By Rodney Dickens

The Reserve Bank (RB) is exaggerating the threats from the housing boom it created to justify expanding its realm of influence beyond what is good for New Zealanders.

The RB and Minister of Finance have announced the plans for more interventions by the RB in the housing market. This is supposedly in the pursuit of “tackling financial stability risks”. However, as was pointed out by ex-RB senior economists, the RB’s initial housing market interventions were based on substandard analysis that overstated the threats. I back their assessment and judgement well ahead of that of the self-aggrandising RB.

The RB has single-handedly driven a housing boom by cutting the OCR excessively and being too slow to reverse the cuts. Instead of doing the obvious and reversing the excessive cuts quickly, the RB is using the boom in house prices it created to justify adding to the dubiously justified interventions. A bit like the RB drawing links between itself and Tāne-mahuta the Māori god of forests and birds, it is trying to make its role unnecessarily grandiose.

The RB is showing signs of being power crazy and the Minister of Finance doesn’t appear to have the quality advice or knowledge to see the dangers of a central bank that justifies decisions on substandard research and has such a poor understanding of the drivers of the housing and labour markets it cannot make quality OCR decisions.

The RB’s incompetence in assessing the outlooks for house prices and the labour market is so alarming it will be a fluke if it makes quality OCR decisions.

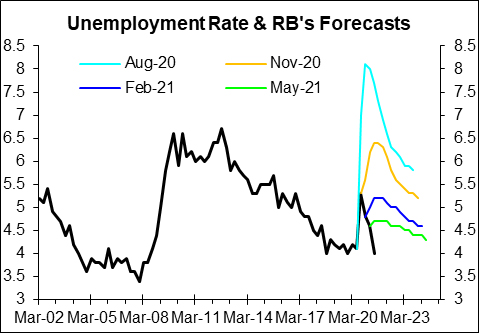

How can the RB be trusted to make quality decisions about the OCR when it has a poor understanding of pivotal drivers of economic-inflation outcomes like the housing and labour markets?! The top right chart shows the RB’s unemployment rate forecasts from the last four Monetary Policy Statements. Even in May it predicted the unemployment rate would not fall this year (green line), but it has tumbled.

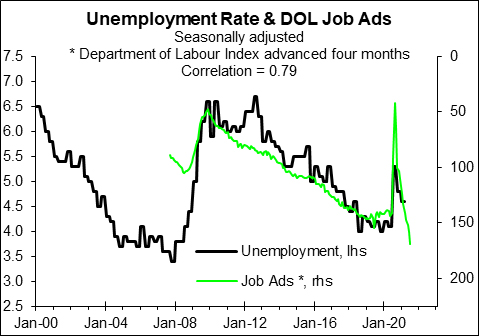

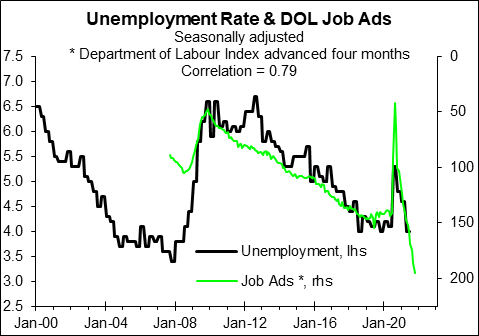

Criticising the RB in retrospect is easy, but there was information available before the RB produced the forecasts that said the outcomes would be much different to what the RB predicted. The second right chart shows what a useful leading indicator of the unemployment rate was already predicting before the RB finalised the May forecasts. The third right chart shows what the same indicator now predicts for the unemployment rate. I doubt the RB will predict a further large fall in unemployment in the forecasts it releases on 18 August.

The unemployment rate is a useful indicator of the balance of bargaining power between employers and employees. At 4%, it is, in my assessment, below the level consistent with the RB’s inflation target. But it takes a while for an overly tight labour market to filter through to higher wage and core CPI inflation as is covered in the economic reports. It is clear most firms are finding it harder than before Covid-19 arrived to attract and retain staff.

It is similar with the RB’s house price forecasts and this needs to be viewed in the context of the RB itself acknowledging that the housing market plays a big part in economic cycles.

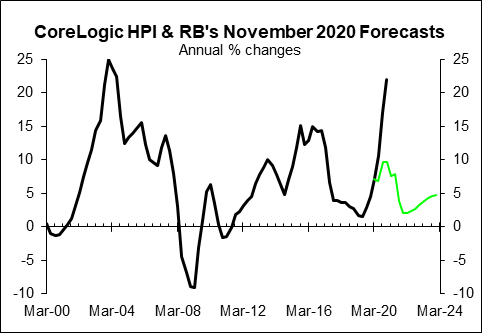

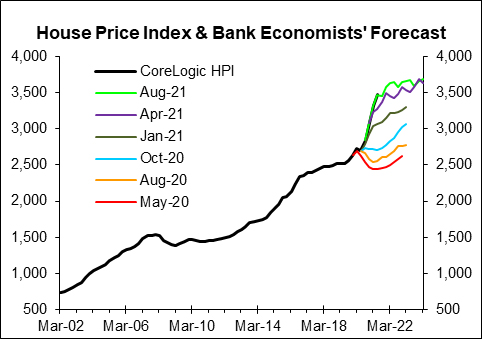

In the November 2020 MPS the RB predicted minor near-term upside in house price inflation followed by a fall back to below average in 2022 (next chart). At the time the RB was finalising these forecasts there was already information available pointing to a much higher outlook for house price inflation.

