BNZ economists are picking that the house price correction is over, which means prices will be levelling out still about 20% higher than they were before the pandemic.

In his latest Property Pulse publication, BNZ chief economist Mike Jones said the BNZ economists' long-held view was that NZ’s house price correction would "run out of steam" around the middle of this year, with prices 15-20% below the 2021 peak.

"Our confidence in such has grown to the point that we’re now sticking a fork in the correction and calling it as roughly done at levels around 16% below the peak," he said.

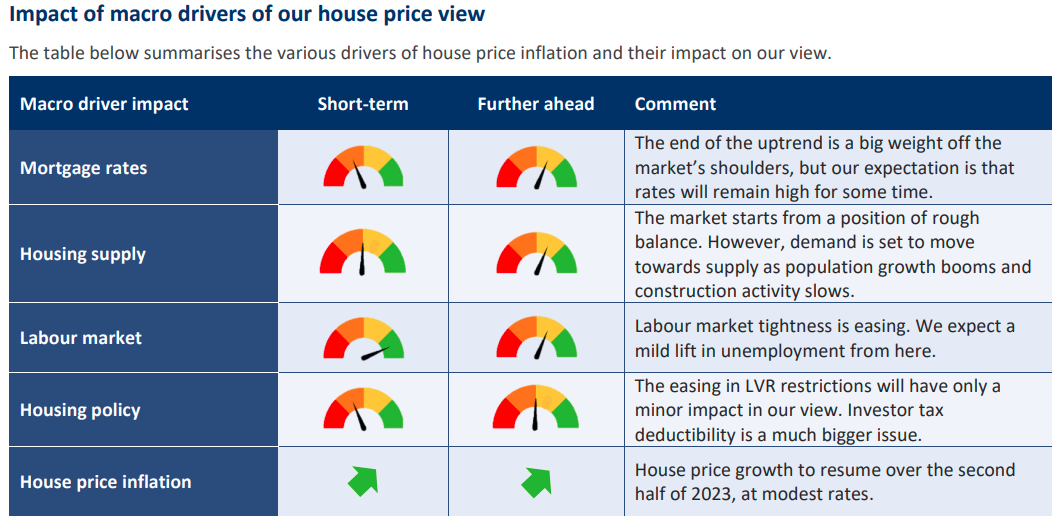

He now sees house price growth resuming over the second half of this year. "But only at modest rates of around 1-1½% per quarter," he said.

"That is, we remain of the view that still-high mortgage rates, stretched affordability, and sluggish economic conditions will all constrain the extent of the upturn. We see annual house price inflation at -2% by the end of this year (from -12% currently), rising to +7% over calendar 2024."

