Kiwi households face a $15 billion spending crunch over about the next 18 months, according to estimates by ASB economists.

In a new Economic Note on the potential impact of rising mortgage rates, ASB senior economist Mike Jones estimates that higher mortgage interest rates will add a net $5.6 billion to aggregate household outgoings over the coming 18 months.

"It’s a big number, but we expect it to be fully offset by strong income growth," he says.

"However, adding in other cost of living hikes lifts this estimate to more like $15 billion, Jones says.

Strong growth in household wealth will help buffer this impact, he says, "but most of it is tied up in housing. And you can’t pay the bills with your house".

"We’re left with support for our view that consumer spending growth will slow to a crawl later this year," Jones says.

The $15 billion estimated extra hit to household budgets over the next 18 months is "roughly equivalent" to 9% of retail sales, Jones says, as a means of comparison.

"That’s a big hit for households and the economy to absorb over the coming 18 months."

He notes that the Reserve Bank (RBNZ) "is putting plenty of store" in the buffering impact from strong household balance sheets.

"We find that they are indeed in good shape, with reported household net worth surging by around $600 billion through the pandemic. Most of this wealth run-up reflects the revaluation effect from the boom in house prices."

But this raises a couple of issues.

"First, house prices are now falling, meaning a chunk of this (paper) wealth will be disappearing again. This flipping of the wealth effect is typically not good news for retail spending. Second, you can’t use your house to pay the bills. Cash and deposits comprise a comparatively small part of household assets.

"So, will households run down savings to pay the bills, or will they cut up the credit card?

"We think it will be a combination, but with a healthy dose of the latter."

Jones says it is well known that households have built up "a swathe" of savings through the pandemic.

"But our ball-park estimates suggest that the mortgage rate and cost of living hit of around $15 billion is of a size roughly equivalent to two thirds of all post-Covid savings. We doubt these savings will be chewed up by spiking costs, partly because the savings distribution won’t evenly match the pain. Belts will be tightened.

"Overall, we’re left with support for our view that consumer spending growth will weaken to anaemic levels later this year, in line with our and RBNZ forecasts."

"...We continue to think the RBNZ is being too optimistic on GDP growth."

The ASB economists "continue to expect" a 12% peak-to trough decline in nominal house prices.

61 Comments

I'd like to think one day consumer spending just fell and kept falling because people woke up to the hedonic treadmill that is consumerism.

What do you think the NZ economy is based around and what do you think has been driving the economy? International sales of milk powder and kiwifruit?

Mostly services, also international trade.

Oh wait, I forgot where I was. Uhhh, housing ponzi?

Mostly services, also international trade.

Private (H'hold) consumption comprises approx 58% of GDP.

Do you have a day job or interest ?

Excessive government spending and debt fueled growth created by central bank policies of low interest rates creating too much speculative money. That is not an economy. Economies should be built on production not speculation and 'wage subsidies'.

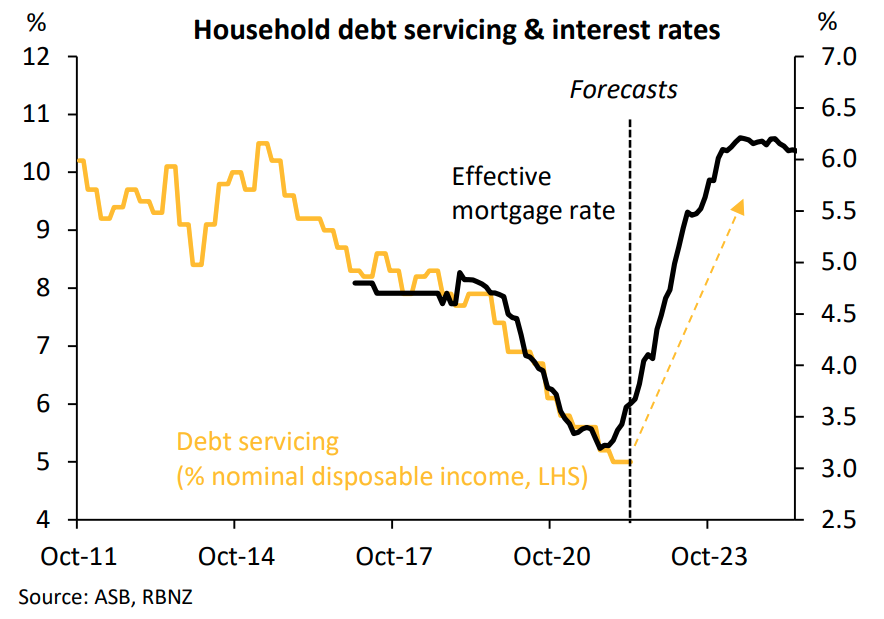

Is this an old graph? The ASB 1yr is 5.3% ish right now?

