Additional or “on the margin” demand from buyers and additional or “on the margin” supply from sellers determines price discovery and thus price change in any free market. The volume and timing of both this demand and supply determine the speed and length of price trends, up and down. The demand and supply of New Zealand dollars in the foreign exchange market is no different, therefore it is opportune to examine the demand and supply equation for the NZ dollar as it stands today and going forward in 2022.

Outside of general US dollar movements against all currencies on global forex markets, the Kiwi dollar will make gains against the USD on its own account if the demand from buyers exceeds the supply from sellers on any given day or cumulatively over time.

Over coming months, the keen buyers of the Kiwi dollar are expected to come from the following sources (in no particular order of importance or intensity): -

- Trade related export/import flows: Local manufacturing and some primary industry exporters are currently reasonably highly hedged (they have already bought their NZ dollars forward against forecast USD receipts over the next 12 to 36 months) and therefore additional buying from these companies will only be small hedging top-up’s. Sheep meat and beef exporters only hedge the currency forward on procuring the livestock, so we will again see the traditional volumes of NZD’s being purchased through the more thinly traded FX markets over the Christmas/New Year period. Historical patterns reveal that the Kiwi generally moves higher in January due to these seasonal flows. Dairy export giant, Fonterra stick to their rigid and mechanical FX hedging policy, so nothing unexpected from that source. Fonterra’s monthly volumes of FX hedging will be higher than previous years with the much higher dairy commodity prices. Local importers (sellers of Kiwi dollars) will now be operating their hedging policies at the lower end of their policy limits as they anticipate NZD gains on rising local interest rates and a weaker USD on global FX markets.

- Currency speculators altering their AUD positions: The NZD/USD rate always closely tracks the larger neighbour currency, the Aussie dollar rate against the USD. The AUD remains heavily “short-sold” against the USD in measures of speculative positioning. Given that the AUD/USD rate has returned to the bottom end of its 0.7200 to 0.7500 trading range over this last week due to general USD gains, the AUD punters will be enticed to take their profits and unwind their positions before the end of the year. The resultant AUD buying over coming weeks could be large and concentrated, potentially driving the AUD/USD rate back above 0.7500 again. Depending on what the RBNZ say and do this Wednesday 24th November on the speed and extent of future interest rate increases here in NZ, the Kiwi dollar will follow the AUD up, to the same or smaller degree.

- “Carry-trade” investors: New Zealand is currently attracting international attention as one of the first central banks among developed economies to end the 2020 monetary stimulus and increase interest rates as inflation is above its maximum allowable speed limit. The NZD/USD rate is already two to three cents higher at 0.7000 to where it would have been based on USD gains against the Euro to below $1.1300. That premium is entirely due to the local interest rate market pricing-in steep increases in the OCR over recent weeks following the much higher than expected CPI inflation result for the September quarter. In years gone by, NZ interest rates needed to be 2% to 3% above those in the US to attract in the “carry-trade” investors seeking the higher yield return and likely associated currency again. Currently our two-year swaps rates are only 1.5% above the equivalent US interest rates, so it is debatable whether we will see large-scale carry-trade buying of the Kiwi dollar on this monetary tightening cycle.

- Foreign direct investment: It is difficult to get accurate and definitive information on permanent capital inflows into New Zealand. Recent trade sales of local companies to offshore acquirors include Ziwi Pet Foods to Chinese PE firm FountainVest Partners for greater than $1 billion and a Weta Digital’s technology unit to American 3D game-development platform, Unity for $2.3 billion. If the vendors get paid in Kiwi dollars, the foreign investors must buy those NZ dollars across the FX market. The local mergers and acquisitions market is buoyant, despite Covid disruptions, therefore further big-ticket sales to offshore acquirors have to be expected in 2022.

- Hedging by local fund managers: International equity portfolios managed by local fund managers for their clients generally hedge the currency risk (against NZD appreciation) between 50% and 100%. Active currency hedging strategies have probably been on the back burner for many mangers over recent years as equity market returns have been so spectacular, that the FX impact is very much on the margin. However, should global share markets start to correct down on rising US interest rates in 2022, the fund managers will not want a rising NZ dollar value adding to their negative returns. The incentive to run higher hedge percentages is added to if the fund managers subscribe to the view that the US dollar will be on a weakening trend against all currencies next year. Lifting hedge percentages requires them to buy Kiwi dollar forward.

- Return of immigration flows: When the Government eventually gets its act together with re-opening the borders and ending quarantine requirements, we should see a flood of returning Kiwis and foreign immigrants sometime next year. The new immigrants do bring with them another source of NZ dollar buying demand as their convert their funds on arrival. The NZ economy desperately needs these immigrants to provide the skills and expertise to maximise our potential to expand economic activity. When that happens tax revenue coming into the Government increases and in turn it puts us in a better position to repay all the additional debt from the Covid shock. I am not sure the current Government understands these connections and the importance of immigrants to the NZ economy. They currently appear to be using the Productivity Commission to find other solutions to the shortages of skilled labour. Sadly, there will be a lot of talking, working groups and reports, but not much in the way of actual decisions and implementation. In the global post-Covid era New Zealand has a unique opportunity to promote itself as a great place to do business and live. It requires innovative and imaginative immigration policy settings to set us apart as an attractive destination. However, it seems it will require a change of Government to start considering such initiatives.

There are sufficient positive forces to suggest the Kiwi dollar is more likely to appreciate somewhat on its own steam over coming years, rather than depreciate. However, export commodity prices which are all currently near their historical highs (except for logs) perhaps can only go one way from here and that is back down. Falling export commodity prices would certainly temper any NZ dollar gains from the sources listed above.