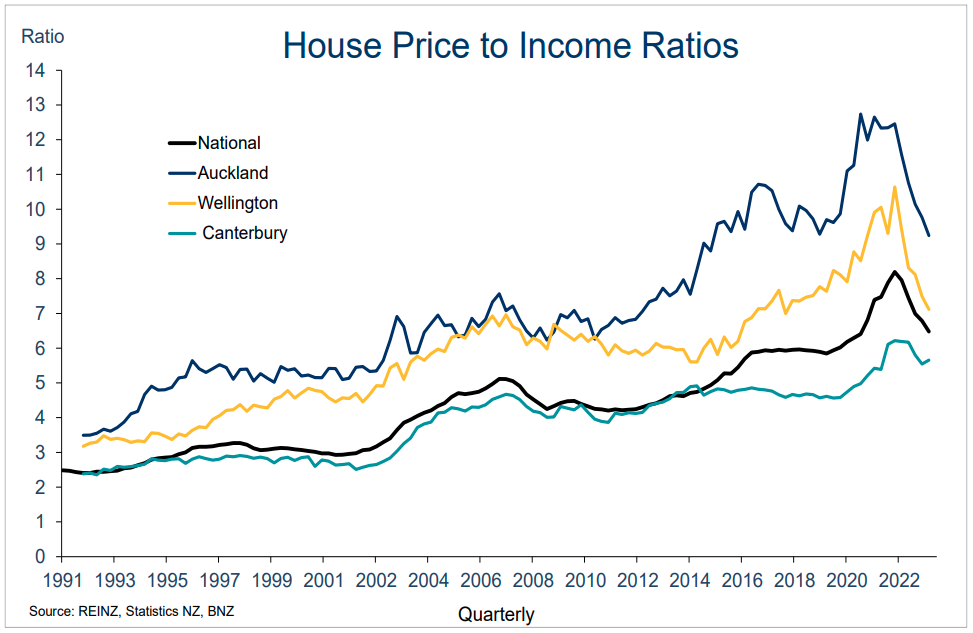

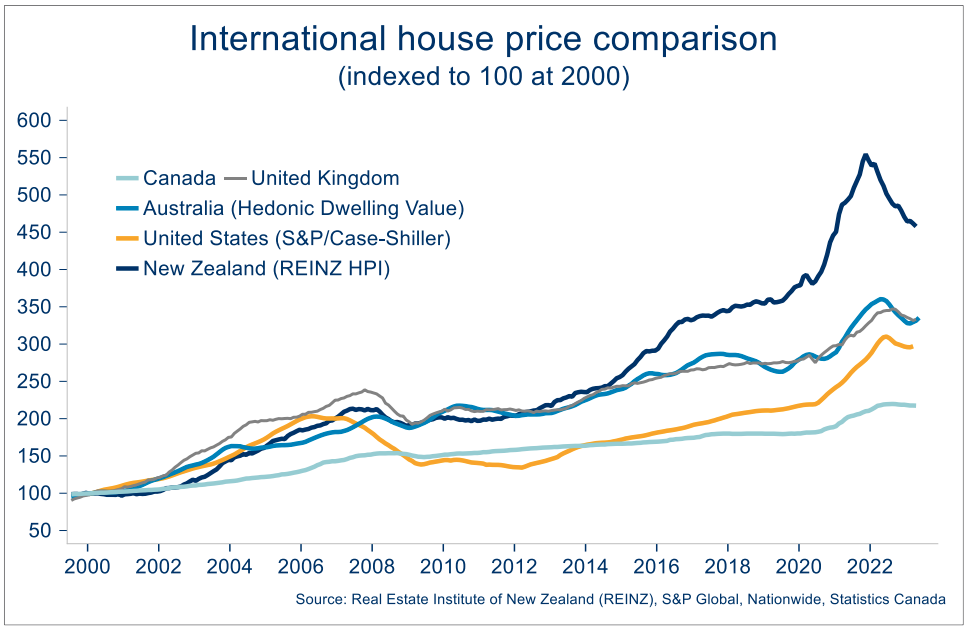

He said if the pick about the bottom of the market was correct, this would still leave house prices about 20% above pre-pandemic levels "and still elevated on any number of valuation metrics".

Jones said the "tools-down" by the Reserve Bank (RBNZ) - its decision to hold the Official Cash Rate at 5.5% for now - is seen more as "removing a source of downward pressure on house prices" rather than something likely to provide a strong boost.

"After all, RBNZ data show the major banks are testing new borrowers on 8.5-9.0% mortgage rates, and rates don’t look like they’re going to come down anytime soon.

"Still, the light at the end of the mortgage rate tunnel is likely to help lift buyer confidence off the floor and, in turn, assist the nascent recovery we’ve seen in various housing activity statistics like monthly turnover and days to sell. Even at current levels, sales-to-listings ratios – a proxy for the demand/supply balance in the housing market – are suggestive of a stabilisation in prices."

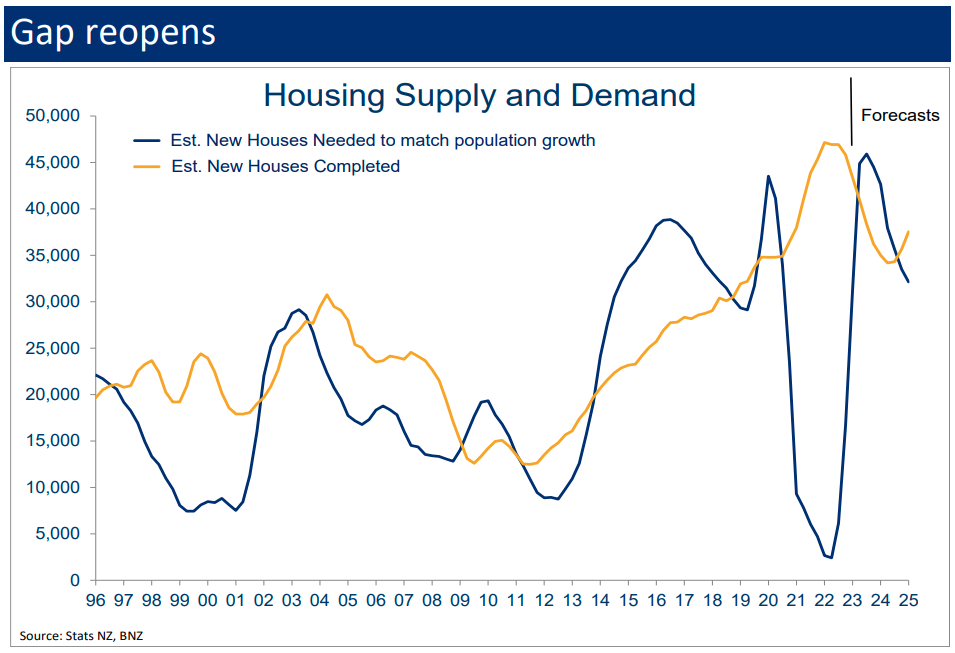

Talking about the recent surge in inbound migration, Jones said extra population will add to housing demand.

"If mortgage rate dynamics have played out loosely as expected, population dynamics have not. The extraordinary boom in inward migration numbers is turning out to be a game-changing development for the economy, and it certainly has implications for the housing market.

"The surge in residential construction of recent years had, in combination with closed borders, restored balance to a market that, pre-Covid, was probably undersupplied to the tune of 50-100k dwellings.

"Now, with population growth surging again and construction activity slowing, we’re, conceivably, in the process of moving back into a position of excess demand for housing. Our rough projections have incremental demand nudging above incremental supply over 2024."

The extra pressures on housing resources is likely lead to upward pressure on prices and rents, he said, though the extent of such is "anyone’s guess".

On the projected gains for the housing market in coming months, which Jones has "pencilled in" at around 1½% per quarter, on average, from the third quarter of this year through 2024, Jones said he had retained an expectation "that the upturn will be fairly tepid".

"The end of the downturn does not a boom make. There are still some stiff headwinds facing the housing market, namely:

• Mortgage rates are set to remain around current high levels for some time. This, and the more general cost of living crimp on incomes, means the serviceability burden on new borrowing will remain high.

