Parliament’s Finance and Expenditure Committee has challenged the Reserve Bank of New Zealand over its view that Government spending won’t make inflation worse.

The central bank’s Monetary Policy Statement, released on Wednesday, lifted the official cash rate to 5.5% and said that level was expected to be high enough to halt inflation.

This was a surprise to economists and financial markets which thought extra spending in Budget 2023 and high migration would require higher interest rates, closer to 6%.

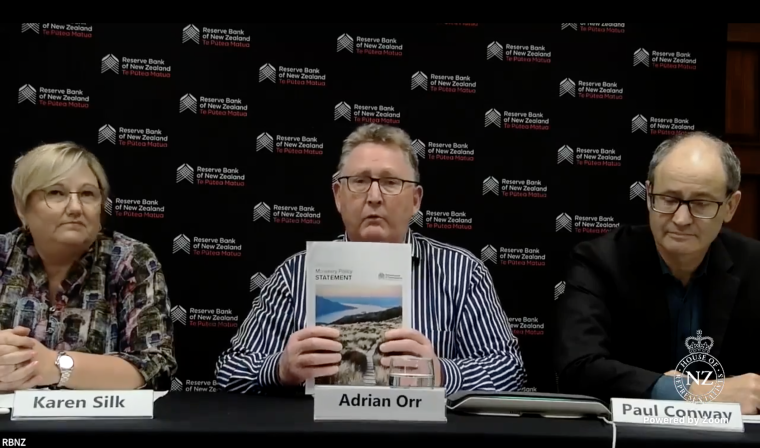

In a press conference on Wednesday, Governor Adrian Orr said fiscal policy was “more friend than foe” to the goal of bringing annual inflation back to 2%.

On Thursday at a meeting of Parliament’s Finance and Expenditure Committee, ACT party leader David Seymour took issue with that comment.

He said it was difficult to square that view with the $10 billion of borrowing Labour has planned over the next two years in Budget 2023.

Orr said the central bank looked at the fiscal impulse across the forecast period, which shows a decrease in real spending levels over the next few years.

“The level of government spending is rising, it just isn’t rising as fast as inflation and we are predicting it will fall by 5% over the prediction period as a percentage of GDP”.

The governor, who is known for his combative communication style, also criticised the media for what he saw as sensationalist reporting.

“I love the sound bites and I note that despite having produced a document that is significant on insight and effort, the one soundbite that makes it to the New Zealand Herald is ‘friend or foe’.”

Hook, line, & thinker

National Party deputy leader Nicola Willis said fiscal policy settings were expected to support demand and inflationary pressure in the 2023/2024 fiscal year, according to the Treasury.

Again, Orr said the central bank was focused on a two or three year horizon during which fiscal policy, for the purposes of economic modelling, was negative.

At times, the exchange between Orr and, in particular, Seymour was almost antagonistic.

The Act Party leader said it “didn’t seem plausible” that fiscal policy could be helping to fight inflation in the next two years, and asked if the Governor had meant to say four years.

Orr said there was net positive fiscal impulse from Government spending in the first year then a “strong net negative” for the following two years that make up the projection period.

Monetary policy decisions take more than 18-months to take full effect in the economy, so rate changes made now are based on expectations of economic conditions in the future.

“When we set interest rates today, the impact for inflation won't be seen for at least 18 months to two-and-a-half years ahead. So, we always have to think about what is the net expected spending two and a half years ahead,” he said.

Seymour said government spending as a percentage of GDP was forecast to be 32.5%, 33%, and then 32.5% over the next three years.

“And yet, you are unwilling to criticise the effects of government expenditure on inflation”.

Orr said the bank was concerned about persistent core inflation, which was driven by spending in the local economy.

“So domestic spending, and government spending, is a big part of the core inflation pressure — which is why we have restrictive interest rates,” he said.

Manufacturing consent

Willis asked if it was appropriate for the Minister of Finance, Grant Robertson, to have said in an interview that the Reserve Bank would not have to lift rates as a result of Budget 2023.

Orr said he had “utter confidence” in the bank’s operational independence and uninfluenced decision making, but didn’t comment on whether the remark was appropriate.

Chlöe Swarbrick, a Green Party MP, asked if the Reserve Bank was still “manufacturing a recession” as it had implied during a committee meeting in November last year.

Orr reiterated that the goal of monetary policy was to bring supply and demand back into balance, which requires some slowdown in the economy.

The Reserve Bank forecasts economic activity will be flat, if not slightly negative, while Treasury forecasts it will be flat, if not slightly positive.

