By David Hargreaves

Well, the Government and the Reserve Bank have leapt into action aimed at taming that naughty, naughty Auckland housing market.

One thing that I hope comes out of all this is some sort of precise information about who's buying houses and where. And yes, it would have been nice to have that information first before measures to tackle the problems were announced, but there's no point in keeping on about it now.

All we can hope is that from this point onward very specific information will be forthcoming about property purchases and ownership.

Then obviously any future Government policy decisions aimed at the housing market can be done on a highly informed basis.

Key factors in the current Auckland housing market in terms of the demand side of the equation are the number of houses bought by investors and also - given what the RBNZ is now doing - the portion of cash buyers, IE those blessed types that don't need a mortgage millstone.

The RBNZ's official nationwide figures - published only since last year - show that investors are currently making up about 33% of new mortgage approvals for the whole country. But the Reserve Bank has itself for a little while been quoting ball-park figures that they think about 40% of house purchases in Auckland are being made by investors.

Hence the fact that the investors are now being targeted. The RBNZ says that after October 1 Auckland investors cannot borrow more than 70% of the value of the property they are buying.

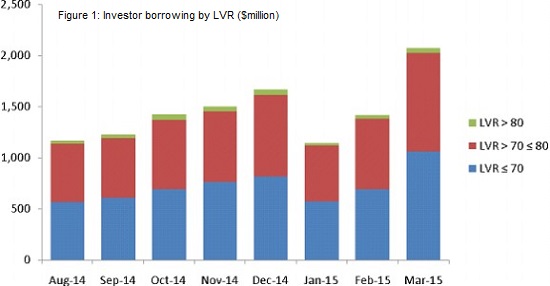

This should prove a pretty significant change. The RBNZ's own breakdown of the national borrowing figures (note, that's national, not Auckland) shows that at the moment the proportion of investors borrowing between 70% and 80% is considerable, as demonstrated by this graph:

But, notwithstanding those figures, the RBNZ's proposed measures could at the very least be weakened by the number of people buying houses without mortgages.

Last week Deputy Governor Grant Spencer gave some New Zealand-wide ball-park figures, stating that it was the RBNZ's belief that the proportion of cash buyers - which includes both Kiwis and overseas buyers "gets up toward 20%", while the number of new-to-market sales, in other words new entrants into the market who are not first home buyers was in the "8-10% range".

“So, there’s numbers that suggest it could be – we’ve talked about this before – the non-resident component could be around 10%, that sort of territory. We don’t think it would be significantly greater than that,” Spencer said.

The RBNZ sources this information from property information, analytics and services provider CoreLogic.

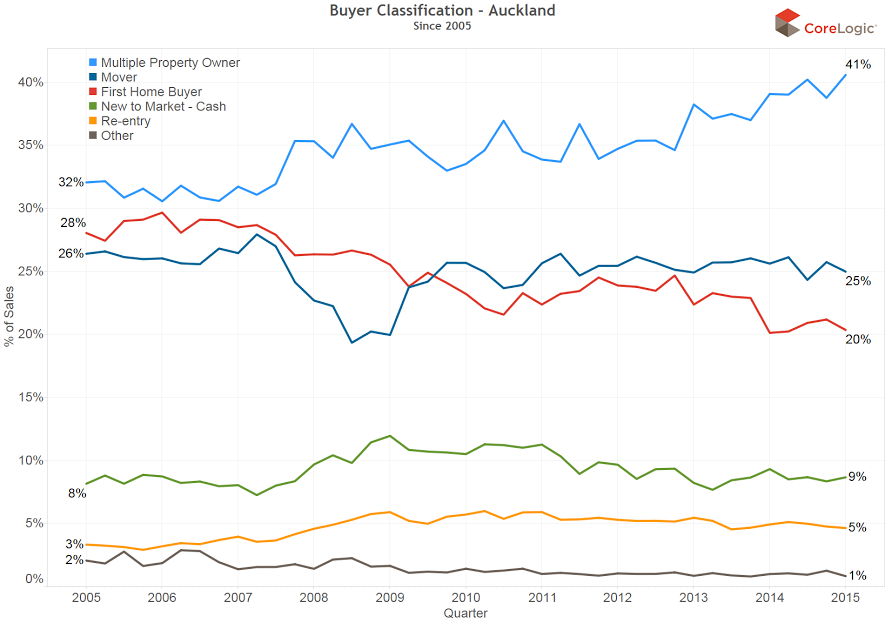

We were keen to see how the Auckland figures alone shaped up, so approached CoreLogic and they were good enough to provide us with some summary figures for the Auckland market between 2005 and this year.

