Summary of key points: -

- Kiwi dollar’s interest rate premium is unceremoniously dismissed

- Massive RBNZ flip-flop on GDP growth forecasts

- FX speculators set to unwind short-sold AUD positions

Kiwi dollar’s interest rate premium is unceremoniously dismissed

A few weeks back we made the comment in this column that the NZD/USD exchange rate would have been back in the 0.6700’s by now due to the general US dollar strength, however the high expectation by the local interest rate markets that the RBNZ would endorse their pricing of sharply higher rates was keeping the Kiwi above 0.7000.

What has transpired of this last week is a rapid unwinding of long NZD positioning by the speculative market as they were disappointed that the RBNZ monetary policy statement did not deliver the endorsement of higher interest that they were expecting.

The RBNZ did raise interest rates and said that they would increase the OCR a lot more over the next 18 months. However, they were also rightly cautious (as we thought they should be) about the outlook due to the scarring on the economy from the Auckland lockdown and the possibility that there would be more Covid related disruptions ahead of us.

The RBNZ statement was hawkish due to the inflation rate being well above their maximum limit of 3.00%, however just not as rabidly hawkish as the overcooked interest rate market and numerous gung-ho bank economists had expected.

We also proffered the view that the NZD/USD rate could equally move one cent higher from 0.7000 or one cent lower dependent on whether the RBNZ scotched or endorsed the interest rate market pricing of rapid increases ahead. As it turned out, the RBNZ stance and rhetoric was somewhere in the middle, however sufficiently circumspect to force the currency market punters to sell out of their long-NZD positions.

Continuing US dollar strength against all currencies over this last week has pushed the Kiwi dollar down another cent, resulting in the lower than expected 0.6820 rate.

We did anticipate one last bout of US dollar strength through this period, however the USD gains against the Euro to $1.1200 has extended somewhat further than the $1.1500/$1.1400 target area we had forecast.

It certainly feels like the US dollar has strengthened too far, too quickly against the Euro in recent weeks in response to positive US economic data, the Federal Reserve potentially lifting their interest rates earlier than late 2022 and Europe having problems with a fourth wave of Covid infections.

All excellent reasons to buy the US dollar, however it appears to have overshot the mark It has been a straight line down from $1.1700 at the end of October to a low of $1.1190 last week.

It would not be surprising at all to see a two cent pullback to above $1.1400 in the short-term a long USD positions are unwound before the end of the year. For this reason there is a better than even chance that the NZD/USD rate returns to above 0.6900, rather than pushing into the 0.6700’s, over coming week.

The NZD/USD exchange rate has caught up with the EUR/USD rate, and that now the RBNZ statement is behind us, near-term Kiwi direction will return to being determined by whether the USD continues its bull run or corrects the other way. We favour the latter.

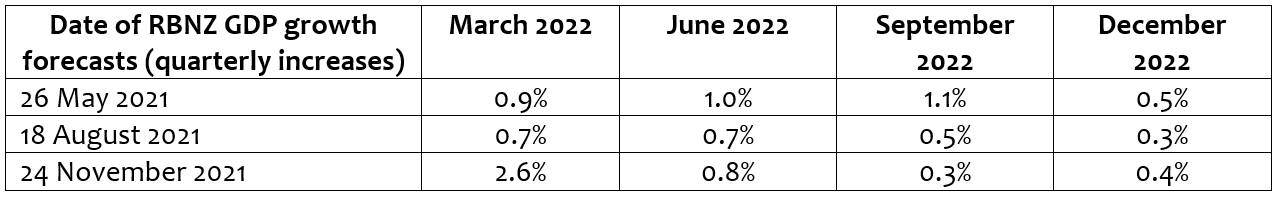

Massive RBNZ flip-flop on GDP growth forecasts

Given their considerable resources, one would expect the RBNZ to be reasonably consistent and accurate in forecasting the GDP growth rate for the NZ economy.

Their management of monetary policy is totally dependent on projecting the economic conditions 12 to 24 months ahead. The GDP growth rate plays a large part in determining the inflation rate and the unemployment rate that they are charged to keep both stable and low.

Whilst the Covid delta lockdown over recent months has thrown a curve ball at all economic forecasts, the change in the RBNZ’s GDP growth forecasts for the four quarters of 2022 over the last six months is something else again.

The big change in the March 2022 growth forecast is understandable as the economy goes through a rebound to the 7.0% lockdown contraction in the September 2021 quarter.

However, on what basis do they reduce their June, September and December 2022 quarterly GDP increases by 50% from their May forecast to their November forecast? They do not explain in their latest statement what sectors of the economy will now be considerably slower in 2022 compared to their May forecast.

As many have suspected, the RBNZ GDP growth forecasts are largely determined by a circular back-solving exercise to always have the annual inflation rate returning to the mid-point of 2.0%. To get the inflation rate back down from above 4.0% to 2.0% their economic forecasting model requires a sharply lower 2022 GDP growth rate.

Global economic growth forecasts have not changed much from May until now and dairy commodity prices are higher, therefore it is hard to fathom what has changed to cause the RBNZ to slash their 2022 forecasts by so much.