• Despite the sizeable correction of the past 18 months, NZ house prices are far from ‘cheap.’ Valuation metrics (see appendix) show that the degree of stretch to anchors like rents, incomes, and offshore equivalents has reduced but remains elevated.

• The economy isn’t in a great spot. Growth is recessionary, and the labour market is set to deteriorate. The fact we’re comfortable forecasting a small house price recovery in this environment reflects the fact our projected lift in the unemployment rate is relatively mild, and is driven more by extra labour supply than widespread job losses. But should things turn out worse than we’re expecting, we’d expect the housing market green-shoots to wither pretty quickly.

108 Comments

When you consider inflation, a 20% increase is a significant drop after the pandemic.

It's wage inflation we need to consider. LCI is 4.3% at the moment.

Monthly $3,161 for $800,000 @2.5%

Monthly $3,180 for $502,000 @6.75%

Adjusting for LCI my guess is down 30% from peak.

What about wage growth prior? This article dated Aug 22 states an 8.8% jump in the 12 months prior. https://www.beehive.govt.nz/release/wage-growth-best-record

800k mortgage @ 2.5% = $3161/month

640k mortgage @ 6.5% = $4045/month (20% lower mortgage due to price drop)

Difference is under 1k a month. Take 2 incomes at $75k, add 12% wage increase since peak prices, and the increase in repayments is covered.

I ran the NPV/sum of future discount cash flows of an asset under these conditions in a spreadsheet. To make sense, the investment price still needed to come down 30-40% even if 7-8% wage/rent increases were sustained across a 30 year term of the investment.

Changing the discount rate/required rate of return for the investment, from 2-3% to 6-7% has a massive impact on the asset price.

Wages will need to rise much more to offset the impact of higher discount rates, but if that were to happen, then the discount rate would again go even higher as the OCR goes up to fight the inflation it would cause!

If people were buying during the peak (and they obviously were),now with wage inflation + the 20% drop in prices we've had, the affordability level is the same. Perhaps that's why BNZ is calling it.

They might be right - I'm skeptical given the picture global yield curves are painting. They are saying more pain is ahead of us which most of the time is negative for asset prices.

Generally these bank forecasts are along the lines of 'as long as everything goes well from here then XYZ will happen'.

They never say things like 'global yield curves are the most inverted they have been since the early 1980's. We are predicting a big recession with associated loss of incomes which could impact housing affordability while the OCR is reduced to stimulate our weakened economy. Where the bottom is for housing if the yield curves are correct is an unknown and too difficult for us to forecast with any real accuracy'.

Yeah, and they never say "We don't care what rates do, lending to anyone who isn't already rich during this shit storm would be nuts."

discount rate longer term look at 10 year - closer to 4%.

Rent increases 7%.

net yield 7% plus i'd be happy.

Cap growth is bonus - and even at merely rate of inflation 2.5% returns a decent amount which can't be ignored.

"discount rate longer term look at 10 year - closer to 4%."

We don't have 10 year fixed term mortgage rates to apply as the weighted average cost of capital/required rate of return.

Short term rates (i.e. the thing that cash flows will be discounted by as the cost of debt when servicing a mortgage in NZ), if general inflation is 7% (e.g. rents in above scenario you providde), will be at least 7%...could be 8-10%.

Not a great idea to run long-run NPV calcs using a short-run discount rate. The consensus as far as I can tell is that neutral interest rates are unchanged or perhaps slightly higher. Of course, we don't know what the neutral rate is, but I don't accept that it has structurally shifted higher to any great extent.

When you consider inflation, a 20% increase is a significant drop after the pandemic.

Alas, not so, when you consider the strength of house price growth through 2020 and 2021. Or, for that matter, over the past 5, 10, 30 or 50 years (or longer).

The vast majority of home owners/investors have done very nicely indeed - and even more so when avoiding rent payments (or earning rent as a landlord) are factored into the calculations.

But opportunity still exists...... Those who purchase houses over the next few months (or before prices rises return) will be sitting pretty within a few short years.

TTP

"Those who purchase a house over the next few months (before prices rises return) will be sitting pretty within a few short years."

So you would be willing to insure / underwrite all current owner occupier house buyers against any mark to market losses, and realised losses then?

How on earth did you find out I'm in the insurance/underwriting business⁉️

TTP

The vested will be waiting a very long time to celebrate house price gains once again exceeding the inflation rate, this being their once most favored measurement now seems to have been conveniently abandoned. Once the housing market bottoms, they'll still be falling for years when adjusted for inflation. Under the weight of still elevated financing, insurance, rates and maintenance costs (dead money), lets see how it stacks up against rent then. This is a reset. It could take decades to play out especially if/when the RBNZ introduce DTI.

Avoid taking notice of the DGM!

Each time the market recovers, they get swept away in a tsunami of fear.

In fact, in the last market recovery Retired-Poppy disappeared completely - for several years. He'd been forcefully predicting a market crash but, in fact, house prices soared - causing him a great deal of humiliation and embarrassment.

TTP

I can tell you're rattled by the hard facts - and right now you should be. Get used to it buddy :) I have never been afraid of tackling those who misrepresent the facts for their own selfish advantage. Why would I need to be absent for reasons of humiliation and embarrassment? You conveniently omitted it was me getting 4.25% (for a 5-year TD) from Rabo whilst others were getting 1%!

Instead of craving the return of yesterdays foolishness try embracing the realities of the present.

There will ALWAYS be someone telling people that now is the best time to buy.

Why?