As you can see, the figures show investors now heading north of 40% in terms of the proportion of house sales they account for.

The new entrant to market figure, which the RBNZ seems to be taking as a proxy for foreign investors is running at 9% in Auckland. CoreLogic actually estimates the numbers of foreign investors to make up between half and 80% of this percentage - so on that basis foreign buyers buying for cash could make up between 4.5% and a little over 7% of the Auckland total.

But of course foreign buyers are also included in the investors category, so how many they actually are remains open to conjecture.

Likewise, the "new entrant cash buyers" are not the only cash buyers, given that cash buyers can also be included in other categories.

So, to go back to the fact that cash buyers might not be affected by the new RBNZ measures, can I say I thought Spencer's assertion that as many as 20% of house purchases nationwide might be for cash seemed pretty high and therefore potentially disruptive to the RBNZ's plans.

*In fact, according to CoreLogic and their detailed figures, the proportion of cash buyers, when you put them together from the various categories is nationally rather higher than that 20%, at just under 27%, having been as high in recent years as 30%.

That's a lot. In Auckland the figures are somewhat less than that, coming in at near to the deputy governor's 20% - although perhaps that should not be surprising since you would need way more cash to buy the average Auckland house!

CoreLogic provided us with this (at right) summary table of cash v credit house purchasing in Auckland since 2005:

| Year | Cash | Mortgaged |

| 2005 | 17.32% | 82.68% |

| 2006 | 17.19% | 82.81% |

| 2007 | 17.01% | 82.99% |

| 2008 | 22.22% | 77.78% |

| 2009 | 23.57% | 76.43% |

| 2010 | 25.93% | 74.07% |

| 2011 | 22.68% | 77.32% |

| 2012 | 19.19% | 80.81% |

| 2013 | 18.83% | 81.17% |

| 2014 | 20.12% | 79.88% |

| 2015 | 19.45% | 80.55% |

| Grand Total | 19.84% | 80.16% |

As you can see, there's a fair proportion of people who won't be directly affected by the new RBNZ measures. Whether that will weaken the effectiveness of the measures, only time will tell. But it certainly might do.

What is not arguable from CoreLogic's research is that the numbers of investors are on the march, while first home buyers are shrinking.

I was interested to see how the figures, which of course are proportionate, match up against the raw house sales figures produced by REINZ.

If you go back to 2005 there were 35,200 sales in Auckland, by 2010 there were just 19,564, while in 2014 this had bounced back up to 28,832.

According to CoreLogic investors made up 32% of buyers as at 2005, around 35% by 2010 and heading north of 40% by the end of last year.

In the same time frame the percentage of first home buyers dropped from 28% to around 23% to 20%.

New entrants to the market - including cash overseas buyers, have been quite consistent, at 8%, rising to around 12% at one point and then 9% heading into this year.

Just for illustrative purposes, if you use all these percentages against the REINZ Auckland house sales figures in 2005, 2010 and 2014, you would get 11,250 houses (IE based on the 32% figure given) bought by investors in 2005, dropping to 6,850 in 2010 and then arcing up strongly again to 11,500 (based on 40%) as of last year.

So, whether you want to talk about percentages or otherwise, the raw numbers of investor-buyers are certainly surging at the moment - demonstrating, I would certainly say, that the Auckland market is by no means a story only about supply. There's some demand there.

As for the suggestions that investors are taking up the slack left by first home buyers - well our illustrative comparison figures might suggest so. Again, based on the percentage figures and applying them to raw REINZ figures, this would suggest first home buyers bought something like 9850 Auckland houses (based on a 28% figure) in 2005, dropping to 4500 during the depressed days of 2010 and rising only weakly in comparison to other buyer category figures at around 5750 last year.

On the same basis, the new entrant figures are not showing much of a trend either up or down, giving us indicative figures based on the percentages of 2,800 in 2005, 2150 in 2010 and 2,600 in 2014.

All you can say is that all these figures suggest that some action on the Auckland market is warranted. Whether it works...only time will tell.

*An earlier version of this article ran a table of national cash/mortgage figures wrongly identified as Auckland-only figures. The table has now been amended with Auckland figures and some supporting text has been altered slightly. Apologies for the initial error.

57 Comments

(Comment not relevant to this story deleted, Ed. Please see our commenting policy here - http://www.interest.co.nz/news/65027/here-are-results-our-commenting-po…)

The relevance: the booming Auckland housing market has been blamed on historically low interest rates. This premise seems to be now unproven given the issues of foreign buyers, immigration, investor activity etc. So perhaps low and future lower interest rates are not the main factor? So interest rates keep falling this may have little effect on Auckland. Therefore there is no reason for the RBNZ to delay the inevitable dropping of rates, and little effect of banks preempting this.

