Summary of key points: -

- Change to forward interest rate pricing sparks Kiwi dollar depreciation

- NZD downward correction still has further to run

- Supply side forces in all markets dominates price direction

Change to forward interest rate pricing sparks Kiwi dollar depreciation

It required an unexpected event or development to act as a catalyst to break the Kiwi dollar out of its shackled 0.7100 to 0.7300 trading range against the US dollar. Once previous key support levels for the Kiwi dollar at 0.7100 and 0.7050 caved-in, the currency sunk rapidly to 0.6955.

You never know in advance just where such tiebreakers will come from, and in the case of the Kiwi dollar it came from an unexpected source.

The bold and unanticipated decision by the New Zealand Government last week to suddenly change the tax rules on residential property investment sparked heavy selling of the NZ dollar in the FX markets.

The instantaneous market reaction to sell the Kiwi was due to the local interest rate market effectively removing the pricing-in of OCR interest rate increases in 2022.

The prospect of New Zealand’s monetary stimulus being unwound ahead of Australia and the US in 2022 was a Kiwi dollar positive that was dramatically eliminated overnight. The view being that a weaker housing market and potentially weaker economy from the Government’s draconian tax change would reduce the probability of the RBNZ increasing interest rates next year.

A secondary factor playing into the Kiwi dollar sell-off was the negative messaging delivered to existing and potentially new foreign investors into New Zealand businesses and assets.

The fact that the NZ government can change property investment rules overnight without warning, just signals to the rest of the world that they cannot be trusted and could suddenly change the law/regulations in other business, trade and investment areas.

New Zealand’s hard-earned reputation as a safe, consistent and stable investment destination with low Government interference and intervention just took a body blow.

The counterargument from Finance Minister, Grant Robertson is that New Zealand needs to shift investment dollars away from unproductive buying and selling existing houses with each other, to other industries and businesses to help grow the economy.

Unfortunately, middle New Zealanders with one or two rental investment properties to provide stable income in their retirement are highly unlikely to invest their money in technology start-ups, an investment asset class they know nothing about.

However, do not be surprised to see a proliferation of industrial and commercial property investment syndicates being offered where tax deductibility of interest costs is still allowed to provide acceptable returns to Mum and Dad investors.

NZD downward correction still has further to run

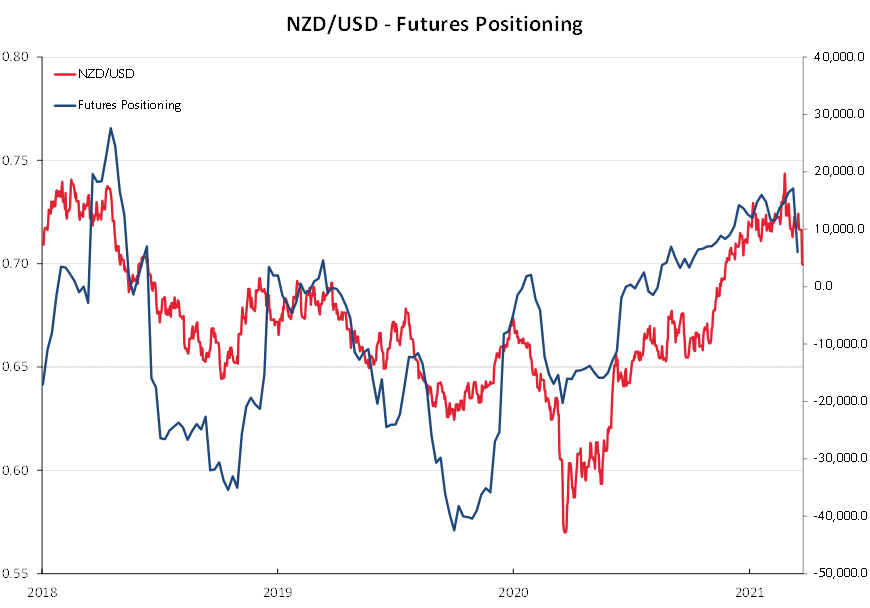

Over recent months we have highlighted speculative market positioning in the Kiwi dollar as a likely source of NZ dollar selling pressure once the currency punters had a reason to unwind their long-NZD positions (becoming NZD sellers in the process).

The amount of long-NZD positions in US futures markets had started to reduce before the Government’s tax bombshell last week, however the impetus to sell certainly took hold afterwards with open long-NZD contracts tumbling from 17,000 to 5,000 over the week.