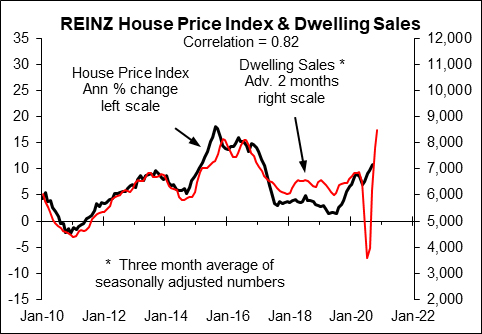

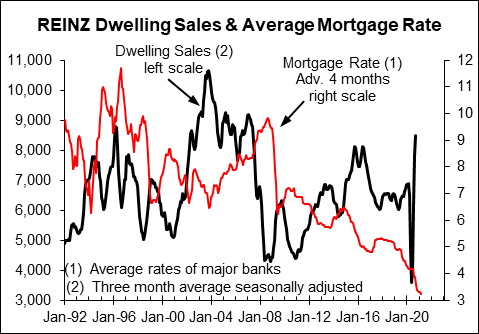

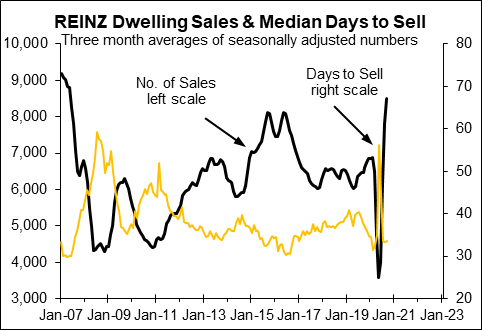

The chart below shows the REINZ information that was available prior to the forecasts in the chart above being finalised. House sales had surged to above the pre-Covid-19 level, pointing to much higher near-term house price inflation. In addition, the fall in interest rates pointed to further upside for the number of house sales over the next four months (2nd chart below). Add a super low stock of property for sale – top right chart – and it was clear that the housing demand-supply balance was supercharged.

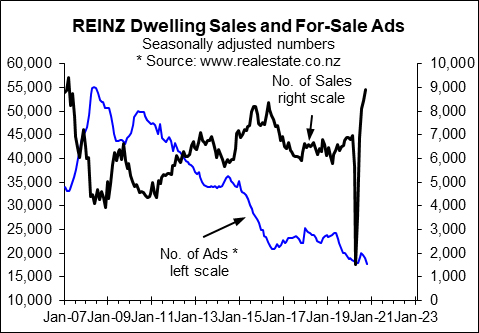

The chart below shows the number of house sales reported by REINZ relative to the number of for-sale listings on www.realestate.co.nz available to the RB when it prepared the house price inflation forecasts in the adjacent chart. The number of sales largely reflects demand, while listings measure supply. The same story emerges when sales are compared to the median number of days properties were taking to sell (2nd chart below that again shows the info available prior to the November 2020 MPS).

It does not take rocket science to forecast the near-term outlooks for the unemployment rate and house price inflation, just sound analysis of the drivers and use of the most useful leading indicators. Equally it does not take hindsight to expose the low quality of the RB’s forecasts for critical bits of the economy. If the RB had a robust approach to forecasting (and making OCR decisions) that included taking account of the most up-to-date, relevant indicators it would not have produced the hugely inaccurate forecasts it did in November (and more generally).

How can it make such incompetent forecasts? Based on what I saw in my time at the RB I know why. The forecasts just vindicate the RB’s preconceptions. The RB has an arduous formal process for preparing the forecasts but along the way they get amended to fit the preconceptions of the overseers (overlords). The RB indulges in a rigorous process that is flawed to the extent it would be funny if it wasn’t for the damage the resulting OCR decisions can have.

You cannot rely on the bank economists to warn you when the RB is making a huge mistake because they are no better.

You don’t have to think back long to remember the bank economists predicted falling house prices, a negative OCR and protracted low interest rates. An example is ANZ’s November 2020 forecasts for the OCR that was supposed to stay at 0.25% until at least September 2022 while the unemployment rate was not supposed to fall to as low as the 4% reported for the 2021 June quarter even by December 2022. I have highlighted the forecasts by ANZ’s economists because they were the worst when it came to predicting falling house prices.

Despite holding somewhat different views at times, the bank economists have in general been as bad as the RB in the inaccuracy of key forecasts especially since the advent of Covid-19, but even before then. The chart below shows what the economists of the four major banks were on average forecasting for the NZ average house price in May 2020, August 2020, October 2020, January 2021, April 2021 and most recently. In October 2020, for example, house sales reported by REINZ had been above average for four months. Despite this fact, the bank economists on average predicted a near-term fall for the national average house price (light blue line).

The problem is the bank economists’ forecasts are not backed by quality analysis of the drivers nor by an assessment of the demand-supply balance that is critical to near-term price behaviour. The problem runs so deep their house price forecast should be ignored, but there are rare exceptions. The problems with their latest forecasts are covered in the August Housing Prospects report.

The bank economists have been equally wrong with unemployment rate forecasts for the same reasons: lack of quality analysis of the drivers and insufficient use of the proven leading indicators.