It is about supply, David. All of the demand side issues that consume gigabytes of comment on these pages would disappear in an instant if there were always enough dwellings to meet demand in Auckland. If there is never any need to bid up a house price there can be no speculation. Investment can only be for rental income and once the normal demand for rental properties is met there is no need to invest in any further rental stock.

We use the metaphor of fire for the property market in Auckland. It's labouring the metaphor a little but we should remind ourselves of what a fire is:

1. A fire needs fuel. In this case what is really burning is the chronic housing shortfall. We should occasionally remind ourselves that most New Zealand housing is over-priced because we use a similar development system throughout the country. We notice Auckland because of its extreme situation but as I am constantly reminded by a developer friend "All of New Zealand is an Auckland in the making". As long as land for development is being eked out so slowly the fuel is being constantly replenished.

2. A fire needs air. In Auckland the air is the prospect of money for nothing. But this only makes the difference between a smouldering fire and bright blaze. Ultimately the fire is still in the fuel, the air only makes a difference to the appearance of the fire.

3. A fire need a source of ignition. The kick starter to this latest round of price rises was the collapse of interest rates during the GFC. At first we had prospective house buyers realising they could afford to bid up house prices a little higher - and they needed to because there weren't and aren't enough houses to go round - then capital looking for higher returns elbowed them out of the road. Et voila: the Auckland housing market merrily ablaze. And I cannot emphasise enough that this bull run started when net migration was negative, i.e. demand was falling.

The fire is burning and will continue to burn as there is plenty of wood on it. Closing the damper a little won't put the fire out.

you missed the most obvious one, why do you need supply because of demand, what is the demand very high levels of immigration, and why wont the government up the points and slow it down, because it suppresses wage inflation for their masters.

immigration should be used carefully and controlled, we need some but remember we also need schools, hospitals, police, jails, transport, roads to be capable to handle the extra workload, and with that comes extra funding and whom is it going to pay for this through rates and taxes

Explain why house prices jumped in Auckland when people were leaving town and I may listen to the arguments on visa-based immigration. Until then I stand by the points I made above especially the one about house prices rising when net migration was negative.

I have no problem with constantly reviewing what we are doing by way of controlling visa-based migration. But I have looked at the numbers for the last ten years and the English, Americans, Chinese etc are not the problem in Auckland.

because the high price was the causal factor, increasing the migration from the city

Oh bollocks. The houses were much much cheaper than now. Even while visa-based migration stayed steady NZers were flocking in droves mainly to Queensland for mining jobs. Remember the jobs fairs here when mining companies were recruiting to jobs across the ditch.

across the ditch speaking of witch....

To an extent then, Australia has the same problem as New Zealand – a dwelling price bubble concentrated in one city.

http://www.smh.com.au/business/the-economy/the-sydney-housing-bubble-to…

- and same banks

There is a really good article about the UK housing market here detailing why urban land doesn't respond to the usual supply and demand features of other markets.

The housing crisis is a classic market failure situation and requires some sort of intervention(s).

http://blogs.lse.ac.uk/politicsandpolicy/why-arent-we-building-enough-h…

If it was a problem of supply - why are rents not going up at 14% keeping in step with house escalation?

I think its more a problem of perception - ie I dont wanna miss out so i got to buy a house instead of rent mentality.

Plenty of houses to rent.

It's the classic sign of the property bubble.

1. It has been years since "investing" in residential property in Auckland made business sense apart from the prospect of a capital gain

2. While you are holding onto the property for capital gain you can't really afford to let it stand empty either so you rent it out.

3. Who are you renting it to? Probably the people you outbid to buy the place originally. By definition they can't afford the level of rents that your purchase price would suggest so you take what you can get.

4. The two markets go their own way.

the run ending in 2007 started from a scam.

In that run, cheap interest and high leverage deals did fuel the rocket.

The scam was 3 people, one was in banking, another in real estate sales. They would find a place with modest merit and sell it to the third member of the group (using the age old tactic of pushing the agent pushing the seller down to get a quick sale).

The property would be purchased based on a valuation that deliberately had a margin and deposit added in, so a 350k house would be valued at $400k, the bank would lend 90% = 360k, which would be 100% of the purchase price, plus some cash. Then 2 - 3 months later they would re-sell the place to another member of the team, this time with a valuation based on 500k... possible because they had an offer for 500k (from the remaining team member), the property would get a mortgage for 90% of 500k = 450k. which paid off the previous mortgage, and spat out 90k in spare change.

