STILL will not borrow despite fact that pension funds are desperate for a good safe return.

Luckily this piece is listed as 'opinion'.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.