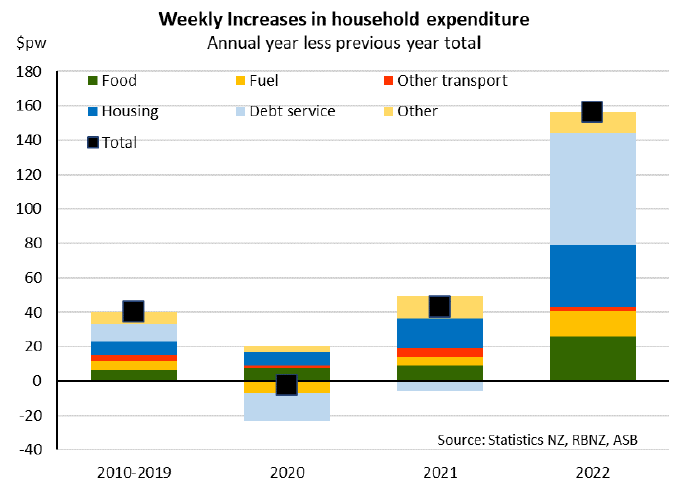

Rising costs are likely to see average household budgets hit by a "significant dent" of about $150 a week this year, according to ASB economists.

The economists say this would equate to an extra $15 billion households will have to find over the next year - equivalent to about 7% of household disposable incomes.

Housing costs are likely to be about 8% higher.

In a detailed crunch on the household living cost outlook, ASB senior economist Mark Smith says households built up a larger saving buffer in the 2020 and 2021 lockdowns. Household deposits have jumped by about $25 billion since early 2019, though the build-up in savings "is unlikely to have fully dispersed across the household sector and many households would still be living pay cheque to pay cheque".

"Nevertheless, if current spending patterns are broadly maintained, rising costs look set to place a significant dent in household budgets," Smith says.

And while he says "for the average household", the increase in the 2022 calendar year would be $150 per household per week compared with 2021 "some households would experience much steeper increases, including more heavily-indebted households". Others would not see as sizeable an increase.

"For most households, we don’t expect household disposable income growth to increase by as much as the cost of living.

"With a shrinking savings buffer, difficult choices and potential trade-offs lie ahead.

"Households will either have to dig into their saving, sell assets, increase their borrowing or cut back on spending. Discretionary (i.e. non-essential) spending is likely to be the first in the firing line and consumers will also look to economise spending on the essentials. We suspect the penny is starting to drop now."

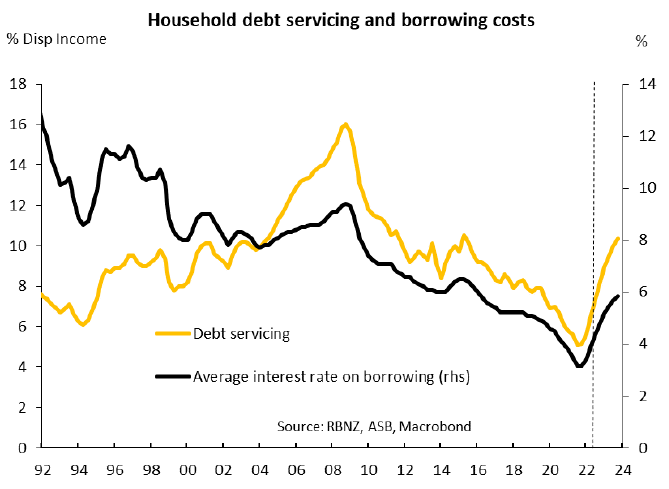

Smith notes that borrowing costs "are also ratcheting up" and are expected to move sharply higher over the course of 2022.

"RBNZ [Reserve Bank] figures suggest that the average mortgage interest rate charged on the total stock of mortgage debt troughed at around 2.83% in September 2021. Average borrowing costs are now on the way up, with carded mortgage interest rates rising and approximately 60% of current fixed-rate loans due to be reset over 2022, often at much higher rates.

"Our latest mortgage interest rate forecasts flag further increases ahead. All up, the average mortgage interest rate facing borrowers will likely increase by roughly 150 [basis points] over 2022, ending the year at just over 4.5%.

"That would push household debt servicing back towards historical averages from a record low share of household income."

On general housing costs, Smith says costs of building a new home have "rocketed" with higher costs and shortages of labour and materials.