By doing this to several properties simultaneously they were able to game the valuations methodology into accepting the new prices as valid current market prices.

Lots of others got excited at the booming profits, and so they'd buy that 500k place for 520k. A place that was sold by the original non-speculator for around $310k-330k less than a year earlier.

The scam team walked with 10k from the first finance round, 90k from the second finance round, and 170k from "capital gain" on the property's increase in value. = 270k with nothing down.

And more fools were racing for the market looking for their quick buck.

If it hadn't been for toxic debt in the US sub-prime buffet who knows were it would have got to.

IIRC the scam came to light after complaints were made to the Real Estate Institute as clearly the real estate agent wasn't getting it's initial client a real market value for the property if six months later it was worth 66% more. Investigations found it was the same agent and bank involved in the deal.

The inflating the valuation for a buyer is an old trick but if not abused tends to just be forward looking but is now illegal.

- -

The modern prices are not related to that at all.

We have big money and a silent OIO, also the level of sales (especially fast sales) is much lower.

What is fueling the fire is modern New Zealand governments lax attitude to foreign economic threats. As long as big money is able to safely hoard here it will find it's way and distort the market. I just wish they'd wake up to the fact and build the economy rather than choking the local economy. The rate they're going most of the country will be left behind

David, very good research and article, thanks.

The 2013 census showed Auckland had 473,000 dwellings, so say 485,000 now.

If 28,000 were sold in 2014, then that is just under 6% of the total- a slightly surprising to me small percentage. The inverse of that number suggests the average length of ownership is approximately 17 years. Which sort of suggests that a two year free pass will be whistling in the wind.

I also recall some rule of thumb that suggests the average length of time spent living in a particular house is ~ 7 years. Investors on average must therefore be holding properties for some time, to keep the average ownership up at 17 years.

If 20% of the annual purchases are by foreign investors, then over say 10 years, 56,000 houses would be owned by foreigners. That would be over 10% of the total stock. And importantly that does not include immigrants who have it seems to me used house buying as their investment ticket in to the country. Once they are in, they are not foreigners of course.

I remember seeing data that 60% of NZ investment properties were sold within 2 years and 90% within 5 years. The point at the time was most investors don't get the true benefit of compounding as they take an early gain and the ones who truly win are real estate agent via churn.

Same with Lifestyle blocks. When people realise they're a money and time drain they flick them again, and again.

Nice charts. So about half of 'investors' (speculators?) borrowing in the 70-80% lvr band must be really praying that the economic miracle of ever inflating prices continues, offsetting their holding costs (yields lower than 4%, minus interest costs, rates, repairs, etc), so they won't be in a position of having to liquidate when there is no further borrowing available to them. They may be standing on a ladder they are trying to hold up in mid air. I've seen circus performers do that.

How do they sleep at night - thats the amazing trick. Wondering if they can get enough equity to hold up the whole edifice before it all comes tumbling down. The market will turn, its just the timing that is in question. "Everything has its season, everything has its time" to continue with the Rock Star theme associated with the AKL economy.

You are exactly right we don't actually know what happens. So even though I think the new policy is good, just what the effect will be is yet to be seen. We are guessing.

We even have predictions of a proerty spluge with a rush to purchase prior to October 1st. Those predicitions coming from sectors with a vested interest in saying so.

I'm fine with the goverment modifying it's first shot across the bows as the result shows up.

Trouble is, when we see some result, if any, we won't know the mechanisms within it.

My nephew and niece, one of whom has bought and sold four properties and one who is about to get into the Auckland market tell me that there is tremendous competition at auctions from overseas buyers and buyers who were not born in New Zealand but are now domiciled here. My nephew who was about to buy is now going to hold off and see what the RB and JK measures do to the market. There is also the possibility other measures will be introduced if the market does not cool down. JK is certainly under the pump and will be sick of hearing about the Auckland market.

The corelogic figures need some clarification.

An actual "mover" who owns a Bach or 1 investment property or any other property would be listed as a multiple property owner? So that means investment properties would make up less than the 41%?

But a FHB and a "new to market" are essentially the same except that the latter has no mortgage?

So many in the FHB and "new to market" could also be investors buying their first rental, they could also be foreign based. Right?

Does anyone actually believe 20% of homes in Auckland sell to FHB when on average home owners move every say 7 - 10 years and say the average ownership lifetime is 50 years, then there are probably 4 movers for every FHB in any given year (assuming an even age distribution). As the age distribution is not even and their are more young then let's reduce it to 2.5 movers for every FHB.

