Summary of key points: -

- Risk of tightening NZ monetary and fiscal policy too quickly

- US Federal Reserve’s “lift-off test” soon to be met

Risk of tightening NZ monetary and fiscal policy too quickly

From the bullish and optimistic forecasts of strong post-Covid growth of only a few short months ago, the outlook for the New Zealand economy today is far less certain with risk clouds gathering.

The lockdowns have caused the economy to lose all its positive impetus from the strong numbers in the June quarter.

The economy is now in a transition phase from the extreme levels of monetary and fiscal policy stimulus implemented last year in response to the Covid shock to a period of where the artificial stimuli are now being quite quickly withdrawn.

The question is whether the economy can gain sufficient traction under its own steam from here without the special life support measures? We have been very lucky that export commodity prices have lifted to record highs over the period to compensate the economic activity we lost from foreign tourism.

Two major risks for the NZ economy in 2022 stem directly from what policy changes the Reserve Bank and the Government will make with monetary and fiscal policy respectively from here: -

- If the RBNZ over-react to the sudden surge in the inflation rate by tightening monetary policy too rapidly over coming months, they run the risk of unnecessarily sending the economy into recession. Should the RBNZ endorse the current aggressive forward interest rate market pricing at their next monetary policy statement on 24 November, they will increase the risk of economic recession. They have the opportunity to hose-down the over-hyped interest rate market expectations of much tighter policy conditions, but there is a big question as to whether the RBNZ will have the intestinal fortitude to give the markets the finger! The central bank Governors of Australia and England did exactly that this last week. As the Bank of England Governor, Andrew Bailey stated a few days ago "Putting interest rates up, I'm afraid, isn't going to get us more gas".

- A damning report from the Government Treasury last week warned Finance Minister, Grant Robertson that economic growth over coming years will not be enough to provide extra revenue into the Government to repay all the additional debt that has been taken on over the last 18 months. Fiscal policy will need to be tightened by either increasing tax rates or reducing Government spending. A Labour Government will not be doing the latter, so businesses and households should strap themselves in for taxation increases that will impede both consumer spending and investment.

The probability of the “doomsday” scenario for the NZ economy in 2022 of falling house prices, falling commodity export prices, a global equity market downward correction and both monetary and fiscal policy being tightened by too much at the wrong time, has arguably gone up a notch.

