A survey the Reserve Bank pays close attention to has shown a significant drop in the expectation of future levels of inflation.

However, the results of the latest Survey of Expectations, carried out quarterly for the RBNZ, are unlikely to deter the central bank from another 50 basis-point hike in the Official Cash Rate when this is reviewed again next week - on August 17.

The data for survey was obtained from 35 business leaders and professional forecasters by the Nielsen group on behalf of RBNZ. Field work for the survey was run between the July19 and 25 - which, significantly, was after the release of the most recent inflation figures, showing annual inflation of 7.3%, when the RBNZ had expected just 7.0%.

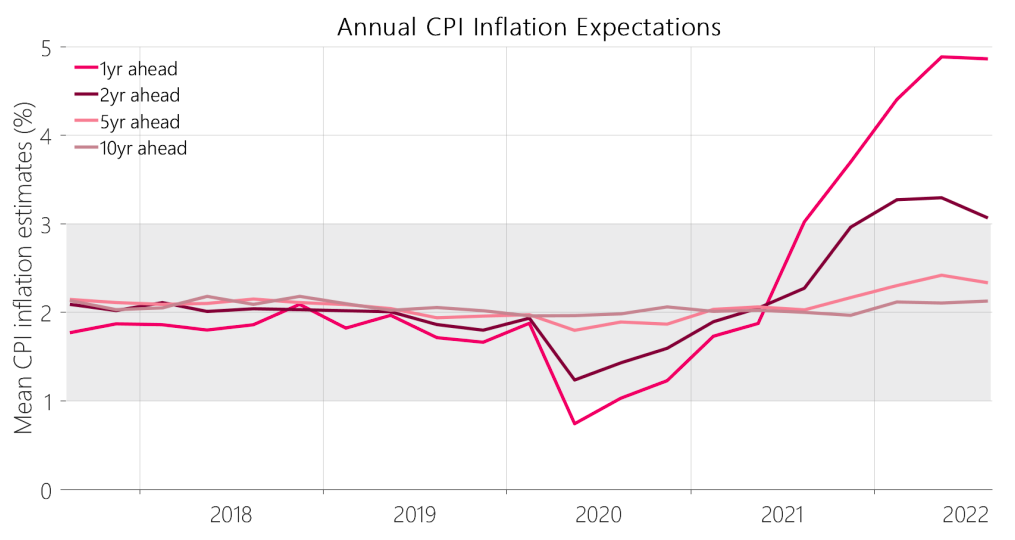

The key survey statistic is always what the surveyed experts view inflation will be in two years' time. The RBNZ is always looking for expectations to be 'anchored' around 2% which is the explicitly targeted level of the RBNZ's 1%-3% target range. Recently as actual inflation has taken off these expectations have become seriously unmoored and have risen rapidly.

In the latest survey, however, the two-year-out expectation has fallen to 3.07% from 3.29%. In the context of these surveys that is a big fall and it will please the RBNZ a lot, showing to the central bank that its efforts to convince people it is deadly serious about knocking out inflation are being taken on board.

But of course, 3.07% inflation in two years' time would still see the inflation rate outside the RBNZ's target range, so it will not feel its work is finished yet in convincing people - so, it will probably still follow through with another 50 point rise to the OCR as widely expected next week, taking it up to 3.0%.

However, I would say the results of the latest survey may well cast some doubt on whether there will be another 50 point follow up - as many have also expected - in the October OCR review. Perhaps a follow-up 25-point move becomes more likely.

ASB senior economist Mark Smith said the findings of the latest survey "would have been very reassuring to the RBNZ".

He said the survey showed respondents to the survey were looking beyond rising observed inflation rates, with the weakening activity outlook (growth expectations at post-GFC lows) expected to cool short-term inflationary pressures.

"Furthermore, longer-term inflation expectations remained closely anchored around 2%, downplaying the risk of a prolonged inflation overshoot. We caution that this is just one survey with a low number of responses, but it suggests that the RBNZ have not lost the battle on inflation.

"We expect a 50bp OCR hike next week, and for the OCR to move higher over 2022 as the RBNZ strive to get inflation under control. Once that is done, the OCR can be lowered, and we expect OCR cuts from 2024."

For the RBNZ, removing expectations of higher inflation is arguably a bigger part of its task than tackling actual inflation - since its the expectations people have of the future rate of inflation that drive pricing behaviour. Therefore if people expect inflation they put their prices up - which leads to higher inflation.

