Global dairy markets have deteriorated "at a quicker pace than anticipated", say ANZ economists - who have cut their forecast for the farmgate milk price this season.

In an NZ Forecast Update publication, ANZ agricultural economist Susan Kilsby said "at this stage" it is not clear when dairy commodity prices will lift "but we have factored in a gradual increase".

"However, most of this won’t occur before a large proportion of the new season’s supply is already traded," she said.

However, milk output remains relatively subdued in most jurisdictions, "which will eventually support higher prices".

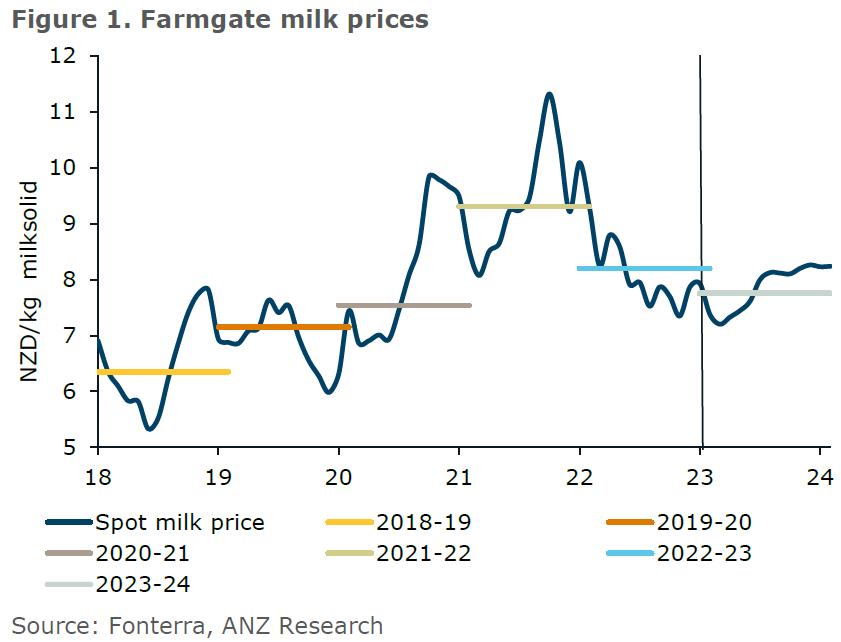

Giant dairy co-operative Fonterra has made an opening milk price forecast for the season that started last month of between $7.25-$8.75 per kilogram of milk solids, giving a 'mid-point' price of $8.

Kilsby has dropped her milk price forecast by 50c following this week's GlobalDairyTrade auction results, and now has a price of $7.75 - below the midpoint of Fonterra's own forecast.

She said the current weakness in the NZ dollar is providing some assistance to farmgate pricing, but hasn’t been sufficient to offset the sharper reduction in the price of milk powders and dairy fats such as butter and anhydrous milkfat.

"Dairy commodity prices continue to soften and it is difficult to know exactly for how long prices will recede. Typically, such low prices stimulate demand. There has been a little extra demand from some buying regions recently, but this has been muted, as while prices are still falling buyers tend to hold off, looking to benefit from any further downward movement in pricing.

"Clear signs that pricing has turned are likely to stimulate additional demand, as buyers scramble to secure supplies before prices trend even higher.

"But when this point might arrive remains unclear," she said.

What is clear, however is that consumer demand is being impacted by weaker economic conditions in many regions. Most economies are still growing, albeit at a considerably slower pace than normal, which is taking a toll on dairy demand.

"The softer demand from China is having the largest impact, as China is by far the world’s largest importer of dairy products. This market is expected to remain relatively weak for some time yet, but as milk supplies tighten prices are expected to improve later in the season."

Westpac senior agri economist Nathan Penny, in a Dairy Update publication, also noted that the chief catalyst for the ongoing price decline is the (unexpectedly) sluggish Chinese economy.

"Indeed, we have made significant downward revisions to our forecasts for Chinese economic growth this year."

Penny still has the highest milk price forecast among main bank economists, at $8.90, but says there are now "clear downside risks" to that.