The Reserve Bank’s excessive OCR cuts in response to Covid-19 will have a range of undesirable consequences in addition to creating a “wellbeing disaster”.

You know something is seriously wrong when the former chief economist and Chairman of the Board of the Reserve Bank criticise its OCR decisions for creating a “wellbeing disaster”. Arthur Grimes is now a prominent academic economist who I’ve known since university days.

I tend to be non-conventional by choice because the traditional approach to forecasting used by the bank economists is flawed. Arthur is mainstream in a good way. When someone like Arthur is publicly critical of the RB you should take notice.

The RB’s overly stimulatory response to Covid-19 will have other undesirable outcomes as covered in my regular economic, housing and building reports.

This article is here with permission.

111 Comments

"The problem is the bank economists’ forecasts are not backed by quality analysis..."

We noticed!

The other thing that annoys me is the persistent forecasts of higher future inflation prior to the Coronavirus epidemic. For years economists where forecasting a "hockey stick" and seems absolutely bloody minded about this even when it didn't eventuate. When inflation did tick up most didn't see it coming.

With due respect to the profession it's clear that forecasts are being made that the science is too nascent to support.

I refuse to take any economists' analyses seriously until they factor in the effects of the recent years of UNSKILLED IMMIGRATION.

How about it Rodney Dickens? We don't want selective graphs that supposedly support your opinions which are no better than unproven beliefs. They are no better than palmistry . We want you to include ALL the relevant factors.

BOOM! great article

What a lot of comments here have alluded to over the last year.

RBNZ are useless and clueless!!!

Please read article below which confirms how everyone in NZ has switched business into buying and selling houses or planning to switch as everyone has realized that it is foolish to work hard, take risk for little money when one can get easy and assured fast money with support from RBNZ and government.

Who can forget what Jacinda Arden said that she will not like to see house price falls - how more forthcoming can she be as has made it clear that need votes and for power come what will do everything and anything to support the ponzi.

https://i.stuff.co.nz/business/opinion-analysis/125950625/reining-in-th…

This is Jacinda's gift to the nation presented by Orr....changing mindset.......Only business in NZ will be (if not already) Housing Economy and than they say that their is shortage of Labour - why work when if you have a house and now can use the equity in that house and interest only loan to speculate and get $200000 to $300000 in a year that is equavelent of five to six year of salary in just one year that too risk free and if flip twice or thrice than multiple the profit.

This politicians and rbnz as has no intent but are forced so creating more problem than solution as ultimately being in power will never act sincerely like they acted last year to protect Speculators, as wanted from heart achieved by their action.

Not only that. Investment into property has been driven tremendously by the fact that it as “safe as houses” compared to shares or other equities. NZ has a record of sorry failures going back to for instance, JBL, Securitibank, Broadbank, RSL , Fortex, Feltex to name just a few and then all those “well monitored” finance companies in 2008. When the government/RBNZ reduced Term Deposits to realise virtually nothing, what other option was there then other than property, they created nothing short of a Le Mans start. As far as the RBNZ and their forecasts analytical capacity, the author here hits the nail fair square and centre. This latest admission simply proves they couldn’t pin the tail on the donkey even if unblindfolded.

So Jacinda has said a lot of things but then done something else, what makes you think her comment on house prices is any different?

Hi Taimaiakka0

You write, ".....everyone in NZ has switched business into buying and selling houses....."

I'm not sure that's correct. There seem to be a lot more buyers than sellers in the NZ housing market.

TTP

How can there be a buyer without a seller. Lost for words.

So here's the question I have that comes from all this: What happens next? Do we all just shrug our shoulders and learn to live with $1m first homes? Do kids coming through now take on an unpayable debt they can't clear before retirement just to get a basic three bedder, and then be so constrained by debt servicing that they can't have families?

And who, in government, steps up to reform the different parts of our civil service, be it immigration, the banking regulator, legislators and local body councils have made New Zealand severely unaffordable for even those in the middle income households, after years with no accountability and no scrutiny and no over-arching strategy?

Because otherwise, the RBNZ will blame migration and investors, the investors will blame the migrants, the migrants will call everyone racist and the legislators will continue to tax us as if our living costs are the same as they were a decade ago.

This country is getting too hard to just exist in, let alone prosper.

"Do kids coming through now take on an unplayable debt they can't clear before retirement"

They will all just leave NZ. The saying last one out turn the lights out will come back. The circle of influence these kids have now with social media will cause an exodus to Aus and other countries not seen before. Mates sending back images of houses purchased for half the price of here and lifestyles with disposable income will win out over what we have to offer here.

FenderB. The number of talented young professional people in our kids circles who have given up and are eying up a move from NZ once COVID subsides, is alarming. I deeply resent that we will lose contact with grandchildren whose parents would prefer to stay here but see no hope of getting a house in NZ. Ardern promised to reduce the flood of migration that was clearly creating excess demand but went back on her word. Robertson’s failure to identify the repeated mismatches between RBs forecasts and the obvious reality is unforgivable. We’ve been badly let down.

Agree middleman - those in their 20' that I've been talking to have had enough of NZ and are ready to go when they get their chance. Can't fault them really given the oppressed conditions that appear to be being forced upon them by a dysfunctional economy that caters for one group with such bias, at the expense of another.

agree with everyone on this. To be honest (Covid aside) no different to living in OZ, to living between the NI or SI. We have grand parents(again Covid aside) in both and we see them about the same amount of time each year (again Covid aside) so once those borders open....one may be slightly more expensive to get to but you save on costs once there, and I aint talking about NZ.

