The surge in mortgage growth of the past two years is quickly beginning to recede, with annual growth in mortgage stock slowing to its lowest level for a year in February.

But meanwhile business lending, which was crushed by the pandemic, is now growing at its fastest clip since the onset of Covid.

New Reserve Bank sector lending figures show that in February total housing lending stock - the country's mortgage pile, if you will - grew by about by $1.5 billion (0.4%), which was down on the $1.7 billion (0.5%) increase reported in January.

There's an argument to say that if you take out months that have been in some way affected by lockdowns or Covid restrictions, then you have to go back to 2018 to find month on month growth rates as slow. The only exception to that is arguably the post-lockdown June 2020 month, which also saw 0.4% growth.

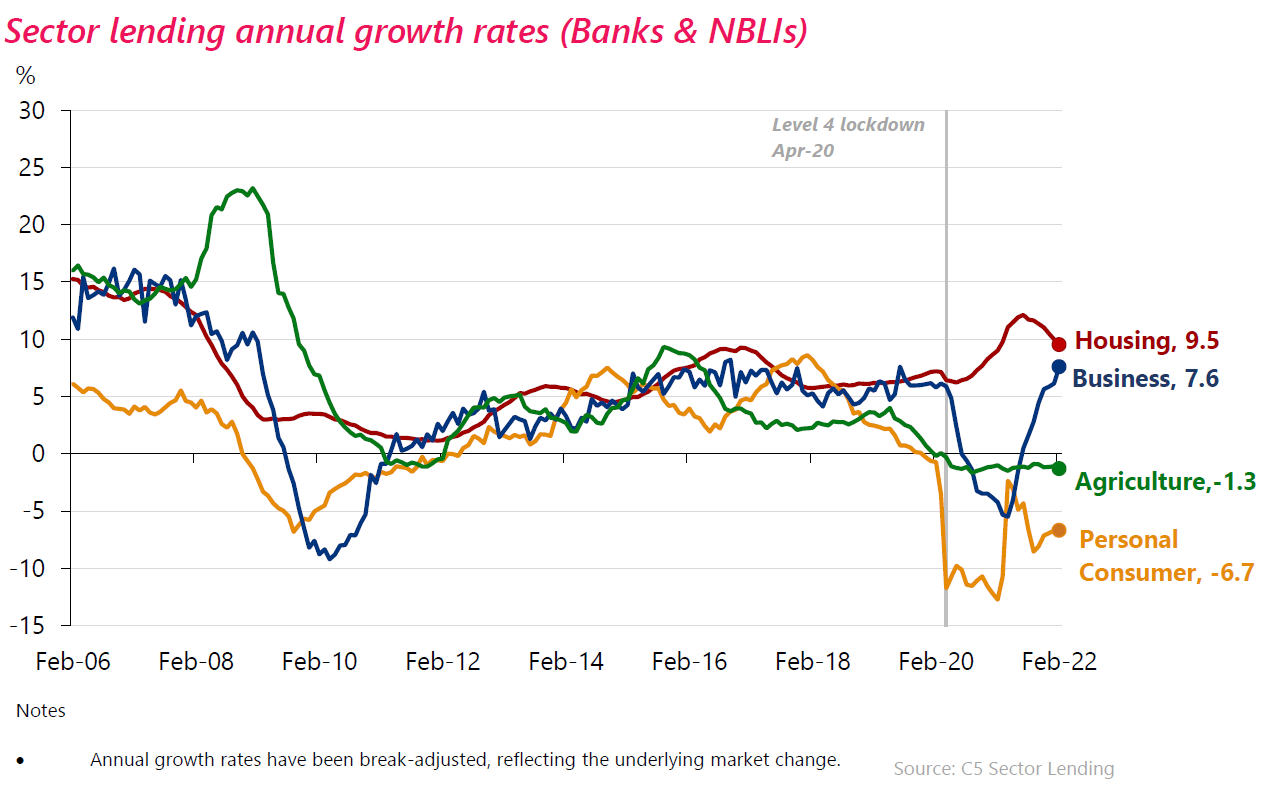

Either way, annual growth in the country's mortgage stock continued to slow - down to 9.5%, following 10 months of double digit growth.