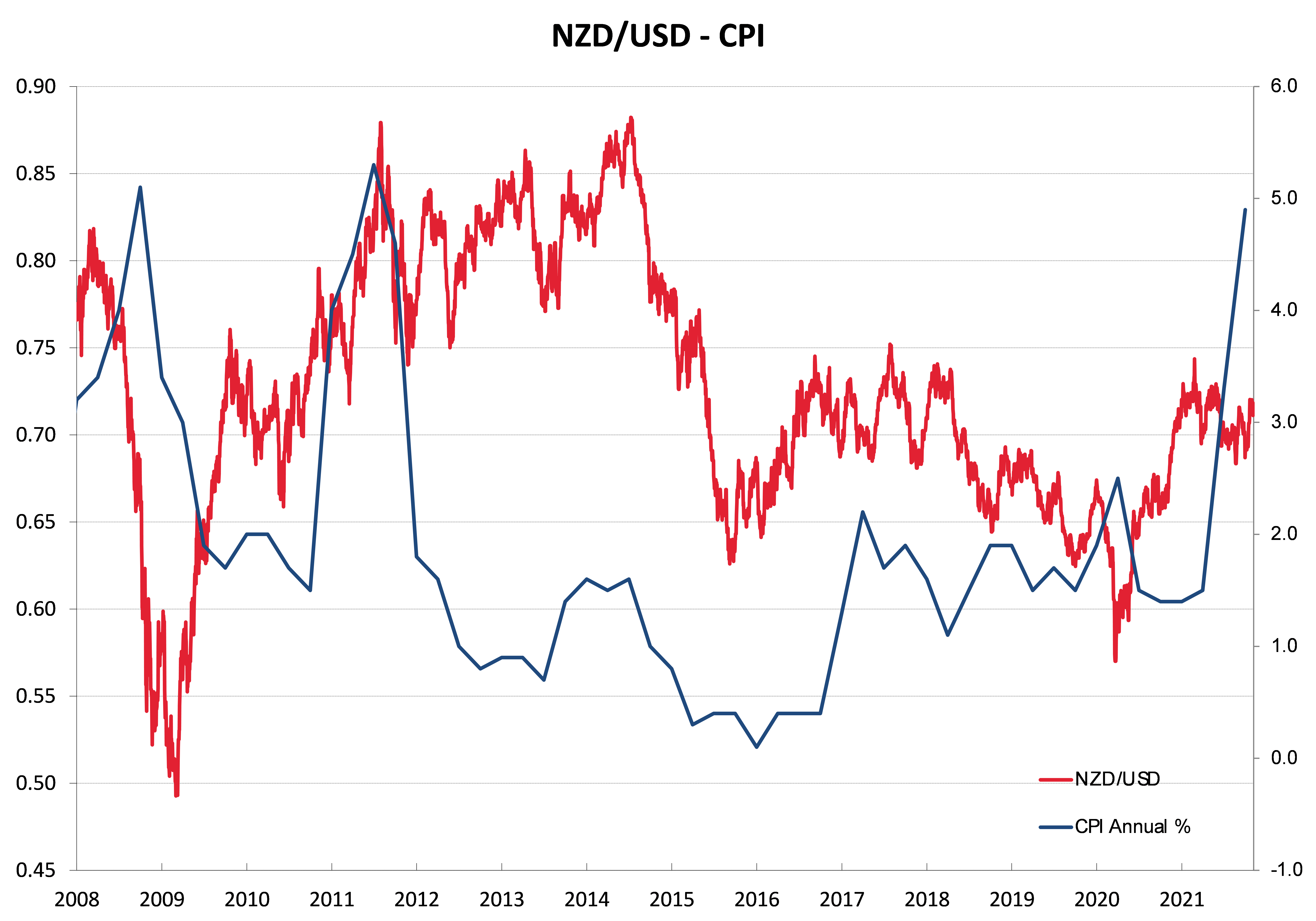

Implications for the value of the NZ dollar from the RBNZ’s upcoming monetary policy forward guidance will be negative if they correctly dial-back on the speed of interest rate hikes.

However, the Kiwi dollar will appreciate further if the RBNZ endorse the rapid monetary tightening currently priced-in to the interest rate market.

They will be the lone shag on the rock in doing so, as the Aussies, the Brits and the Americans are all adopting a much more cautious approach.

US Federal Reserve’s “lift-off test” soon to be met

Whilst a relatively poorer economic performance by New Zealand in 2022 would not be a positive for the Kiwi dollar, an NZD/USD exchange rate in the 0.6000’s does not seem likely in an international environment of a weaker US dollar against all currencies.

The bearish case for the USD in the medium term remains, based on their dual deficit problem and all the good news on US interest rate increases being fully priced into the US currency value well in advance.

The timing of US interest rate increases next year is now the debate the FX markets will have over coming months.

As expected, the Federal Reserve last week confirmed the tapering of their bond buying programme over the next eight months.

Fed Chair Jerome Powell clearly enunciated the prerequisites and conditions for the Fed to provide the signal to increase interest rates next year.

His “lift-off test” for inflation being above the desired level has certainly been met with US annual inflation running close to 5%.

The “lift off test” for employment levels in the US economy has however not yet been met. Whilst the labour market is very tight in the US with shortages and wages also up near 5%, the growth in new jobs being filled through the months of August and September was slower than expected due the Covid delta outbreak and schools being slow to return to full operation.

Should the US employment data bounce back at a stronger pace then the Fed expect over coming months, the Fed’s message was that they would not hesitate to signal an earlier increase in their interest rates than late 2022.

Following the Fed’s meeting last week the forex markets were somewhat mixed in their reaction, the USD failing to make gains as some players had obviously expected a more hawkish tone with the tapering confirmation.

However, the October jobs data two days later on Friday 5th November was above consensus forecasts at 531,000 and the USD strengthened against the Euro to a low of $1.1515.

The unemployment rate reduced again from 4.8% to 4.6% and another one or two months of strong jobs increases will have the financial and investment markets concluding that Jerome Powell’s “lift-off test” for full employment (the unemployment rate being close to 4.0%) will also be met.

There was strong growth in jobs in the hospitality/leisure, services and manufacturing sectors during October. However, reductions in US Government jobs (schools) was still a detractor to the overall employment numbers.

The prospect for continuing strong jobs increases of above 500,000 per month over coming months looks good as those Government sector jobs increase instead of reducing.

We are getting very close to the timing of when all the positive news of interest rate increases over the second half of 2022 will be fully priced into the USD’s value today. Therefore the US dollar is still on track to weaken through the early part of 2022 and only a major downward correction in equity markets would disrupt that forecast.

The USD side of the NZD/USD exchange rate still dominates the day-to-day movements.

It was instructive that the NZ dollar failed to strengthen on our local “stellar” September quarter employment figures last week.

The FX markets, along with many others, rightly questioning the true accuracy of the strong employment growth and the unemployment rate plummeting to 3.4% in the middle of a Covid lockdown!