Yet the figures show movers and FHBs about the same.

Something must be wrong.

How many FHBs are actually first time foreign investors getting a mortgage?

How many "new to market" are actually cashed up FHBs?

How many multiple property owners are actually just "movers"?

The only number that is clear is that the "movers" are actually mostly "movers" but there may be more of them to.

All in all these figures aren't that useful.

Interestingly no facts about the kiwi dollar. The number which dictates conversion value to a foreign owner.

Kiwi below 0.60. RBNZ intervention will not save the drop

Certain groups are desperately hoping to find legitimate reasons for what they call a residential property "boom" because they refuse to admit what the rest of us have known all along: It's not a boom, it's a bubble, and, as with all ponzi scheme-like bubbles, there are no legitimate reasons for them... They are always and entirely based on nothing more than hype and hysteria.

It's not about interest rates or immigration, or supply-and-demand, or any of the other smoke-and-mirrors explanations tossed about by bankers and economists and REINZ criminals: The simple truth is that the pig-ignorant hillbillies of NZ talked themselves into believing they can't lose with houses.

Now they are about to lose in a very big way.

Some hard facts - Having recently sold in Remuera, been in the market looking for a rental to sit out this "madness". Been trawling in the same eastern city fringe area including approaching agents on sales campaigns suggesting that if the homes either don't sell, or buyers are overseas and not seeking to occupy, please consider us for a tenancy. Having viewed over 20 homes in the past 2-3 weeks, over half have been "ghost houses" owned by overseas investors, some "staying" in Auckland (as the story goes??!!) apparently owning many properties, but many living in their home country with no intention of living in the property. Sadly, a number of these properties are in all manner of condition, some not having been touched since the time they settled - grounds overgrown, clear evidence of being shut up for months. My point is, if this is the ball-park statistic in the upper end of the market, its unlikely the percentages will be any less in the middle price range of the Auckland market where the mass of trading is occurring. Foreign investment is well and truly alive and flourishing.

see the same in my area houses been sold and nobody in them sitting like gold in the vault, im sure they make their political donations so all is well

nobody believed me - tried to warn them

Iconoclast 13 September 2010

There is evidence of many 20+ year old overseas students successfully outbidding and obtaining $2 million properties in affluent suburbs. Further evidence has been reported of groups of these properties being purchased and remaining unoccupied. What raises questions is when more than handful of these expensive houses remain unoccupied simultaneously in one street. That should be an alert.

http://www.interest.co.nz/news/50660/90-seconds-9am-bnz-earthquake-legi…

http://www.interest.co.nz/opinion/64930/bernard-hickey-says-when-houses…

Dear kids,

You may be wondering why we now live in a small caravan parked behind gran's retirement village.

No doubt you are also wondering why we've pulled you from your expensive private school and why daddy has sold all his cars and now has to walk to his second job at MacDonalds.

Well, it's like this...

Several years ago, everyone told us we couldn't lose with houses, and we had to get on the property ladder before it was too late.

So, mummy and daddy lay awake at night worrying about how we were missing out on this sure-thing, and spent every spare minute of every day looking for houses.

Eventually the bank was kind and generous enough to let us borrow the money for a place guaranteed to strike envy into the hearts of your uncles and aunts.

By many estimates, the amount was approximately 30 times the true value of the property, but we knew the capital gains would more than cover this because you can't lose with houses.

Our nice employers congratulated us on our fancy new home in an exclusive suburb, but stopped short of increasing our pay, which hasn't changed in a long time.

Life was already a bit of a struggle since we were trying to keep up with the non-stop increases in price for, well, everything, but at least we were winners once we owned the house.

We gloated about how much richer we were getting with each passing day, as the nice real estate people kept us updated with rock solid numbers derived from secret-but-utterly-reliable sources.

How we all smugly chortled at the headlines about something some people were calling a "property bubble," and how it was about to burst.

Ridiculous of course, because you can't lose with houses... That's just a fact on which everyone can agree, and obviously the "bubblers" were envious have-not renter scum.

Of course, me taking leave from work to have your little brother made things slightly tricky, what with our single year-2000 income trying to keep up with year-2015 prices, but we knew we'd survive on one income due to the magical capital gain awaiting us.

That's when the bubble burst.

Unfortunately, the mortgage was now about twice the current value of the house which continues to drop by the hour.

Those lovely people at the bank did their best to help us, since they too know you can't lose with houses, but in the end we had to give them the keys and find temporary accommodation.

