By Gareth Vaughan

The Commerce Commission is "conducting an assessment" of whether some bank interest rate swap agreements with farmers, and ANZ National Bank's Rural Growth Fund raise issues under the Fair Trading Act.

A Commission spokeswoman told interest.co.nz the "assessment" comes after the watchdog received complaints. Under the Fair Trading Act, if a court decides a company or individual has broken the law, it can fine a company up to NZ$200,000 and an individual up to NZ$60,000 per breach. Courts may also award compensation to those affected by any breach of the Act.

The Commission's comments come after a series of articles about interest rate swap agreements banks entered with farmers between 2007 and 2009, a period where interest rates were mostly much higher than today, in both Straight Furrow and the Sunday Star-Times. The reports said the swaps were sold by banks including ANZ National, Westpac and ASB to farmers as insurance against interest rates rising.

Then when interest rates actually fell, farmers were left locked in to high interest rates they couldn't escape from, unless they paid pricey break fees. The SST said the deals had helped send some farmers to the wall and left some with the choice of coughing up something in the vicinity of NZ$1 million in break fees, or of paying interest of around 10%, significantly higher than the about 6% for a standard floating rate mortgage.

According to the SST, a major gripe some farmers have is they didn't realise the swap agreements had provisions allowing the banks to increase their margins.

The Commission spokeswoman wouldn't provide any details of the complaints, nor how many there had been.

"We are not prepared to disclose the details of those complaints at this stage. In withholding this information we rely on:

· s 9(2)(ba)(i) of the Official Information Act (OIA), as complaints were provided to the Commission under an obligation of confidence and providing details of the complaints 'would be likely to prejudice the supply of similar information, or information from the same source'.

· s 6(c) of the OIA, as providing the details of the complaints 'would be likely to prejudice the maintenance of the law, including the prevention, investigation, and detection of offences, and the right to a fair trial'," the spokeswoman said.

Banking Ombudsman investigations 'don't suggest widespread issue but do suggest some customers & their advisers didn't understand the product'

A spokesman for ANZ National Bank said the bank gives customers general information on how interest rate swap products work and advises them to seek independent advice before entering into a swap to ensure they fully understand the product and its suitability for their business.

"We're not commenting further on swaps or the Rural Growth Fund," he said.

Banking Ombudsman Deborah Battell said her office had completed five dispute investigations involving interest rate swaps.

"When you look at the disputes and the causes of them, nothing really suggested a more widespread issue," Battell.

"One concerned the quantum of a break fee associated with the interest rate swap product, one concerned delays in effecting the product, another complained that the product they purchased was not the same as a similar product they had had at another bank. In the other cases, the complainant withdrew their complaint after receiving an explanation, and the final case involved a dispute about the length of the swap rate agreement, whether it was to be three or five years."

"It is, however, evident from our complaints that the product was complex and that some bank customers (and even their legal and accounting advisers) did not fully understand what they had signed up to and how the product worked. In particular, it appears that customers did not understand how the product would work if interest rates dropped, as they did in late 2008, after the start of the GFC. This is relevant because interest rate swap products were generally being sold in an environment of increasing interest rates," Battell added.

'Innovative' capital source for farmers

The Rural Growth Fund was launched by the National Bank five years ago. In a press release issued on May 15, 2007 the bank said its Rural Growth Funding initiative would provide farmers seeking additional capital with a new funding option. This "innovative" way of providing capital for farmers would complement traditional capital sources such as borrowing through mortgage finance and personal or family equity, the release quoted Charlie Graham, then National Bank general manager of rural banking, as saying.

The release went on to say that a special purpose company owned by the National Bank (Rural Growth Fund Ltd) would invest in preference shares in farming companies for up to 20 years with capital provided on the basis of a property's potential value and a farmer's proven ability to realise that potential. The preference shares would have no voting rights, meaning farmers kept managerial control and paid a pre-arranged dividend.

Farmer-shareholders would have the right to buy the preference shares after 10 years, and the bank company would have the right to require the farmer-shareholder to purchase its shares in some circumstances, such as default. The price paid for the preference shares by the farmer would be based on the change in the Quotable Value All Rural Land Index, not the individual farm's value at the time.

"By linking the exit price to the QV index, the farmer has an incentive and an opportunity to outperform the national average growth in rural land values. The farmer can then capture a far greater share of the capital gain he or she has built up in their own farm," Graham said.

'Higher risk'

The release noted that Rural Growth Funding would take a higher level of risk, with the lower running dividend yield on Rural Growth Funding lower than the cost of debt, thereby allowing the farm cash flow to service a higher level of external funding.

The latest financial statements filed to the Companies Office for Rural Growth Fund, covering the year to September 2009, show interest income of NZ$1.98 million, versus NZ$2.4 million the previous year, and profit after tax of just under NZ$1.5 million down from NZ$1.6 million. An ordinary dividend of NZ$2.2 million was paid and the venture had equity of NZ$26.5 million. Loans totaled NZ$15.4 million.