The low unemployment rate is not signalling a strong NZ economy, it merely reflects the absence of immigrant workers.

One last push by the EUR/USD rate below $1.1500 (stronger USD) over the next few weeks will pull the NZD/USD rate lower to around 0.7000 from its current 0.7120 level, thereafter the greater risk looking into next year is USD weakness and a higher NZD/USD exchange rate.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

25 Comments

House prices MUST come down, it’s nuts at the moment. We need a good old fashion crash, at least 20-30%. The economy can only prosper once a sense of normality returns to prices. i.e kick inflation in the butt. OCR to 5-6%.

I agree. In particular, the OCR must be raised urgently to a level where inflation can be controlled. Maybe not as high as 5 or 6% (there is just too much debt in the system, thanks to Orr), but definitely to a level at least in the range between 3 and 4%.

Dream on. Next to zero chance of happening.

I seriously doubt the OCR will be more than 2% this time next year, let alone 5 or 6%.

Im sure your maths is rock solid but just in case it isnt, do you think an OCR of 5-6% may cause businesses to die, employment to fall and harm the poorest in the nation?

They have the opportunity to hose-down the over-hyped interest rate market expectations of much tighter policy conditions, but there is a big question as to whether the RBNZ will have the intestinal fortitude to give the markets the finger!

I think this way of looking at things puts the cart before the horse. It suggests that interest rates are set by central banks, and that the job of markets is simply to try and pre-empt what central banks are going to do.

A more accurate way of looking at it, in my opinion, would be to say that markets set rates, and central banks then get to decide what rate of interest they're prepared to defend. This is the problem which the Reserve Bank is facing now, rather than simply deciding what rate of interest they might like to see. That is determined by the markets.

An asset reset is only doomsday scenario for those profiting of stupid levels of debt. For everyone else its an essential reality. Just get on with it and lets the speculators and banks take their medicine. Banks easily have the capital and profit buffer to handle this.

Interest rates are absolutely set by central banks - the OCR and market interest rates are for all intent and purposes policy variables for any central bank that is willing to follow through on its stated intent (e.g. through market intervention like QE). What we have learned from US Fed, Japan BoJ, UK BoE etc is that once a central bank demonstrates that it is willing to take firm action, it only has to signal its intent in the future to control rates.

Bond yields and market rates are increasing at the moment because RBNZ has signalled future rises in the OCR. If they announced today that they intended to hold OCR at 0.5% until early 2022 and would take action to control the yield curve, the market would fall into step. Although the currency would respond as per Roger's notes above.

Interest rates are absolutely set by central banks

That's a misconception, I'm afraid. Adrian Orr made it quite explicit during his Financial Stability Report less than a week ago:

New Zealand is a ‘price taker’ when it comes to determining the level of long-term interest rates. We are a small economy, and must accept the fact that saving and investment decisions in the rest of the world determine the bulk of our interest rate levels.

It is absolutely not a misconception - not for a sovereign country with debts in its own currency.

It is amazing how many people distrust Orr until he says something they agree with!

It wouldn't be any less true if Pol Pot had've said it.

Ha ha. Usual story

Rsise rates when everything is dandy not now

Meanwhile look “through” inflation exceeding wages for a year

mikekirk29,

You might not wish to remember, but early in the year you predicted a major stockmarket crash in October. Any comments?

How is it that the people who work in our treasury don't understand how sovereign currencies operate? perhaps they should take a trip down to the Reserve Bank and see how the government finances its spending just by typing numbers into the the reserve accounts of the banks.

All NZ Dollar Currency is in the form of these bank reserves other than cash and bonds and neither taxpayers, bond holders or even the banks themselves have the ability to create this currency which must be spent into existence by the government or lent to the banks if they run short of reserves to operate their interbank payments.

It is the banks that are dependent upon the governments money to operate their payments system and it is not the government that relies on bank created deposit money to finance its spending. The Treasury should not be in the business of issuing debt at all as this is a monetary procedure which falls under the mandate of the Reserve Bank while taxation merely destroys the governments currency.

Get rid of self serving real estate agents and you will see house prices coming to real value prices. We have got too many leeches (reap estare affected) sucking on people and keeping prices up and in stratosphere. Lots of people will suffer due to these leeches sucking on them.

Would be good to see the UK style of agent get going in NZ, and the lower comission rates.

Unfortunately these recent governments have been unprepared to except a recession .when you remove the risk of recession you remove all risk from house price correction. A recession is a healthy part of the economy and reminds people to think about how much they borrow.

Another good piece from Roger.

I agree the economy faces some real headwinds, especially as supportive monetary and fiscal stimulus is eased back.