"There are hefty increases for dwelling maintenance services. Local authority rates look set to rise steeply for a second successive year. What’s more, annual dwelling rental inflation looks to be accelerating as landlords recoup rising costs. An 8% annual increase in housing costs looms."

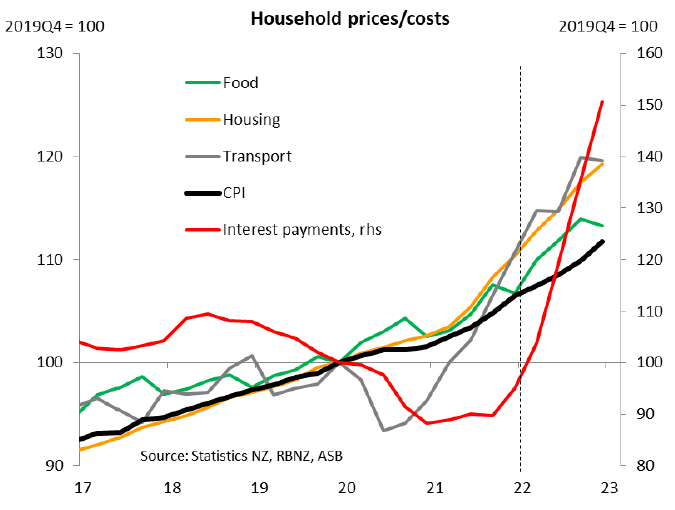

On climbing inflation, Smith says consumer prices have "rocketed", with the sources of price rises become increasingly broad-based.

"After ending 2021 at more than 30-year highs (5.9% yoy) we expect annual consumer price inflation to remain elevated over 2022, coming in just under 6% per annum. Broader living costs for households have also risen, with a less stratospheric 5.2% annual rate over 2021, though with household interest payments advancing at a close to 8% annual rate after troughing at the end of 2020.

"Viewing the increases (see chart below) suggests that the lifts post COVID-19 have been more pronounced for the essentials – food, fuel and shelter – than the nice-to-haves. Further volatility lies ahead, but we expect consumer prices to continue to ratchet higher, with debt-servicing costs sharply increasing. Both will place household budgets under pressure."

Smith says in order to to estimate the cashflow impact on household budgets the ASB economists use Stats NZ's NZ household economic survey, which records what households typically spend each week.

"The latest survey was taken in the March 2019 year, but we have updated the figures to reflect more recent spending patterns using a combination of consumer spending and consumer price data. Household spending patterns have clearly been impacted by Covid-19. For example, retail sales and traffic mobility data indicate lower household fuel usage.

"Household debt has rocketed since early 2019, tempering the benefit provided to debt-servicing costs (including principal repayments) provided by lower borrowing costs."

Smith says with household balance sheets no longer benefitting from rising asset values, consumer spending is unlikely to be as robust or as resilient as it was in 2021.

"The economy will need another driver of economic activity," he says.

A more sluggish outlook for household spending may well temper the extent of OCR [Official Cash Rate] tightening required by the RBNZ.

"We expect consecutive 25bp hikes and an OCR peak of 2.75% this cycle.

"Still, there is the clear risk that the RBNZ hikes by more if they deem their inflation mandate to be under threat."

93 Comments

Time to pay the piper.

The Labour Government is in the process of completing the distribution of around $15bn of public spending to those who own assets. The cost of that is about to be felt acutely particularly by those without.

Well done.

The problem with the whole 'people who own assets' thing is that unless you're in a small minority of people who are downsizing or moving to the regions, you either haven't sold (no realised gain) or you bought and sold in the same market, and many of those people would have just taken on a whole heap of new debt.

That's of course ignoring investors who have now had the opportunity to sell for a massive gain and now get the benefit of rising interest rates on what they cashed out.

Very few investors would of sold in November last year. Many are stuck trying to get out while values are tanking. You would be surprised at how so few investors really win big. Then of course there is going to be bank bail in collapses here in NZ that no one is talking about or securing themselves against. So those few investors who did win big will only lose their wealth at the end if they are not up to speed with bank collapses in the near future.

Exactly. Sales rates have not been especially high. There hasn't been a wave of investors who "got out". Most are still stuck owning.

2022,

"Then of course there is going to be bank bail in collapses here in NZ that no one is talking about or securing themselves against".