News of the Commerce Commission's "assessment" comes with agriculture sector debt having recently topped NZ$49 billion for the first time, according to Reserve Bank figures, as Fonterra's annual payout falls 19%. Rural debt is up NZ$17.9 billion, or 57%, from NZ$31.5 billion in January 2007 with monthly year-on-year growth rates having peaked at almost 23% in January 2009.

Back in June 2007, when the Rural Growth Fund launched, the Real Estate Institute of New Zealand (REINZ) said in its monthly Rural Report that the national median farm price had reached NZ$1,262,125 in May, second only to the record median price of NZ$1,425,000 recorded in December 2006. REINZ National president Murray Cleland was quoted saying: "The dairy industry is starting to look like some sort of economic miracle, sustained prices and returns for more than a decade underwriting what is now the shining example in the primary sector."

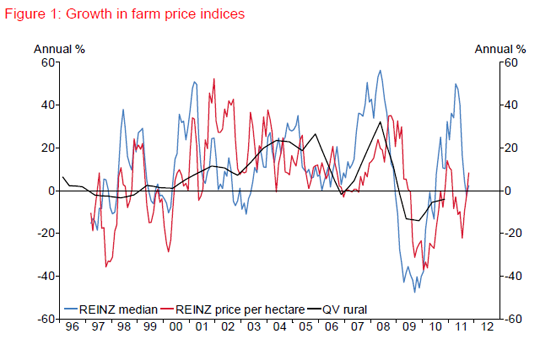

(The chart above was sourced from the Reserve Bank).

The latest REINZ figures, for August 2012, show 106 farm sales that month, compared with 266 in May 2007 and a monthly low in between of just 46 in both January and October 2010.

(Updated after Banking Ombudsman Deborah Battell came back with some additional comments).

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

26 Comments

The Commerce Commission is "conducting an assessment" of whether some bank interest rate swap agreements with farmers, and ANZ National Bank's Rural Growth Fund raise issues under the Fair Trading Act.

Fair is an emotional term and is usually determined on the bias of necessity by each of the conflicting parties - especially so up to mid 2007 for one party and thereafter for the now agrieved party.

But It is fair to say banks funding lending via currency basis swapped NZD Uridashi, Eurokiwi and Kauri issuance had a mighty keen need to find clients willing to pay fixed in a swap associated with short term 30 to 90 day floating rate mortgage schemes.

Those Japanese housewives were ever ready to receive their fixed 6.0% plus annual coupon payments on those Uridashi notes as were the Belgium dentists on the Eurokiwi versions.

Some one had to pay even if it was the bank in a falling interest rate environment.

I guess some thought farmers were better equipped to do so.

I would assume the banks economists given how blinkered they have been over the last 5years didnt see the low rate coming..not that many did. personally I cant see the OCR going up much if any for years.

Those following the antics of the Federal Reserve since 1982 were under no illusion of how low rates would go - the route was well sign posted by Greenspan and then Bernanke. How else could a USD 30 trillion shadow banking system based on cash and carry trading ie Repurchase Agreements (RP) and rehypothecation evolve otherwise?

Our conomists had to know, but just played dumb - an approach better suited to the targeted punter.

I think the fed v rbnz is different though. Bonuses to be made, dont forget those, every year..who cares about 5years away. not so sure our dimwits saw this coming, thye have been whining about rates having to go up for 4 years, such a myopic view is neo-classical, ie one man's debt is anothers credit so cancel out...PRivate debt therefore doesnt matter and if the attacks on steve keen are anything to go by still think that way.

regards

Fair may be an emotional term but we are talking fear. I ahve some friends with large debts and it makes them vulnerable, we are talking their job,home,reason for being. The local bank manager rolls up for a cuppa tea and in a nice way tells them they have too much debt and are exposed to interest rates going up because of the GFC. These guys are scared of the bank they would do anything to keep the farm, the bank has already had a go at selling the farm,so they sign on the dotted line and pay an extra 500k in interest over 5 years. That black horse sh*t all over them.

Remember these are vulnerable people but we have safe guards in place we have Bollard and we have our local Mp's in this case Foss. So what happens, Bollard and Foss end up working in the banks interest, they may as well take a salary from them.

Interesting comment, thankyou....perspective is always good meanwhile some critise the level of tax but not it seems this private tax....

regards

Priceless...

from one of the links..

Swaps, growth fund: a hospital pass for farmers JANETTE WALKER 17 Sep, 2012 04:34 PMIn 2010 a survey was carried out to ascertain the level of rural debt and the impact of bank behaviour on rural businesses.

Many of the farmers that responded referred to the detrimental effect Swaps and Rural Growth Fund (RGF) equity products have had on the financial viability of their farm business.

The impact of these products has in many cases led to receivership, financial ruin, bankruptcy, threats of bankruptcy, selling down of assets, payment of high interest rates (9-12 per cent), physical and mental ill health, destruction of families, relationships and for some farmers self-harm.

Conversely, the impact on the banks that aggressively marketed these highly complex financial derivatives has been record profits, in a time when the cost of funds has never been so cheap and a world recession....