I also agree with him, as I have said repeatedly, that the RBNZ may well not raise the OCR as aggressively as most commenters here expect or want. And it's certainly interesting seeing how reluctant some central banks are to raise at all. That might be another factor that limits the extent to which the RBNZ raises the OCR in 2022.

Unfortunately, rates can now only be moved nothwards and unfortunately, very steeply as well, all because of such a loonatic level of very low interest rates. Low interest rates are fine and acceptable when you need to drive up demand but to keep it low while all signals are telling you asset prices are going crazy is even more crazy. Its as if, they wanted and expected a diffirent result from this stupidity. The rates are still not moving fast enough, people are still loading with debt as if owning a home is the only way to move up. Unfortunately, NZD will shoot up now, unavoidable. Maybe not a bad thing, will help when we head overseas after this crazy lockdown.

Dude, do you realise how self-contradicting the stuff is that you're saying?

The rates are still not moving fast enough, people are still loading with debt as if owning a home is the only way to move up. Unfortunately, NZD will shoot up now, unavoidable.

The reason why the NZD goes up is that NZ is one of the first countries to be in the position to raise rates (forced by inflation & near full employment) while most other economies still run QE and/or low interest rates.

While I was wishing for the last ten years that the housing market would crash (or just see a correction from pre-covid levels) I think this still remains whishful thinking.

NZ has a home ownership of above 60%, the majority of the population doesn't want to see their retirement nest egg lose in value. This is especially true after lots of people have topped up their mortgages to pay for extensions, renovations and toys (cars, boats, etc.).

Further, NZs economy as a whole has shifted a tremendous amount of lending towards residential real estate & construction away from business lending.

This means the residential RE sector has become the liveblood of NZs economy and a huge contributor to our GDP.

If this market crashes a lot of people will lose their jobs, their tools, their cars, their houses and their worry won't be a roof over their heads but getting kai on the table.

Remember, a recession doesn't just bring prices down so you can find an easier way into the market.

It will reduce the ability for lending (meaning the banks won't give you even half the dosh) and possibly job losses on a wide scale (no cashflow, no borrowing for you) and it can throw us in a hole from which it will take a long time to recover (think the US great depression).

Nobody sane wants that (at least the majority of the population) and all political parties and the RBNZ will do what the majority wants, which is keep this thing stable (and growing if there's any sign of trouble) as it's less painful to let inflation creep into everyones pocket than having masses of homeless, unemployed, hungry and frustrated people. Guess how our crime stats and suicide rates would look then?

I am not saying there won't be any correction at all but I have doubts we'll reach pre-pandemic levels (ever) because we're so dependent on keeping the level of prices we have achieved, so people can have the peace of mind and keep spending (the wheels moving).

There are also factors that may stabilise prices in the short-term, mainly the housing stock shortage from the past decade taking a couple years to resolve and the supply chain issues driving prices up.

No immigration due to the national lockdown may help stiffle demand but with a vaccination rate of plus 90% we'll soon re-open our borders and we will take new migrants but hopefully these are highly qualified people that have a good chance to earn a top wage.

In my opinion, the least painful way out of the affordability issue would be to stop house prices moving up (maybe make them loose 1% per annum, this could be done with a tax that is re-invested into new housing supply) and let wage inflation catch up with it.

i am not a nimby,

Just to be helpful, it's lunatic not loonatic. The beginning of the word 'lun' refers to the moon. Scotland had the Lunacy(Scotland) Act of 1857. I studied Scots Law a lifetime ago.

It'll be interesting to see if raising the interest rates higher will result in a recession that demands going on negative OCR down the road.

That will make history.

CPI holding between 7 and 10% and a recession will ensure the RBNZ is defenseless against stagflation. Of course you may think it is the job of the RBNZ to throw everyones wages into the bank accounts of property investors to ensure the Ponzi stays inflated.

.

Whenever RBNZ will try to raise interest rate and control money printing, atttemps will be made to influence and stop them.

Nothing new and RBNZ normally falls to the pressure as it too....

We work in housing.

Inflation is running riot. Steel prices for us went up 26% last month. Aluminium, copper both heading north.

Labour costs are rising.

Materials are in very short supply.

Bureaucratic nightmares with carbon calcs

Insulation requirements (and therefore timber with thicker walls) is about to increase.

6 story houses all trying to get services designed for 2 story houses.

And no labour to do anything with. Either new houses nor the infrastructure.

We're stuffed. There is no way new house prices are going to drop.

Any idea what Treasury report he's talking about? My understanding was the most recent one said Covid borrowing was nothing to worry about and entirely justified. It just gave the usual spiel about government having to address rising super costs in the future.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.