Perhaps because that is highly unlikely. On what do you base this prediction? You express absolute certainty, but produce no evidence of the likely causal factors. Since all our banks have considerable exposure to the housing market, I can perhaps assume that you think the crisis will come from that direction. How might that happen? I can only think this could be triggered by a massive collapse of the market forcing banks to call in their loans. When borrowers cease to be able to service their debts in large numbers, a bank(s) may then become technically insolvent. Is that what you think might happen?

Before that happened, the government would step in and bring forward the deposit guarantee scheme, but without limit.

"Before that happened, the government would step in and bring forward the deposit guarantee scheme, but without limit."

"But without limit" Oh do please show us the proof of that ! You express absolute certainty, but produce no evidence !

New Zealands modus operandi is to do nothing and then overreact. We've got a 100k deposit guarantee scheme which would mitigate the risk of bail-in or bail-out, but that wont be in place until 2023. Oh well, the government wasted over 100 billion on unnecessary covid measures so why not waste another 100 billion or more bailing out the banks.

100k is not much. Especially when you have sold up the portfolio so you can retire .

"would of sold" ?

Perfectly on plan. -30% Crash in home prices by December this year.

I'll have some of that, how much do you want to do??

It will certainly be interesting to see the total % drop in house prices after say three years has passed. Especially once adjusted for inflation. It will be a brutal wake up call to many who played this game as a one way bet.

Some here will still try and hide the pain of others, argue it as a soft landing and talk up the gains of the last 100 years.

Soft Landing translation - Its going to be a blood bath, financial ruin.

People who typically use the words Soft Landing - Property Broker Agents who must temper the chaos. Government paid media. BANKS.

"Government paid media." - what? Can you name me a publicly paid reporter or presenter who constantly says we are headed for a soft landing. Like an actual name or example.

Sharon Zollner, Bernard Hickey, Ashley Curch, Tony Alexander... do they count?

They are not government "controlled" but all toe the party line. They all know that it would be disadvantageous to scare the people.

Only one is a journalist - Hickey

Hickey doesn't champion property - he's led the calls for housing being in a crisis - and has been in despair of the state of unaffordability for years - if anything, he's one of the only ones with the guts to standup publicly and say it's criminal what we have done to future generations.

“I now think it's unrealistic to say to those people, you can have affordable housing in your lifetime. And we're essentially now a country where you have to be born into wealth, to be able to expect to have your own home and be able to build a stable family life,”

https://www.rnz.co.nz/national/programmes/afternoons/audio/2018801616/b…

Ashley Church & Tony Alexander are paid spruikers of the property industry... so are paid to pump and preach.

Sadly 99+% of working people don't have time to read interest.co.nz (they don't get distracted!) and any impartial financial news or press, as they are too busy at the coal face trying to make ends meet, raise a family, care for a parent etc.

So the hardest working part of society are the ones who have been falsely led to believe by the likes of Church in mainstream news, sprouting that the NZ property market was a bulletproof one way bet.

Ashley Church - 1 news, March 2021 - House prices will double in the next six years

https://www.1news.co.nz/2021/03/24/property-commentator-ashley-church-p…

Even if they had researched or read the warnings of others (or better still, interest.co.nz DGM'ers 😜) last year they would have believed ol' Ashley cause he's on the telly... so he must know what he's talking about.

The OECD has warned for years, of the fall that's now baked in, but it was brushed aside by mainstream NZ press as 'doom mongering' rather than a russian roulette of financial risk for a household.

If you think A Church and T Alexander are similar, you really, really don't know them at all

Which one of them are you?

I know one is a former BNZ chief economist who now only writes about property as an expert for property companies… and the other is a muppet that only writes about property as an expert for Oneroof.

Both have a voice as property experts in mainstream NZ media. That’s who they are to viewers/listeners/readers.

What did I miss?

They have a similar modus operandi, but to be fair at least Tony is an economist. I have really mixed feelings on him, he does provide some good analysis but he's also so clearly biased.

"Which one of them are you?" Childish response.

"one is a former BNZ chief economist who now only writes about property as an expert for property companies"

That's quite simply wrong, Alexander writes about all aspects of NZ's economy and his clients are not property companies

"That's quite simply wrong, Alexander writes about all aspects of NZ's economy and his clients are not property companies"

It's not wrong, I wish he did write about all aspects, but if you google 'Tony Alexander' you will see exactly what he writes about - everything is with a property market lens and impact.