“These are so within the bounds of being irrelevant — the main point is aggregate demand and spending will be flat,” he said.

“That will feel painful for people. We love to consume. But it's necessary to take the inflation pressure out of the economy”.

40 Comments

Interesting chart from Kelly Eckhold (Westpac) on the correlation between government debt growth and inflation.

https://pbs.twimg.com/media/Fw1ArbVagAAx2-L?format=jpg&name=large

"A hard hitting slide from Richard Clarida on the genesis of todays inflation challenges. Expansionary fiscal and monetary policy was unsurprisingly the driver. NZ fits nicely on these lines"

Perhaps goes to show that our fiscal and monetary policy are currently completely at odds with one another at present.

Two outliers: Japan and Switzerland. Both share net creditor nation status and both have currencies that have quasi 'safe haven' properties (at least in the past). Both also have strong industrial bases.

Not saying this has any meaning. Just an observation.

You got me wondering with "Switzerland having a strong industrial base" as I can't recall buying anything with Made in Switzerland on it.

So looked up Wikipedia and learned something today:

Switzerland's most important economic sector is manufacturing. Manufactured products include specialty chemicals, health and pharmaceutical goods, scientific and precision measuring instruments and musical instruments.

Switzerland's most important economic sector is manufacturing.

Yep. Not sure why you would have thought otherwise.

I would have though Finance due to Wealth Management and tax haven bankl acc provision - tho that second one moved offshore now

or to ireland where you do pay tax but minimal

Ever heard of Rolex, Omega, Tissot, Longines, Patek Phillippe, Jäger Lecoultre, Breitling, IWC, Audemars Piguet, TAG Heuer, Baume Mercier, Hublot, Chopard etc… ?

Please pass on my apologies to your countrymen as I have never bought any of those, or frequented shops that sell them.

Edit: after reading about Switzerland on Wikipedia, for comparison I thought I would read what it says about NZ. That was depressing.

Ever heard of Rolex, Omega, Tissot, Longines, Patek Phillippe, Jäger Lecoultre, Breitling, IWC, Audemars Piguet, TAG Heuer, Baume Mercier, Hublot, Chopard etc… ?

Would expect you focus on the shiny trinket stuff Dr Y.

Switzerland has many recognized companies outside in the trendy stuff; for example, in pharma, medical devices, precision engineering.

You forgot Toblerone

You forgot Toblerone

Toblerone is a brand. Nestle is a company. Nestle owns many brands.

And it's Swiss.

Toblerone is owned by Mondelez (formerly Kraft foods).

Fun fact: if they move manufacturing out of Switzerland, they can no longer use the Mattehorn logo on their packs.

Switzerland is one of Europes low tax havens for both corporate & personal (as Singapore in Asia). Consequently they pick up a lot of the multinational profitshifting business.

Switzerland - Corporate - Taxes on corporate income (pwc.com)

Switzerland - Individual - Taxes on personal income (pwc.com)

Swiss Army knife.

Correlation not causation

Where's the correlation? None is evident in those graphs.

""A hard hitting slide from Richard Clarida on the genesis of todays inflation challenges. Expansionary fiscal and monetary policy was unsurprisingly the driver. NZ fits nicely on these lines""

Was that comment supposed to be commentary of the graphs in the image? If so, I am really, really struggling to understand how any such conclusion can drawn from the graphs!

Case in point: The US and UK both grew government debt at about half the level NZ did and yet have only slightly less inflation. And NZ grew the money supply way more than Australia and even more than the US, and once again, NZ's inflation is only a tad higher.

So I'm calling b.s. on this.

Here's the presentation if you wanted to dig deeper into it:

Thanks IO. Context is everything as they say.

The thrust of the presentation I agree with. i.e. central banks were way to slow to starting raising when there was significant evidence that "looking through" supply shock inflation just wasn't going to cut it. In NZ, our RB was one of the first to telegraph OCR rate rises would just keep coming - a shame they didn't do it far, far earlier when obvious signs of out of control borrowing-to-spend first started, e.g. houses, cars, services (e.g. architects, planers started charging 100% more than a year before) etc. When this started, our RB should have immediately raised from 0.25% to 3.5% in one jump! 3.5% would be back to normal.

I wonder whether the RBNZ screwed up so badly was because our CPI (actually the RBNZ's) doesn't include house prices so it totally underrepresented real inflation ... And of course no-one at the RB did any sort of analysis "normal retail interest rates vs high rates to bring down stubborn inflation". If they had? - We'd be in a very different situation now.