Because these people need to earn income to put food on the table to feed their families, pay for the roof over their heads (either rent or mortgage). More property transaction volume and transaction values financially benefit the following groups of people:

1) real estate agents

2) mortgage brokers

3) property mentors

4) property developers

There are others.

Positive spin leads to increased confidence to persuade people to buy.

Always remember the vested financial self serving interests of the messenger.

More property transaction volume and transaction values financially benefit the following groups of people:

1) real estate agents

2) mortgage brokers

3) property mentors

4) property developers

There's one more important group: banks, which benefits from the interest on mortgage repayments. They also benefit from house prices being valued high since more than half of their asset portfolio is real estate. Like BNZ, for example

A lot more benefit indirectly, including but not limited to:

- builders

- tradies

- construction material suppliers

- furniture retailers

- valuers

- architects

- planners and engineers focused on residential development

The house (bank) always wins sir

"The house (bank) always wins sir"

Not necessarily. Look at shareholders and debtholders of the following lenders:

1) Silicon Valley Bank

2) Signature Bank

3) Republic Bank

4) Credit Suisse

5) Northern Rock in UK in 2008 / 2009

6) Irish banks in 2008 / 2009

7) Icelandic banks in 2008 / 2009

8) IndyMac in 2008

9) Washington Mutual in 2008

10) in NZ, look at the finance companies in 2008 / 2009 - e.g South Canterbury Finance

11) Bank of New Zealand in 1989 and 1990

I'm none of those, but I've just spent a large sum of money buying land in an area where I believe there's huge opportunity.

I made the mistake many years ago of listening to doom merchants, and I've done pretty well since I've been ignoring them.

Nobody cares RP, what did you have invested ? $1000 ? Honestly the DGM's should just leave this site, they are wasting their time. People come here for financial advice on when to buy a house, not listen to people that will NEVER buy a house even if they dropped 50% tomorrow. If I had listened to the clowns on here I would have be ruined for life. If you didn't buy a house 20 years ago and you could have financially done so at the time you screwed up big time. Fact of the matter is are you really going to wait another 20 years to see if you were right ?

LOL!

If I was a DGM how did I manage to sell for 3.25mil in Nov 21? Correct I purchased after the GFC near the bottom...... Take it from someone who buys and sells, this is not the bottom and its a crazy time to try to buy property as an investment

But but tones said its going "to rocket". He guaranteed it,,, wait a minute

Lols

Correct. To many negative factors in play to give me the wow factor,

The people talking it up are doing so based on limited optics on the key drivers.

Life as a DGM, is the way to go TTP. Have more mates, get more life satisfaction and its way more fun. You should try it

What message does TTP send when in 2020/21, in neurotic fashion he advised FHB's should cast aside cautionary chatter of a downturn in house prices. Post Nov-21, TTP then started telling FHB's month after month to buy counter cyclical - lol!

This guy has to be a Mortgage Broker - surely!

Just trying to give the poor fella some hope. After his broking or REA business fails we dont need him getting all sad.

The 1929 depression lasted 6 years and this one has that written all over it

#4moreyears

Yip...

Let's look at the COL/inflation pressuresI

Imports up cos NZD down

Fuel subsides gone

Fuel up as the Saudis cut production

RATES UP MASSIVELY

ELECTRICTY UP Massively

UNEMPLOYMENT GOING TO RISE AS Retail DIES.

food up more due to above and winter weather curtailment of supply

Govt spending pre election up

Green policies will add cost to everything.

Debt recovery will be the big driver.

Blah blah blah

Orr will raise the OCR big time

Bust! NZ housing market crashes

NZ is going to see the peeps go into spending lock down and by December inflation will be closer to 10% than 7% and a fully blown recession will be on!

Aussie have just learnt this lesson and even the RBA governor has said. " Stop increasing wages! It's driving inflation up!"

Robertson and Orr are using faulty Fiscal optics!

Bookmark that!

Nearly everyone made money from property over the years, TTP you and few others on here just missed the memo to get out late 2021 and have had to watch as your housing portfolio’s lose value weekly. Why do you keep encouraging people to buy property at these way over valued price’s you seem to be oblivious that the market has already crashed and is still continuing downward trend maybe you should disappear for a few years as it is you who is embarrassing yourself. If someone purchased a property today this time next year it would be worth 10% to 20% less.last year you said same nonsense and people who did purchase property have lost around 15% to 20% of the purchase price paid.

As usual. Spruiker dreams are free. But when the property plane runs out of fuel (cheap leading) you can -pull up- as much as out like, at best you get a dead cat bounce, before continuing its decent into the ground.

Let me know when we are no longer beating Ireland in the 'swiftest housing crash- stakes.

The RBNZ doesn't care about property speculators, loan holders or mortgage holders. All they *really* care about is inflation.

There are no signs that suggest that inflation is dropping significantly. Canada made the mistake of thinking all was fine. They just raised their OCR by .25 and this is after 6 months of economists predicting rate cuts this year (now they know a further increase is coming in July too). Canada is a powerhouse compared to NZ.

I liked the bit where they ignored a 2.5%->6.5% interest rate increase is a 38% drop in affordability. Interest rates stalling doesn't stop a price fall that hasn't finished yet.

Totally agree. I work in property and am largely invested in commercial property but even putting the most optimistic spin on current data I can’t see property prices increasing whist interest rates are at this level. Nothing I am looking at stacks at these higher interest rates. I think a more likely scenario is that people will leave their money in term deposits until it looks like interest rates might come back or the market retreats another 5-10%.