That's because you'll find the companies that now pay him are all part of the property industry - see the back of his newsletter

http://tonyalexander.nz/resources/Tony's%20View%2017%20March%202022.pdf

What other companies pay him?

He once was a bank economist but he's now positioned himself as a expert on 'what's happening in the property market'.

That's why NZ media now wheels him in, and he uses that public profile to get more paid 'Tony's view' property industry clients.

In his latest OneRoof article, Tony Alexander talks about 10% house price falls this year, and flat prices next year.

I don't think that he believes that to be likely. He is just writing what OneRoof wants to publish.

Exactly Fitz... he's careful not to bite the hand that feeds him.

I have seen several big spikes in inflation before. This one is very different as it is occurring in a time of house prices dropping. This has not happened before to the same degree.

I conclude we are entering a period of "Stagflation" which invariably ends in a period of severe recession.

The only savior, whether we like it or not, is that the war in Ukraine will create a boost to the world's economy. Now for the demand for munitions and then after the war to rebuild Ukraine.

Just more indicators that we are in for some serious pain very soon and we have a Prime Minister who will happily talk for hours about Covid but avoid any conversations around cost of living, housing, inflation etc etc.

We are effectively leaderless at a time when we are going to need some very strong leadership. I think we will look back at this time in the future and wonder how so many people could have just stood by and watched as our country came crashing down.

I'd be interested in what you think the government should do about any of that stuff?

Labour have already done a lot around the tax advantages of housing (which National plan to reverse), they have removed a lot of the restrictive planning rules, and there are a lot of houses being built (whether you can attribute it to the government is a different matter). I can't really see how much more they can do.

As for inflation, that is for the independent reserve bank to worry about, not the government. All the government could do to fight inflation is to stop spending and public pay rises, which would just make things worse for many people.

Arguing the RBNZ is 'independent' doesn't hold any water when they changed their mandate pre-Covid and have failed to uphold any consequences for repeatedly overshooting their inflation target. So at what point do you become complicit? Probably about the point at which you start saying house prices shouldn't drop because people don't want to see their house prices go down.

As for their tax changes? They could have followed through on the tax reform policies they campaigned on in order to get elected instead of ruling it out forever. And the planning rule changes have been diluted after the dithering from councils, instead of being focused around key transport corridors, they're now just going to happen where ever land is cheaper; i.e. not in the central corridors with the transport to support it. And even then it took them four years to get to that point.

Wrong on the planning changes. There's a massive plan change coming in Auckland in August.

I can hear the screams already from Ponsonby and Mt Eden.

No, I'm not "wrong" on the planning phase. The changes coming in are because the Policy Statement in 2020 was being strangled by councils who were finding ways to limit development along key transport routes. The changes we are getting now are a direct response to that. But instead getting tall apartment blocks along key transport corridors, we're getting the potential for relatively minor intensification to three levels everywhere.

The land prices in Mt Eden make it extremely unlikely someone will bowl a historic villa and build three units when they could buy five houses and build 15 in Massey for the same money. Except one of those areas has trains, link buses and bus lanes, and Massey has none of those things. If they'd just told the councils to take a running jump then they could have ended up with far better urban outcomes, but instead they took the approach you're talking about here. Yes, it looks better from a 'look at how broad the change we're making is, please don't ask about how functionally effective it is' approach, but it's a step backwards from what they initially proposed in 2020.

Sorry, you are wrong. I work in and around this space, for part of my working week.

The NPS-UD came in, in 2020. Councils had to notify a plan change no later than 2022 to give effect to that. That's requiring zoning for 6 storey apartments in certain locations (eg. within walking distance of train stations and centres). The August plan change in Auckland includes that.

Then there are the changes that came in late last year, that requires zoning for 3 storeys pretty much every else (unless certain exceptions can be made, under 'qualifying matters')

The August plan change will change the Unitary Plan to provide for both of these things. It's massive.

And you are wrong on Mt Eden. Usually it's areas with high amenity and high land values where apartment development occurs. Look at all the 5 and 6 storey apartments being built around Remuera right now, as proof of that.

100% correct. In fact Mt Eden station will be one of the areas that gets huge intensification. If you've not been down there recently they have demolished about 4 city blocks and once the works are done those blocks will be redeveloped with high rise, open space and street improvements. Then you have the dominion road interchange close by which will have more of the same with light rail.

Yep. Heaps of under-developed land near the new station will be ripe for 5-6 storey apartments.