The irony stemming from this analysis is that when their GDP growth forecasts were much higher in May 2021 they were not signalling any change to the super-loose monetary policy at the time. They are now tightening monetary policy based of GDP growth forecasts that are much lower!

The current tightening of policy is designed to slow demand to pull the inflation rate back down. Time will probably tell us that the inflation rate will reduce in 2022 due to the oil and freight prices reversing from their large 2021 increases.

The RBNZ Governor has explained that half the current high inflation rate is due to domestic (non-tradable) prices continuing to increase i.e. nothing to do with the external oil, commodity and freight prices.

As the guardians of our dollar to ensure inflation does not erode the value of our savings and spending power, the RBNZ need to put more resources into understanding why non-tradable inflation has increased by over 3.0% each year for the last decade.

The big three non-tradable prices that consistently increase are house building costs, local government rates and electricity. If they are doing their inflation guardian job, the RBNZ would be challenging the Government on policy changes to address these constant price increases.

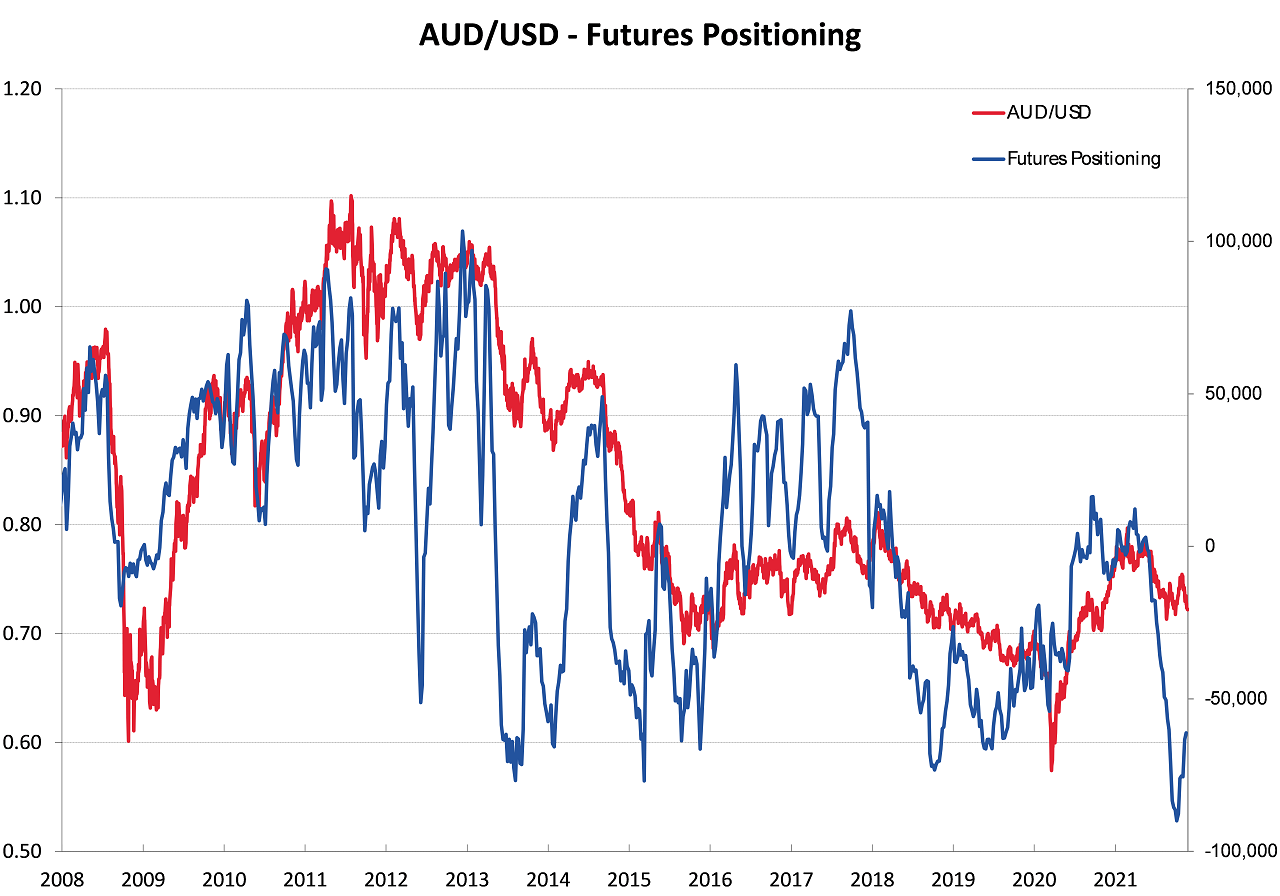

FX speculators set to unwind short-sold AUD positions

Whilst there has been some unwinding of short-sold AUD positions over recent weeks, there is a lot more to go (refer chart below).

Therefore, expect the AUD/USD rate to reverse back up rapidly from its current 0.7125 level, pulling the Kiwi dollar up with it.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Another great piece. My Monday 'go to' on all things finance.

If the RB knew what it was doing it would be a fine thing indeed.

Future of the NZD/AUD cross?

Given RBA signals no rate rises.

Here is an interesting article to read as background on both the U.S. Dollar and Euro. https://www.goldmoney.com/research/goldmoney-insights/the-euro-s-death-wish

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.