The country's banks are expecting that demand for new residential mortgages will stabilise over the next six months "with buyer confidence returning".

And the banks feel that if interest deductibility on rental properties is reintroduced there will be "a more significant increase in investor demand".

In the Reserve Bank's latest six-monthly credit conditions survey, 15 banks, including the big five, have outlined their latest thoughts on credit trends in the immediate past and the near future. The Survey period covers credit conditions observed between the start of April 2023 and the end of September 2023 and asks how banks expect them to evolve over the next six months.

The expectation that demand for new residential mortgages will stabilise over the next six months stems from the fact that house prices are starting to show signs of recovery and interest rates are at "or near" their peak.

Mortgage demand has been very low this year, but has shown some signs of beginning to perk up a little in recent months. RBNZ figures for August, the latest available, showed that in that month the amount of money advanced rose by over 8% on a seasonally-adjusted basis. The $5.782 billion worth of mortgages committed to in August 2023 was up from $4.997 billion in July 2023 and up up 6.8% on the $5.413 billion of mortgages committed to in August 2023.

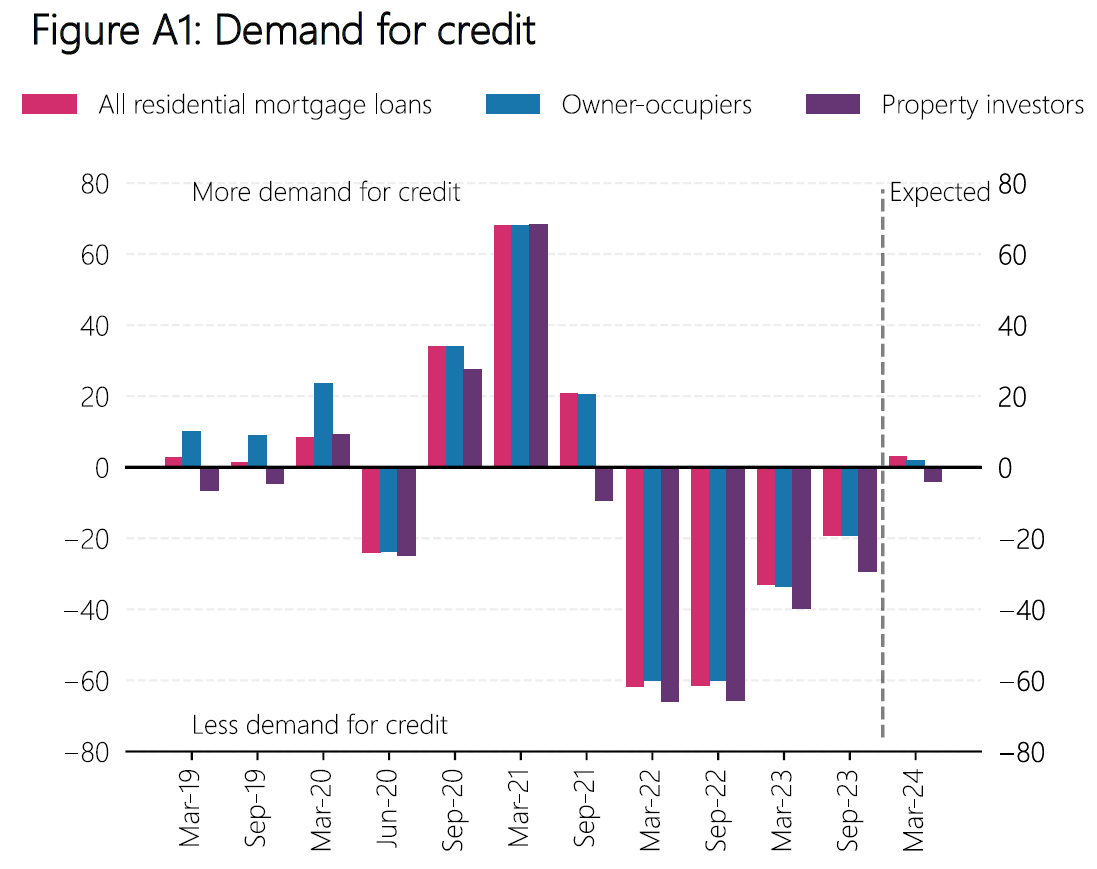

In the previous credit conditions survey released in April of this year the banks had said they expected mortgage demand would remain "subdued". And this has proven to be the case over the past six months.

