By David Hargreaves

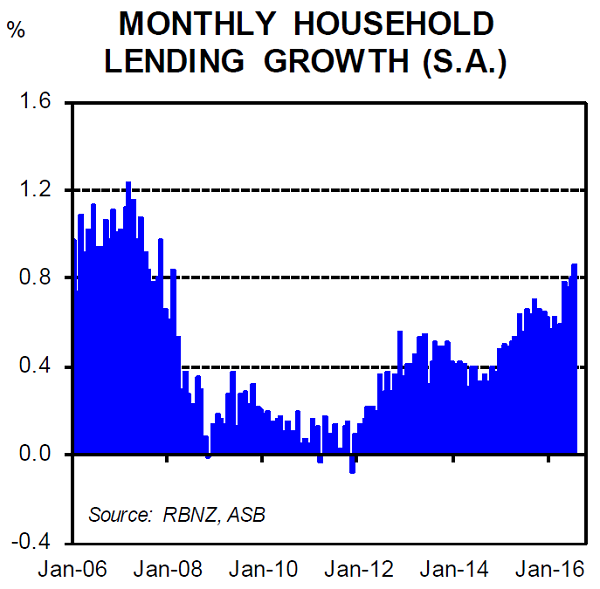

The level of household debt taken on by Kiwis rose at its fastest pace last month since November 2007.

The RBNZ's monthly sector credit figures for July show that total household claims (mostly mortgages, but also including consumer finance) rose a seasonally-adjusted 0.9% to $238.432 billion (from upwardly-revised $236.791 billion in June).

This is the fastest monthly rise since the 1% gain recorded in the month of November 2007 when the previous housing boom was just starting to tail off.

In terms of just mortgages, the total in July rose to $223.052 billion (from $221.42 billion in June), and is up 9% in the past 12 months.

That's the biggest rate of annual growth since May 2008.

Nearly $18.5 billion was added to the country's mortgage bill over the past 12 months.

The RBNZ watches these figures closely, so will be concerned at the continuing increase in the rate of mortgage borrowing.

The new LVR restrictions to be placed on housing investors were announced by the RBNZ on July 19. Whether there has been therefore something of a surge in the latter part of the month to 'get in' before the introduction of the rules will become more apparent over the next few months.

Clearly the RBNZ will be hoping the new LVR rules will see an easing in the rate of credit growth.

New figures in the RBNZ's Key Household Financial Statistics series are due to be released next week.

The latest available figures for the March quarter showed that household debt had now risen to a record high 163% of disposable income.

It's almost certain the figure will be now higher than that, given the way borrowing has surged in recent months.

At the moment the costs of servicing the debt are comparatively low because of the low interest rates, but whenever interest rates do eventually start to rise, this would hit repayment levels quite quickly and could generate stress for heavily borrowed households.

ASB economist Kim Mundy said housing credit had "yet another strong month", by growing over $1.6billion in July.

"However, it is slightly down from May’s stellar $2.1 billion increase and June’s strong $1.9 billion lift."

Mundy noted that the 9% annual growth rate in the mortgage total was only around half of that seen at the peak of the previous cycle.

"We are expecting housing credit growth to slow from here on out, however, as the new investor LVR restrictions take effect.

"Current RBNZ mortgage approvals data for August are hinting of this, as they are showing a slowing in activity. Further, for the first time in 8 months, investors did not gain a higher share of all new lending. Nationwide, lending eased back very slightly to 37% (was 38%) and fell 2% pts in Auckland, to 46% of all new loans.

"We would expect to see the share of new lending to investors to continue to ease over the coming months, as the new LVR restrictions limit the amount investors can borrow."

30 Comments

It is called asset price inflation cause by a credit bubble, and one day prices will undergo an almighty collapse to the underlying value. Only question is when, but ever declining interest rates are a clue.

"ever declining interest rates" are the clue alright, that the system is being changed and rigged at whatever cost to keep the status quo

Interest only mortgages(issued by banks) need to be stopped asap. If they are phased out and replaced with repayment mortgages it will give a greater buffer if and when there is a downturn.

And its all going into housing, an asset that could end up being worth less than what one paid for :(

Could wait for the market to come back like a tombstone around ones neck.

Just keep on borrowing peeps. At least we may get a chance to buy back our banks.

People Borrowing more and more is the sign of confidence that people have in economy - would be the response from our PM.

Just like house pricing going up is the sign of prosperity and more people coming but our dear PM does not realise that people from Asian country are coming as this is the easiest, fastest and cheapest way to get Residency in any developed country.