This is average across all current mortgages - eg the vast majority of mortgage holders are still locked in on older lower interest rates in the 2-3% range, and so the average wont be closer to the new prevailing higher rates for another 12 months or so.

.

"higher mortgage interest rates will add a net $5.6 billion to aggregate household outgoings over the coming 18 months"

Wouldn't this have been better spread across households with mortgage debt?

Aaaagh! This treatment of 2 million households as a single homogeneous group is seriously dumb. Do we think the tens of billions of extra savings are equally distributed? That every household has the same spending headroom, buffer to absorb higher costs, or job that they can squeeze a pay rise out of? The card spending data is already showing major cutbacks in discretionary spending on meals out, entertainment etc, and we haven’t even got going yet on channeling big money into mortgage rates. Hell in a handcart.

Their graph looks wrong. If debt servicing is indeed on the LHS, then current interest rates on the RHS look barely past 3.5%, way out

They probably had the graph done by the graphing experts at the Ministry of Health.

Probably the effective rate across their mortgage book, still plenty of people (and a lot of $$$) on 2.xx% rates for a while longer.

This is average across all current mortgages - eg the vast majority of mortgage holders are still locked in on older lower interest rates in the 2-3% range, and so the average wont be closer to the new prevailing higher rates for another 12 months or so.

higher mortgage interest rates will add a net $5.6 billion to aggregate household outgoings over the coming 18 months. It’s a big number, but we expect it to be fully offset by strong income growth

So, will households run down savings to pay the bills, or will they cut up the credit card?

Can anyone else see a contradiction in the two sentences above?

People in my field... IT are resigning for better wages ever day.......

You're missing the point, ASB say that the higher expenses can be met by wages growth and then later they say that higher expenses will have to be paid by dipping into savings… It's contradictory

They say that the $5.6B can be met by wage growth but not the $15B.

You need to read the whole thing. It's referencing the overall impact of rising prices, not just the rising HL interest. HL interest offset by wages, sure, on paper, but the rest of it, not so much.

Well IT GUY, these people better hope that that it doesn't come down to a case of "last on, first off" because by the end of this year, and certainly next year, the unemployment rate is going to start taking off all because of the serious economic mess we are now heading into.

You need to reread the article. Income growth will cover the higher mortgage interest rates, but wont cover the remainder of cost of living increases, which will require either using savings or reducing spending to cope.

Private consumption is 58% of New Zealand GDP. So when consumer spending weakens to "anaemic levels". Where will the employers who depend on consumer spending for their profits obtain the 5.6 billion to provide the wage raises to their employees to "fully offset" the effects of higher interest rates?

Exactly. Spending on discretionary items is already nosediving as an increasing proportion of income is diverted into mortgages, rents, rates, imported petrol, and utility bills? The trends in the data are clear and the evidence is overwhelming. Hell in a handcart.

This time last year everyone was going nuts for luxury items for their homes. At the home show last year the swimming pool installers were booked out for 2 years ahead and not trying very hard to get more business. Going again this weekend so will be interesting to see how this has changed.

Spa’s ?

kiwimm,

Well, there will still be at least one order-from my younger son. I had hoped that they would put it on hold but they intend to go ahead, so i will lend them the money rather than see them go back to the bank. I know they both have very good jobs, but they are obviously less cautious than I am.

Can you provide a specific link with the evidence that “spending on discretionary items is already nosediving”? I think its likely to happen, but so far there hasn’t been any evidence released that im aware of that the nosedive has begun. Would happily be proven wrong.

Sure - check out the electronic card spending data on infoshare.govt.nz or get the raw data here: https://www.stats.govt.nz/information-releases/electronic-card-transact…

The data is noisy but the 12 month rolling average shows a clear trend by category.

Thats the whole point! Stifle demand!

Its a blunt tool, but IMO no alternative

Shhh if you mention this it makes it sound you think there might be some downside to interest rate hikes, which everyone here knows only has upsides and it will sound like you no longer trust the idiots who got us into this mess over a period of decades and years to have sudden become competent enough to manage us out of it.

Unless of course you're just a young Kiwi or someone who bought a house for your family to live in. That would make you the worst person in the world, and definitely in need of some sort of lesson.

GV,

You missed the bit where crumbling infrastructure is also young peoples fault.... need to put the council rates up to cover for those young uns not paying their share

They should have thought of that before they voted to destroy the sovereign pension fund under Muldoon. Damn millennials.

Hospo are fucd here

I wonder if the local lunchbar owners with their shiny new 2022 Merc know what's coming...

Strong growth in household wealth will help buffer this impact, he says, "but most of it is tied up in housing. And you can’t pay the bills with your house".

