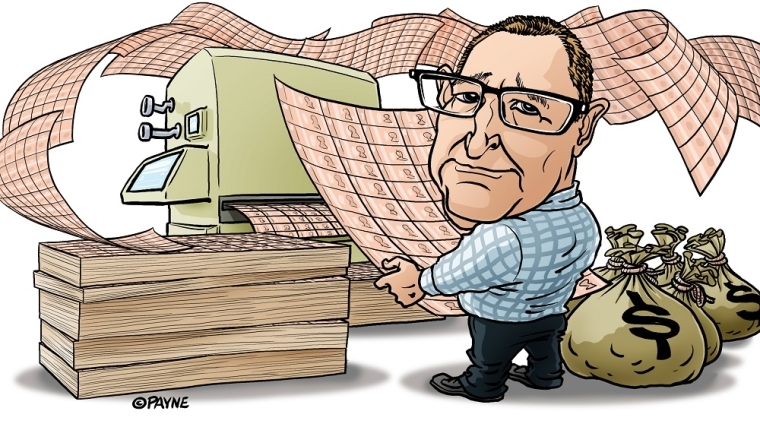

ASB is the biggest user of the Reserve Bank's controversial and ongoing Funding for Lending Programme (FLP), which was introduced in 2020 with the aim of lowering interest rates and encouraging households and businesses to spend and invest.

The most recent figures available from the Reserve Bank show that, as of July 18, banks have borrowed $12.660 billion via the FLP. Banks are free to use FLP money as they choose, with up to $28 billion available to them.

Interest.co.nz asked individual banks how much they've borrowed. Of the big banks, ASB has borrowed $3.8 billion, BNZ $2.1 billion, ANZ $1.75 billion, and Kiwibank $1.1 billion.

A Westpac spokeswoman says the bank doesn't comment on FLP drawdowns. However, Westpac's latest general disclosure statement shows that, as of March 31, it had accessed $2 billion through the FLP.

Among smaller banks, The Co-operative Bank has tapped the FLP for $120 million, and SBS Bank has borrowed $164 million. An SBS spokeswoman says this is "in line with the bank’s allocation to date."

A TSB spokeswoman says TSB hasn't accessed the FLP, and has no plans to do so.

So the seven banks we know have accessed the FLP have, combined, borrowed at least $11.034 billion. It's possible the balance of $1.626 billion, or the bulk of it, has been sourced by Westpac since March 31.

The FLP was launched by the Reserve Bank in December 2020 to provide additional monetary stimulus to the economy to help the central bank meet its consumer price inflation and employment monetary policy remits by reducing banks’ funding costs and lowering their borrowers' interest rates.

The three-year FLP funding is available to banks over a two-year period running until December 6 this year. The FLP allows eligible banks to borrow directly from the Reserve Bank at the Official Cash Rate (OCR) with the borrowing rate adjusting over the term of the transaction if the OCR changes. The OCR was 0.25% when the FLP launched and is 2.5% now.

Collateral needed

The way the FLP is designed means it's set up for residential mortgage lending banks. SBS Bank, for example, noted as of March 31, it had pledged $119 million of residential mortgage-backed securities as collateral for the $100 million it had drawn down through the FLP at that point.

FLP funding is structured as floating rate repurchase transactions priced at the OCR for a term of three years. Bank participants can access the funding at the equivalent of up to 6% of their total outstanding loans. Eligible securities banks can pledge as collateral for FLP money include Residential Mortgage Backed Securities, New Zealand Government Securities, and Kauri debt issues.

SBS Bank notes its initial allocation, being 4% of eligible loans as at 31 October 2020, able to be drawn down between 7 December 2020 to 6 June 2022, is $164 million.

"An additional allocation may be drawn down equal to 50c for every dollar of net growth in eligible loans from 1 November 2020 up to a maximum of 2% of eligible loans as at 31 October 2020. The additional allocation can be drawn down until 6 December 2022," SBS Bank says in its latest general disclosure statement.

The sums bigger banks are able to access are obviously much bigger and well into the billions.

Heartland Bank CEO Chris Flood told interest.co.nz last year that Heartland would need a bigger mortgage book to be able to participate in the FLP.

Although it does some home lending, Heartland's bigger lending exposures are in vehicle lending, small business lending, livestock finance and reverse mortgages. Flood said Heartland thought the Reserve Bank could've used motor vehicle assets as collateral for FLP money but the central bank chose not to.

A solution looking for a problem

When launching the FLP the Reserve Bank said it would make banks less reliant on more expensive deposits and wholesale borrowing, thus lowering their overall funding costs. Banks could then pass these reductions on to their borrower customers through lower mortgage and business lending rates.

However, by the time it launched the FLP was arguably already a solution looking for a problem, with the most dire economic predictions in the early days of the Covid-19 pandemic not coming to fruition. Earlier government and Reserve Bank support measures including the Wage Subsidy, OCR reduction to just 0.25% and Reserve Bank quantitative easing, or government bond buying programme, were already stimulating economic activity. Asset prices were surging with Real Estate Institute of New Zealand data showing national median house prices up 18.5% year-on-year to a new record median high of $749,000 in November 2020.

The FLP hasn't been good for savers and it's not designed to be given the aim of reducing banks’ funding costs including the deposit rates they pay savers. In its February Monetary Policy Statement the Reserve Bank noted; "Term deposit interest rates fell to historical lows in 2020, in part due to monetary policy actions including the Funding for Lending Programme."

At the time of launch the Reserve Bank said the effectiveness of the FLP would depend on banks passing on declines in their funding costs to borrowers, and it would monitor pass-through to lending rates closely. The success of the programme would be measured by the fall in household and business borrowing rates, rather than the level of drawdown.