In other results in the survey, the expectation for one-year ahead inflation dipped very slightly from 4.88% to a still very high 4.86%, but the five-year ahead expectation dropped to 2.33% from 2.42%, putting it closer to that 2% level the RBNZ likes to see expectations at.

The 10-year ahead expectation actually rose very slightly, to 2.13% from 2.11%. More details of the survey results here.

A more recent addition to the questions in this survey (since 2017) has been to seek views of respondents for their expectations of the annual percentage change in the house prices in the September quarter of 2023 (one year ahead) and 2024 (two years ahead).

Expectations for one-year-ahead house price change had a mean of -5.84%, a further decrease from last quarters mean of -4.37%. The RBNZ says this figure is the biggest expected one-year-ahead decrease in house prices since this question was introduced in September 2017.

"The responses indicate that, in general, house prices are expected to decrease, however a wide distribution of values, point to a heightened level of uncertainty over the next twelve months," the RBNZ said.

"Mean two-year-ahead house price changes were higher at 1.93%, which is an increase from last quarter’s mean estimate of 1.74% - the first time two-year-ahead expectations have increased since December 2020."

31 Comments

Well, if a few influential people are expecting less inflation, it must be true.

so inflation should be back within range in about 2 years time with the RBNZs current plan.

Lets see if that plays out...

I tend to agree but I think the new normal for 1yr mortgage rates will be around 5% for a long time

I agree, inflation might comes down a bit and inflation expectation might follow with it due to lots of recession fear talk going on. But future inflation movement will be determined by central banks future monetary policy. If central banks decide to drop OCR again, inflation will likely bounce back. So I would think they will keep OCR around 3.5% at least for a while then move to neutral to 3% for quite a bit time. From the current data, if unemployment rate slowly moving up and Inflation slowly comes down. I think recession will unlikely happen. It will be just a soft landing for our economy.

The problem is not ocr, allowing wealthy to make more assets by inflating the market

and they let the wealthy sell property to the middle class and poor later use banks to take away what remains after tax and gst.

Working class pays for the infrastructure and subsidies

businesses just take their share from everything but does nothing good to economy unless the business exports goods and services or bring foreign direct investment

all unproductive businesses should not be supported as they will just inflate market and make poor more poor

any new job by any so called successfully business targeting locality will only take their share and make people living in the region pay for it.

Literally working class pay for everything

What’s their track record like in this survey?

2 years ago they were predicting inflation to be about 1.5% right now. So almost pointless really...

I read an academic piece about the accuracy of inflation forecasts which said that implied break even inflation (from the difference between nominal and inflation linked bonds) is the most reliable, if not particularly reliable, approach. Surveys, not so much.

Unfortunately in NZ the inflation linked bond market is not particularly active or liquid but in Australia the implied 10 year, average break even rate is currently only 2.3% p.a. https://www.econdb.com/series/RBA_G03.GBONYLD.Q.AU/

In my view, the risk of inflation is to the upside of where the market is pricing it.

"Interest Rates will stay very low for a very long time".

"A survey the Reserve Bank pays close attention to has shown a significant drop in the expectation of future levels of inflation."

Words Are Cheap. Even Cheaper by the Vested Interest.

But our costs keep going up. I think i will ignore this Fake Future "significant drop" talk and just look at my supermarket bill. Listen to the BBQ conversations.

Finally went into Wendy's today for a sit down lunch its now $18.00 for a 1/2lb burger, medium fries and a medium Keri orange drink. Price has increased every visit over the last year plus. 7% inflation ? I think not.

I pay more attention to those stories than the RBNZ .

But Carlos, I would of thought you would of ordered the Cilli ???

would "have" thought

I'm keeping it street talk. Thats just the way it is in the hood.

"Would’ve sounds perilously like would of, however would of is not correct and should never be used"

In real life nothing has changed. Just suck it up

... since its the expectations people have of the future rate of inflation that drive pricing behaviour. Therefore if people expect inflation they put their prices up - which leads to higher inflation.

There is zero evidence that this theory holds true in the real world. It sounds plausible enough, but so did the idea that bloodletting would reduce inflammation. Modern economics has probably regressed to the maturity of medieval medicine.

https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf

I am not sure its the expectation of inflation that drives price increases. Rather the momentum of cost increases taking a while to deaccelerate and go back to notmal... and if course the desire and excuse for increased margins and thus increased returns for shareholders and business owners.

