Summary of key points: -

- USD inflation at 40-year highs, US dollar fails to respond

- The RBNZ’s failure to control non-tradable inflation

USD inflation at 40-year highs, US dollar fails to respond

Consumer prices in the US of A increased by 0.80% over the month of November, marginally above consensus forecasts of +0.70%.

The annual rate of increases of 6.80% is the highest in 40 years. One would typically expect the US dollar to appreciate on such news as the FX markets build-in the Federal Reserve needing to hike interest rates higher and sooner to combat the inflation. Tellingly, the US dollar did not appreciate any further on the inflation release, remaining at $1.1300 against the Euro.

The muted reaction by the EUR/USD rate is another piece in the jigsaw that supports the view that the currency markets have now largely fully priced-in to the USD’s value the Fed tapering QE earlier and increasing interest rates next year.

Time will tell as to whether the $1.1200/$1.1300 level proves to be the major turning point for the US dollar direction; however the evidence is gathering that the next big move in the EUR/USD rate will be upwards to $1.1500 and above. It may only take some slightly weaker than expected US economic data or improvement in the European economy to push the EUR/USD exchange rate back up.

In many respects, the speed and extent of the USD gains against the EUR since $1.1700 in September have been “too far, too fast” with the USD bulls now exhausted and not buying additional USD at these levels.

The market is ripe for a correction, it just requires a catalyst to spark profit-taking from those who have been long the USD and have gained handsomely from the appreciation to $1.1200. The Federal Reserve’s meeting this Wednesday night will confirm what the markets already know in that the tapering amounts will be increased. Increases in the interest rate forecasts of the Fed members (the “dot-plot”) will be of no surprise to the FX markets.

US November retail sales data being released at the same time will be another gauge on whether the much weaker consumer confidence levels are transferring through into slower spending. Consensus forecast are for a 0.80% increase in retail spending over the month.