Plenty of Kingsland is also likely to be rezoned for 6 storey apartments within 400-800 metres of the station there. One to watch too. Ellerslie as well.

I gave my uncle in Wellington some advice when the NPS-UD first came out (and hardly any one was thinking about it...) and it was pretty obvious what was going to be rezoned for 6 storey development. He's going to make an absolute killing. And he's looking after me for my advice :)

Ponsonby / Grey Lynn will probably get three storey zoning over at least 50% of it's area (replacing Single House Zone). So that area will be ripe for multi-unit development (mind you, whether the development sector is buoyant in a year's time is a big question, although I think there will still be a reasonable amount of high end stuff happening)

It's going to be entertaining hearing the massive outcry once council consults on proposed draft changes in April / May......

Interesting how hardly anyone seems interested in this stuff, given how profound it all is for Auckland and other bigger cities. Plenty of Aucklanders WILL be though come April / May once the draft is released....

That differs entirely from what I've heard from others who work in the space; that the corridor reforms were being gradually watered down by councils looking for the loosest interpretation possible rather than what was clearly intended by the change, which made the wide-spread changes something that had to be expedited in order for the unitary plan changes to be actually made on time. I really liked the initial NPS-UD and I think the key focus on routes with transit options was one of the smartest things Auckland has ever done.

I'm still convinced this was the way to go, and I'm not entirely sure if spreading development all across the region at a lower level is a better option. It takes significant focus off the transit element and now seems to mean we'll get more low-rise spread out across the entire region (infrastructure be damned) as opposed to the specific routes that the NPS was targeting for a very specific reason.

I'm not doubting the appeal of Mt Eden as a location, and if it does get developed then that's an ideal outcome, but living in West Auckland and seeing a level of development I don't see anywhere else (bar South Auckland and parts of New Lynn), I'm not sure why the cheaper land in the outer-suburbs won't just continue to be developed ahead of the far more pricey central stuff. I would love to be proven wrong though.

All good. Your friends are wrong though :)

April / May you will be able to see what's proposed when council consults.

I'm not saying they can fix everything or even that it is all of their doing, but just acknowledge that we have a cost of living crisis, housing crisis, mental health crisis etc etc, engage and listen to "their" people that they promised to represent.

Start taking ownership, stop hiding behind Covid and some honesty would be a good start, it's called leadership!

I'm sure they have done some research and found that taking ownership leads to less votes than hiding. If they take ownership then the likes of Hosking will use it against them.

Drop GST down, start taxing religious organisations, Maori organisations pay same tax as every other business. There is 3 for you.

Key and English were the only people in a position to handle what is coming. Jacinda couldn't balance her own chequebook. This does have the potential to get really ugly.

I'm trying to work out if you're serious. Bill English, maybe, pragmatic down to earth. John key, you gotta be joking, he's a gambler nothing more.

And yet largely Key and English are implicit in creating this mess? Again like the RBNZ they would be arsonist firemen.

Which that is to have some form of split personality mental disorder where you create problems for yourself to resolve, then claim to be a saviour/hero of society.

DonKey was a speculator throughout his life, speculating on currency bets is both a hollow endeavour (it does nobody any good, except the specuvestor) and short term thinking. Key bought both to his government, minus a few clear infrastructure examples that have turned out pretty well (cycling infrastructure, fibre, the Auckland car tunnel, probably the Auckland subway). Otherwise it was short term thinking, open the immigration flood gates and sell milk to China while intensifying dairy throughout the country - both having severe consequences for those who aren't multi millionaires and can just move to Hawaii when the consequences have to be worn. English was boring, but at least had some sense.

"DonKey", name calling, really? are you proud of that one?

I prefer Chon Kee. I am proud of that one, although its not mine.

how about Max Key?

Politicians are almost always worthy of our scorn.

There's the occasional decent one that's not. DonKey isn't one of them.

I liked B English, though.

The biggest intensification of dairy happened under Helen Clark's labour govt, not John Key's National govt.

Jacinda isn't the finance minister.

Almost took you seriously until that comment. Key and English are fairly smart people but there really isn't anything special about them. Key wasted half his time making people talk about a flag. We really should stop being disappointed by senior politicians, they are just people with high energy and a desire to be the boss.

Just confirms what so many people on here were saying last year re the hangover will kick in, just the general public have lagged behind. But going on the latest polls they are now discovering the empress has no clothes.

"...now discovering the empress has no clothes."