We have also recently highlighted the dominance of EUR/USD movements determining the short to medium term NZD/USD rate direction.

Superior US economic performance over a Covid-restricted European economy and much higher US long-term interest rates were cited as reasons why capital funds would move out of the Euro into the USD and push the EUR/USD exchange rate below $1.2000. That scenario is playing out as expected, with the USD gains to below $1.1800 and it appears on track to reach the $1.1500/1.1600 target.

The currency markets will be looking ahead to the US Non-Farm Payrolls jobs numbers for the month of March being released next Saturday morning, 3 April for the next signal to prefer the USD over the Euro. The increase in new jobs is forecast to be 650,000, a number above that will be USD positive.

After a 2½ cent sell-off from 0.7200 to 0.6950 last week, it was no great surprise to see the Kiwi dollar bounce back up to 0.7000 in late Friday trading. On the basis of the USD continuing to strengthen to $1.1500 against the Euro over coming weeks/months, the NZD/USD pullback we are now witnessing still has further to go. However, the NZD/USD exchange rate in the 0.6800’s and 0.6900’s has entered the hedging zone for local USD exporters who have refrained from locking-in hedges above 0.7000.

Whilst the USD itself is now in a major corrective strengthening phase, the longer-term view looking ahead into 2022 is for the USD to return to its weaker trend due to high Government budget deficits and massive Government debt levels. The Biden administration raising corporate tax rates will not help business investment and US economic performance in the longer run either. Our longer-term currency forecasts have the NZD/USD exchange rate returning to the 0.7000 to 0.7500 range in 2022.

Supply side forces in all markets dominates price direction

The supply side part of the supply/demand equation that determines price direction in all markets and economies is unquestionably the prominent influence currently: -

- Massive dislocation to the supply chain of goods with global shipping already reeling from Covid shocks and now the Suez Canal blocked and US$10 billion a day of trade disrupted/delayed. Increases in consumer goods prices are inevitable.

- Supply lines for energy and commodities are also stretched. LNG prices spike higher as transport ships cannot get through the Suez. Our forestry log exporters are enjoying the highest prices in years as Russian and European supplied logs into the Chinese market are reduced. Worries of milk powder supply volumes were behind the recent jump in dairy commodity prices.

- The supply of land to build houses on New Zealand’s city fringes is artificially restricted by Council zoning and RMA red tape. The net result is house prices completely out of whack with income levels. The solution to the problem is not to deal to the demand side as the Government did this last week, but to address the supply roadblocks.

- The supply side has always been the cause of higher (or lower) inflation in New Zealand, consider oil prices, local government rates, rent levels, building materials, technology, health costs etc.

- Increases in the money supply with massive QE monetary stimulus and money printing has collapsed interest rates to zero and debased currency values (e.g. the USD weakness over the second half of 2020).

- Huge increases in US Government debt to be issued (supplied) to the market over coming years is already having a significant price response with US 10-year Treasury bond yields increasing to 1.60%. Will there be sufficient demand from bond investors to stop further yield increases? Maybe the yield return has to be closer to 3.0% for that to occur?

Recognising and forecasting changes in supply will continue to be more advantageous in predicting future price changes than analysing the demand side.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

I wonder if foreign investors also backed off from UK when they phased out the same tax advantage for buy-to-let investors

These comments are starting to annoy me - the UK implementation of tax deductibility is not the same as the NZ one. The UK still has interest deductibility- interest is deducted using the lower baseline tax rate of 20% and the higher tax rates of 40% and 45% can no longer be used- so effectively 20% of interest can still be deducted. The equivalent in NZ would be using the 17.5% tax rate isntead of the current 33% and effective as of next week the 39% rate. However NZ is not proposing that they are removing the interest deductibility full stop. This is a big difference in policy

When the leader of our country comes with such a strong background in business, such as working in a fish and chip shop and demonstrating pots and pans. Are we really surprised where New Zealand is heading?

I'm done with NZ for now. I cannot trust the govt. to have my money there as you cannot rely on steady common sense business/monetary environment. They absolutely created the latest housing problem with their ridiculous OCR. Such a low OCR effects hardly anything except real estate, it was kiwis buying, not foreigners, and now they put up immediate and draconian off the sleeve bullshit attempt to reverse what THEY caused.

Not for me. My money has gone offshore where I can get stable and reasonable investment returns. Of course the less confidence foriegn investors have the lower the NZD which is good for exports.Good luck.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.