I know it's hard now, what with us all crammed into a tiny caravan and everything we own smelling of baby poo, but it's only temporary, because the property market is set to rocket up once more.

After all, you can't lose with houses.

XOXOXO

Mummy and daddy.

....cracker!. I need to print this out and put it on the fridge....the grief i'm getting from the war office for not buying into the ponzi is relentless...and currently hard to defend......

... small caravan down at grannie's !!! .... 'eeeee by gum , lad , they got it lucky ....after the bubble bursts the Gummster clan are gonna live in old septic tank down at council tip ... 100 of us clinging to corrugated walls for fear 'o fallin' .... woken every morning at 4 a.m. by having 7 ton 'o rubbish poured over our heads ...

It's not that we can't afford a freehold house ... it just that septic tanks are our thing ...

Nothing wrong with a septic tank if you are bacteria. All the food you could ever want and the by product makes for a net positive energy balance.

Like reading a sci fi story.

except if they hadn't overextended relying on _employment_ to pay the way, then they'd still have the house through the cycle because even though the non-PI pundits keep predicting the bubble will burst... it hasn't because it turns out it isn't a bubble. (if it is, just trying getting those career wages elsewhere in the country).

Because it certainly sounds like the wages bubble burst first....

So, you see nothing wrong about people just keeping up with the mortgage payments on an insanely overvalued property because those magical Divinely Guaranteed Capital Gains will make it all worthwhile when they sell?

It's not a bubble when panicky suckers fizzed-up on RE spruiker hype and hot air pay any asking price just to get their foot on the residential property "ladder," even though the boat anchor mortgages to which they so happily shackle themselves will mean their life consists of working to meet the payments and absolutely nothing else, save for those magical Divinely Guaranteed Capital Gains dreams?

Wow... Aspirations!

Let's all croak our last, happy in the knowledge we devoted essentially our entire lives to nothing more than keeping the bank's balance sheet looking good and healthy.

So worth it.

How does that dioffer from shares, commodities or securities markets?

Are you serious?

Sigh, I know this will be wasted time, but I'll explain it for you in simple terms.

Shares and securities are priced based on future expected earnings of the business or underlying asset... i.e. fundamentals

That is VERY different from what we see in the Auckland housing market where the fundamentals are that investors are yielding 2-3% gross (i.e. before rates and repairs & maintenance) which is below the current government bond yields (i.e. the best proxy for a "risk free" investment). Add to that houses are priced at 7-8x income so there is little scope to increase rents to anything resembling a market yield.

If the housing market was a stock then experienced investors in capital markets would be taking their gains now and running a mile from it.

All true

However, if an entity wishes to acquire enough shares to obtain control of entity 2, a "going entity", entity 1 will pay a control premium, based on a different metric, which is what is happening in the Auckland property market

A sceptic tank and all that Malarky..

Well said...it really is a Tale of Two Cities. Escapism for the Idle rich. Reality for the ones keeping up with the Joneses, eventually..

Maybe it is Freehold, over stranglehold.

.Maybe Mr Wheeler can read the writing on this blog wall. Sorry bog wall...in Gummy's case.

Maybe Mr Key is on the write page.

Maybe he has our real interests at heart. (Maybe not).

Maybe Mr Key will be the Key Holder if it all tanks. Skeptics aside, Figures don't lie, but they can be distorted.

Maybe income and deficit will tank.

Maybe we should all bet on the House.

Maybe petrol will defy gravity.

Maybe planes will defy all futures exposures.

Maybe gravity is all we need.

Maybe reverse mortgages will be his thing.

Maybe printing money will save us all.

Maybe all is well in hindsight.

Maybe voters should open their eyes.

Maybe wallets are empty, but not as we know it.

Maybe a surplus of houses for the rich and infamous.

Maybe New Zealand is a safe savers haven after all.

Maybe stocks will tank, cows will boom, sheep will follow,

Maybe a dearth of reliance on decent houses, will be a slum landlords dream.

Maybe 30% deposit is a lever up the ladder, not down the pan.

Maybe inflation will save us all.

Maybe an Apple a day will keep the good Doctor at Bay.

Maybe the secret is in the TTPA...the IRD, the Trust Account, the Futures bet, the Derivatives loss, the Currency Exchange. The Open Economy, the Fiddlers elbow.

Maybe I am just confused, maybe we all are.

Just Maybe?.

Maybe a collapse of the house ponzi scheme will finally give Kiwis that much-needed incentive to invest in something worthwhile and productive -- such as, say, business -- instead of only in the idiotic economic sinkhole of residential property?