Clarida is a proponent of this: https://en.wikipedia.org/wiki/Dynamic_stochastic_general_equilibrium . Models based upon it - so long as one recognises the limitations - are not too bad.

We'll all have a view on the above, but for our sake, I hope he's right. Because if he misses the mark again, as he did by dropping rates far too low and delaying correcting that, then New Zealand is staring economic disaster in the face. An OCR of just 6% could look naively low in the rearview mirror.

He has not been right in the past...not a great track record..

But this is economics - past performance doesn't predict future performance. Am I right, or am I right, or amiright?

*crickets*

House prices double every....... OOPS - wrong script!

Well - I'm calling drops in the OCR way before September 24. Orr has already done enough to ensure a hard landing IMNSHO.

We'll see who's right I guess.

Just look at the body language of the Reserve Bank Committee in both interviews. Overall i think Adrian Orr has done a good job. (Politics aside)

Don't bite the hand that feeds you.. The World is in terrible financial mess and it is not going to get any better. But there is hope on the Horizon when you Get people like Gascoyne articles about the Road New Zealand is heading down. Bring on National and Act

"US Fed Chair J Powell.

The buck stops and starts with the 16th Chair of the Federal Reserve Bank. His is the responsibility for the health of the Americans – and consequently the global economy. Yet, like a brain surgeon with a butter knife and a hammer, Powell’s got the bluntest of instruments to deal with the most complex of problems."

He has all the power, none of the control.

"Why do you people love to consume food so much?"

After seeing the currency take a dive, they're past the point of no return. They realistically cannot afford to admit they were wrong and that inflation may stay higher for longer, all they can do to keep our dollar propped up is to exude nothing but confidence and reassurance that they have control of the helm and things will get better.

Like the Labor government over lockdown and mandates, they can't show all of their logic or true reasoning for decisions, lest they be dragged over the coals by the media and politicians for their incompetence. Let's be clear - jobs are at stake in the top tier of the RBNZ, minus our countries best actor Adrian Orr.

Can we believe them? Well we could, but their track record has dented most of our trust in their ability to perform their duties, as much of the country is paying for the lack of performance on their part.

Reading between the lines, this interview was more of a "lets push projections to be positive end of next year to prevent panic now, then after the election we'll shift the goalposts again".

Remember that the yuan is under more pressure than all the Anglo currencies and JPY.

Excellent

Wow that's a happy looking picture, seen bigger smiles on death row inmates.

I can’t help but think of the term ‘Useful Idiots’ when I look at that picture.

The Act Party leader said it “didn’t seem plausible” that fiscal policy could be helping to fight inflation in the next two years

Seymour's not wrong.

He is normally right (as in Right and sits to the Right)

Seymour is a fool. I shudder when anyone quotes him on economics (or just about anything else for that matter).

Case in point? If Seymour is right and a wage price spiral eventuates, then the current fiscal policy of not adjusting the tax brackets for fiscal creep will result in the government collecting more income tax that they can squirrel away (and maybe pay down some debt with it). I.e. fiscal policy will depress demand by sucking money from people's wallets so they can't spend it.

Orr looks orrful doesn't he?

Anyone who actually looked through the budget data in any detail would know that the budget is far from expansionary - glad to see Paul Conway and Adrian Orr agree with me (for once).

We are now entering a period during which both Govt and Private spending / investment will drop in real terms. Our current account deficit will however stay high as (a) wealthier households who are largely unaffected by the slowdown continue to import Teslas, BYDs etc, and (b) we continue to rely on imported oil for two-thirds of our energy needs. We are also likely to see reduced prices for our exports, which will add to the gap. Let's set out the recipe here...

- Low net Govt spending (spending minus taxation) +

- limited increases to net private sector borrowing +

- current account deficit =

- a much sharper recession than is being forecast

The only way we will avoid this recession and a significant increase in unemployment etc is if people start borrowing like crazy again to buy houses, or Govt steps in with serious fiscal stimulus. Which is more likely?!?

Your aptitude for clarity and insight knows no boundaries Jfoe. Cheers.

I concur.

In the next six months it should be clear spending has falling off a cliff and government spending (and rich people's) may actually be all that stops us from experiencing a very hard landing indeed.

I think perhaps the current account might actually be buoyed a bit by a lower exchange rate? (I'm still working that one through.)

COMPETITION.. COMPETITION… COMPETITION…

if you want to help NZers then overhaul the Commerce Comission and stop trying to attack everything else, like tge RBNZ in this instance.

Are you drunk? It's quite early.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.