Summary of key points: -

- US economic data is (so far) too inconsistent to produce a stronger US dollar.

- What will not be in Grant Robertsons’s budget (but should be!).

- Medium term FX hedging policies pay off for USD exporters.

US economic data is (so far) too inconsistent to produce a stronger US dollar

The expectation that US economic data would be consistently stronger through the months of March, April and May to produce a stronger US dollar and propel the EUR/USD exchange rate back below $1.2000 again has not materialised as we had anticipated.

There is no question that the US economy is rebounding out of the Covid restrictions at a very robust rate, however the various measures of economic activity have not been consistent in confirming the speed and strength of that recovery.

The up and down nature of US economic data over recent weeks, being a lot weaker than forecast in some cases and a lot stronger than forecast elsewhere, has caused similar topsy turvy price action in the bond market, equity markets, the USD exchange rate index and thus the NZD/USD rate.

Had the economic data rolled out as uniformly strong across the board, the financial and investment markets would be pricing risk with a lot more confidence that it would only be matter of time before the Federal Reserve have to relent and signal an unwinding of their monetary stimulus (tapering of bond buying).

Much stronger than anticipated data in the US such as their April CPI inflation figures released last week did cause immediate market responses in the form higher US bond yields, lower equity markets, US dollar gains and two short-term sell-offs in the NZD/USD rate to the 0.7140 area.

However, subsequent retail sales, industrial production and consumer confidence numbers released on Friday 14th May all proved to be weaker than forecast, resulting in the 10-year US Treasury Bond yields decreasing from 1.68% to 1.63%, equity market rebounding higher and consequentially the NZD/USD rate returning back up to 0.7250.

Whilst the rapid Covid vaccination rate in the US has restored confidence in stronger economic activity, at the grassroots household level there still appears to be some hesitancy with some schools slow to re-open therefore parents slow to return to full time employment and suggestions that the Biden benefit cheques are producing a disincentive to return to work.

The inconsistent pattern that we have witnessed so far is not expected to continue over coming months.

As major public attractions such as Disneyland progressively re-open and Americans travel inter-state for their summer holidays, the pent-up demand from 12 months of restrictions should come through more forcibly in their economic data.

US housing starts for April being released on Wednesday May 19th will be one example of more consistent upbeat economic outcomes, as will the continuing reductions in the weekly Jobless Claims numbers. The volatility in the US economic data at this time is also being caused by the Covid shutdowns over the last 12 months distorting accurate collection of data and measurement of economic activity i.e. normal seasonal adjustments are all over the place.

The outcome of the ongoing debate as to whether the current sizzling increases in inflation in the US will prove to be purely temporary (the Fed label it “transitory”) or more permanent will determine if and when the US dollar strengthens on the Fed delivering a tapering signal.

The argument for the inflation jump being temporary is based around shipping/freight disruptions and related cost increases quickly self-rectifying and oil prices reversing back down.

The evidence from US manufacturers is that shortages of micro-chips and semi-conductors is shaping up to be much more permanent in nature.

At the end of the day, permanent higher inflation is only really caused by consistently higher labour costs and the central bankers in the US, Australia and New Zealand with dual inflation and employment mandates will need to see wages lifting before they unwind monetary stimulus and start the process of increasing interest rates. On current trends, that scenario appears much more likely to occur in the US economy than in Australia and New Zealand.

What will not be in Grant Robertsons’s Budget (but should be!)

Unlike Josh Frydenberg’s Australian budget delivered last week, Finance Minister Grant Robertson’s NZ Government Budget statement this Thursday 20th May will not be expansionary, delivering tax cuts and incentives for stronger business investment.

Instead, expectations of innovative and bold economic policy initiatives to drive growth, business investment and employment from the Ardern labour Government are close to zero.

The Robertson “wellbeing” Budget will be all about re-distributing the pie rather than growing the pie.

Therefore, the implications for the NZ dollar currency value are also zero, as there is absolutely no expectation of anything else but the status- quo for Government economic policy settings.

Looking back on the last 12 months and considering the unique position New Zealand found itself in respect to a Covid-free status, the opportunities to take advantage of our economic fortune, and other nations’ misfortune, have largely been ignored and/or squandered by our Government.

A more proactive and innovatively-thinking Finance Minister would be confirming the following alternative policy prescriptions in his Budget this week to expand the economy and thus deliver the additional tax revenue to reduce ballooning Government debt: -

- A clear plan on the timing and protocols to reopen the borders in order that international investment and trade interactions can happen to stimulate new and increased business investment in New Zealand. Uncertainty continues to hinder new business investment decisions and economic growth will be subpar as a result.