Man, I'm ugly as sin but that is not a pretty sight.

Disclaimer-I'm balding, have crooked teeth and sun damaged skin.

I know which one I'd rather see

People may have to start cutting up their notes to extend their value..

This is one of the more DGM articles I've seen on interest dot co for quite some time.

And all endorsed by the ASB.

What's the bet the RBNZ reacts with some emergency measures? The banks simply request a tune and the RBNZ gets out it's fiddle...

Rates are still close to emergency level people have just borrowed at low rates pushed up house prices so a house with value of 400k is now a million this is now just reversing and a lot of investors are just about to lose all they made on way up, people who bought in last couple of year will have lost deposit and be in negative equity for years.

In fairness, they are following the signals sent by the govt / central bank and what they're being told by the media / water cooler chatter. Robbo, etc will be pushing the narrative of "couldn't see this coming."

I tried to politely discourage them, but the in-laws have just gone and borrowed against the house to purchase their first investment property.

I know for a fact that they'll be putting in money each week (i.e. it won't cashflow enough to cover costs) and they are banking on capital gain, as that's what they told me.

I did try to point out that there are a few economic headwinds at present, to say the least, but alas.

Funny watching the investment property forums on likes of Facebook etc....a few people are saying watch out for rising interest costs and loss of interest deductability....but there are still more and more people on a weekly basis saying that they are about to buy their first rental property. And many comments encouraging them to do so even though others point out that the cash flows don't stack up for it to be a worthwhile investment.

I'm sure some people will still find a way to do well out of residential property investment in the current climate. However - and I mean no disrespect to my in-laws as they are lovely people - they really aren't all that savvy when it comes to investing. It's a bit like the shoeshine boy story with respect to the stock market.

They've got some rich friends who've made a packet out of leveraged property investment, because they got in early enough to ride the wave. The problem is that because the Smiths have done so well out of property (they have his and hers Audis, you know) it must surely work out for them too.

Interestingly (to me) is quite a few people in the facebook forums asking for advice on buying rental properties appear to be young families in their 30's....they might have the required equity in their current property and are now looking at using that to buy a rental. And this I find very dangerous....the use of equity in previous properties to purchase more properties....I think its riddled with risk in a flat or falling market. Been great the last 20-30 years with the price appreciation that we have seen....but if the tide turns....you are essentially doubling your leverage and losses.

Exactly right - can somebody please let housing specufestors know that leveraging works both ways ?

Meanwhile, you can get ~4-5% PIE yields on NZX listed REITs. No chance of them phoning you up in the night because the toilet has flooded, either.

Ouch. Well hopefully they are long term and not wanting to get out again within ... I dunno... 5 years maybe 7, could be 10.

No point in the average house being valued at $1,000,000 if you can't afford $100 to fill the car up to get to work or to pay your rates or feed the kids.

Perhaps now its time to reverse the cycle so that debt to income ratios are back inline with historical affordabilitiy ratios? Then issues like this go away as the debt service costs are no longer an issue if/when interest rates need to rise.

Or we could just put our heads in the sand about it all.....which has been the popular theme over the last 5-10 years.

And anyone who thinks having some of the worlds most expensive houses is an issue that needs to be corrected is a negative person who deserves the tar and feathers of public shame by labelling them as doom gloom merchants or being envious of other peoples success.

What is the point of being successful if the product of your success (insanely high house prices) is the cause of misery and suffering of others?

We can't stop now. House prices must always go up.

See what we were taught, for the last 10 or so years, is that it's not possible to buy your dream home right up. You have to buy a starter home first then climb the ladder (i.e capital gains and so on)

I think we're forgetting that pretty much every first home buyer of the last 10 years has bought a "starter home" and has planned on trading up in the near future. Prices had reached a point where it simply wasn't possible to buy a nice home right off the bat, you HAD to buy a starter home, and even they were taking off.

So prices falling... inconceivable. It just doesn't work like that. In fact, the advice given to recent buyers now is, hold tight, tough out the bad times, keep paying off that home, and just be glad you have a home. Are people that fickle, they'd forget why they even bought that crap house and start to love it, because people told them to? Or will the housing market become a victim of its own fear-driven homeowners who will panic-sell as fast as they panic-bought.

If homeowners are presented with arguments from real estate professionals, like "the best time to buy is today, house prices always go up" in good times, and "don't sell, tough it out" in bad times, they HAVE to conclude that it's not good advice at all. It's just using you to prop up house prices for the benefit of those in the game.