Nah!

work out what will (a) make banks support more, (b) make NZ supporting ease.

reverse engineer your scenario then check for signs.

You lot make me queasy with your whining and whinging.

You don't know what hardship really is.

We had it much tougher in my day.

Watch this video and guess which one is me:

Your haiku need a lot more work.

I look at X and Y (my children included) and I very rarely see anyone who is willing to give up anything and focus completely on building up a house deposit like we did. The main culprit is overseas travel. It is expensive and they are all into it. Not simple Aussie trips either. Expensive European travel. They come home then moan when they cannot live like mum and dad.

The options are:

1. Work like a dog for an employer who thinks staff are an expendable overhead, just to earn and save enough for a deposit on a ridiculously overpriced piece of junk house and be a slave to the bank until they die;

2. Take the money and run, seeing the world and gaining valuable insight and experience in the process, not to mention the opportunity to do interesting things in other places for much more money.

NZ is an "aim low, no-can-do, bottom of the barrel, lowest common denominator" culture.

Kiwis are expected to die paying off a mortgage and that's it, end of story.

To do more than this -- to even want to do more than this -- is seen as an affront to the Good Kiwi Way, and you will be backstabbed and belittled until you fall into line.

Young NZers are stupid to not get out and away at the first opportunity.

OK, now here's where you roar the obligatory, "THIS IS GODZONE, AND IF YOU DON'T LIKE IT, YOU CAN F*** OFF!"

3. Many New Zealanders exist to pay tax and think this is a good thing. Not paying your fair share of tax (fair share = as much as possible) makes you a thief

I just don't understand your logic Malarky - why wouldn't you want to stay in NZ your whole life, slave your arse off for 60+ hours a week for the first 10 years of your career so you can get the 20% deposit required to buy that 3 bedroom shit-hole in Mangere for $700k off a retired Boomer living in Remuera. They have to off-load their under-invested portfolio of 20 properties to someone at some stage.

If you don't stay and do that you're just selling yourself short and ruining it for everyone. Son, the time to get on the ladder is now!!

Well if they did not have that large student loan around their neck they would be flatting or own their own home and not still living with you Gordon. Boomers like yourselves had it all, then shut the gate as you use it up, so travelling the world why not ...may as well have some fun while they are young.

the overseas travel isn't too bad as it does break some of the local parochial mindsets and often those who have traveled do find themselves in the better paying positions relative to those without the wider experience. Although doing it on a budget and working as you go is not so popular in the entitled world.

the difficulty is finding a decent paying position AND being able to sacrifice at the same time.

To get the better positions they either need capital to start business or a decent education to sell high value skills. There are few positions these days which pay well for the uncertified, there is just too much competition.

Frequently I find that New Zealand workplace training goes something like this: "Here's is the people you work with, here is your place. When you work out what you have to do we will consider you trained." Employers and businesses are far more concerned about seeing everything is certified and properly approved than actually doing anything useful.

I find it interesting talking to foreign professionals that they don't see any correlation between their salaries and the sales or performance of their firms. Sales are large enough scale that such things don't matter any more. It's more important to trim 0.7cents of a production line that does 12 million units a year, than it is to provide a $2 extra promote-able benefit to a customer. The former gives instant performance improvements, and that metric is already captured by the existing analytics, where the latter involves reassessing and distributing resources.

Is it the trips? Or could it be that housing costs have tripled in real terms since your day? Plus the student loan. It's going to take a lot of trips, designer jeans and frothy coffees to match that damage.

Not so much the student loan ... more that to get a median or better paying employment then you need one. Similar to business startups, previously a lot of business startups didn't require extensive training, now it's a challenge to pay for all the certifications (from everything from office fit-out, to staff contracts). It's become like the old export regulation system (which was so crippling many exporters just left the country to get to their market)..

I didn't think it would take a rocket surgeon to work out that a 20% reduction in demand would have a negative effect on prices. Apparently people are a bit slow. The oil markets crashed on far less, milk tanked on a similar reduction in demand.

There are 230,000 odd residents who need to be out of someone else's home and into their own just to get Auckland's housing occupancy rate aligned with the rest of the country.

There are 115,000 odd people who not that long ago would have lived in their own house not rented.

Every year 15,000 additional Aucklanders are born there.

Overlapping groups admittedly but where would you like to start with your 20% drop in demand?

PS If I ever grow up I so want to be a rocket surgeon. Sounds like the coolest job on Earth.

Demographics people. Are we right to assume that the occupancy rates in Auckland should be the same as the rest of NZ? The demographics in Auckland are diverging very quickly from other centers with large numbers of families from different cultures arriving there. Multi-generational households are the norm for some of these.

