Summary of key points: -

- Second spike higher in the Kiwi dollar likely to follow the pattern of the first

- Speed and strength of US economic recovery surprising everyone

- SPAC investment craze likely to end in tears

- US dollar temporarily decoupled from US bond yields

Second spike higher in the Kiwi dollar likely to follow the pattern of the first

The Kiwi dollar was bid up to a two month high of 0.7270 against the US dollar last week on the back of a weaker USD in global FX markets, rising commodity prices and thus an appreciating Aussie dollar which the NZD continues to closely follow.

However, in a similar trading pattern to the peak of 0.7445 reached on 25 February, the NZ dollar has since promptly reversed direction and dropped a cent to 0.7150 on Friday 30th April.

Following the February spike up the Kiwi dollar depreciated five cents to 0.6950 by the end of March, helped along by the NZ Government’s abrupt changes to taxation on residential investment properties.

Time will tell whether this recent spike higher and reversal in direction will result in a similar outcome for the Kiwi. It was a stronger US dollar that largely caused that five-cent Kiwi dollar depreciation down to 0.6950 during March, and it is shaping up to be repeated if the US dollar returns to its appreciating trend on the back of stronger US economic data and rising long-term US interest rates.

Yet again, the driving force of the NZD/USD exchange rate direction is solely the USD side of the equation.

Against the Euro the US dollar lost ground after the US Federal Reserve on Wednesday 28th April kept their monetary stimulus amounts at exactly the same levels as previous, as was widely anticipated. However, the selling of the USD to above $1.2100 against the Euro following the meeting certainly proved that there were some participants in the currency markets who really believed that Fed was going to hint at tapering back the stimulus and were disappointed when that decision was no forthcoming.

It has been very clear for many months now that the Fed are not going to allow the financial markets to make the same mistake they made with the “taper tantrum” in 2014 when monetary stimulus was unwound too early and caused many problems.

Last week the Fed was never going to hint as to the timing or conditions precedent to start the monetary unwinding process. It is surprising that such expectations existed in the currency markets at this time. However, the financial markets will continue to test the Fed’s resilience on this matter as US economic data continues to improve at a very robust rate with implications for long-term inflation. The EUR/USD rate reversed to $1.2020 on Friday 30th April and appears set to return to the $1.1800 region in traded at in late March.

Speed and strength of US economic recovery surprising everyone

The US economy expanded by 6.40% (quarterly figures annualised) in the March quarter, however the result was not sufficiently above prior expectations and therefore did not result in a stronger US dollar exchange rate following the release.

Whilst consumer/retail spending increased by a spectacular 10.7% over the quarter as Americans got back to work, travel and shopping after all the Covid disruptions to the economy, the overall GDP growth number was impeded by a contraction in inventories.

If there had not been a run-down in inventories, the overall expansion would have been above 9.00%. It is very positive for the rest of 2021 as those inventory levels are built up again and contribute to pushing to GDP growth numbers up.

All other US economic data continues to surprise on the top-side i.e. stronger than what economists forecast and the financial/investment markets expect beforehand.

On Friday 30th April US personal spending data for the month of March was +4.2% (above the 4.1% consensus forecast), the barometer Michigan consumer sentiment gauge for April came in at 88.3 (above the 87.4 expected) and the Chicago manufacturing PMI for April was 72.1 (well above the consensus forecast of 65.3). The US ISM manufacturing survey this coming Tuesday morning is likely to be well above the 65.0 number forecast.

The speed and strength of the US economic recovery over recent months has proven to be far greater than what most expected. Further evidence will be provided on Friday 7th May (Saturday morning 8th May NZT) when the April US Nonfarm Payrolls jobs figures are released. Consensus forecast are for an increase of 880,000, however judging by the strength of all the other economic data do not be surprised that the result is well above that. A stronger US dollar against the Euro to well below $1.2000 and higher US 10-year Treasury Bond yields from the current 1.64% will result from a stronger employment number.

In terms of upcoming New Zealand economic data, this week has the Global Dairy Trade auction for dairy commodities on Wednesday morning and employment data for the March quarter. Employment increased by 0.60% in the December 2020 quarter, however forecasts are for weaker +0.10% change in the March quarter. Businesses across most sectors of the NZ economy just cannot find the skilled workers they want to employ. The expectation is that the NZ economy will be very sluggish over the first half of 2021 and the shortage of skilled labour is the main contributor to that weaker economic performance.

Comparing US economic performance with New Zealand’s performance at this time is a complete miss-match. We are not too far away from this stark contrast being reflected in the respective exchange rate values i.e. a stronger USD against all the major currencies and New Zealand’s flat economy not allowing the Kiwi dollar to hold out against the appreciating USD.

SPAC investment craze likely to end in tears

For the last nine months one of the potential risks we have highlighted that would cause a weaker NZ dollar value is a major correction downwards in US equity markets. When global financial and investment markets switch into a “risk-off” mode, growth and commodity currencies such as the Aussie and Kiwi dollar are sold off.

However, over the last nine months this potential risk has just not happened.

Instead, equity markets have spiralled higher on the US economic recovery, stronger profits in the tech sector and funds moving out of zero yielding bonds into equities.

