The great mortgage reset is under way. Well and truly.

The latest monthly figures from the Reserve Bank (RBNZ) for April confirm the past three months have seen a substantial shift in the duration of fixed terms mortgage holders are taking up. The move from a 'you ought to be short' to a 'longer is stronger' mindset is on for mortgages.

What also appears to be an emerging trend is more involvement - from admittedly very low levels - from investors. More on that further down the article.

As we've previously observed, in the past year those with mortgages have increasingly looked to go for shorter and shorter fixed terms - and quite a few have even gone on to floating rates - in the expectation that interest rates will be coming down.

Well, as we know the RBNZ started to drop the Official Cash Rate (OCR) in August last year from the cycle high of 5.5%. With another cut last week, the OCR is now down to 3.25% and mortgage rates have been falling to a similar degree.

The OCR will be the key

Now though, the question is how much lower the OCR and mortgage rates may go. The RBNZ last week indicated it may be lowered as far as 2.75% by the end of this year or early next, but this is not a given. Some major bank economists are still pushing for a 2.5% low point.

Wherever the OCR does end up at will be instrumental in whether there are many more mortgage rate reductions from here.

The April mortgage figures as reported by the RBNZ do suggest a fair few people have still been waiting to see what would happen with the OCR in both the April and May review before definitively locking themselves in, but a fair few have also decided they've seen 'enough' and are moving their rates to longer terms.

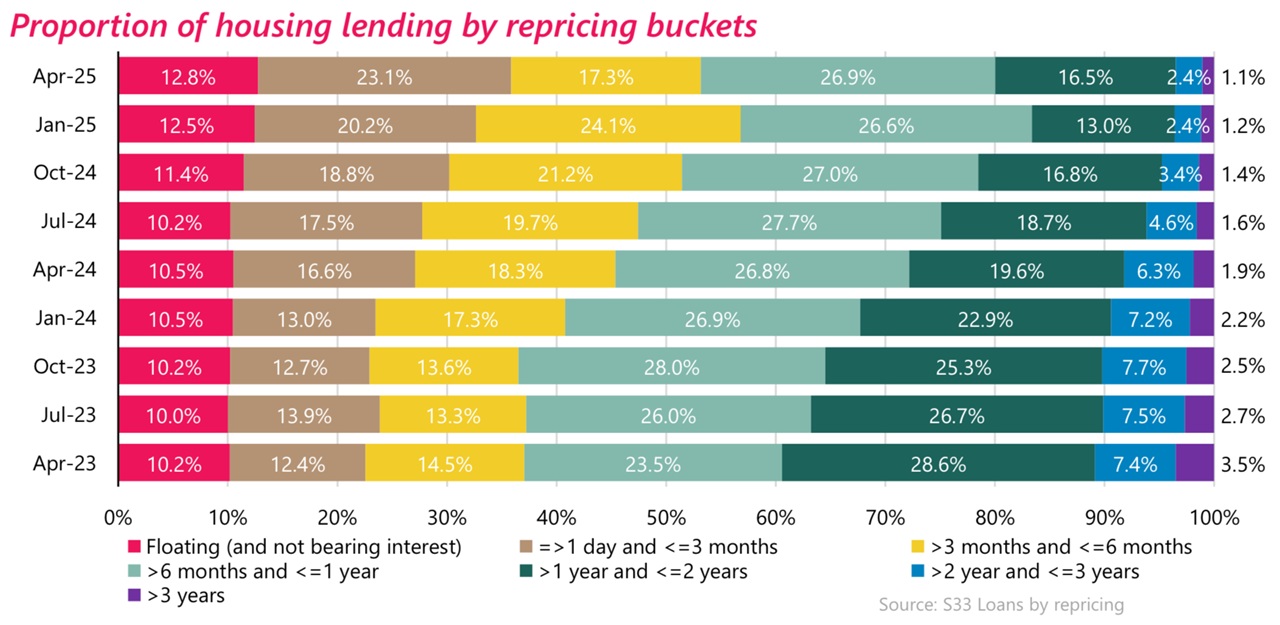

The figures show that in January of this year out of a total of nearly $371 billion worth of mortgages outstanding, over $211 billion worth were either on floating rates or on fixed terms of six months or less.