I have updated the story to incorporate some additional comments from Deborah Battell. I also received an email from Janette Walker who has featured in the SST & Straight Furrow articles. Janette says: "I have been inundated with calls from farmers the last three weeks and the impact of swaps on good sound rural business is appalling. Some of them are paying 12% and 25% on OD, and these are guys producing high solids per cow."

Yep, the masses are now living in a state of fear. If you dont own you rent. So whats the dif.You pay through the nose. I saw it coming, so why didnt those in positions of power stop it. They had to see it too. I'm no economist or seer. Everyone I know is so deep there is no climbing out. Those that are forced into bankruptcy are probably the lucky ones. The rest soldier on, but for how long, it wont end well.

In the meantime the likes of some around here think dairy farming was NZs saviour. The joke is heartbreaking.

Belle, a dairy farmer at Patoka HB, last week went home and settled all his outstanding accounts online, then he went outside and killed himself.

Oh boy, have we got a score to settle with the banks.

I dont know what to say Andrew. Thats just awful. I am really getting a hate on for the establishment. Lets face it, those in charge are enabling this to happen. Somewhere, meybe trademe I just read some poor buggers rates have just gone up heaps, they are charging him a dairy charge for the roading. Except he is no dairyfarmer. So he has to pay for his neighbours daily tanker visits by the sounds of things. I am becoming very disillusioned with John Key and his government. They havent got control of local councils. He seems to jet around the world ALL the time, frolicking with actors and pollies and royalty.

I have never seen a man look like he is enjoying the baubles of power more. Its not right. Did I hear correctly that he tweeted a pic of himself and the MENTALIST. I just wanted to puke. Did that really happen?

If someone, anyone that is close to John reads this, please tell him to grow up, get his ass back to NZ, and lead. That means instead of fawning over every other dick that has media points, making yourself unpopular in the back rooms of power and standing up for us that do all the work.

You did the right thing buying all the guns and ammo you could.

Lol, I do not have the GSBNSBC or whatever the acronym is down pat like every other bugger, but I AM A NEW ZEALAND CITIZEN AND I AM SURE THAT ANDREW WAS JOKING whew, relax now

They are listening to everything. Some advice when contacting those in your group ;-) share the same email and save messages as drafts and then you can access the server read the draft and delete, then no email gets sent to trace, then Jkey wont get a briefing on you, which he probably wouldn't remember anyway.

I would just bank on him not remembering and not doing anything, cos sad to say, these seem to be his strong points.

Andrew hows it looking down the Hawkes Bay? Up here on the plateau we could do without the wind, grass grew like buggery last week, this week zippo. It seems store beef are going through the roof, I just hope it pans out and we arent robbed later on with our dollar on a par with the US. I have a bunch of bulls I cant wait to turn into burgers, and I have my fingers firmly crossed for a sensible exchange rate.

Belle, I leased my farm but he tells me he's short and struggling. I live in California where it never rains, 38deg C today. Fine every day, no rain since early June and lots of guns, lots and lots of guns, you get the truck then you spend your money on guns.

Ooh I dont do well over 25 C. What is your lessee farming? Yes I did forget you were flaunting it in the US. You should head down town and find John for me, give him the msge.

I would like to point out it has taken me four years to lose my rag. I didnt expect a miracle, but I did expect a plan. It seems there wasnt one. I dont consider pear it back, but dont whatever you do rock the boat, a plan. I wanna see the boat rocked and rolled and rocked again. I wanna see him show he has a pair of gonads.

If you ask him, Im sure he will show you his, where it goes from there is up to you.

Yep that would be a giggle, they are the funniest thing god created.

Dp

Pgp encrypt emails. (Pretty good privacy) as far as i know cant be cracked.

Te email server could catch drafts in a backup btw. or they get the admins to copy it for themWith pgp u encrypt it on your desktop then send it. However i assume thye can turn up and arrest you and get a court order for your key to decrypt them.

anyway the president must die.....

:)

regards

Pgp encrypt emails. (Pretty good privacy) as far as i know cant be cracked.

Te email server could catch drafts in a backup btw. or they get the admins to copy it for themWith pgp u encrypt it on your desktop then send it. However i assume thye can turn up and arrest you and get a court order for your key to decrypt them.

anyway the president must die.....

:)

regards

How the hell can you justify 12%+ wen the ocr is 2.5%? That to me is loan sharking....

"It is, however, evident from our complaints that the product was complex and that some bank customers (and even their legal and accounting advisers) did not fully understand what they had signed up to and how the product worked. In particular, it appears that customers did not understand how the product would work if interest rates dropped, as they did in late 2008, after the start of the GFC. This is relevant because interest rate swap products were generally being sold in an environment of increasing interest rates," Battell added.

No Shit - let's add Auckland City Council and it's advisers to that list.

It is good to have an authoritative body to regulate the commerce industry by intervening any irregularities found. This way, no companies would be making more profits than they should be. That would also mean consumers will not be over-charged to cover those extra profits which is considered as cheating. With the relevant authorities in the picture, companies will be more wary of their actions and practice a fair trading attitude.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.