"Demand for residential mortgage lending decreased in the last six months, continuing the trend seen since mid-2021," the RBNZ said.

"Both owner-occupier and investor activity has remained subdued in the higher interest rate environment, with low consumer confidence and an uncertain trajectory for house prices also having an impact.

"Some potential buyers are opting to delay investment until there is greater certainty over future government policy," the RBNZ said.

"Banks also noted the impact of the increase in households’ living expenses on the ability of borrowers to pass affordability tests, particularly with some banks’ test rates continuing to increase."

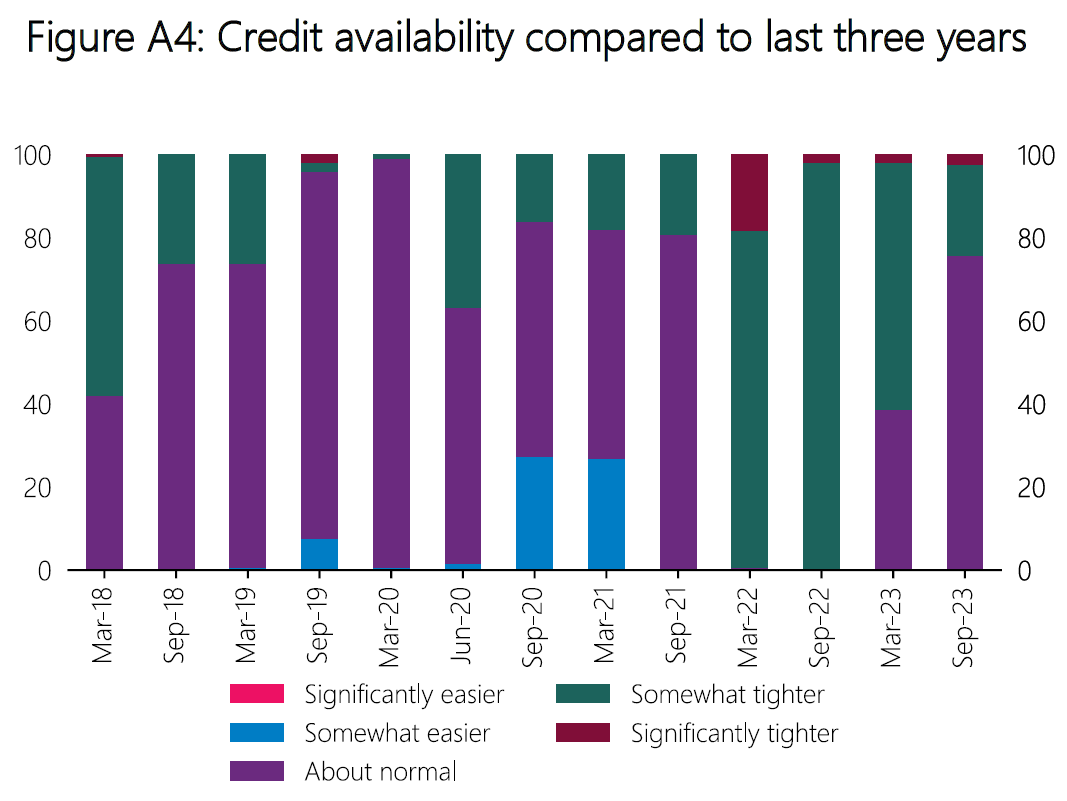

The banks reported that there was an increase in the availability of residential mortgage credit over the past six months, "following materially tighter conditions over 2022".

"While some banks have increased mortgage serviceability test rates slightly further, the effect on credit availability has been offset by an amendment to the Credit Contracts and Consumer Finance Act in May, which eased requirements for measuring borrowers’ discretionary spending, and the easing in the Reserve Bank’s LVR [loan to value ratio] restrictions in June," the RBNZ said.

However, availability of consumer credit tightened slightly over the past six months, "as some banks adjusted pricing following changes in risk appetites".

The banks reported increased demand for consumer credit over the survey period. This was driven by demand for secured personal lending, as demand for unsecured personal lending and credit cards contracted.

"A key driver of this trend has been inflation in household expenses which have necessitated some households to make greater use of credit facilities. However, some banks noted that tightening in their unsecured lending terms had reduced the number of applications, making it more difficult to assess underlying changes in demand."

Most banks do not expect significant change to household credit availability over the next six months, however, it was noted that Debt-to-Income restrictions may have some impact if introduced in 2024.

