The Reserve Bank says it expects more borrowers will fall behind on their mortgage payments this year "given the ongoing repricing of mortgages and expected weakening in the labour market".

The comment is made in an excerpt from the RBNZ's latest six-monthly Financial Stability Report being released on Wednesday. The RBNZ disclosed that about a quarter of the current outstanding mortgage stock in the country was taken out in the period from late 2020 to late 2021. Of this about a fifth went to first home buyers.

The significant point about this is that this time period coincided with the peak of the housing market - from which prices have subsequently fallen by about 16.2% (specifically from November 2021). That time period also coincided with very low mortgage interest rates - under 3% in many instances.

As of March RBNZ figures indicate that there was $347 billion outstanding in mortgages in this country. A quarter of that would represent a touch under $87 billion, while a fifth of that figure (IE for the FHBs) would be over $17 billion.

"While we are not currently seeing widespread financial distress amongst households or businesses, in part this reflects the fact that the repricing of the stock of mortgage lending will take some time," the RBNZ said.

"Households are also adapting by reducing discretionary spending and drawing on savings, including working with their banks to extend the durations of their mortgages where they are ahead of their repayment schedules. Furthermore, the lack of acute stress showing up in banks’ lending portfolios reflects the strength in the economy and labour market to date."

The RBNZ reiterated its earlier statements that for a household with a mortgage, the share of disposable income required to service the interest component of their mortgage debt will more than double from its recent low of 9% to around 22% by the end of this year.

"Despite the significant rise, this would still be lower than the peak experienced in mid-2008," the RBNZ said.

"However, this increased debt servicing burden is distributed highly unevenly, with some borrowers, such as those who fixed at the low of mortgage rates in mid-2021, seeing far greater rises in their debt servicing costs than others."

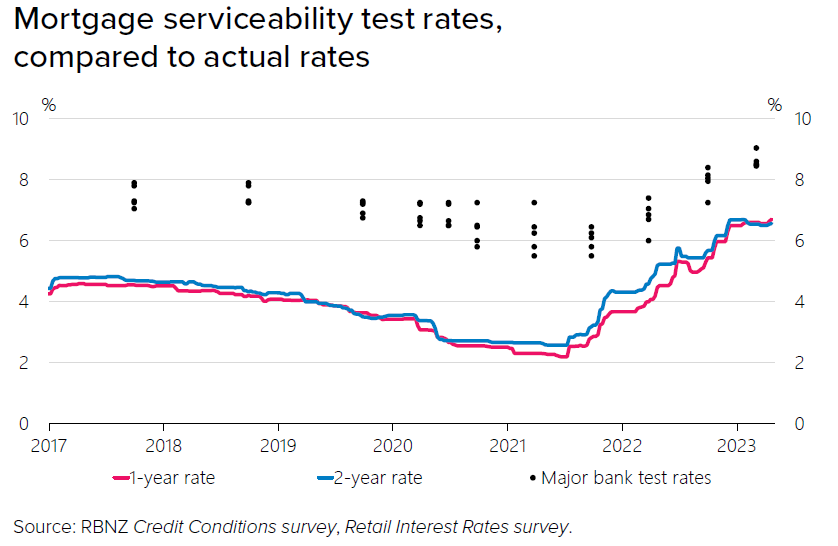

The RBNZ said it expected most borrowers will be able to continue to service their debt obligations without significant stress, given the servicing test buffers that banks have applied when assessing borrowers’ loan affordability and the current strength in the labour market.

"However, for households that borrowed during the period of very low interest rates between late 2020 and late 2021, current interest rates exceed some of the test rates used by banks during this period. Therefore, some of these borrowers and other borrowers with high debt-to-income levels may begin to struggle to meet their repayment obligations as they reprice onto the higher rates."