I completely agree - again - with what you are saying, IO.

I have a very personal example to confirm what you are saying - my daughter (who, by the way, would not have a pressing housing problem as I bought a unit for her some time ago, where she is now living with her boyfriend) has decided that she does not want to live in a country that is so monumentally screwing the new generation and all prospective first home buyers, for the sake of an unproductive, parasitic minority of housing specuvestors.

I wish people would understand how incompetent and reckless Orr and the RBNZ have been with with un-necessarily ultra-loose monetary policy, and how disastrous, to the longer term health of the NZ economy, Orr's decisions have been. It will take a lot of effort to undo the damage that he has done.

This article is refreshing, as it appears that some people have finally come to the realization that Orr is utterly incapable of doing his work, and he should be immediately replaced by somebody who can urgently normalize the current interest rate levels and the monetary policy in general. I have been calling for his dismissal for an year now - and it is even clearer to me now that Orr must really go, and now.

Even Winston wasn't a handbrake on the immigration numbers as that was something he wanted to reduce too. Yet they did the opposite. Young people should absolutely leave for Australia. NZ doesn't deserve them.

Pretty sure new governments get dragged into a room with Treasury on day one and given the lecture on the crippling bill of baby boomer superannuation and told that maximum immigration is required to keep the country running via increased tax take - hence as soon as a new government comes to power, they silently reverse their views on immigration they just campaigned with.

I'm in the same boat. My kids have given up the thought of buying here. They started saving years ago, but can't keep up with house prices. The quality v price is also out of line. In OZ you can purchase a better quality home at a much more realistc price.

Just did this exercise, comparing my 70s three bedder to a modern four bedroom home in the Gold Coast that is twice as large, has a pool and is $100K less, but with a mortgage that would be serviced from higher wages than I or my partner earn here. The difference would be substantial enough that I suspect only one of us would actually need to work, which would remove the pressure of childcare - meaning we could possibly afford to have another.

These are huge, life-changing opportunities that are being denied to Kiwis. Yet we take the path of least resistance, importing more people, restrict land supply, ignore construction cost blowouts and refuse to build things like public transport networks. We're ruining this country, and not only is no one squarely responsible for fixing it, they're all doing they're best to clip the ticket.

Even building. You can build a 350sqm mansion on 600 sqm of land around 50km from Melbourne city for around $1m NZ. In NZ you will spend about 400-500k now on a section and just a standard house build will cost 3-4k per sqm (i.e. $1050k to $1400k). And you aren't likely to get the same quality in NZ...

The flood of migration and cheap finance has stuffed things for the migrants too. I have young Asian workmates saying things like "all my friends have moved on to oz", or "maybe i can buy a section, in Westport.", or "I don't think we can afford to have kids".

This. We are safe for a few years while COVID rages but post-COVID there will be a tidal wave for sure. The influence of social media is a really good call out, this generation's community is always connected in sometimes meaningful ways to each other by living virtually in each other's pockets.

A mate in Aus looking at buying a fully renovated free standing 4 bed house on a big block near vineyards, Hunter valley for 250k. Their quarterly power is the same as our monthly bill. $1.60/ l fuel. 20k tax free income. 9.5% super on top of higher pay for a basic retail job which pays $50/ hr public holidays and double pay. Food is cheaper. They can access their super at 60 which is when they plan to retire.

From 67 they get unlimited free off peak travel and one free inter state train trip every year and a lot of other pensioner discounts. Medical is free and specialists plentiful. Aus govt super pays more than NZ and they'll be under the income and asset threshold to qualify for it. Why would you stay in NZ?

Probably we get 10-20% inflation for the next 10 years and everyone gets to live in multi-million dollar homes forever.

The result will be like Ireland, I think it's almost unavoidable. Wait for the RBNZ leadership to retire, that will be the canary in the coal mine.

We will lose a million people or more and house prices will likely drop 60%. The government knows this, and whoever is in charge at the time will be blamed. So it's a grand game of hot potato between parties, each just trying to extend it a wee bit more until they are out.

The OCR wasn't designed specifically to control house prices.

RBNZ's house price forecast was accuracy ±3.9% 12 months ahead excluding 2020 for 10 years. It is actually not bad given the number of fundamental factors that can affect house prices.

The supposedly good leading DOL advertisements indicator at various points throughout its time was extremely misleading. Idolising DOL adverts and we may get by 80% of the time roughly right but when it's does goes wrong it's magnitude likely erases the benefits of the times we got it right based on DOL.

If RBNZ over-states its house price forecasts, then it risks a further blow-out in house prices via fueling the public's expectations of increased house prices.

RBNZ is doing a damned good job in damned difficult circumstances. I take my hat off to Governor Adrian Orr and his expert group of economists, lawyers and other central banking professionals. They're a very talented and competent group, who don't justify the flack they get from the "know-it-alls" who hang around here.

Globally, NZ has become a country of choice to live - and the Government's handling of Covid has further reinforced that. Like it or not, the current buoyancy of the housing market is largely a structural phenomenon - and not something which RBNZ, the Labour Government or anyone else can do much about. Remember, RBNZ is merely a regulator - not a magician.

Certainly, it should come as no surprise to anybody that house prices have risen steeply.

TTP

Is this satire?