What are you seeing in the commercial property space? Especially in respect of lower valuations resulting in breaching maximum allowable bank LVR limits?

What I am witnessing is Valuers are gradually walking back their valuations. Many landlords are in breach of their banking covenants on a LVR basis but the banks aren’t in any hurry to pull the trigger. In some cases I am aware as mortagages roll over the bank is requiring landlords to tip in more equity and in some isolated cases they have instructed clients to sell an asset. Most buildings are still sitting on valuations that are well above what would be achieved in the market. Interesting fact is commercial lending is currently at rates >8.5% but yields and valuations are typically <6.5%. Something has to give. I’m picking a drop of 15-20% over the next 12 months.

From the RBNZ May 2023 Financial Stability Report

"The capital value of Auckland prime retail property declined 16 percent over 2022"

JamesM,

Thank you for sharing your observations.

"Many landlords are in breach of their banking covenants on a LVR basis but the banks aren’t in any hurry to pull the trigger. In some cases I am aware as mortagages roll over the bank is requiring landlords to tip in more equity and in some isolated cases they have instructed clients to sell an asset."

This highlights the importance of what the banks decide to do - whether they instruct borrowers to meet contractual obligations or whether they are willing to tolerate forbearance for a period of time.

These borrowers are relying on the kindness of their lenders and in a potentially precarious position. Who knows how long they before they stop their forbearance.

Totally agree. Banks at present are playing nice (presumably because they don’t want to crash the market) but if their attitude changes it could get very ugly very quickly.

It is also worth noting that most of the listed property stocks have already seen a significant drop in their share price this year. The markets know the value of these properties has dropped but many private landlords are still in denial.

These economists only ever talk in anecdotes. When you see the hard facts ie. Mortgage costs associated with a 9% test rate. I'm sorry, I strongly disagree that the market is bottoming out. I saw an article about Andrew Tate and his controversial views. For me, these economists are in the same category.

Lower house prices are against the financial interest of NZ's banking oligopoly. High housing inflation in NZ means homebuyers keep locking themselves in on larger mortgages for longer terms.

Can't blame these economists who are on the payroll of those banks, when the institution responsible for regulating banks appears to have a conflict of interest as well.

Business.Scoop » LVR Easing Leading To More Borrowing Enquiries – C21NZ

They are not vaping cherry berry

Saw that Tony Alexander said that seasonally adjusted sales transaction data from REINZ was +11% in April 2023.

Yet when looking at April 2023 vs April 2022 sales transactions for the whole of NZ,

April 2023: 4,262

April 2022: 5,006

That is a DECREASE of almost 15% yoy

Does anyone know the reason for the discrepancy?

Might be from one of his surveys? Otherwise that’s some pretty gnarly fake news…

Survey data is irrelevant. This should be based on actual historical results.

It should be based on historical data released from REINZ for April 2023.

The REINZ report says that volumes are DOWN 15% in April 2023 vs April 2022.

Refer page 4 in this report

https://www.reinz.co.nz/libraryviewer?ResourceID=554

Yea nah 100% agree. I’m implying it’s likely complete bs from TA, misleading as per usual

Yeah I'm a bit thick when it comes to "seasonally adjusting" the data when comparing to the same month in previous years. Was April not in mid-Autumn last year? Is there a chart somewhere that shows in which season April will fall (no double pun intended) over the next 5 years?

I just ignore things like that. If people want to play with the data, they can do so amongst themselves...

Sometimes there is a difference due to where Easter falls - your April might have a few more or fewer business days than last year. Got to be careful with seasonal adjustment these days as it might be tainted by the random Covid lockdown noise, though.

April 2023

Public holidays

7 April - Good Friday

10 April - Easter Monday

25 April - ANZAC day

17 business days

April 2022

Public holidays

15 April - Good Friday

18 April - Easter Monday

25 April - ANZAC day

18 business days

If feels like everyone is desperate now and trying to prop up the market artificially. Its like MSM, Banks, REA etc are trying to place floor underneath the falling market. Its evidently visible that they are trying to create suitable environment to smooth out the incoming tide of distressed sales after the mortgages are re fixed at higher rates.

Before all the nay sayers jump on saying it is the market data. Can anyone please explain to me that why on one side banks are putting provision for loans and on the other side they are saying that market will bottom out soon. Seems there is contradiction to what they are doing and saying.

'When it becomes serious, you have to lie' - Jean-Claude Juncker :

I think the advice as mentioned in this article will be quickly found out to be "forked".

"If feels like everyone is desperate now and trying to prop up the market artificially. Its like MSM, Banks, REA etc are trying to place floor underneath the falling market. Its evidently visible that they are trying to create suitable environment to smooth out the incoming tide of distressed sales after the mortgages are re fixed at higher rates."

Here's an example of media spin - accentuate the positive, eliminate the negative

Report Headline: "Highest number of Auckland house sales in a year"

"Auckland’s housing market had its busiest month in a year last month as buyers returned to the market, Barfoot & Thompson says."

"New figures from the city’s largest real estate agency show it sold 723 properties in May, up 52.9% from 473 sales the previous month."

"... they were up 31.7% on the average of 549 over the previous three months"

“After a dismal April, May’s sales are another sign that the Auckland market has either hit the bottom of the current cycle or is close to it.”

The number of sales was the standout feature of the month, and showed buyers were not shying away from paying current mortgage rates, he said.

“It is a positive signal that after we ease through the coming winter trading months the market has the capacity to rebound.”