At back near to 0.9700 the NZ dollar is yet again overvalued against the Australian dollar. Exporters selling in AUD should be hedged against these increases. However, the hedging eventually runs out, so they will be looking to the FX speculators who have bought the NZD against the AUD to unwind those positions to pull the NZD/AUD cross-rate back down again. Historical NZD/AUD trading patterns over the last seven years would suggest there is a very good chance of that occurring over coming weeks and months.

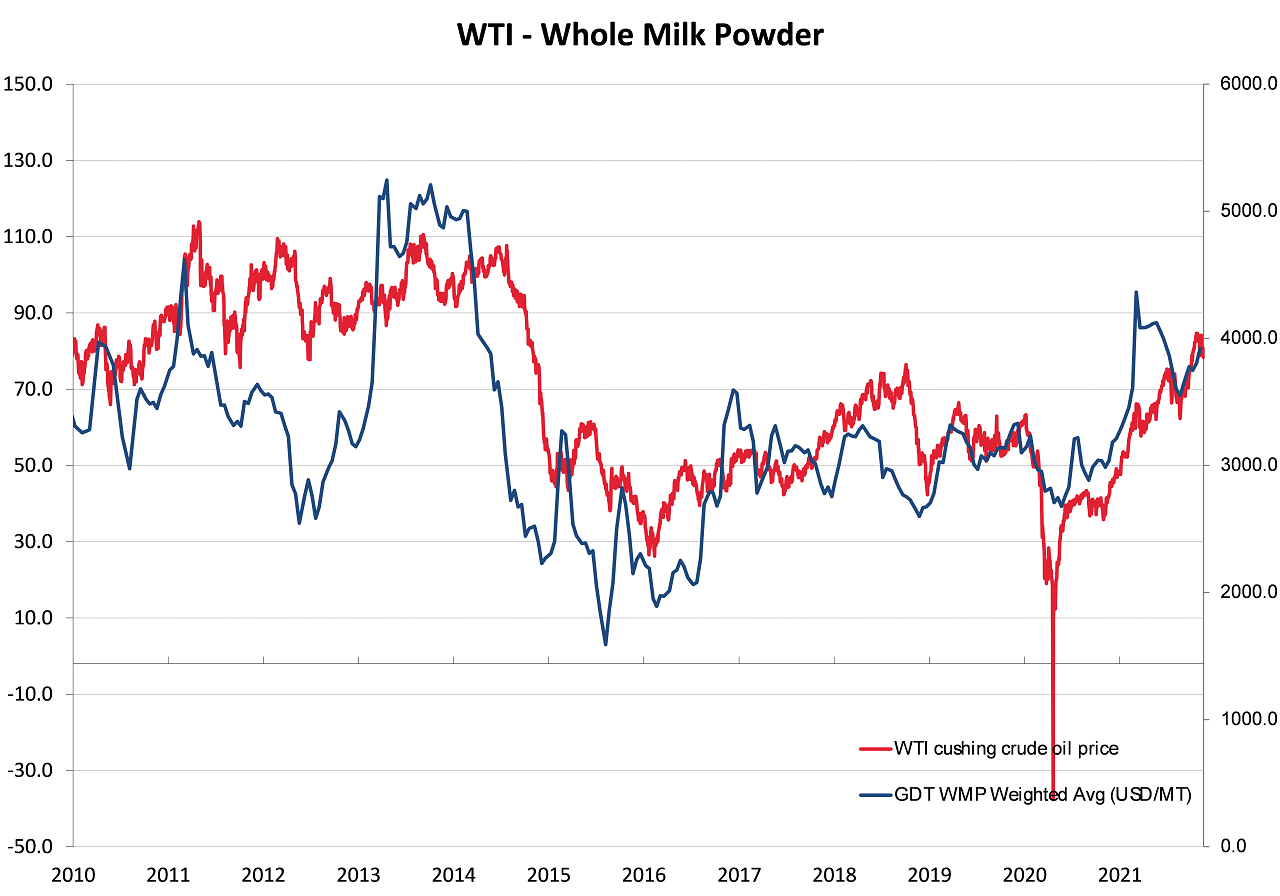

There is a reasonable correlation between crude oil prices (WTI) and while milk powder dairy commodity prices (in USD) due to some oil producing nations having more funds to import protein when oil prices are up. Oil prices reached a high of US$85/barrel recently but are now starting to move down again. Further reduction in oil prices over coming months would suggest that whole milk powder prices will also be heading south, removing some of the gloss off the Kiwi dollar.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

"The NZ economy desperately needs these immigrants to provide the skills and expertise to maximise our potential to expand economic activity. When that happens tax revenue coming into the Government increases and in turn it puts us in a better position to repay all the additional debt from the Covid shock. I am not sure the current Government understands these connections and the importance of immigrants to the NZ economy. They currently appear to be using the Productivity Commission to find other solutions to the shortages of skilled labour. Sadly, there will be a lot of talking, working groups and reports, but not much in the way of actual decisions and implementation. In the global post-Covid era New Zealand has a unique opportunity to promote itself as a great place to do business and live. It requires innovative and imaginative immigration policy settings to set us apart as an attractive destination. However, it seems it will require a change of Government to start considering such initiatives."

Gratuitous politicking by Roger J Kerr. How many people would he like to see living in New Zealand? Six million? Ten million? Twenty million? One hundred million?

Only bank reserves, government bonds and notes and coins are currency, all other NZ Dollars are commercial bank created deposits which are not currency. Bank reserves can only be traded between institutions which hold accounts with the Reserve Bank and so most international NZ Dollar trades will be in commercial bank deposits which account for the greatest quantity of NZ Dollars.

Will there be a pump and dump on NZD?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.