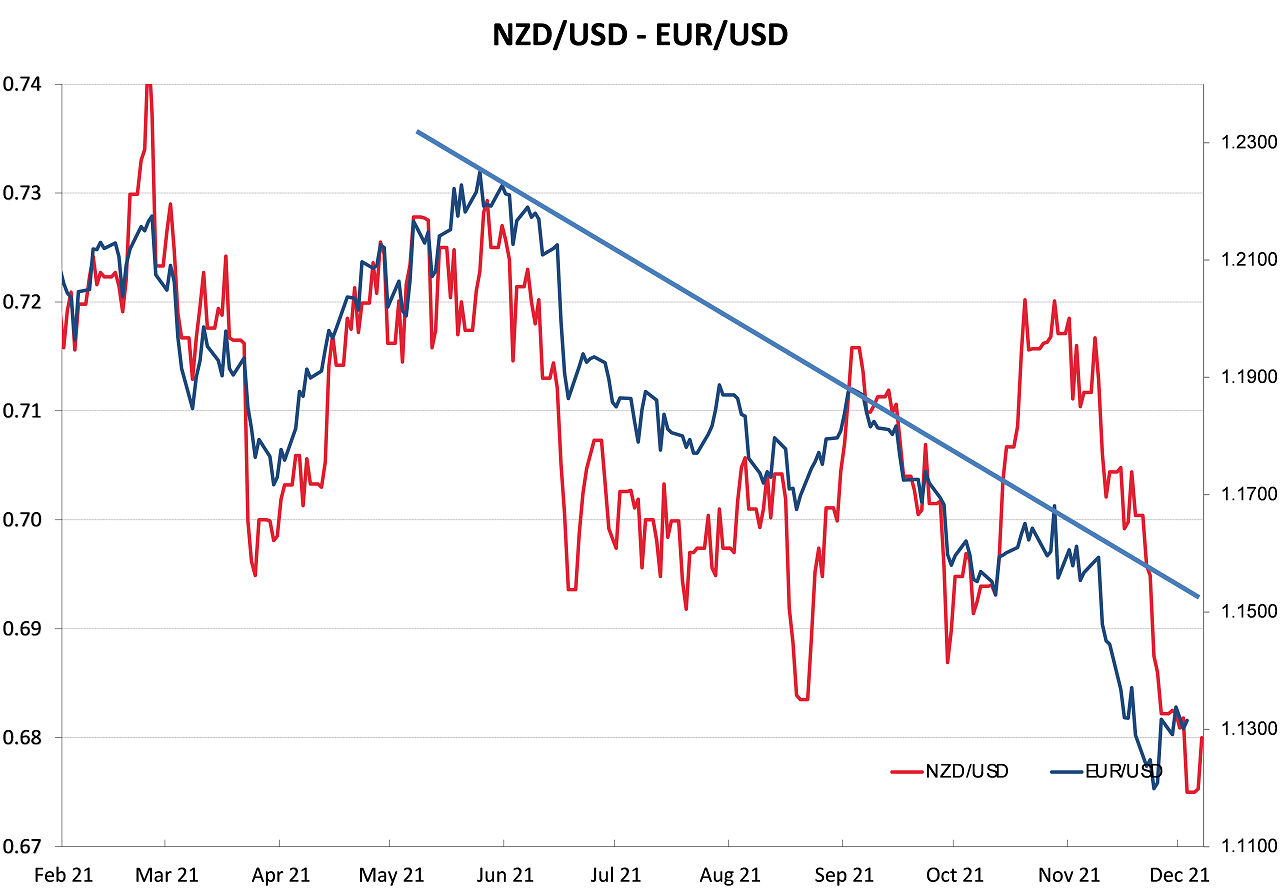

The chart below indicates that the USD’s strengthening momentum against the Euro over the last few weeks from $1.1700 is running out of puff. The expected correction back up to $1.1500 over coming weeks before the end of the year would pull the NZD/USD rate back up to 0.6950.

The EUR/USD movements continue to dominate NZD/USD direction, outweighing higher NZ interest rate and commodity price positives at this time.

The RBNZ’s failure to control non-tradable inflation

The RBNZ Governor, Adrian Orr provided a succinct and perceptive observation on New Zealand’s much higher inflation rate following their last statement.

He stated that “half the inflation we have is not from higher freight, commodity and oil prices (tradable inflation) which comes from offshore and which we can do nothing about”. The half he was referring to was the domestic economy “non-tradable” inflation which consists of local government rates, cost to build a house, electricity, insurance, rents, health costs etc.

Non-tradable inflation has been running at a consistent annual increase close to 3.00% for more than 10 years now. There is nothing at all new about high non-tradable inflation.

Before freight, commodity and oil prices increased over the last 12 months, tradable inflation had been very low for several years, thus keeping the overall CPI inflation rate well below the 3.00% top limit.

The technology revolution has resulted in tumbling communication prices over the last decade. Telecommunication equipment and telecommunication services which combined have a minor 3% weighting in the NZ CPI inflation index have decreased at an average rate of 18% and 4% respectively each year since 2011.

The massive telecommunication deflation has disguised normal household inflation and painted a picture of very low overall inflation, whereas the “staples” for any household of food, shelter and transport have consistently increased in price.

Average wage increases over the last 10 years have been a lot less than the 3.00% non-tradable inflation, therefore lower income households have been considerably worse off when it comes to paying the bills every week.

Much of the housing, social, health, crime and child poverty issues New Zealand has today can be sheeted home to there just not being sufficient cash to pay ever increasing household costs.

The RBNZ, as guardians of preserving our spending power and value of our savings (maintaining low inflation,) have done absolutely nothing to address the persistent non-tradable inflation that has financially stressed lower income households and caused many other problems.

Someone, somewhere has to take responsibility for this unacceptably high non-tradable inflation.

It is not difficult to work out that the high domestic inflation comes from goods and services either provided by the Government sector or less competitive parts of the economy. Healthy competition in an economy is the major ingredient to maintain low inflation.

However, we never hear of the RBNZ analysing and discussing the level competition in the NZ economy.

The major categories within the non-tradable part of the annual inflation rate that have contributed to the consistent 3.00% annual increase are as follows: -

- Local body rates (2.8% weighting) have increased on average 4.40% every year over the last 10 years. It is out of control. The Government continuously imposes additional regulatory and reporting burdens on Councils and ratepayers/renters end up paying for it. Instead of worrying itself about diversity and climate change, the RBNZ could do some analysis on Council staff costs as a percentage of total Council costs? – it might be revealing as to why rates continuously increase.

- Electricity prices (3.5% weighting) have increased on average 2.10% every year over the last 10 years. The environmentalists, who do not want fossil fuel generation of electricity, have stopped the construction of new hydro generation over the last 30 years, our cheapest source of power. The Government’s Lake Onslow pump/store feasibility study is preventing any new investment in electricity generation. Uncertainty over the aluminium smelter and Manapouri clouds the picture further. We remain our own worst enemies in this space.