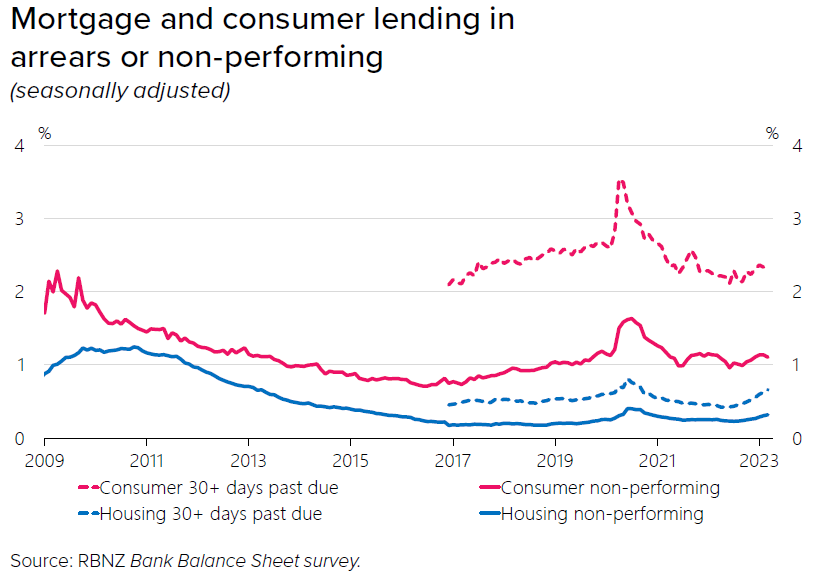

The RBNZ said early-stage arrears (missed payments by a borrower of one to three months) have been increasing in recent months, and are currently back to where they were before the pandemic. Compared with the Global Financial Crisis, these indicators so far remain low. Rates of non-performing mortgages and the number of mortgagee sales are also low albeit growing.

"Evidence from previous debt servicing distress periods shows that households with multiple forms of debt generally try to prioritise mortgage and utility bill payments. Data provided by Centrix has shown that those with multiple forms of debt including a mortgage are increasingly missing payments on non-mortgage debts. When encountering stress, a borrower may be able to move onto a hardship programme at their bank. This could involve temporarily switching to interest-only payments or increasing the remaining term of the loan," the RBNZ said.

Talking more broadly on business lending, the RBNZ said in general, there has been a deterioration in business performance across most sectors.

"However, banks have maintained conservative lending standards in recent years and businesses appear to be adjusting to higher debt servicing costs without significant increases in loan arrears so far. No industry is showing a marked increase in debt servicing stress, including those most disrupted by the pandemic. Banks have reported that businesses that survived the pandemic are generally quite resilient. "

The RBNZ said that in the commercial property sector, capital values have started falling across property types, particularly for retail.

"...But we expect further declines as values adjust to high interest rates and lower demand, for example due to increases in people working from home.

"Liquidity and credit demand in commercial property markets has been low. Higher interest rates and a poor outlook for the sector have contributed to an increase of 10 percentage points in closely monitored lending, from a low level since mid-2021."

41 Comments

ahhh duh

-SMG.

It’s obvious, yet we have still had numerous commentators try to say”everything is fine, we don’t have forced sales”.

For a mortgagee sale you generally need to hit 3 trigger points:

1. Spike in payments or drop in income. The majority of interest rate rises have not flowed through to existing borrowers and unemployment is yet to rise, but both are likely

2. Drop in equity (or negative equity). If people have a lot of equity, they will chose to sell on their own terms, instead of going into default. As prices continue to fall more people fall into this category.

3. Exhaust other savings or sell other assets. You may be able to dip into other savings, sell a car, but this will only last so long.

Basically mortgagee sales tend to lag price falls, not predict them, and can have a long lead time.

AND since the royal commision and the introduction of CCCFA banks now have a real duty of care to respond to short term customer hardship. If a customer asks for help the bank has to clearly document the help thats offered etc etc, or they may open themselves up for a claim later.

This will take time to play out, it will impact stretched investors first as banks treat these as a pure commercial transaction.

Another warning shot from the RBNZ.

Firstly, the subtle raising of the OCR in 2021, that was ignored, until it became obvious when a higher rate had to be specified by them to get their message across.

Then, the 'Recession we have' to have announcement, and now this.

Those who take no notice, can't say they weren't warned.

Yip the central banks can't be anymore obvious with what they want - but when you try to take away from the candy from the child who has been conditioned to receiving it all their lives - why would they expect that tomorrow would be any different than yesterday?

I personally have no issues with candies for everyone every time.

Warned. But what can you do?

BW thinks if you've been warned then you should be able to magic up some money.

The report also shows effective mortgage rates are still in the mid-4% range but projected to reach above 6% by year end.

Soooo. On the one hand more and more people are struggling to make mortgage payments.