It seems nothing will stop the RBNZ from destroying our economy via further OCR hikes. Like robots, they look at consumer price inflation only, whilst ignoring property price inflation (up to 2021) and now property price deflation. As a result, they are sending our country including the livelihoods of people on a mad roller coaster ride.

First, they created a massive property price bubble with artificially low interest rates and QE. This priced many tenants out of the market, they were unable to buy. Now, the RBNZ are crashing this bubble. This now triggers massive hardship for those who did manage to buy property, and soon it may trigger a full-blown insolvency and banking crisis.

For example, the article says the RBNZ expect a house price change of -6% in one year (which would be a nice correction). In reality, house prices have already fallen by over 20% in the last eight months alone. This is a disaster.

Interest rates should have never been reduced to a mere 0.25%, especially not alongside removed LVR restrictions. Now, a soft landing of the property market should be engineered, with mild and carefully timed interest rate hikes (the effects of each hike take a full nine months to show, usually). But the RBNZ is smashing our country and its inhabitants to pieces - with aggressive interest rate hikes into an overindebted economy and a falling property market.

Financial stability does not seem to interest the RBNZ. They are out to destroy, it seems.

It is just a game. Really winners and losers. Heads they win tails you loose

'Tis all a checkerboard of nights and days,

Where the RBNZ with men for pieces plays,

Hither and thither, indebts and ruins and slays,

And one by one back into the closet lays...

- Orr-mah Khayyam

Spot on. More like a game of roulette where the key players get to set and change the rules and their bets whilst the ball is spinning.

Learn the rules, watch what the key players qre doing and make sure you can afford to lose.

How will they do they without perpetuating wealth transfers from folks' wages and savings into property?

Asb made 1 billion profit even after paying minimum of 100k per employee.

How do they get paid ? Interest rate on top of ocr

mortgage and rent after taxation leaves people poor for ever

businesses takes every bit of their tax which they call gst from customers , so what does a businessman pay to economy NOTHING

their job creations only make it expensive for people

The key survey statistic is always what the surveyed experts view inflation will be in two years' time

In other words, totally meaningless. Just look at the inflation expectation for today, from two years ago...

The 10-year ahead expectation actually rose very slightly, to 2.13%

10 years ahead, LOL, I wager that my cat has an equal chance of getting the inflation in 10 years time right, to the boffins above

It probably has a good chance of a dead cat bounce in ten years.

The trillions pumped into the global economy in response to Covid is inflationary. This growing divide between the worlds super powers is inflationary. The war in Ukraine is inflationary. The conflict between China and Taiwan is inflationary. This ongoing pandemic is inflationary. At some point we will see peak inflation and then a bit of disinflation, but given these factors above I believe we will see high levels of inflation for a while yet that are above the RBNZ's target range of 1 to 3%. Possibly years.

Yes, I agree Adam. And none of the points you mentioned can be successfully tackled via interest rate hikes. These hikes will only achieve one thing: collapse our debt-laden economy. Interest rate changes mainly affect lending and borrowing activity, they do not mainly affect consumer prices.

True, however..

Everyone knew and knows that ocr hikes are the only proven tool the reserve banks have. So watching the economy go red hot and housing market boom... it was obvious inflation would rise and thus ocr would need to rise. The only unknown would be that a black swan event would trigger a different sort of downturn (e.g. the pandemic or ukraine war or taiwan).

So most people should have been anticipating the OCR rise and planning appropriately .

I like the cycle as it is all predictable except the timing. If we introduce alternative ways to deal with it then we risk an unknown outcome which would be far worse as we wouldnt know how to plan (changing response to inflation would be like our experiment of dropping the ocr too far or opening immigration gates too wide during the boom as an experiment.. see how those experiments worked out .. i would rather another country did the experimentation stuff ).

Given we now import so pretty well everything with real added value, we don't have much alternative to importing other people's inflation, that seems to be becoming entrenched, so the prospect of our inflation returning to manageable levels in even the medium terms looks a bit optimistic, particularly given overseas expectations.

Once inflated market is inflated for ever

have you ever heard the value of something decreasing in long term.

in reality value is always the same , to take out the money from pockets nee businesses gets started offering list of employment which probably creates nothing but inflates market and later charge that amount form the public ocr and make everything expensive to poor and middle class

Inflation makes richer richer and poor poorer

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.