Real advice would be "Sell your first starter home, since house prices will fall, you can keep the capital gains then buy your dream home when its price falls too"

I read the book "Animal Spirits" by Shiller and Akerlof back about 2015 to try and understand the mania that was being witnessed in our housing market (after having seen the same in the US a decade before). And how it could be effectively managed in order to prevent a dangerous bubble from forming - with the known financial and social costs of such an event.

Our government and Central Bank have essentially failed every recommendation that Shiller and Akerlof suggest and hence why we find ourselves in this very bad position we do now with some very highly indebted families/development companies and the risk of rising costs.

And the general suggestion is, is that the quantity of FOMO you see in the upswing of the cycle, is matched by equal fear of getting out on the way back down. Having been to many auctions in Auckland, the greed/FOMO has been very high for a sustained period of time. So I honestly think anything could happen this decade.

That's my sentiments too mate

Wouldn't a real estate agent's advice always be for those considering selling to sell and those considering buying to buy? Unless people are buying and selling they get no $$$.

I'm sure they're indundated with desperate sellers at the moment demanding top dollar, and having to tell each one they're dreaming. Can't imagine they'd encourage more of that.

The leveraged still need to eat, travel (fuel), and pay an increasingly greater tax payment on their income, just like their tenants. Could be worth tracking the number of mortgagee listings moving forward.

The cost of shelter is crippling this country - govt. needs to build some state houses. Rezone current state house land, forget the terrace housing and motels. Build some effing towers. The public/private patchwork in GI/Panmure is a joke. Forget the woke mixed community BS and pack them in around the train stations.

Yeah, because that works so well whenever it's been tried ...

There is good news, we are allowed to tuck our jerseys into our jeans again!

says who?

Article picture.

We would be in a better position right now if RBNZ had not pumped housing.

The answer is easy .....some (not all) PI's have done very well paying off their mortgage interest payments with their rents being subsidised by the taxpayer (you and me !) through the accommodation supplement. And believe me, I have seen in Auckland some absolute dumps with ridiculous rents, that obviously the tenants couldn't of afforded without assistance.

If these PI's think they are so smug and smart and nothing will ever change for them, will drop the friggen accommodation supplement ! and start building more housing with this tax payer money, whether it's done by the private or public sector (or a combination of both)

Then rents will fall to a "true market" value ....what ! I can hear the screams out there all ready ! Well, boys and girls, what ever they taught you at those property seminars, I bet never included things changing for the worst ie who would of thought the govt. would take away claiming mortgage interest payments against your income ? - even I didn't !

Again, why should people that work (and rent) for a salary, put money into the pocket of these landlords.

Some of you PI's are so used to having things your "own way" for more than 10 - 20 years - so it's now time for a turning of the tide.

While it might even encourage people out of residential property investment, realign house prices to a more "normal" level and encourage people to buy, who just want the ONE home.

Advocacy group Renters United says it has been approached by landlords horrified at Property Brokers stance.

https://www.rnz.co.nz/news/national/412965/property-brokers-tell-landlo…

and the 'owner'

https://www.stuff.co.nz/business/91418098/property-brokers-manawatu-and…

This is the wealth effect in action. Sure necessities such as food and gas are more expensive but think about how much your house has risen price relative to how much more expensive these things have become. I guarantee you if you crunch the numbers you are winning all the way to the bank! To many pessimists on this echo chamber!

Another trick with a calculator that can make someone like you happy for no good reason, type in 58,008 turn it upside down and read. Thank me later...

And, as of today, Trademe is no longer specific with exact number of residential properties for sale on the website. Back in February the number was 18000 and on March 19th was 31943. The website now advises there are over 32000. I wonder if this small yet significant change is brought about by Trademe itself or some property Whales who spend a lot of money advertising their products on it.

It's boom times ahead for Trademe if listing numbers rise and they can cash in on the selling and advertising fees. I just had a look and you are right. This probably looks like a ploy to hide the real state of affairs as troubles are brewing in the economy and more and more companies are going to do the dodgy on their customers.

This happend in the GFC. The have a tech issue and the website cannot display past 32000. Was curious to see if the had fixed. That's a negative.

I also remember this it maxes out at 32000

I wonder if they cannot afford the special software to go past 32,000 ?

16 bit signed int LOL.

It's really not like National would have put us in a better position. The same thing is basically happening all over the world

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.