That was a record high during this 'short is good' period and meant that 56.9% of the country's entire mortgage book either could be or needed to have a reset of mortgage rate in the next six months. So, in other words that's $211 billion worth of mortgages that would be reset by the end of July.

Over $309 billion worth of mortgages (a peak 83.4% of the total mortgage pile) were as of January set for a reset within 12 months, IE by the end of January next year.

As we said above, there were some signs of those with mortgages holding fire a little in April, presumably to wait for the RBNZ. But there's nevertheless been a fair bit of movement since those January figures came out.

A newer separate data series the RBNZ now publishes showing what fixed terms people are signing up for with new mortgages each month has been revealing a swift switch in preference to longer terms - particularly two years. Two-year terms have usually been popular with NZ mortgage holders, but fell out of favour completely in the past year.

Anyway the recent trend of people seeking two-year terms for new mortgages is also showing up in the complete figures for the entire outstanding mortgage pile too.

As of the end of April just over $200 billion worth of mortgages were either floating or fixed for six months or less. That's still a lot and it makes up 53.3% of an outstanding mortgage pile now of $375.5 billion. But the share is down from that 56.9% peak figure as at the end of January.

In terms of the 12-month picture, just over $300 billion is up for reset, which is 80.1% of the total, down from 83.4% in January.

So, still big figures on 'short' terms, but the reset is definitely starting and it's to be suspected it will gain speed in the wake of the May OCR decision.

The 'go longer' move is on

The impact of those folk who've already decided to go 'longer' is clear already in looking at the outstanding amounts of mortgages that are due for a reset in up to two years' time.

(Just as some explanation of the outstanding mortgages categories as having more than one year to a reset and up to and including two years, this would largely relate to mortgages on either 18-month or two year terms although obviously it would also capture some lesser amounts that have been on longer terms but now just have between one and two years to run. But the figures on terms longer than two years are relatively small, with for example only about $13 billion worth, just 3.5% of the total outstanding mortgage pile with more than two years to run on mortgages before a reset. Hope you can follow all that okay.)

As at the end of April the amount of mortgages with over a year and less than or equal to two years to run before a reset was in excess of $61.5 billion, up by over $13.5 billion (28%) on January's $48 billion figure.

It now means just under 16.5% of the total loan book was as of April on terms of greater than one year and less than or equal to two years, up from just 13% in January.

The reset is upon us, and it will only gain momentum from here.

The investors return

Also gaining momentum, as mentioned at the start, is borrowing by investors - from admittedly very low levels.