I understand you have a vested interest in property but come on... How can you praise them when they've (along with our recent governments) comprehensively shafted the younger generation. They deserve derision for all the years of suffering they're have subjected the next generation to.

It's satire, but he isn't very good at it.

market a bit quiet there in Palmy and surrounds TTP .....you should be out there drumming up business on a Friday ....or helping your colleagues out, increasing those commissions......not in here "championing" an organisation, along with the current and past governments, that have led this country 'up the garden path', away from it's true core values.

Plutocracy, Brock Landers and Mad Horse:

Let’s be perfectly honest….. A few years ago, you and your DGM mates were telling FHB’s not to purchase a house - because house prices were about to crash…..

You were completely wrong: no wonder FHB’s are now baying for DGM blood.

Your comments above contribute nothing toward resolving the housing situation - and even less to stimulating quality dialogue on this forum.

TTP

Nonsense. I would never be so foolish as to predict the timing of the crash of the property market. It could be this year, or it could well take several more years.

Resolution of the housing situation requires large price adjustments in a downwards direction. What suggestions do you have to hurry it along?

I agree.

We need a 30-40% house price crash.

Since the govt doesn't seem to want to do anything, maybe market forces eventually will.

A crash would teach this country a bloody good lesson.

Hi Brock Landers,

Go back and check the DGM record on this website........

Through 2014-2019 the DGM persistently forecasted that house prices were about to crash, vehemently warning first-home buyers NOT to enter the market. (One DGM, in particular, who comes to mind is Retired-Poppy, who earned the name "Crash Crusader".)

That you now deny this speaks loudly of your lack of integrity.

I will continue to hold the DGM to account for their plethora of misleading and deceptive contributions to this forum over a number of years.

TTP

Imagine having an IQ so low that you can't even tell individuals apart and believe in bizzare conspiracy theories about "DGMs".

Is this what you call "quality dialogue"?

Hi Brock Landers,

Suggest you take heed of the time-honoured wisdom.......

"When you're in a hole, quit digging."

TTP

I prefer "Never engage with an idiot. They will drag you down to their level and beat you with experience."

Have you paid your big fine yet?

Ah TTP....always rely on your vitriol for a good laugh...

I picture a boomer sitting in his rocking chair shouting at the sky while counting all the $'s he is going to take to the grave.

You do you champ.

I don't know if he has that many $, he's had some big fines to pay.

He's a naughty boy.

In 2010 just prior to purchasing my first house it was suggested by the DGM's on here that I hold off for while. 11 years years later the damn thing has nearly 3x. 11 years later its the same "doom" being rinsed & repeated on here, but am glad I didn't listen back then. My crystal ball is no better or worse than most others, but if I was an FHB now, I would do it again.

I don't know if that many people are saying FHBs should hold off.

What many of us are doing is lamenting the shambles that this housing debacle has become.

It has ruined our country.

Another one of our old, selfish resident bores.

... deleted as too late posting ...will post this on another story though

The current buoyancy of the housing market is a speculation problem. You can see that in the data about investor holdings, the articles by 'experts' pumping the market, the divergence of price to income and long term mean, and conversations by 'Joe Bloggs' around the BBQ...

"The forecasts just vindicate the RB’s preconceptions." This is classic for public service leadership. Politicians appoint people into senior roles in the public service who will toe the party line. To some extent this flows down within those organisations. The end result is that the politicians never get told by their appointees something they don't want to hear. When this happens in the commercial world, companies collapse, in public service they just get bigger pay packets. Bad news only comes from the media or the public. Then we see denial and obfuscation.

Every layer of management in the public service is a filter. These managers are all being paid well over $100K, but they all get to where they are through their ability to play the political system, their ability to say the right thing. Those who persist in telling the blunt truth do not get those promotions because blunt truths cannot be spun into something more palatable, unless it is already a success.

And to cap it off, the Government has refused pay increases to most of it's workers. Those who had to work through the COVID crisis, those who often work in high risk jobs facing threats every day. Those who have to do the real work, not toe the political line. Of course the government will deny this but it is still a pay freeze, at a time when significant inflation is obvious to all but the most stupid!

That'd be the inflation that the government mandates into existence through the agreement with the RBNZ.

And at no stage is there any consequences when said inflation (or the more likely higher retail inflation) overshoots the targets they set.

It's an absolute shit-show with stuff falling into cracks in the system which no one wants to fix, because then someone would have to do something tangible.

100%

Saw this behaviour day in, day out when I worked for a ministry a couple of years back.

It's a joke.

Same experience when I had the misfortune/ windfall to work with public servants. Incredible waste, inefficiency. I was gob smacked everyday. Then when I thought it wasn't possible to smack my gob again, whack, I'd be smacked again by the sheer incompetence, incoherent, patch protection, lack of accountability on a daily, nay, hourly basis.

Because I wasn't very good at playing the game my days were numbered there, however probably couldn't have lived with myself if I'd stayed anyway.

Now from the outside, looking back at my imprisoned friends and colleagues inside the wire we can have honest conversations about what it was really like. They are all there, towing the line, biding their time til 65, stringing it out as long as possible. However at least one is on stress leave as the mental strain of being so fake is having a detrimental impact on them. Should be able to write that off to a PG though and get a nice fat payout, string it out to retirement.

Nail on the head murray.