Buyers were returning to the market, with the second-highest number of monthly sales in the $2 million plus price bracket this year, and strong demand in the under $750,000 price bracket, he said.

But there was increasing speculation that the market might be starting to bottom out, as mortgage rate rises were peaking, and demand had started to pick up.

Earlier this week, ANZ economists said house prices looked to have found their floor, and would start to lift from here on in.

CoreLogic’s latest figures, which were released on Thursday, showed prices fell another 0.7% in May, but the company’s head of research, Nick Goodall, said evidence was mounting that the market was approaching a trough.

Key historical data

"Sales were down 7.5% from 782 at the same time last year,"

Despite the increase in sales, the region’s median and average sales prices fell further in May.

The median price dropped 4% to $955,000, from $995,000 in April, and it was down by 15.1% on $1.12 million at the same time last year.

It was now down $285,000 from the November 2021 market peak of $1.24m.

The average sale price was $1.07m, and that was down 1.5% from $1.08 the previous month, and 10.9% on $1.18m last May.

https://www.stuff.co.nz/life-style/homed/real-estate/132219029/highest-…

Provides an orgy of evidence as to why the housing market has further to fall, but concludes that it means we are going back up…?

what are they smoking? ... just making stuff up, it's still in a nosedive. clowns

Think its pretty much the bottom from here myself, but only if the RBNZ now holds. At the end of the day you can twist the figures any way you want to fit your narrative. My place is now at way below the RV but is still valued at above what I actually paid for it in 2020 so really I don't care. Factor in three years living rent free and you are still way ahead. Unfortunately those that bought in the last 2 years during the frenzy and are now also facing big rate increases have been screwed and its only going to pan out for them in the long term.

Only rent-free if you paid cash. Otherwise, you're renting the capital from the bank for interest.

Cash is king baby.

And yet we've been told on this website that cash is trash and the best idea is to take on maximum debt as you can against your income and then inflate that debt away.

So is cash really king?

"And yet we've been told on this website that cash is trash and the best idea is to take on maximum debt as you can against your income and then inflate that debt away."

What were the vested financial self serving interests of the messenger?

There will ALWAYS be someone telling people that now is the best time to buy.

Why?

Because these people need to earn income to put food on the table to feed their families, pay for the roof over their heads (either rent or mortgage). More property transaction volume and transaction values financially benefit the following groups of people:

1) real estate agents

2) mortgage brokers

3) property mentors

4) property developers

There are others.

Positive spin leads to increased confidence to persuade people to buy.

Always remember the vested financial self serving interests involved.

Yes, only if paid cash, and the next best use of those funds returns 0.

One side has words, the other has the overwhelming evidence.

I know which side of the coin I’d rather be on…

Ok Mr Bank Man, tell me how much Joe Borrower can borrow today vs what he could borrow pre-pandemic.

It's lower today, wouldn't you say?

If wishes were horses, beggars would ride.

From above

Housing supply - "the market starts from a position of rough balance"

How does that explain the 17% house price falls from peak prices in NZ based on REINZ house price index?

When talking about house price forecasts, UNDERLYING supply and UNDERLYING demand is irrelevant and not meaningful - it is an attempt at rationalisation of their house price forecast.

When talking about house price forecasts, what matters is EFFECTIVE supply vs EFFECTIVE demand - it is also very dynamic.

What impacts EFFECTIVE supply but does not impact UNDERLYING supply?

How many will be unable to hold on?

Investment property estimated top ups:

Auckland: 566 per week ($29,432 per year)

Tasman: 547 per week ($28,444 per year)

Waikato: 401 per week ($20,852 per year)

New Zealand:380 per week ($19,760 per year)

Note that the calculations do not include any other expenses such as rates, insurance and maintenance.

Remember that this comes out of post tax household income, so the above numbers have to be grossed up to determine how much gross income is required to support the top ups.

This is also before the phasing out of interest deductibility on existing houses purchased before March 2021, and zero interest deductibility on existing houses purchased after March 2021.

https://www.oneroof.co.nz/news/how-much-money-do-mum-and-dad-property-i…

Is the interest deductibility issue a distraction for most highly leveraged property investors? If the following choice was given to highly leveraged property investors:

1) lower interest rates, zero interest deductibility OR

2) current interest rates, full interest deductibility

Most would likely choose option 1 as the higher interest rates has adversely impacted their cashflows significantly more than the phasing out of interest deductibility.

Remember how Ashley Church was saying that property investors would be in a strong position and snapping up bargains in the event of a market crash?

"Conversely, property investors - who up until a couple of years ago were required to have a 40 per cent deposit when buying an investment property – would, therefore, be affected to a much smaller degree and would be in a strong position to “snap up” bargains created by the market crash,"

https://www.oneroof.co.nz/news/ashley-church-this-is-what-a-house-price…

In reality, many property investors are highly leveraged and in negative cashflow and unable to purchase bargains. There are only a very few property investors that are in a strong position to snap up bargains.

Yep, I've always found this line of thinking a bit odd.

As you pointed out, many of them are in negative cashflow, but I think it's also worth thinking about how they were able to secure these loans in the first place - many would have done so using existing equity in their properties as a security for the mortgage on a new one. With sliding house prices eroding their equity, I can't imagine banks will be falling over themselves to lend them more money to purchase more properties.

A few other commenters frequently point out the impact that rising rates will have on house prices re: when housing makes sense as an investment, but I wonder if it's worse than that - even if the investment were to make sense, investors may not be able to go through with it.