"As a result, our forecast is under review."

In terms of China, Penny said as recently as last month, Westpac economists expected economic growth for 2023 of 6.2%.

"Since then, we have cut the forecast to 5.7%, and this week’s June quarter GDP data indicate further downside risks to that number."

Regarding dairy prices, Penny said looking over a longer period, "the downward price trend is clear and has been sustained much longer than we expected".

"For example, overall prices have fallen at 10 of the 14 auctions held this year. And overall [prices] and WMP [Whole Milk Powder] prices are down 22% and 17% in annual change terms.

"In contrast, we had expected that prices would have bottomed by now, if not begun to turn higher."

Dairy prices

Select chart tabs

19 Comments

According to my sister NZ cheese still cheaper in Australia than here so until somebody gets in there and bangs some heads together I have no sympathy whatsoever.

Yes, it's disappointing when we pay more in NZ than offshore. But are you comparing Edam with Edam?

No gst on cheese in OZ.

This morning it took NZ$1.08 to buy AU$1.00.

Someone else check my maths, my simple reckoning indicates that's approaching a 23% price advantage to Australian consumers.

That's right LouB, and a lot of consumers think just because NZ farmers produce X amount of protein it should be cheap.

Since when has anyone been expected to work at a loss. Check out how many farming operations run on big profits, stuff all.

And don't go on about capital gain bla bla, we are not talking the housing rout.

Expenditure costs are rising and produce price is falling, work it out.

Think someone a while ago posted that in AU they have minimum domestic supply requirements. Which I think is fair.

Its not they they would make a loss, they just can’t sell ALL their product at higher margins.

I would say that has more to do with supermarket competition , than Fonterra.

Based on what, trying to protect Fonterra? Fonterra price gouges the NZ domestic market every bit as much as the supermarkets. In fact they form a cosy little cabal with the supermarkets which forbids either of them releasing any information about the prices they receive and pay. If Fonterra was innocent it would be rushing to disclose what it receives from the supermarket.

Based on the supermarket prices for pretty much everything been higher here than in Australia.

Conspiracy theories alive and well.

Rabobank and other analysts agree that farmer owned cooperatives are the best structure to deliver maximum return to the farmer producer.

Critics of this seem to inhabit a world where because it's food products, the farmer producers should be peasants.

I expect you take home a salary - selling your labour - and I bet that with the c9st of liv8ng crisis, you are looking for a pay rise. Hopefully you get 9ne and your employer passes on that added cost to the purchaser of the product you are part of producing.

Globally for food production, in the absence of effective farmer cooperatives, cost is pushed down the value chain to the farmer who has no point below to pass that cost on to - they have to wear it.

The old adage: "farmer - buys retail, sells wholesale and pays the cartage both ways" is as true today as a century ago.

nktokyo

What are you trying to say?

As a farmer I have ZERO influence on the price of cheese, either here or in Australia.

Isn't Fonterra a Co-Op so is owned by the farmers?

So you hold shareholders in companies like power generators responsible for the price of power too? Farmers are shareholders in Fonterra.

Ohh those rich farmers.

I reckon.

Which ones are those again?

The rich ones?.

Bank keeps telling me to enjoy the lifestyle.

The ones who every now and then will drive their $250k - $500k tractors into town to protest initiatives such as swimmable rivers.

And drinking water

$250k-$500k tractors are usually arable or contractors. ;-)

China announces it will stockpile foods and other goods during Covid, including dairy, so GDT index rises in 2021 - 22. In 23 lockdowns end and China begins to decrease stock piles so GDT index heads back to long term trend. Of course it will over shoot this as NZ will be increasing stocks, so we will see a lower than expected payout like in 14/15.

Why something so simple and well publicised is ignored by bank economists is difficult to fathom, unless of course they are just talking the market up as in housing to protect the banking system from collapse.

China's days of driving the Bentley are almost over. Right now the only thing they're driving is the price of milk - down.

And here we are driving the costs of Fonterra exports up, not withstanding this subsidy. https://www.interest.co.nz/public-policy/123135/fonterra-gets-90-millio…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.