Public servant managers will never promote anyone who may be more competent than they are - they see such people as a threat to their own progression. Hence we have had a PS getting dumbed down year after year. Promotion now based on race, gender and softness.

This country is getting too hard to just exist in, let alone prosper.

Great post and insight. I 100% agree and know how they operate in specific functions through exposure, such as NZTE. The politics is rife. And at the end of the day, what they actually achieve is quite superficial. But the ministers, Ardern, etc think that they're superstars. Sure, some of them have come from backgrounds such as Fonterra. But in many way, that's just another bureaucratic organization not known for innovation.

The solution to the pay freeze is to apply for a new job and ask for more than you're getting. Increased churn, higher salaries and lost productivity. Great job!

The RB and bank economists are easy targets given their record. I just wonder how good Mr Dickens' forecasts were over the same period?

Same , a quick search for Mr Dickens' 2020 opinion pieces comes up empty ?

You have to pay for them.

Extremely reliable.

Notice in charts the long term secular fall in people putting house up for sale since 2006 but esp marked after 2015 despite building boom. More landlords and older owners means fewer sales

My concern is that if the difference in supply is investors choosing to hold. Does that mean that when sentiment changes, there will be a huge over supply as they all move to sell at the same time?

Yes. Very few sellers. Up these numbers and we will see just how strong the market really is.

Yep, the old metaphor of the Central Bank being both arsonist and firefighter holds true.

A juggernaut of inflation is being unleashed on us all. All to protect printed currency and debt from a badly needed asset reset.This has created nothing constructive other that a weird sort of society enslavement to greater and greater debt. Well done.

What to do. Let it burn down. When did the actual income cease to have any value in determining an assets price?

The inflation is the reset.

That just bails out the speculators and the banks, while shafting pretty much everyone else. Going to be an interesting election in 18 months. Picking the king maker will be the party that actually has policy to change this farce...aka tax base change.

The economy looks like a fools paradise to me - stealing from the future in order to selfishly preserve its current form.

Great to hear from Rodney again. One of the better economists.

In my view : Inflation scaremongering and clamouring for rate increase is Banks' strategy to boost profits for themselves. We are not out of the woods, the pandemic is not going away, NZ is not immune to an outbreak. Why raise rates now ? To tame house prices, RBNZ should be ready to increase OCR by atleast 3% in one go. And stipulate differential rates at the commercial banks' end for investors and FHBs. Is it ready to do that ? Otherwise, waiting may be a better option, to let the economy recover some more.

There is this article in NZ Herald today.

https://www.nzherald.co.nz/business/brian-fallow-wartime-economy-is-no-…

Quite a few people won't get it. They're blinded by anger of not getting to buy a house according to their price expectations.

On one hand they tout their agenda is good for the country but when you see through it; they just want to crash the national economy so that they finally get to buy what they want based on their price dictation.

However, it's a consolation to know that their desires won't be achieved even if the national economy crashes.

If they can't buy on the way up, they won't be able to buy on the way down.

IDK if we're blinded by it, just tired of dickheads holding our country to ransom and pushing up basic living costs, while the policy wonks and analysts on the government dime get to keep missing their marks with little fear of consequences.

Hell, I'd say the only reason we got any housing reform at all when it comes to rentals and interest destructibility is because it finally got too hot in the Wellington market for the public sector workers down there, even though the exact same situation has been unfolding in Auckland for the better part of a decade with little real change.

Otherwise it's out of sight, out of mind. A bit like how some clueless Kiwis think that it's still just a matter of 'hard work' or whatever other boomer cliches people like to dig out to avoid talking about the massive drop in affordability vs. household incomes.

I think the housing reform we have had is just the media and policitians working together to insist upon "good news all around" for the housing markets of NZ.

1) House prices must go up for the good of all

2) Interest rates can come down because that keeps FHB in the game

3) Rental standards must increase a little, we need to do something to look after them from time to time.

One day we will see an actual tough decision made by a politician. But it has been so long since the voters have had to support any thought of short term pain, maybe it wont happen.

If you are a single middle aged man, or woman,ex-divorce( and there are hundredss of thousands) however hard you work ,on median wage ,you can not own a home again in New Zealand,in any major or minor city ,in New Zealand ,in your lifetime. Same goes for some hard working couples on minimum wage , but essential work.Yes there are exceptions,but the exceptions are few.For the middle aged ones,it will mean Poverty in Retirement,for many ,as nz pension is not set up to cover renting ,poor retirees. So this foolish housing and banking policy and market failure,has a multitude of long term negative effects.

Time to smack the beast down,as it will devour multiple groups ,across generations.

It's a great point, something that perhaps isn't thought about much in discussion on the housing debacle.

The ultra-loose monetary policy pursued by the RBNZ has been catastrophic to the very fabric of NZ society, and highly damaging to the longer health of the real NZ economy and entire financial system.

Not sure why but this post reads something like newspeak from 1984 Orwell.

Might be the use of words like:

- agenda

- country

- anger

- blinded

Would more appear to sum up the paradigm of the writer as opposed to that of the change he or she is fearful of!

Economies are set up to further the living standards of the humans functioning within it. When that stops happening, the economy needs to crash and be rebuilt.

No one sets up an economy; the economy exist when trade exist. Living standards is a function of the economy.

You cannot rebuild something that you cannot set up and there is no living standards when there is no economy.