- A clear plan on when and how foreign tourists and foreign students can return to New Zealand to restore the two industries most adversely impacted by the Covid border closures.

- The creation of special economic/business zones with associated financial incentives to attract investment and people into New Zealand so as to diversify the economy and create new employment opportunities. Examples are biotech, computer gaming, health technology, agri-science and film/television.

- Central government led, but private sector delivered major infrastructure, irrigation and housebuilding projects utilising contracted overseas labour resources to get the work done a lot earlier than what constrained local resources can achieve.

- Government support and backing to exciting innovations now taking place in agriculture to move to carbon positive farms, regenerative farming practices and development of new grasses and livestock breeds to reduce methane. Take a look at what Geoff Ross and Tom Sturgess are investing in.

Unfortunately, none of the above list of innovative strategies will feature in the Government’s Budget. On the contrary, it will confirm further steps along the path of central command and control of the economy from Wellington, as we have already seen with education, health and employment collective bargaining.

Medium term FX hedging policies pay off for USD exporters

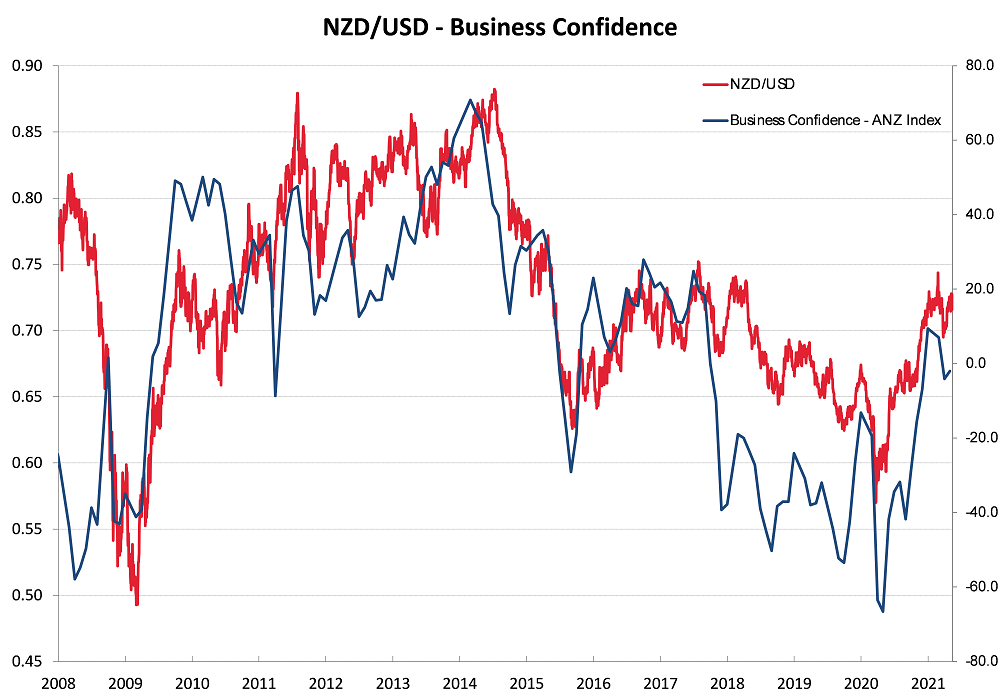

Exporting companies who have consistently employed medium-term FX hedging policies and programmes out to two years forward have seen the benefits over recent months as the Kiwi dollar holds above 0.7000 for longer than expected. Shorter-term hedging horizons do not do the job to protect profit margins and product pricing power when the risk of a 30% NZD appreciation over 12 months (or more accurately a USD depreciation) turns into a reality. Exporters who still have six to 12 months hedging in place at lower NZD/USD exchange rate levels can afford to be patient in entering replacement hedging and/or substituting forward contracts with purchased NZD call options.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

18 Comments

Perhaps there might be candies and freebies taken from one given to another at this week's musical.

... that is what Labour traditionally stand for ... going back to their roots of social welfarism ... we had a fair & open election last year ... the majority went for Robbo to redistribute the " wealth " , rather than to grow the economy .... suck it up , team of 5 million : be kind !

I wonder how many people who mumble and grumble about Labour's social welfarism benefited hugely from past "welfarism" initiatives, but now they're set and sorted it's to hell with everyone else.

It has been that way in NZ for a long time. Law and Rules for everyone else but not for me

There's wild ideological inconsistency here.

When a right-wing Aussie government implements a spending binge and simultaneous tax cuts, it's wise and 'expansionary'. If a Labour government does the same thing, it's foolish profligacy.