The RBNZ has long sought to have the option of DTIs.

Having finally received government approval in 2021 the RBNZ then began preparatory work and earlier this year released a debt servicing framework, which will enable restrictions to be possibly brought in by March 2024 if needed - with the banks therefore getting 12 months to get their systems ready, should they be required.

53 Comments

Of course the predators do 😊

Of course with their National party mates wanting to wind up the Housing Ponzi.

This country in now corrupt has been building sincere the GFC and John Key started the process with laundered money.

Why haven't you got in on it then and made a fortune?

Because it's unethical.

Listened to a podcast with Bill English post election, among other things he said the Central Banks' policies of loose monetary conditions and lowering interest rates post GFC have made people think they were financial geniuses, when in actual fact anyone could do it if they could get some assets and hold onto them.

He also said young people will eventually get sick of being locked out of housing just because they happened to be born at the wrong time and he can see wealth taxes and capital gains taxes coming into policy.

As well as DTIs we need to exclude unrealised capital gains from being used as equity to secure additional loans, this creates a dangerous feedback loop that imo contributed massively to the bubble in 2021. For stability and resilience, equity in an existing property needs to be calculated based on whichever is lower of the purchase price and current valuation.

How would that work for houses purchased a couple of decades ago?

I would assume that the house would need to be sold so that the gain is realised before it can be used on another property.

How would that work for houses purchased a couple of decades ago?

Easy. Mark to market. Throw in a few reckons from a valuator for the box checking, then create the money out of thin air so that the happy customer can specu-punt.

A "valuator ...

Equity = purchase price less outstanding debt, it's not complicated.

Over 20 years you would also be free to accumulate additional equity via savings and other investments.

Basically, it just means no more leveraging unrealised gains on existing properties, if you want to buy another property without selling first, you just have to raise the deposit by other means, like any FHB would have to.

Or sell the property, then buy two properties and be in the same position you would have been anyway. Is the purpose of this proposed scheme simply to increase sales volume?

In conjunction with a CGT then yes.

That starts to treat the deposit of a FHB and an investor equitably from a tax perspective, and recognises the betterment that society has provided to the investor through none of their own work (excluding value-adding improvements).

Alternatively let them draw down the equity but they pay tax on it at the time. Fair since it's been realised.

That selling-then-rebuying process comes with significant costs, delay and risks, especially in a rising market. Some will choose not to bother , those that still partake will find themselves moving much slower than now. That stops things getting out of control too rapidly.

Harder to grow a fire quickly if you have to chop the logs as you go.

Would the same rules apply to all mortgage lending?

What about borrowing for an extension and/or renovation, starting a business, or maybe a boat and a ranger and a garage/man shed to house them?

Would it affect reverse mortgaging?

You said the 'B' word, 'Bubble' which is taboo in NZ. The other is the 'C' word, Crash, which is essentially what has happened to house prices since 2021. But you will be hardpressed imo to find articles mentioning either word in NZs MSM.

How did house prices in NZ reach levels where the house price risks were high?

"almost all of the country became possessed by the idea that home prices could never fall significantly. That was a mass delusion, reinforced by rapidly rising prices that discredited the few skeptics who warned of trouble. Delusions, whether about tulips or Internet stocks, produce bubbles. And when bubbles pop, they can generate waves of trouble that hit shores far from their origin." - Warren Buffett on the US housing bubble

They "hope"......... with what's happening in the middle east ....USA with $33 trillion in debt..... ECB just released a CBDC etc etc

Hope is all the banks have .....they FINALLY can not push that can down that road any further....they have run out of their "arsenal"...... and that is where the $$$ will be going now and somehow, someone, somewhere NZ will get dragged into it .....

Yes watched a video just the other day on the USA debt. Funny how people rave on about the China housing collapse at what $350 Billion when the USA has to pay $500 Billion on interest alone on that $33 Trillion EVERY YEAR. The USA debt level is now unrecoverable and will go exponential so they will be forced to "Dream up" some sort of alternative currency. I was thinking the USA had 10 years left but it doesn't.

They are actually closing in on $1T a year in interest now. And they won't invent a new currency, they will just do what every controller of every fiat currency that has existed will do. Print money to devalue their currency and hence the debt. Even the US Fed and Treasurey are publishing papers saying this.

But you know, throw in a few wars and other attention distracting events and the populace won't even notice they are being fleeced into the dirt.

Why just not borrow that money in the first place? They are a rich country, they could easily live within their means.