Economies are systems that determine the consumption of goods and services, and the flow of money, based on philosophical theories such as capitalism or communism or utilitarianism. These philosophies are implemented by people we vote into power. Economies are built by people to serve people. Just as they can be built they can be changed.

The economy isn't some mythical untouchable unicorn. It is an ever evolving system to benefit the people who allow it to operate.

You have a really weird idea of what an economy is.

Enjoy.

You are both right.

MW, you are referring to the level of interference in the economy from Government - who set the laws and boundaries of which the economy operates… however there is a limit to their influence (requires the masses to cooperate) and also their effectiveness - perverse outcomes

No one sets up an economy....no but a few can manipulate it for their own benefit.

It's an interesting and valid point.

You talk of needing to lift 3% to have any impact. I think lifting by 0.5 or 0.75 several times over the coming year would have an impact, but by doing several rate increases the RBNZ could shift course easily if there was another lockdown.

I still think on balance it's better to lift rates, especially if it's done this way.

absolutely agree - i dont understand this hesitancy around a "maybe scenario ie the delta outbreak" - if the scenario never eventuates then waiting to raise rates creates a bigger mess - ie higher rate increases faster, if the scenario eventuates that delta arrives then we lockdown for 6 weeks like last time and the RBNZ can then lower interest rates back to 0.25% if the economy needs stimulating.

I dont think it will however need stimulating - the government will give wage subsidys and people will use their savings to spend up big when things reopen negating the need to lower interest rates to stimulate the economy.

I think we need to follow the path of least regret - which means raising the OCR back to 1% in two weeks time, and progressively increase it to 2.5-3% by mid next year.

The OCR decisions were not made with the best intentions for NZers in mind. They were made in cahoots with the other central banks around the world. And it's understandable. If anyone moves out of lockstep, it would create violent shifts in money supply/velocity in different countries.

Bingo. Our economic masters are elsewhere.

Its going to be interesting to see what happens when the world collectively realises the US is buggered and everything that central banks have been doing is to follow the monetary policies of a dying country/empire.

How do we move forward when the current crop of economic witch doctors are indifferent to the economic signals that confront them.daily?

Economists and central bankers unaware of this wealth of information right in front of them, right here for everyone to see, confused simply because their outdated, anachronistic worldview doesn’t allow for rational interpretation.

Though very different from what you’re taught in the textbook, the textbook having it all backward, in this instance it truly is easy: rising yields = good, meaning less deflationary pressure and potential; falling yields = bad, meaning more deflationary pressure and potential.

Central bank bond buying, or QE, except on occasions in the early reflationary periods when the bond market gave QE a chance to prove itself. It just never did (zero chance for success; can’t fix a real money problem with rainbows and unicorns). Interest rates rose reflecting the simple reality – even as the Fed was buying up billions per week of the same bonds – that up is good (for the economy and the people in it) and down is bad.

The up part never lasts and that’s the thing. The deflationary potential never goes away, the structural malfunction of the eurodollar system makes this impossible; deflation potential merely switches, over time, between periods when it becomes really bad (Euro$ #n) and then those when it is less so (Reflation #n).

Therefore, all there ever can be is reflation, never recovery (and the inflation which would confirm it; this really isn’t about consumer prices, or at least not solely about them). Link

Witch doctors - I like it. Incompetence is no longer a possibility, they are witch doctors adding fuel to the boiling cauldron on purpose.

Wow Rodney, someone finally put into print what half the commentator's have been saying on here for months. Is managing the economy really that difficult ? I get the feeling its isn't if the average Joe can see what's happening on the street and has been making the call for months now to raise the interest rates and we don't even have all the data. Something is badly wrong at the RBNZ, its like a drugs cartel telling you to quit the housing high but is still supplying cheap cocaine into the market at the same time.

I completely agree.

Interest rates should have been raised months ago - it was so clear that I can only assume that the RBNZ just did not want to see.

Keep cribbing folks no one is reading & your opinion doesn't matter at least for next 2 years, they got all the power & will make sure if not you than your future generation will pay for it, if they decide to live here..

"Be Kind"

Its interesting how there appear to be more and more disenfranchised people out there and the popularity of the more extreme parties left and right (Greens and Act).

People are ready for change, but nobody is willing to deliver it.

The momentum of a broken economic system is more powerful than any political party at present.

The fact of the matter is that nobody is really willing to accept the changes required. I'm not talking about housing, thats just the tip of the iceberg and just a distraction really, I'm talking about looking after the future of the planet. Nobody really gives a rats ass, they rush out and buy an EV and think their job is done. If we even came close to making the changes required right now, the people would all scream in protest and there would be riots on the streets about their civil rights infringements. Arguably its all to late now anyway so lets just get back to worrying about house prices.

It does not help that there is no consensus on the "required changes".

Thats just an excuse to do nothing. The public will never suck up the real changes required, we cannot even talk about the real changes that are required let alone attempt to implement them. Anyone in government would not get in or would be swiftly booted out again if they tried to implement the "Required Changes". We will just continue down the current path until the planet rebels and we are forced to change.

Your attitude if turned into a fragrance would be called "Self disgust"

I have the same intuition… it’s the same swing into power of extreme politicians when our system is too far out of balance… watch this space everyone

Brilliant piece, reflects on a bunch of stuff most of us have pointed out. The RBNZ has been reckless for far too long and have made abhorrent decisions based on often wildly speculative assumptions instead of actual data. The key piece was this:

"The forecasts just vindicate the RB’s preconceptions. The RB has an arduous formal process for preparing the forecasts but along the way they get amended to fit the preconceptions of the overseers (overlords)."