So what have banks used the FLP money for?

Interest.co.nz also asked the banks what they've used the public money they've obtained via the FLP for.

An ASB spokeswoman says the bank is putting it "towards supporting lending for productive and sustainable purposes to benefit all New Zealanders. This includes low cost loans for new builds to help boost New Zealand’s housing supply, lending to large businesses investing in infrastructure and sustainability projects and low-cost rural sustainability lending for farmers making environmental upgrades."

ANZ says the money has been used "to meet the bank’s general funding requirements."

A BNZ spokesman says the bank has "run its 'Good to Grow' low-cost lending programme for businesses, supporting many customers through the pandemic to invest, grow, and drive digital and sustainable change to take advantage of new consumer behaviours."

"We’ve also made drawdowns as a prudent measure to secure funding and support our customers in the face of ongoing uncertainty and volatility in global markets, particularly with the war in Ukraine and inflation spiking in many key economies around the world," the BNZ spokesman says.

A Kiwibank spokeswoman says the money has been "used for general lending purposes."

A Co-operative Bank spokeswoman says FLP money has been used "to fund lending growth including lending to first home buyers."

And SBS Bank's spokeswoman says the bank has used FLP funding "to provide additional support to first home buyers."

*This article was first published in our email for paying subscribers early on Thursday morning. See here for more details and how to subscribe.

27 Comments

How long before Orr is on Westpac's board?

Is this, I scratch your back now and you scratch mine when the time comes.

Is it corruption officially as policy makers and decession makers are the one........

This is my kids future taxes being given to foreign entities on the cheap... Corruption in plain sight.

It is an absolute disgrace this is still in operation - in effect a giant subsidy for the Australian banks (with a few bob for their smaller NZ brethren).

Aussie banks. Biggest gang in NZ

I suspected ASB were drawing big on the FLP, they have had the worst savings accounts and TD rates over the last 12 months, not doing their savers any favours.

I agree. I have 2 TDs left with them and I won't be sticking around.

Yeah it seems savers get shafted by the FLP because banks can borrow cheaper from the taxpayer, who are those same savers.

Good to know the Govt via RBNZ is competing with the electorate by undercutting their TDs, Nov 2023 should see Labour red splattered on the moon such will be the slaughter I hope - metaphorically speaking of course.

Any yet we are constantly told that the government has no money of its own and must depend upon the private sector to finance it through taxes and borrowing.

Any yet we are constantly told that the government has no money of its own and must depend upon the private sector to finance it through taxes and borrowing.

Yes. What we're looking at is a technocratic process that ends with what is essentially 'money printing' (or credit creation) by the commercial banks. It almost seems like the banks have the govt / central bank over a barrel. The more I think about, the more crazy I think our monetary system is. I can't see this ending well but I also can't see the weaknesses in the system. I think it will take a black swan event to uncover the vulnerability.

Hey J.C , how is this FLP is different to money creation by govt( issuing bonds /running deficits) or by private banks (by asset /property purchases)?

Is banks capital ratio being bypassed is the difference here?

Also why the main banks haven't taken full use of FLP ,? Only 12 billion when 28billion was available?

Thanks

The real injustice is that non-bank mortgage lenders could not access this facility, it was carved out for those that needed it least and it just served as a revenue transfer from tax payer to shareholders/bonuses.

Non-bank lenders lend to non-conforming borrowers and play a vital role in the mortgage market. The facility wasn't the issue, it was who could access it.

FYI, I wrote about this back in 2020 - https://www.interest.co.nz/opinion/108058/nz-financial-services-sector

Thanks GV. The RBNZ probably see them as a source of systemic risk rather than providing valuable finance to those who don't fit inside the big bank cookie cutter mold. I know a number of Maori use them (contractors, poor or incomplete credit history etc). Maori are often classed as non-conforming and RBNZ supporting non-banks would help more than references to mythology in the MPS.

Agreed. The facility is fine if it generates a money go round in the NZ economy. But this doesn't happen with foreign banks.

An ASB spokeswoman says the bank is putting it "towards supporting lending for productive and sustainable purposes to benefit all New Zealanders. This includes low cost loans for new builds to help boost New Zealand’s housing supply, lending to large businesses investing in infrastructure and sustainability projects and low-cost rural sustainability lending for farmers making environmental upgrades."

Really? This is virtue signalling at its most stark. ASB doesn't give a rats about "benefitting all NZers." Their obligation is to their parent company Commonwealth and the shareholders.

I thought that when I read it too. What a wonderful, nice, lovely bunch of people they are.

Mmmmm.....nothing tastier than a risk-free carry on other peoples money.

I'm sure I'm not the only person who finds it odd that we taxpayers are effectively subsidising offshore banks to charge us for the pleasure of borrowing our own money.

Seems no-one at the RB or the govt. benches does though.

To the govt and central bank, the existing hegemony is sacrosanct. They're terrified of change as their livelihoods are at threat. Then there is the fears of accountability in the face of change and the relationships between all the vested interests. The commercial banks are in the most powerful position IMO. They wear the trousers.

Wow, just wow

This is some very expensive corporate welfare.

Add this into the picture and you can begin to see how the biggest wealth transfer in New Zealand's history has taken place. Nearly 1 trillion dollars to wealthy asset owners.

Hickey said the Government had also given at least $20 billion in cash to businesses and asset owners, whose cash savings accounts swelled from $45 billion to $319 billion since about 2019.

This is under the stewardship of a government that is supposed to be looking after the "poor".

Not complaining, but the sheep are clearly asleep.

What else does it need to happen before Orr and the management of the RBNZ get the sack ?

Mission impossible.

So where is the balance of this slush fund sitting at the moment?

Is it depreciating in value or is it doing something else?

Good on the TSB.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.