Ah so the austerity route, yea good luck getting voted in when telling the populace you have to stop paying veterans and remove social security. The $33.5T is just their funded liabilities. The Debt Clock also shows there are $280T in unfunded liabilities that they have promised but don't know where they will get the money from.

Sure it could be done, but which option is easier for the government? Being responsible, or just robbing your citizens?

How about tax increases? Taxing less than you spend is just robbing future citizens.

Clinton was able to decrease debt to GDP during his term, so it is possible.

And after raising taxes, they can go shoot the goose that lays the golden eggs.

Problem is, they've reached the point they'd have to tax some of the untaxable classes, not just the plebs. The untaxable classes are the financial equivalent of Captain Segura's untorturable classes in Graham Greene's "Our Man in Havana":

'Did you torture him?’

Captain Segura laughed. No. He doesn’t belong to the torturable class.’

'I didn’t know there were class-distinctions in torture.’

'Dear Mr Wormold, surely you realize there are people who expect to be tortured and others who would be outraged by the idea. One never tortures except by a kind of mutual agreement...Dr Hasselbacher does not belong to the torturable class.’

Who does?’

'The poor in my own country, in any Latin American country. The poor of Central Europe and the Orient. Of course in your welfare states you have no poor, so you are untorturable.'

The USD's been going up for years, and US govt. debt is the safest investment on the planet.

In software, we call this an implementation detail.

CBDC is merely a modern implementation of the existing monetary system. This is not a systemic shift, the balance sheet will still look the same, banks will be required to update their technology to support digital currency. The benefits will be instant transactions, more reliable T-account records etc. $10 cash will still equal $10 deposits will still equal $10 DC will still equal a $10 liability on the balance sheets of the banks.

Hah there is no benefit to the general populace. Just to Orwellian governments.

It gives the central bank direct control of every single cent in the network, all tracked, all traced, all instantly removable. See someone is saving too much then just give them a negative interest rate. Someone says something the government disagrees with, boom instantly removed with no due process (which we basically don't have already, Canada showed us that)

It will help them to kick the current systems can down the road though, thats for sure.

Looks to me like we’re heading into a recession so this isn’t good for debt/lending unless the government is going to employ everyone again/pay their wages while the produce less (ie create even more inflation!)

Will the reintroduction of interest deductability really spur investor demand at current interest rates? What level of equity would a re investor need to make a investment property cashflow positive for the purposes of bank lending?

It will definitely increase investor demand compared to no change. Whether it will be significant, who knows.

I can't see any reason whatsoever to invest in property right now at current yields, but some people are still doing it, and with interest deductibility those yields look a lot better.

Will banks lend on negative yields though?

"Will banks lend on negative yields though?"

For non owner occupied properties, banks assess borrowing power based the gross cashflow (e,g gross rents) and discount this amount for ownership costs such as rates, insurance, maintenance, taxes (based on interest deductibility rules in force).

Surely only equity is of interest to banks. If you have enough existing property to use as equity, they should give you an interest only loan for the whole investment shouldn't they? Worst case they make you sell up the lot and still get all their money back.

Yes it would be very hard for new investors to get in without using their existing house or similar.

No JJ, banks want their customers to be able to service their loans, that's their core business. Trying to recover bad loans through mortgagee sales is the last resort and not what banks want.

"I can't see any reason whatsoever to invest in property right now at current yields, but some people are still doing it, and with interest deductibility those yields look a lot better. "

Some non owner occupier buyers:

1) property traders

2) property developers

3) capital gain oriented buyers

4) property buyers who believe that mortgage interest rates will fall to levels where the net cashflow will become positive

I watched an auction for two two bedroom units in a block in a good area in Christchurch, get to a highest bid of 700k, and the auction got passed in. No buyers for two tidy 2 bedroom units in a block in a good sized city, with a rental of each unit being $450, gross income $46,800 pa for a 6.69% gross yield. (at 700k) . Show me "property buyers who believe that mortgage interest rates will fall to levels where the net cashflow will become positive".

"No buyers for two tidy 2 bedroom units in a block in a good sized city, with a rental of each unit being $450, gross income $46,800 pa for a 6.69% gross yield. (at 700k) "

There are buyers at the $700,000 price (the highest bid at the auction). There are no buyers above $700,000. The vendors were unwilling to accept the highest price offered by buyers, and as such there was no transaction. That previous $700,000 bid may now have expired.