Good luck using that paper wealth.

Good luck using that paper wealth.

Tokenize the houses

Brickcoin?

We have been hit since the month before covid when we realised that our main product couldn't continue. This is Year 3. I think there's a lot of other households in a similar boat. They postponed the (created?) reality, but they could never eliminate it. Reality has a nasty habit of catching up eventually.

Not sure how tourism will recover with Asia.... probably a bit issue for NZ

Yeah it’s a bugger Chinese aren’t allowed to leave their country. And it’s going to be a bugger when Aussies can’t put a ski trip to Queenstown on the house.

Yep, tourism will be on struggle street for probably a couple more years.

even when the Chinese are *allowed* to travel many of them will be cautious for quite a while. East Asian people are generally pretty cautious with their international travel.

And Americans will not come to a hermit kingdom where you have to be jabbed to enter. They like their liberties unlike kiwis.

Dick M,

Like the liberties to have lots and lots of mass shootings-children are a regular target-and to deny women rights to their own bodies?

America is pretty polarised (#understatement)... half will LOVE it here and the other half will HATE it.

FYI, you have to be jabbed to enter the US also.

https://www.cdc.gov/coronavirus/2019-ncov/travelers/proof-of-vaccinatio….

- If you are a non-U.S. citizen who is a nonimmigrant (not a U.S. citizen, U.S. national, lawful permanent resident, or traveling to the United States on an immigrant visa), you will need to show proof of being fully vaccinated against COVID-19 before you travel by air to the United States from a foreign country.

This is circular. Less consumer spending into the economy means less revenue, profit, and incomes. That means less to feed the housing bubble. House prices fall and less is spent into the consumer economy (people who feel the house is $100K less in value think twice about buying the spa pool).

Worse case scenario: Downward spiral that feeds off itself. Not empirically proven. But you're foolish to ignore the possibility.

It also means less GST. A prudent Government would be taking that into account.

A prudent government..hmm

No worries, print some more.

The lifestyle to which you believe you were entitled has been cancelled.

The ASB economists "continue to expect" a 12% peak-to trough decline in nominal house prices.….

Lads, that’s already happened, and house price falls are only starting to pick up momentum. When predicted falls in retail spending feed into job losses in retail (and other) sectors, etc, there’s are long way to go with this downturn

Haha, talk about being behind the eight ball ey?

Economists in this country are such muppets.

Less money to spend on clothes, coffee, and groceries. Power costs rise and did not seem to fall even when oil prices were low.

A gaming computer might an affordable option. Or an electric bike from TM.

At the beginning of last year I warned that the flood of Adrian Orr's cheap money (with silent endorsement from Grant Robertson) that was being used by first home buyers and others to unrealistically up-value the housing market could only end in tears. You just can't create a spending flood without inflation taking off! Then, when the only way to tackle this inflation is by raising interest rates, those that can least afford their high mortgages will feel serious pain. Plus, no economy deals with high inflation very well.

Let me now make another fairly safe prediction. With the rapidly rising cost of living and mortgage servicing payments at least doubling then, as this article says, people will have no choice but to seriously restrict their spending. Consequently businesses will begin to feel the pinch big time and then we will have that other component of the economic plague that we are moving into, rapidly rising unemployment. At that point, say Q1 next year, the stock market crash of 87 and the GFC of 2008 may well look like child's play compared to the mess we will find ourselves in.

I read that only 35% of properties have a mortgage.

Yeah, but even if half of those owners have to refinance this year and tighten their belts significantly then that’s still a significant impact on consumer demand.

in and of itself it may not be a major but when you have the demand-reducing impacts of soaring costs of living and falling paper values of housing, you start to see a pretty large impact on demand.

Assuming that is correct then wouldn't raising interest rates be inflationary as it gives hoiseholds with savings more money to spend by a factor of 2 to 1 over those with mortgages?

To me logically this makes sense but curious as to why this doesn't translate to real world. Is it just because most people don't have savings?

The combination of increased fuel, 40% fixed mortgage rollovers and inflation on living costs mean the required level of interest increase to dampen inflation is much lower. We are already in the zone where inflation will be checked.

RBNZ left n increase too long but they'll massively compound the problem by overshooting.

"or will they cut up the credit card?"... or learn some fiscal discipline...?

If your paying interest on credit cards, shift to a 0% card at another bank and if your in a hole stop digging....

Find a way to spend less than you earn (that also means try to earn more) and put the balance to work for you

We can thank Labour for this,

Spend $80-$100billion, triple the debt balance and spend on wasteful 'things'....

What could possibly go wrong...??

Whoops!... inflation...

So, there is a good market for personal loans and Banks are looking to exploit that ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.