"With sliding house prices eroding their equity, I can't imagine banks will be falling over themselves to lend them more money to purchase more properties"

A property investor in Wellington with an LVR of 60% at the peak, on interest only financing terms, would now have an LVR of of 80.6% (based on the REINZ house price index fall of 25.5% from the peak)

This property investor would unlikely be able to meet current investor lending criteria from a bank (both on LVR or debt servicing criteria) and would be unable to borrow more to buy another investment property based on equity recycling financing techniques. This is likely the reason that most leveraged property investors are unable to borrow more and buy more properties.

Don't know about non bank lending rules.

None of these clowns called the top In Nov 21, even though the RBNZ started lifting OCR at the end of Oct 21.

Orr came back from Jacksons Hole crapping bricks, he fully understood the scale of his miscalculation.

Why do they have better crystal balls now.... I propose that the size of the building bad loan provisions is forcing caution in economic releases. Even Hosking is trying to sell the propaganda, though you can tell from his subtle voice twitches he is not convinced either.

A brave call by BNZ indeed! I believe their thinking, that the end of rising interest rates will lead to a house prices recovery, is wrong. Simply put, many mortgagors have yet to renew at a much higher interest rate, which will keep pressure down on house prices

Two reasons why interest rates will fall from here:

1. We are in a deflationary recession.

2. Lots of people are losing jobs.

Neither of these are good for asset prices. So if rates are falling, then from my perspective, this is going to put even more downward pressure on asset prices (shares, property etc). Obviously bonds will then again be the safe bet (bond prices up as interest rates go down) which is good - because people will have a safe haven to go to, other than speculating with debt on houses.

These articles to me have the smell of desperation about them - like they can see the problems that are coming ahead and think if we can change the narrative that we can change the outcome. But the banks made their mistake 2 years ago when they lent too much debt to people who wouldn't be able to afford it if rates regulated - so they have made their bed. Time to now sleep in it.

Yes.

There have been instances where:

1) mortgage interest rates have fallen AND at the same time

2) house prices have fallen

I lived through this in the US during the GFC.

Falling interest rates aren't a certainty to stop property prices from falling. Interest rates were dropping right through 2008 in the US and house prices continued to fall.

And this is what bankers, like in this article don't talk about, and that is the behavioural financial/economic side of these issues. Ie the psychology/animal spirits of people.

Once an asset bubble starts to deflate (if that is what is happening here in NZ), it could take years to unfold and they won't be able to do anything about it. If people think prices are going to keep falling, they will keep falling. Dropping the OCR will have very little impact in the short term - it could take 12-24 months for it to make much of a difference.

Bingo.

"we’d expect the housing market green-shoots to wither pretty quickly"

This 'green shoots' thing I find completely crazy.

Green shoots from what? The beanstalk that Jack planted and that is already so top heavy because it grew too big for itself that even the smallest gust of wind and it will topple over. Why would you want green shoots growing from the top of that - when those greenshoots would make it even more unstable and be even more exposed to any bad weather?

You are better off for that beanstalk to fall over because it is weak and fragile, and then grow a new more sustainably sized beanstalk that isn't going to fall over in the wind and is less exposed if the weather is bad.

This concept of green-shoots from something that has overextended itself, is to me a sign of delusion among those with a vested interest within this market...one final attempt to pull the wool over people's eyes - not for the good for society and our financial stability - but to try and keep a system going that benefits the few at the expense of the many.

Green chutes actually.

Your record of predictions is second to none. Im with you

If you look across those charts above, there is still a possibility that house prices could fall another 30% (or more) from here to get back to prices that would be considered internationally balanced with other nations - and affordable based upon incomes. e.g. people think the US is in a housing bubble at present and that it will fall substantially from here, and yet since 2000 our prices are 100% greater than the US - so we would need to fall 50% to get to where the US is currently and even then, they think this might be a bubble over there! Our prices really are insane.

Not that banks will tell you that - because this is the bottom! Why? - because they can't afford for it to not be, that is why.

To have a mortgage of a million at base rate will cost $7700 per month for 30 years, after paying this most couples would be living of fresh air, struggling to be able to afford to have children is this the future we won’t for our children. BNZ experts are not living in reality over last few years experts have got most forecast wrong this will be the same. House price’s will continue to fall best to wait if possible and look again in 18 months.

Rent maybe dead money, what you describe is a death sentence, or at least many years of misery in pursuit of better bbq stories.

Potential owner occupier buyers dilemma:

Dead money or (financial) death sentence

HP will start rising when HP stop falling. Four more years bro four more years

There's no need to worry that the numbers of houses for sale is falling. Capitulation is coming.

"population growth surging".... well, something is surging alright. Over 10,000 (net) people have left the country in the first 5 days of June alone. We are now net negative 35,000 people for 2023 to date.

The only "population surge" was in Sept-Dec last year when the borders were finally opened. But now that people are free to leave, they are. In droves. Anecdotally it would seem that most are putting their houses into the rental market as a hedge, which is why rents are mainly stagnant.

If we had a "surging population" NZ would have rapidly rising rents, a sub 1% vacancy rate, and rising house prices. It would look like Canada and Australia, which do indeed have high immigration.

At least the media seem to be cottoning on to the lie, even if the Stats Dept doesn't have a clue. https://www.stuff.co.nz/business/132109458/brain-drain-to-australia-inc…

Exactly. The ‘migration boom’ narrative is cynically exaggerated, for vested interest end goals.

I know three households in the development we live in that have moved to Aus in the last 2-3 months. One household sold their place, the other two are renting their places out.