And on the other hand the reserve bank is wanting to loosen LVR's to make purchasing a property easier.

The Ponzi continues.

They are making sure there will be buyers for the over leveraged investors and forced sales.... most keep there job in a deep recession, but many may not have the deposit. buying at a mortgagee sale normally means you are getting pretty rock bottom price = less risk to the bank of the next buyer getting into deep negitive equity.

Correct as far as it goes but the credit crisis as money is withdrawn form the system means buyers may not be able to buy and where does that leave a Bank - owning a property that is unsaleable and probably un rentable. When this happens cash will be KING and mortgagee losses large.

Loosening the LVRs will do nothing for the market - doing that whilst raising the ocr is like giving someone a dollar and then taking two back.

The OCR will go up again and thousands more people will roll over onto increasingly way higher rates over the next year and jobs will go. We will hit a tipping point when people with less income become forced to sell into a falling market with ever increasing stock.. and then prices will properly tumble.

The RBNZ says its committed to a recession with lower employment and reduced spend - and that hasnt yet happened yet. Thus it is a given fact that things will get worse and we havent hit bottom.

Still - lifes very good in the software game - businesses cost cutting and productivity is the trend again! Yee haw.

A month ago Centrix reported 44,000 NZ active credit accounts were in arrears probably a few more now and growing as rate increases bite. Its clear that globally citizens are not happy/angry and losing the home/car/job especially the younger borrowers, should trigger the elites/Politicians/Bankers into the realisation that with time on their hands, anger in their hands history demonstrates what follows and this time the blood will be on the moon as well on the streets. Look at events in Paris/Amsterdam/much of Europe/USA/Brazil etc and consider how to ensure the explosion is controlled or at least controlible and with so many left wing Govts and their abject failure at everything thins may get ugly, very ugly.

22% of disposable income on res. mortgage eh? Sure I was paying around 40% in mid 1970s in England. So maybe things aren't so bad after all. Course mass of people weren't investing in property back then. Sad day when all that started to happen. Probably get worse when ' Labour has left the building' in October.

It's 22% of disposable income just on the interest component. The entire required payment (principal + interest) would be significantly higher.

That would put paid to a heck of a lot of discretionary spend.

It might even make it up to what renter's spend on their accommodation... most mortgages are paying current rates from years ago, whilst rents are almost always kept up to date (average tenure of a home owner is around 7 years vs 2 years for renter).

Not at 6.5% interest rates. The interest is 84% of the payment at the start of a 30yr mortgage, or 78% for a 25yr mortgage.

You were also paying the equivalent of 84p today for a liter of petrol.

"However, this increased debt servicing burden is distributed highly unevenly, with some borrowers, such as those who fixed at the low of mortgage rates in mid-2021, seeing far greater rises in their debt servicing costs than others."

The lie of averages

I suspect there are few 5 year fixed mortgages so the avalanches of refixes will roll on for a couple of years and defaults will lag so I disagree with RBNZ/Bank economists and others who predict a short period of difficulty. Should the recession (I hope it is a recession ) and not a depression when 5 years of strife will follow.

Add in anotger bank in the US has gone belly up. At what point to the banks start shooting the speculative...?

The Reserve Bank says it expects more borrowers will fall behind on their mortgage payments this year "given the ongoing repricing of mortgages and expected weakening in the labour market".

Even if you don't work for a fancy pants organization like RBNZ, that's a fairly easy expectation to state.

This triggered a slightly unrelated thought for me.

Pa1nter said that many of the old and young will keep spending freely, it’s the people in the middle that will get squeezed.

Fair enough. But isn’t it typically people in ‘the middle’ who are the biggest engine room in the economy? Ie. Households between the ages of 30 and 55, with families. Think of all the things a couple with 2-3 kids spend money on each year.

I am pretty sure there’s pretty solid evidence backing this up.

They also pay a fair wedge of tax, use lots of petrol carting kids around and pay heaps of GST.

Most stay out of the way of Police.

Send their kids to school each day feed and clothed.

Lots have private medical Insurance, personally or via employer offset health costs.

In fact these are the backbone of a healthy society and the current Government is treating them badly, there will be payback on Oct 14th.

IF there was an alternative then there would be payback.