Sure I have over-simplified the picture for the sake of making an argument.

What I was trying to say is that there are three different housing demands in Auckland

1. Base demand: X dwellings for Y people. The occupancy rate is the simplest measure of how well that demand is being met. Statistics NZ also have a much more detailed analysis of genuine overcrowding and a discussion on how you measure it.

2. Ownership: demand to be the owner basically of existing stock. 99.99% of all the discussion over the last week has really been about the composition of the owners of housing stock. There are merits in controlling the composition of owner-occupiers and landlords. But the simple transfer of existing stock between different groups, the measurement of who owns what and the imposition of controls on the transfers doesn't actually affect the base demand

3. There is also a small demand for better quality stock i,e housing that doesn't threaten the occupiers health. This doesn't concern this argument so much.

So I don't really buy into the "bubble bursting" scenarios starting to turn up in comments here. Discouraging a handful of potential buyers from purchasing existing housing stock won't, by itself, cause Auckland house prices to drop. Even cutting visa-based immigration by 20% wouldn't do much either. SImply because there is already so much unmet need already in Auckland. Any minor corrections will just allow some of the currently priced-out access to ownership again but they won't get big bargains.

When's Key going to "get some guts" and do something about that? he hasn't had the guts so far, so who knows.

He's had plenty of "guts". he sits there for his foreign masters while the NZers rant and howl. that takes a little guts. Don't tell me you're one of those who still thinks he's working for NZ, not his next job at a nice big bank.

Guts? Key? Prime minister of NZ, John Key? LOL! Never before has NZ been lead by someone so cowardly!

Key plans his foreign expeditions around bad local news: Notice how he's always out of the country whenever the Nats have to face some music, or when they perpetrate some crime or other? It's not coincidence, you know.

Here's an obvious example from earlier this month:

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11443540

Guess who that was.

No? Okay. Try this: Remember a certain recent by-election? A recent by-election won by everybody's slippery fav, Winnie? Now, remember why that by-election was necessary? Well, that link tells you why. It also tells you why the court appearance was deliberately timed to coincide with John Key's latest inexplicable overseas junket, this time to the Gulf States, a region where he was desperately needed for...?

LOL

I think there needs to be more focus on the 2 year time frame in the new rules......as there will be some affects.

If there has been the high level of speculating (the increase in taxes would suggest there has been a lot of speculative activity) then much of this speculating could well be discouraged somewhat from investing in the lower priced housing market........we know that historically many of these players have the habit of avoiding/evading their tax obligation so will be looking at how they can in the future invest and avoid tax on any profits...

Personally I dislike all this gathering of precise information on where/what/why/how people are investing as it serves no true purpose other than to allow bureaucrats and public servant etc the ability to basically insider trade......this kind of insider trading corrupts the market!!

What is the level of investing into NZ housing undertaken by bureaucrats/public servants???

Of those people who have been captured by the IRD for not paying taxes on their speculative activities how many of these people were employees paid by the Government?

If any facts or figures are ever to be collected it should be on the public system not private enterprise. The Right to privacy is a Right for a reason but it has been completely eroded to be interpreted that the public system has the Right to demand your private information and will then supposedly not personally identify an individual.....when the public system collects private data it is widely dispersed amongst the bureaucracies/public services and many of the individuals working in these areas armed with this inside information can now invest as a sideline.....

The conflict of interest rules in NZ need to be changed immediately.....all persons working in any part of the public system need to be declaring their investment interests. For example it should be known exactly how many people in each region of each public service have investments in housing and what region those investments are in. Who knows what the number of Auckland Council planners who have investments in the Auckland housing market or other regional housing markets are? what about the number of Christchurch Police who have investments in housing or school teachers, Doctors, nurses, treasury, RBNZ, ACC, WINZ, immigration etc?

You can take the whole of the Government, bureaucracy and public servants system and I bet the number of house speculative -investors amongst them is very high. Has any journalist thought about the effects on the housing market if for example there are 10% or 20% or 30% of this group holding or turning over an investment in housing?

Not only does this group have enormous amounts of inside information to base their investment decision on many have until now come under the IRD's radar as they have employee status! As more than one public servant has told me, it is fantastic...I get to go to work, I get all this information on what, where, when and why.....I know where the shortages are, I know when the prices are likely to decline, I get paid and can do all this research in work time as it is required reading, I get a pension fund, I get basically everything you can't get in the private system, so why would I not work the public sector.!!!

So DH while you have stated that you hoped more information is gathered please make sure that those doing the gathering are at the right coal face!!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.