Its a misuse of stats for political purposes. Anyone with a brain would know that there would be a huge influx of people when the borders were opened, after all, people were locked out of this country for almost 3 years. But claiming that influx as something that is sustainable into 2023 is the lie. But no-one in Govt is going to admit that NZ is now so awful that everyone is fleeing, or planning on fleeing. Thanks Jacinda, what a legacy!

Those are some pretty eye-opening statistics in that article.

65k in first quarter - 100k NET (arrivals less departures (tiny 12k of who are kiwis going to Aus ohhh noo, that never happened before like every single year except during covid.

100k net migrations would see 10% rents and flat to up to 5% increases in house prices, which changes in 12 months time we'll be up 10% price-wise.

The Stats Dept "model" is useless (as the article pointed out, it has no data on people's intentions as there is no way to collect it anymore), and its assumptions are from a different time (pre-Covid). Garbage in = garbage out. Customs data shows a net LOSS of 103,418 people from March-June 5th. This has not only reversed the Q1 net gain of people (which was only 43k not 65k), but is now reducing the gain from 2022.

Please provide the link KW

Don’t agree with this analysis.

Given interest rates, and especially test rates, prices need to fall a further 5% before we can talk about a potential bottom. Prices are still too high given interest rate levels to see a bottom yet. Demand will not increase significantly until prices reduce further.

Another factor is the economy - whether we enter recession, how bad that recession is, and how many jobs are lost.

And then - it’s not just about job losses. Think reduced hours of work, reduced bonuses or no bonuses etc etc. These things can have a significant impact on ability and willingness to buy property. My experience around 07-08 was that reduced hours (4 day weeks) were just as common as job losses, probably more so (in the consulting area )

Also, a whole lot of new housing will be hitting the market over the next few months.

If the Auckland Barfoots data is a leading indicator for the rest of the country, prices could be down 5% in a few months time (and in a trend that indicates even more price falls aren't just possible, but entirely probable - I guess we will see what REINZ has to say in a week or so).

If prices are down a further 5% in a few months time then that is *potentially* the bottom. But not necessarily as you suggest.

It’s quite another thing to predict they will rise 7% in 2024. That’s likely to be when the economy is at it’s lowest ebb, and interest rates are unlikely to drop in any significant way until later in 2024.

May 2024? We both thought interest rates would be on their way down by now due to a crumbling economy and increasing unemployment. Looks like we were way off.

The headline should read "BNZ are hoping....". That would be a far more accurate portrayal of their position.

5 days to wait for the latest HPI data and then we can see if things are shallowing out. From the auction results here on interest I would suggest that the data is going to be more bleak and in keeping with the Barfoot & Thompson article on here a few days ago.

We might see some stagnation by the years end at best.

The declines MAY have bottomed. BUT, the new bottom has yet to crystallise into the new sale prices.

So technically perhaps, in the reality of what one will need to pay, it will be les and less over many more months to come.

A sign the bottom is approaching is a marked and sustained increase in sales volumes along with auction success rates, sale by auction once again becoming the preferred method of disposal and I think the last and most importantly - days to sell. We are some ways away from any signs of a sustained turn around. Chances remain high it could all still continue crashing for another 12-18 months and wreak economic havoc.

Fixed interest rate rollovers are just starting to hurt the overloaded investor - so be ready with lowball offers from early 2024 people! There is no hurry.

I don't believe they have bottomed one bit. Little point made was even when we do hit bottom technically, there will still be a lagging droooop down as the data catches up....

All I know are a dozen eggs are $12, cheese is about $15, cost of travel to work is extreme, my kids camp was $400, sports fees are $230. That's just 1 kid. Not to mention all the other costs. But hey these house prices are affordable at over 7 times income (sarcasm). So don't worry that the peak was at extreme levels because of FOMO, once in life time pandemic, ultra low interest rates. Just wondering how much money economist make, sounds like they haven't been to the local supermarket. I get it, they are sales mouth pieces for the bank, but be great to have a little empathy for how hard it is in the real world. We need affordable housing and inflation to drop.

We just got hit with $80 more a month for insurance, a 30% increase.

Indeed. Eating habits can change, the cost of children is less flexible

You either have a one or two and try and do a good job. Or have heaps and let the State take care of everything for you because you are a victim.

Even though I have many children, I love this comment. We can afford them and pay a fair chunk of tax that goes towards those who are *reliant* (euphemism) on a considerable sum from our tax *obligation*.

I doubt anyone can predict house prices without predicting who wins the election. Pretty sure there is a big group of investors out there waiting to buy if National win and bring back the tax perks. Likewise there is a big group of investors who will sell up if Labour win. The two outcomes have to result in vastly different house prices.

National will allow interest rate deductions again.... I doubt they will remove ring fencing or reintroduce depreciation.... By itself it wont make people jump in as rates are way to high and rents to low to make cashflow sense

It seems apartments in Grafton are down 42 percent from what I'm reading - probably a bit moe to go - in saying that though if anyone needs to sell off market in a hurry (no agents please) dm me here on this thread - thanks v m in adv

Even in property slumps there's pockets of interest that will prove to be winners. One of those is Riverhead, just on the outskirts of Auckland. Massive 422 unit retirement village + 90 bed hospital +1,800 houses by a Fletchers consortium + road widening planned.

Right next door to NZ's most expensive suburb - Coatesville

The next few months could be an excellent time to dip your toes in the water. No one blows a whistle when the market hits a bottom.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.