But most of those families dont own investment properties... and dont have farms and arent CEOs of big businesses... they dont have middle aged spread from excess eating (right now they cant afford it - and most are actually fit and do stuff in NZ), they are of a generation that cares about the environment (even in a downturn) and thus have zilch in common with National and Luxon (many of them still rent too). Noone i talk to in that category (and we know a lot) can relate to him (or willis for that matter). Strangely most CAN relate to Chippy - he is the right age, has a young family himself and kind of comes across as someone we could have a beer with and have stuff in common with.

For most there is no obvious/relevant financial advantage to voting National.....

Nats would appeal to rick boomers with investments, big business leaders and possibly some small business owners... people with cash. But to get a decent spread of voters they desparately need a proper story of how to help the mid class and to be relatable.

Elections always won in the middle.

Nats best bet is crime and income tax brackets.

Increase the threshold for the lower tax bands and promise a review of the Crimes Act. The latter to allow stiffer sentences for youth offending and parental culpability. Then completely overhaul the concept of bail and’ cultural reports’ as carrying weight in sentencing. Easy.

I agree.

crime and its causes are obviously complex, but I do think the system is much too lenient.

At the very least, the system is not adequately protecting law abiding citizens.

There’s many parts of Auckland that feel unsafe now, that didn’t use to. I am not a small guy either (187cm and 93 kgs) and learnt martial arts to a fairly high level.

Ute drivers, and those that would use the roads the greens killed off?

I don’t like either of them. So I will vote for TOP or maybe the party that suits my self interest best (since we can’t trust them to do what is best for the public interest, why not?). That’s more lok

I expect it will be TOP for me too. It was last time. I doubt the big two are prepared to move any dials - especially the housing one. The current lot was supposed to be transformational. What bollocks!

Nicely summed up OSE.

Believe me there are plenty of us boomer who hold the same views. Seeing the next generation (which includes boomer kiddies) getting done over by the housing nonsense is a big deal.

Many (like me) are natural Nat voters, buy this lot are so far out of touch they are still impossible to vote for.

I sent a message to Luxon and the main party email a few weeks back basically saying I would vote for them if they modified their stance on housing.

Also said I think they would improve their polling if they changed their stance on housing as well as they would be able capture more of the centre voters - the mums and dads who are concerned their kids can't afford housing as well as all of those in their 20's and 30's locked out of home ownership etc.

Got a 'thanks for your email...we like to hear everyone's view' response. Doubt they'll change. So I won't vote for them.

They appear very tone deaf right now.

Same message to my last 3 Nat Candidates. Saw all of them post loosing at the ballot, and said more or less "I told you so". They remain as they were, far to compromised to the interest of international debt over the interests of the averageman tax payer.

What is J Key doing now...?

according to Peter zeihan , the age group with the most disposable income in the economy are those people aged 50 to 65. mortgage free and kids left home.

Yes most disposable income but that doesn’t mean they spend more. Families with 2-3 kids are constantly spending money in the economy on all the individuals in the household, for a multitude of both discretionary and non-discretionary items.

Correct which likely means the domino effect of reduced payments of Gst/Paye/Corp Tax and rising unemployment will give the Govt post Oct 2023 serious indigestion. All of which was/is highly predictible with much egg on faces and large consumption of humble pie .

'The Sting' 1973 Film (Wikiqoute)

Henry: You know anything about the guy?

Hooker: Yeah! He croaked Luther! Anything else I gotta know? [after he calms down] All right. He runs a numbers racket on the south side. He owns a packing house. A few banks.

Henry: Yeah, and half the politicians in New York and Chicago.

(critical view) ....lol

Seems to me everyones getting stung....squeezed and for what? Is it because its easier to 'sting' the masses than increase productivity? Are some lazy in the way they extract profits. What if the flood of cheap credit was nothing but a calculated enticement? What if it was all too good to be true? "The RBNZ, which is aiming to engineer a recession in 2023 to suppress demand and rein in inflation" (Bloomberg 15.03.23)

"Homeowners with a mortgage can expect to be paying 22% of their disposable income in interest payments on their home loan on average by the end of the year, the Reserve Bank says. That would be up from a low of 9% in 2021, and the increase will be much higher for many recent home-buyers with hefty mortgages."

(Stuff 02.05.23)

The fix is on ?....(critical view)..lol

Based on this information it wants to raise rates higher, Orr is by the far the worst RBNZ governor ever, no surprise though that he was appointed by the board which was appointed by the worst NZ government ever.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.