- Purchase of housing costs (6.8% weighting) have increased on average 4.50% every year over the last 10 years. There are arguments about insufficient competition with some building materials than what would be ideal, but we suffer from poor “economies of scale” with house construction. Excessive red tape, zoning and the consenting process are the major culprits of the continuous cost increases.

- Rentals for housing (9.7% weighting) have increased on average 2.40% every year over the last 10 years. Shortages of supply, abrupt changes in tax policies for investment properties, as well as local body rates and house construction/repair costs have all contributed.

If the RBNZ were doing their job properly they would be putting considerable resources into lobbying, challenging and threatening the Government of the day on the policies that are at the source of the consistently high non-tradable inflation.

Instead of just being observers on the side-lines of the economy/causes of inflation and ramping interest rates up and down as their only combat weapon, the RBNZ need to get their hands dirty with the real sources.

They may not be able to control the offshore-sourced tradable inflation, but that does not mean they abrogate their responsibilities when it comes to the domestic non-tradable inflation.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

10 Comments

Wow. Even Roger now talking about the inflation fraud without directly calling a spade a spade and calling out the credit-driven bubble (the root of why we're in this mess). Things must really be getting concerning. However, stating that the RBNZ, "as guardians of preserving our spending power and value of our savings" has never been their responsibility in terms of "cash savings". Quite the opposite.

RBNZ are puppies to the law of the land. So they sit when they are told to sit and stand when told.

Is inflation under RBNZ mandate?

Now don't tell me it's transitory or because of the supply chain, we have voted you to do your job not giving us excuses. When it comes to house price you say it's not our mandate when it comes to inflation you say it's supply chain then what are you there for?

Sure, non-tradable inflation of essentials is through the roof but novelty dog costumes have been deflating in price so... call it even?

You have thousands of people who cannot afford to rent or buy a house people living in cars all over place crime is on the up and as inflation goes up it’s these people that suffer more. The government needs to start building houses quickly and rent them out so low that house prices come down without affordable living this country will spiral down. If people have nothing who would blame them for stealing at least in prison you are warm and have food. Through this pandemic tax payers money has been wasted the rich continue to get wealthier if nothing is done society will crumble we already have half a million people who cannot function in society because of vax passports people loosing jobs.

Let's be clear. The people that care most about inflation are people sat on a lot of wealth. When inflation exceeds asset growth, the wealthy get very upset indeed.

Wages for lower skilled jobs (and benefits) have risen by an average of 3% per annum for the last three years - and household living costs for the lower income quintile have increased by around 2%. Poor people can't buy houses, so the key housing measure is rent, which is included in household living costs (but has been trending up from a long-run average of 3% per annum to closer to 4% this year).

People on lower incomes have been doing it tough for years - with their labour, rent and associated Govt subsidies being efficiently exploited to increase the wealth of people with assets. But, with minimum wage increases and a tighter labour market it won't be the poor that suffer most from the current round of price increases . Their admittedly meagre earnings should keep up and as demand for goods reduces globally and prices subside, they might even come out of all of this a bit better off.

Given this, why are we seeing so many 'my aching heart bleeds for the poor' articles at the moment? See my first point!

What? Your comment reads like a MSM misinformation piece "Inflation is good!"

It is the poor and middle class that get wacked the hardest by inflation, as the things that inflate the fastest represent the largest portion of their spend. Unlike the wealthy who have all their money in assets, so even a large increase in their living costs is still irrelevant to their overall portfolio.

There is no way low level wages keep up with inflation, and if they do, they are generally in the service and primary producing sector, so the employers just pass these costs on easier, leading to more inflation.

And going back to your first point, the rich don't care about 7% inflation because they are in property, which in the states is up 23% yoy! There is a massive buffer between inflation and it actually starting to affect the rich, with all of us plebs on the chopping block first.

Maybe the reason the $NZ is tanking ....is our current acct .

Tourism + immigration enabled our foreign reserves... ie.. big sources of foreign exchange

Without these we are shown up ( current acct ) for the chronic debtor nation we are....which manifests as a sinking $NZ... ( like a worsening credit rating ?? )

just my view

Roger is spot-on. Councils like Nelson lead in enormous rate increases. My residential rates have increased over 300% in 13years, and are accelerating even more. These councils engage in feel-good projects while neglecting essential infrastructure. They have lost sight of responsible financial management. I have brought this to the attention of the Reserve Bank but of course the RB is more concerned with climate change.

No accountability and an easy passive rate base leads to just this.

We need to Nationally push back against these ridiculous rate increases, and stop spending on nice to haves and focus on core infrastructure and necessities.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.