ASB economist Kim Mundy says lending slightly down in July from May. When is a 25 percent fall in lending 'slight'. Slight of a bank economist tongue possibly. When we talk of annual growth of 'only' 9 percent ,this is off a substantially higher base. In 2007 we peaked at selling 11000 homes to one another , in July 2016 we are 40 percent lower. C16 data shows weekly credit lending/( approvals / amounts) has gone off a cliff . ( Auckland has peaked). Interestingly the RBNZ wants to discontinue this series on basis not all lenders are covered, yet in its series description , states it collects 99 percent of all lending data. Will the RBNZ / banks forewarn anyone .

Fark...that's insane. 25%..wow. Really?

Don't forget to seasonally adjust cowpat. May is always higher than July. Last year May was $1.54b while July was $1.15b... difference being... wait for it.... a 25% drop.

Actually, per RBNZ figures, exact reduction from May 2016 to July 2016 was $454m in net growth, or 22%. So actually a smaller slowdown that last year.

B&T auctions last week for Manukau area - 12 sold out of 50 = 24% success under the hammer.

That looks like a slowdown to me...

Temporary drop. Same thing we saw in 2013 and 2015 with the introduction of LVR limits.

Plenty of Chinese money to come. Ron Fong Choy was correct, as usual.

.... and BTW, I am constantly hearing of people now getting turned down for finance.

Anecdotal evidence doesn't mean anything.

Chinese buyers don't need finance bro.

Any proof of that .....

Auckland property market 2012 to 2016. See also Vancouver up until July 2016

I asked for proof - you still haven't provided it...

Well FHB's are getting so old now once they pay off the student loan and have a couple of kids they no longer have a enough years to pay off a $1 million mortgage (and look after their aging parents).

"Borrowers as young as 40 are struggling to get approved for mortgages because of their age, experts have warned.

Lenders are wary to lend to older borrowers as they see them as a riskier prospect once they retire – meaning those in their 40s who want to borrow past retirement end up being rejected.

A study for Nottingham Building Society found that 37pc of brokers had seen a rise in the number of customers being rejected for mortgages and remortgages.

A survey of customers found that 17pc had been turned down for a mortgage because of their age. This rose to 21pc among borrowers aged 45 to 54."

http://www.telegraph.co.uk/finance/personalfinance/borrowing/mortgages/…

I also notice that household deposit growth was also only $678m v housing lending of $1.6b, so no one is saving any more, they all want houses (which should be sanity-adjusted) ... last 3 months tells a story ... only $1.7b in household deposit growth vs $5.6b in housing lending growth! Ouch.

Returns on bank deposits are so low it drives free cash to seek out profit elsewhere.

Why put money in a term deposit when you can buy a few houses instead?

Makes sense.

Banks need to grow their deposit books to support the growth in lending...

They are chasing deposits and tightened lending policy big time!

Proof please

um, have you read any of the rate cards recently? OCR down, lending rates flat but deposit rates up... proof enough I think. Unless you can point to another time that TD rates increased when OCR dropped?

correct... but banks are still borrowing offshore to fund the gap.

Yes, but Banks will always charge a margin.

The difference between the deposit rate and what they charge for a mortgage for a home borrower.

It's called business.

yes, but funding costs are rising offshore. In addition banks are required to hold a certain percentage of funding from local depositors - so "business" does have certain constraints.

According to mr. Key, this is a sign of success and every kiwi should be proud of this achievement

This sign of success is also blamed on the previous Labour government apparently.

People love to lap up his lies and contradictions.

#JKexit.

Friend of mine just refinanced,now he's driving around town in a new Ford Ranger(essential for Saturday sports).I worked out his new Ranger can sleep about 6 so everything should be ok when the shite hits the fan.

I've heard noise for the past few years and still this "crash" hasn't happened, talk about it for long enough I'm sure you can say I told you so one day....might be another 1-20 years time...

The RBNZ watches these figures closely, so will be concerned at the continuing increase in the rate of mortgage borrowing.

I think not - surely it's intentional?

A monetary policy regime narrowly focused on controlling near-term inflation removes the need to tighten policy when financial booms take hold against the backdrop of low and stable inflation. And major positive supply side developments, such as those associated with the globalisation of the real side of the economy, provide plenty of fuel for financial booms: they raise growth potential and hence the scope for credit and asset price booms while at the same time putting downward pressure on inflation, thereby constraining the room for monetary policy tightening. Borio page 12 of 38.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.