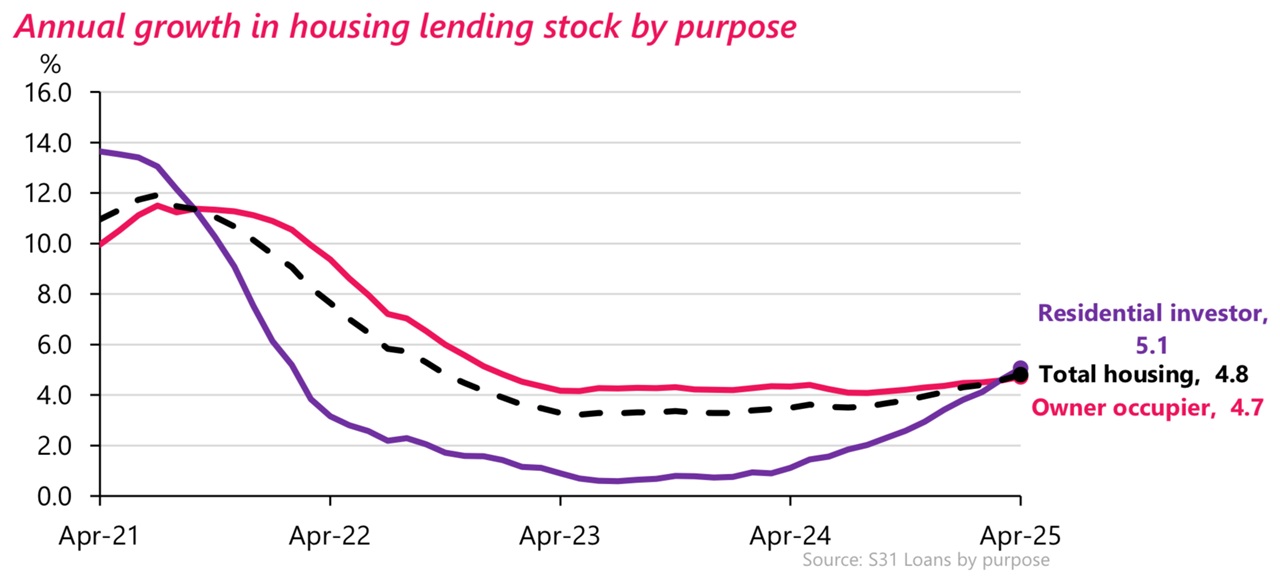

The RBNZ's separate loans by purpose figures show the outstanding pile of mortgages for investors reached $95.433 billion as at the end of April, which was an increase of $572 million (0.6%) in the month.

The loan pile for owner-occupiers (and this includes first home buyers), grew to $274.798 billion, up $1.09 billion. However, that was just a 0.4% increase.

In the 12 months to April the owner-occupier outstanding mortgage stock grew by $12.381 billion (4.7%), while the investor pile increased $4.589 billion (5.1%).

However, the rate of increase has quickened for the investors in recent months. The investor pile has increased by nearly $2 billion in the first four months of this year and at an annualised growth rate of 6.3%, compared with an annualised growth rate of 4.8% for the owner-occupiers' outstanding mortgage stock.

Additionally, in the last two months the investor pile has been growing at an annualised rate of more than 7%.

As can be seen from the above graph it's all a far cry from the surge seen during the pandemic (when the RBNZ removed the loan to value ratio - LVR - limits), but a clear trend appears to be emerging of greater levels of investor involvement.

*This article was first published in our email for paying subscribers first thing Wednesday morning. See here for more details and how to subscribe.

14 Comments

The move from a 'you ought to be short' to a 'longer is stronger' mindset is on for mortgages

Wrong move IMO. There's room for more rates falls as the economy continues to run at less than 1% growth. Having more households stuck on longer terms is only going to exacerbate the problem as they will have less discretionary income to splash around than they otherwise would have.

Great for those willing to hang out on the short end though.

Agreed.

Just locked in another 6 month rate. I think this is our third in a row now. So far in hindsight it’s been better than accepting the 1 year rate each time so if I don’t get it quite right it’s only going to balance out anyway.

Agree. I just don't see a case for going longer at this point.

It's obviously a slightly different landscape, but last time everyone was saying to shorter, I went longer, and my interest rate still starts with a 2 for another year or thereabouts.

Good move.

If you've never seen money that cheap before

And it's called an "emergency rate"

Seemed kinda logical it'd only last as long as the emergency

We might need it again the way things are going.

Perhaps. Strong argument that the reason we are in trouble is because debt was too cheap for too long, leading to silly gambling behaviour.

The Ponzi NZ home market, loves gamblers on cheap debt. UNTILL IT DOSENT,

The chicken has now come home to roost......into the hot DDDebt oven, it will fry the DDDebt gamblers!

I think it's more the dire state of the globe, but I own more than one style of binocular.

When the 2.99% for 5 years was up for grabs we were in the middle of our subdivision and all of the borrowing was stuck in floating/progress payments. It seemed like a no brainer to me but wasn't on the table :'(

The media doesn't understand that half of borrowers won't have any relief from lower interest rates until next year (46.9% 6 months or greater until fixed term is up)

They don't?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.