When a right-wing Aussie government offers subsidies to chosen industries, it's forward-thinking investment. If a Labour government does the same thing, it's 'picking winners' and 'Muldoonist interference in the market'.

Neo-liberals can't even keep the story straight anymore, because they're wedded to ideas about fiscal rectitude but know that the economy as it exists is cooked without constant injections of 'confidence' and liquidity from public coffers. More debt, more debt, that's what it boils down to, and the inane confidence that productivity will *surely* emerge ab nihilo if we do what the men in suits insist we must.

I like that point that neoliberals "can't keep the story straight anymore". So true and quite comical.

You are confusing tax cuts for R&D with subsidies. There is a big difference between tax cuts for R&D in a broad area where a government wants to encourage activity (which is what Aus is doing with medical and biontech patents) and funnelling funds to favoured companies via subsidies.

A clear plan on how nz health system will cope with opening border's and the inevitable outbreak of virus .

A clear plan on immigration and the international students without a pathway to residency as an incentive to come .

A clear plan on training and incentives to nzers to fill vacancies without needing immigrants.

These plans should be added to the ones above

You are too logical in your thinking for the Labour Govt. Good at only PR Spin

Taxation does not provide the government with "revenue", taxation deletes currency and so it doesn't pay for anything. Also borrowing is a monetary policy procedure and not a funding operation.

treadlightly,

Are you advocating for the abolition of taxation? I think you have been reading a number of economic texts without actually understanding them and are now regurgitating half-baked theories.

No not at all. Taxation has very important purposes but financing the government is not one of these. The government must always spend first before it can tax and borrow as it is the source of our currency.

Beardsley Ruml was a chairman of The New York Fed and he had this to say, "since the end of the gold standard, "Taxes for Revenue are Obsolete". The real purposes of taxes, he asserted, were: to "stabilize the purchasing power of the dollar", to "express public policy in the distribution of wealth and of income", "in subsidizing or in penalizing various industries and economic groups" and to "isolate and assess directly the costs of certain national benefits, such as highways and social security"

https://en.wikipedia.org/wiki/Beardsley_Ruml

The only pie Robertson will redistribute will be to his fellow workers and those to lazy to work.

• The average salary in the public sector is $84,500, compared to $69,000 in the private sector.

• Last year wage growth in the public sector was 3 percent, compared to just 1.7 percent in the private sector.

• 15,000 public sector workers are paid salaries higher than $100,000. Few of these will be teachers, nurses, or police.

• The highest-paying Government department is – wait for it – the Social Wellbeing Agency. That agency’s staff enjoy an average salary of $151,700.

• Next highest-paying are the Public Service Commission, the Ministry of Defence (not the frontline Defence Force), and the Pike River Recovery Agency, all paying average salaries above $130,000.

This government will squeeze the life out of those left working

I stopped reading at point 2. Clearly Roger Kerr believes we should return to the old model of having massive numbers of foreign tourists and ( largely Chinese) students asap. Well, is that what the country really wants or needs? I seriously doubt it.

Even less do we need the distorting effects of Special Economic Zones and the associated tax incentives.

When people talk about 'ballooning Govt debt', handing money over to profiteering enterprises, subsidising polluting industries, and increasing our reliance on imported overseas skills (rather than focusing on our actual education and training system), you know you are listening to the last gasps of a dying philosophy.

Between 2008 and 2017 ballooning government debt was all that Labour party (Union) fans could talk about on-line. Now they don't want to know about it. They are still constantly braying about 'neoliberalism' however.

Sadly, the Labour Party (in many countries) fell for the 'Govt deficits are the route to hyperinflation / debt for the kids' nonsense peddled by people wedded to outdated neoclassical economic theories. The centre left parties were also desperate to be seen to be safe stewards of the economy as this was seen as their Achilles heel.

The more populist right-wing parties have worked out that the level of Govt debt is currently almost irrelevant, so they are going big on doing the things they want to do - cash for votes, tax cuts for the rich, huge public service contracts to your mates etc. I had hoped that Grant Robertson would have tried to do the same but with more strategic initiatives like major investment in education and training to reduce reliance on overseas skills, green infrastructure with job guarantees, actually sorting out child poverty, major home building programme, free broadband for all, 21st century sewerage, top spec waste incineration plants etc. But, no.

When people talk about 'ballooning Govt debt', handing money over to profiteering enterprises, subsidising polluting industries, and increasing our reliance on imported overseas skills (rather than focusing on our actual education and training system), you know you are listening to the last gasps of a dying philosophy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.