If you are not the current owner, then you could be the potential buyer. Why did you choose not to buy? Perhaps other buyers are thinking the same way.

Or are you the current owner of these properties listed for sale?

At the risk of stating the obvious, this example illustrates why investors you have identified by type are unlikely to be jumping in for a return less than a bank deposit, and the reinstatement of interest deductibility is nor going to make the net return much better. You would be making a speculative bet on capital gains on those units on Weston Rd, or betting on inflation and wages to continue to increase at 5% pa for a few years at a purchase price of any more than 650k. Which is why there were no takers.

"At the risk of stating the obvious"

Not everyone can see what you see. Thank you for explaining your perspective.

Have seen property investment calculations where:

1) mortgage interest rates are assumed to fall to 4.5% in April 2028.

2) house price growth assumptions are in the 4-5% p.a.

"You would be making a speculative bet on capital gains on those units on Weston Rd, or betting on inflation and wages to continue to increase at 5% pa for a few years at a purchase price of any more than 650k. Which is why there were no takers."

Remember the highest bid at the auction was $700,000 (above the $650,000 price mentioned above). The vendor chose to not accept the bid of $700,000.

The real question is, why didn't the vendor sell?

I've seen a few vendors - sitting on capital gains - decline to sell at proffered prices recently.

Greed? Entitlement? Too much finance? Testing the waters (wasting everyone's time)?

"The real question is, why didn't the vendor sell?"

Price expectations of the vendor. If the vendor's price expectations are a lot higher (e.g. $750,000 - $800,000), then they are more likely to not accept the $700,000 offer by the auction bidder. If the vendor maintains the property for sale after the auction, and gets little or no buyer interest or no offers at their price expectation for a period of time, the vendor may then review / reassess their price expectation (in light of an absence of buyer interest / offers) and adjust it downwards. Vendors are slow to realise that market prices may have fallen and may not be under any time pressure to "meet the market".

This is how properties can remain listed for sale for long periods of time in the absence of any time pressure to sell - saw one property listed for sale in Auckland that has been listed since November 2022 and still unsold - that is 11 months. There have been properties listed for sale that remain unsold for years.

There are costs of listing a property for sale - marketing costs which could be several thousand dollars. There may also have been costs to improve / repair the property cosmetically for sale.

"I watched an auction for two two bedroom units in a block in a good area in Christchurch, get to a highest bid of 700k, and the auction got passed in"

FYI, if you're referring to the units listed for sale on Weston Road, they were valued by homes.co.nz at $680,000.

Does anyone know when the new government will be sworn in ? Thanks.

From https://www.thepost.co.nz/a/politics/350096210/we-may-have-voted-nothin…

This time around the caretaker period, and its cone of silence, is set to extend well into November.

The 566,000-plus special votes should be counted by November 3 and the writs, stating who has been elected, will be returned by November 9. The caretaker period will expire sometime after that, once ministers are sworn in.

The major unknown is how long it will take, after the specials are counted, for National and Act (and most likely NZ First) to strike a deal.

If it drags on beyond the return of the writs (plus four or five days in the event of any recounts) then don’t expect normal government to be resumed until mid - or even late - November.

566k votes yet to count is huge. Like 18 - 20% of the voting age population if I'm not mistaken? Winston has previously ruled out working with Labour again and likewise Hipkins with NZ First. But imagine if they reneged on that, as it currently stands a 4-way coalition of losers is just 1 seat away from NACT.

National expect to lose 1 seat due to special votes, but what if it's 2 or 3? They lost 2 in 2020. Everything changes when the final vote is counted.

Interest has written this article since my question:

https://www.interest.co.nz/public-policy/124909/national-leader-christo…

More cognitive dissonance from the banking sector.

"Yes, we seriously believe the property market will recover while we continue to raise mortgage rates across the board."

The neutral OCR is likely higher than the RBNZ thinks. It's certainly higher than inflation. The population appears to be adjusting to the higher rates. Long term, cost of borrowing in NZ has always been higher than in the USA. No reason to think we are not going back to the long term average. I see a long and drawn out flatline of property prices, until inflation and wages increases bring back affordability. Either that, or the other line of thought, which is a smaller percentage of people are going to own all the property, and the rest of us will own nothing and be happy. #the great reset#.

Not really.

The banks know that HFL is total crap. Ergo, their predictions are based on lower rates.

So you see - it's.not too hard to establish that bank economists are not to be trusted. Take whatever they say with a handful of salt.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.