Such is the confidence of investors that all listed stocks will increase in value, we have seen the emergence of a SPAC’s (special purpose acquisition companies) which raise equity in IPO’s without identifying to the shareholders in advance what assets or businesses they will be investing into.

Readers will see similarities between SPAC’s and the investment companies that were listed on the NZ sharemarket in 1986 and 1987. We all know how that ended up. Investment guru Warren Buffett has weighed into the white-hot SPAC market stating that the current mania will not last forever. According to SPAC Research there are more than 500 blank-cheque deals with US$138 billion of funds seeking target companies to invest into. Seems like a stack of cards waiting for something to topple it over.

US dollar temporarily decoupled from US bond yields

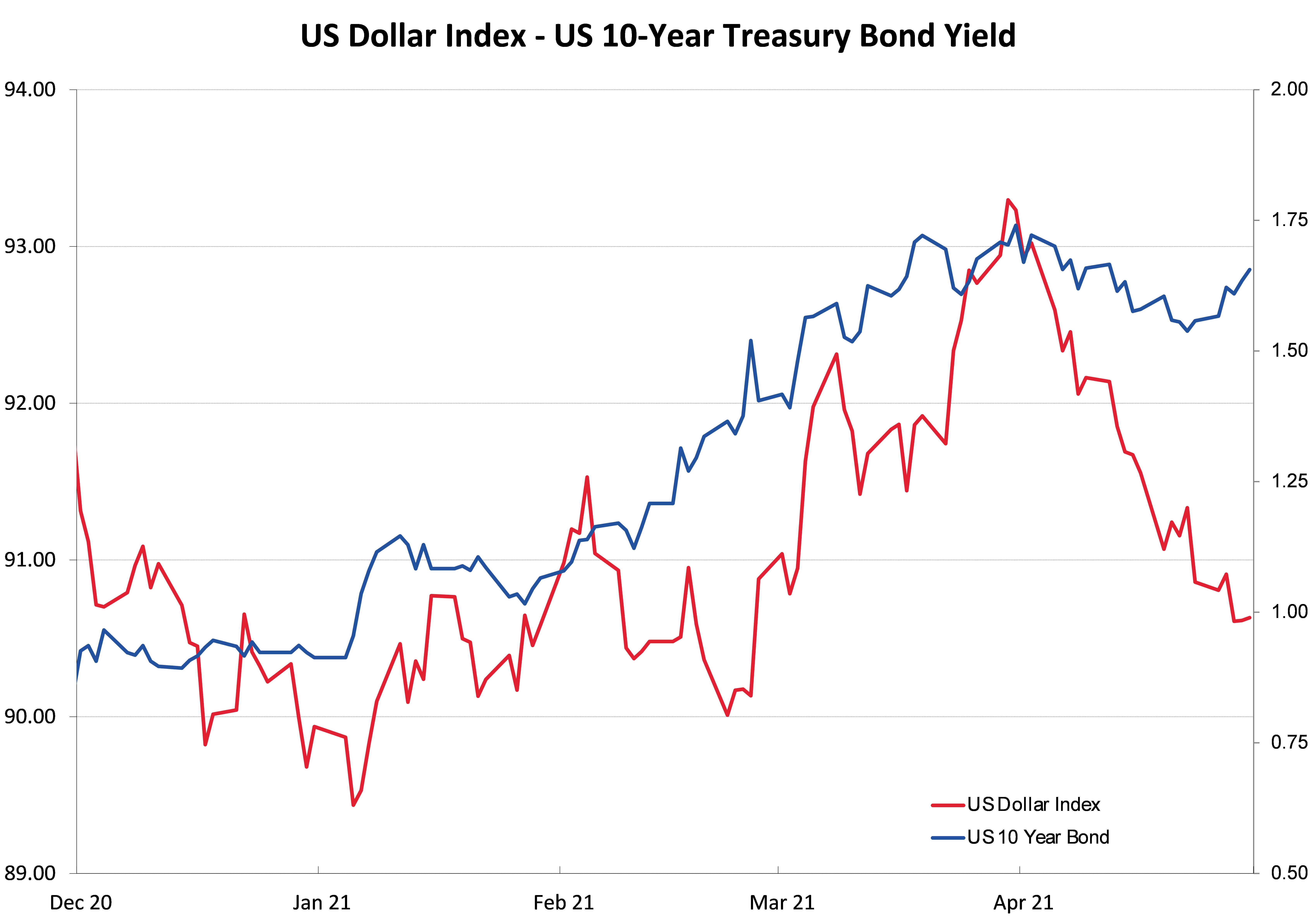

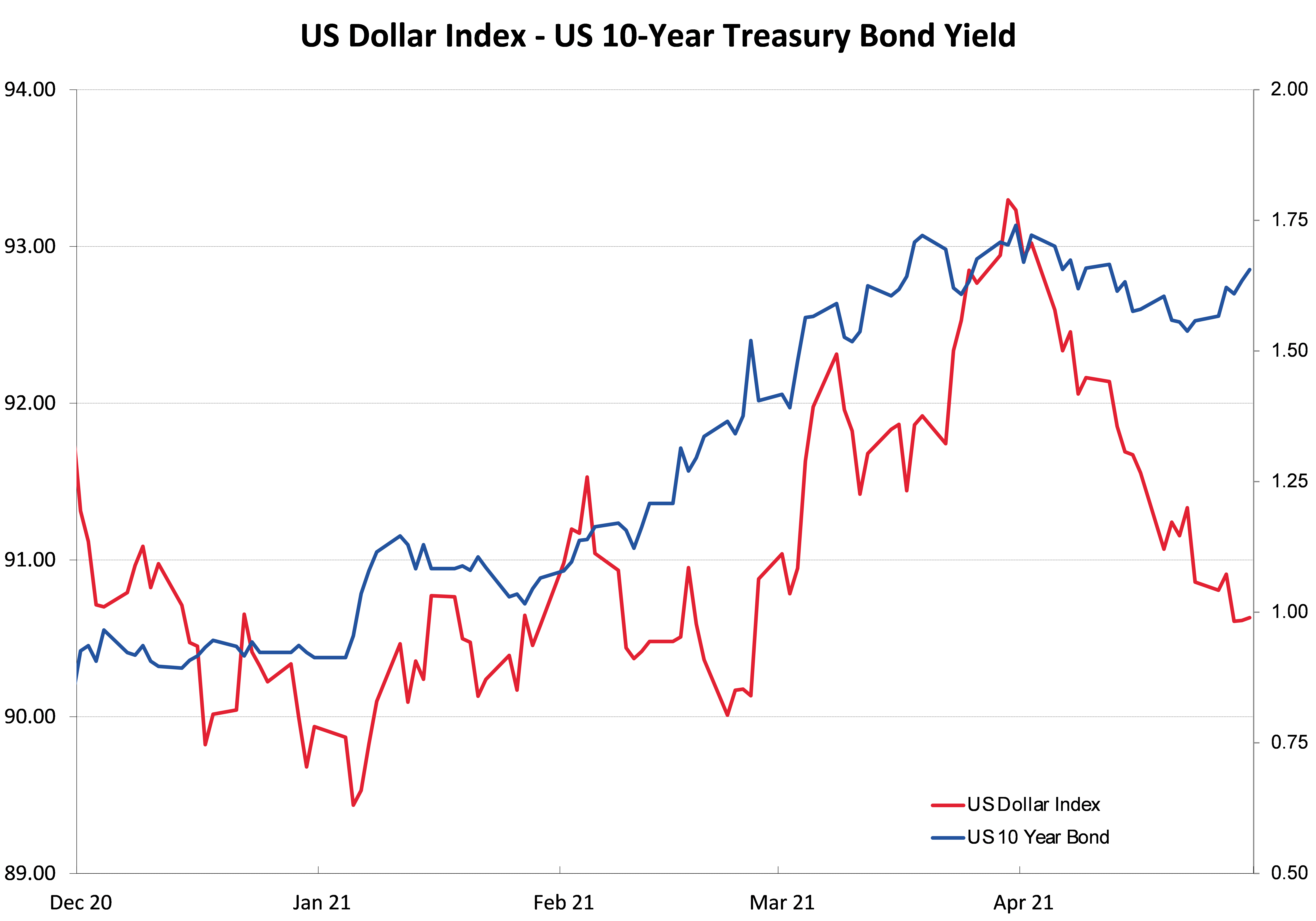

A stand-out feature of currency markets over recent months has been the close correlation between the US dollar value and the US 10-year Treasury Bond yield. Rising bond yields from below 1.00% in January to 1.77% by late March pushed the US dollar Index up from 90.50 to 93.00 (see chart below).

During the month of April the bond yields underwent a correction downwards to 1.55% following the surge higher in yields over the previous three months. Continuing stronger US economic data over recent days has lifted the yields back to 1.64%. However, the correlation has broken down somewhat with the US Dollar Index falling right back to 90.50 last week.

Bond yields are likely to increase further on the US jobs numbers this Friday, therefore the US dollar has a considerable amount of catching up to do over coming weeks. Given that the European economy is now in a double-dip recession, it is difficult to see the Euro attracting global funds when US yields are nearly 2.00% higher.

The risk/reward implications for the NZD/USD from all the above analysis certainly suggests a return to below 0.7000 over coming weeks due to a stronger US dollar against all currencies.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Excellent comments from Roger Kerr. Spot-on!

'It has been very clear for many months now that the Fed are not going to allow the financial markets to make the same mistake they made with the “taper tantrum” in 2014 when monetary stimulus was unwound too early and caused many problems.'

Who made the mistake? The financial markets made the mistake? Selling off is 'a mistake' these days? I have to chuckle at the comment about stimulus being unwound 'too early' and 'causing many problems'. Looks at 2018 when The Fed tried to raise rates & start unwinding its balance sheet, and US equities markets starting tanking as a result. They had to reverse course. (So when is the right time to remove support(?))

What conclusion can we draw from this? Simply that when central banks artificially inflate asset prices using 'stimulus', they are thereafter unable to take away the punchbowl as the artificially inflated bubbles will collapse once the support structure is removed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.