For instance, the decision to remove LVR's last year was stupendously idiotic. But the RBNZ did it anyway and when you heard them talk about why, it was basically for made up reasons that the leadership all bought into. Completely outside of their mandate, but they decided they wanted to act in a particular way, so formed their talking points around supporting that decision. Instead of doing their main job of FINANCIAL STABILITY, they decided they would just act like unaccountable idiots, which has become the institutions mantra.

Absolutely right, the most incompetent period we have ever seen from the RBNZ has been in the last few years, but also the bad direction given to them from the government has made it worse.

Yep.

And this is the worst government by far that we have had since the Nats in the early to mid 90s.

The entire western world is being run by incompetent central bankers being dictated to by bankers. They say it’s not our fault then say oh sorry we didn’t see that situation coming. Watch what is other central bankers are doing and watch our’s follow suit. I’ll be amazed if he puts up interest rates, they’ll be a tiny excuse not to, can’t step out of line.

How can economists predict anything when they don't understand how banking and our monetary system operates and while university economics courses still teach fake knowledge such as the money multiplier.

We have treasury economists who falsely believe that taxation and borrowing finance the governments spending and bank economists who still believe that banks only lend out deposits and that QE gives banks money to lend.

I agree. But to be indoctrinated in the MMT cult is also not particularly healthy for students. It would be better to have courses designed around specific issues. For ex, how the monetary system works and the concept of 'sound money.' You could introduce the different school of thought and direct students to push deeper. But teaching MMT as the "truth" is simply wrong.

MMT is based on clear and concise observable evidence of the way in which our monetary system operates. While orthodox economics has preconceived and prejudicial thinking and an inability to accept any point of view which conflicts with its dogma even when the evidence is so clearly against it.

Orthodox economists suffer from a mindset best described as 'groupthink'.

"Groupthink is a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome. Cohesiveness, or the desire for cohesiveness, in a group may produce a tendency among its members to agree at all costs. This causes the group to minimize conflict and reach a consensus decision without critical evaluation". (Wikipedia)

And now the general public is waking up to the farce. My friend told me over the dinner table last night that she thinks prices will crash. She is a teacher with no education on the matter, and just 6 months ago she believed the housing market would never fall. When Joe Bloggs believes the market will crash, it will be self fulfilling, since the market is now based on sentiment and not fundamentals. The smart money is already on the way out (overseas investors).

Be quick.

I’ve been bleating on for over a year and fell on deaf ears… now all I know have come around to the fact this government is well past its remit..

Jacinda and Chloe got the young people esp women duped, hook, line and sinker. The pollies just say what people want to hear. It's that simple. Delivery, schmelivery. Common knowledge I'm no Jacinda or Chloe fan but thousands of people really love them.

Trump perfected it, read the people and then tell them what they want to hear. Only works for so long however, even stupid people finally wake up after a few years when they notice nothing has changed, or they are even worse off than before and all those promises were fake.

The problem was the knee jerk reaction of the RBNZ going too early. Instead of waiting a little to understand where it was going. The idea to reduce rates was reassuring to the public at the time, and that was the extent of it's usefulness. They needed to wait, Covid19 was a Black Swan event. As it was there wasn't anything to compare it, to gain knowledge from, before a remedy could be applied.

The housing market explosion has been a deliberate Govt decision for the last 2 decades, both recent Govts, fuelling the fires. National by the drift approach, got away for years by don't do anything, and rely on the John Key smile. Labour by failing to grasp the nettle for Capital gains tax. A 30% adjustment in prices, and a period of negative equity is required. Both the market and consumer can stand it. Until the rising trend between rich and poor is addressed by a more equitable tax system, our current approach of stimulus/ QE/ and a OCR less than 3% the recipe for a rising sponge cake remains.

Brilliant article. But I wonder, when Rodney mentions;

...to fit the preconceptions of the overseers (overlords).

Who are the overlords of the RB? Overseas RBs; the major int'l financial institutions; the Davos crowd....?

The overlords can't be our Finance Minister as Orr has been quite disdainful of GR on many occasions (e.g., DTIs).

So who is Adrian Orr beholden to?

If I recall correctly, Arthur Grimes has been critical of RBNZ (lack of) response on asset inflation for many years now.

Well the overlords could also be the government. After all, the government writes the legislation that governs the RBNZ.

The government could have changed it, but haven't.

To me,that means the government is effectively endorsing the RBNZ's approach.

Have worked in NZ for 36 years, off to Australia asap. Here in NZ, immigration tap turned off to slow housing price increase, only to cause another issue of a tight labour market and companies unable to find staff. Hence wage inflation and a job swap not seen for 14 years. Labour have no business acumen whatsoever.

Aussie super fund sitting at $2,4 Trillion, as NZ's $70 Billion.

Great piece Rodney from someone with the right expertise. More bullshit today from the key protagonists. So a 5% fall (after a 30% increase) will make house prices more sustainable? What does that mean? "Least regrets", "well-being" (banks, real estate agents?).

Lots of clever words about the 'narrative' around housing, very little mention of the Bank's role in ensuring that the narrative (that housing, or rather land prices, are a sure bet in NZ) has been proved correct once again. But of course we must respect the Reserve Bank's independence....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.