As at the end of February the mortgage pile (that's from both banks and non-bank lenders) stood at $334.1 billion, compared with $305.1 billion in February 2021. That's still a chunky addition to the pile over the course of 12 months, but the rate of growth has been slowing markedly in recent months - with month on month growth having dropped from at or near 1% each month in the first half of the year to the 0.4% seen in February.

As mentioned at the top, however, it's been a different theme developing in the business sector.

Annual business lending growth plunged into the negatives after the start of the pandemic, but is now very much on the up again, with the annual rate hitting +7.6% in February. That's the fastest pace of annual growth since July 2019. The pile of business lending stood at $125.4 billion at the end of the month - a new all time high.

Agricultural lending continues to languish though, falling at an annual rate of 1.3% in February (to $61.5 billion), which was the biggest annual drop seen since April of last year.

Dairy lending is continuing to drive the falls. The stock of dairy lending was down to $36.7 billion in February, some $1.9 billion - or 4.9% lower than in February 2021.

15 Comments

Record profits for banks, its money for jam, all they have to do is lend more money and they automatically make more profit. Still waiting for those TD rate rises, pretty much zero now for months.

Oh to be a bank.

Business debt is growing because it's not covered by the government's onerous CCCFA legislation. When borrowers get declined on consumer lending they can go and borrow so long as they declare it's for a different purpose that falls outside the regulation.

Often this will be via a non-bank at a higher rate. The legislation is creating systemic risks to the financial system

What about CCCFA do you think is onerous?

It assumes that when people get paid they go and buy jager bombs and gucci handbags first then try to pay their bills with what's left over. Typically people are going to prioritise keeping a roof over their head and will adjust their spending if their bills increase as a result. If they don't do that then it's on them and the liability shouldn't be on whoever is taking the risk of lending them money in the first place. Unfortunately the politicians and bureaucrats don't see it this way and want to control every aspect of the economy and people's lives.

not so much the onerous -- more blind and completely ridiculous -- why woudl anyone ever think that after investing 750K + buying a house that the people smart enough to save and do that woudl not change their spending habits to keep their largest asset and invest in it -- - of course spending habits change with such a purchase ! hell i bought motorhome three years ago -- done 40,000km in it - no other holiday spending whatsover - no air b an b no flights nothing -- its daft to think otherwise and the CCCFA was an unflexible tool - that made no sense and still does not

Nice graph.. Maybe the business borrowing is because covid ate up cash reserves ... rather than optimism about the future ??

Look at agriculture debt growth/decline from 2008- 2016 and then look at farm prices. ( see link ).

https://www.rbnz.govt.nz/financial-stability/financial-stability-report…

Credit growth in a sector is important for asset prices in that sector... obviously.

Credit Growth is Housing is critical to NZ GDP growth . ( Its how most "new" money enters the economy )

Biggest cause for the decline in Agriculture credit growth, was a debt burden together with declining incomes.

The debt burden was the "White Gold fever" narrative back in the 2000s', and which was going to grow NZ.... into the future.

SO... With Housing... if we have a deep downturn that results in increasing unemployment, and housing credit growth falls off a cliff,... then the decline that happened in farm values might happen in housing, somewhat..... and that would spill into a deeper recession.

IF... incomes start rising because of inflation, and inflation is not so much transitory, maybe it will be like the 1970s' where house prices went largely sideways while incomes rose... ( minimum wage is about to go up by 6% )

Banks were able to "manage" the debt issues in agriculture ( mainly because interest rates went down )

Will Banks be able to handle a down turn in housing... with rising interest rates.. ?

This graph ( link ) suggests there is alot of room for interest rates to rise before serious stress happens ??

https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-household-debt

One thing is for sure..... Money is losing its value.

Inflation going to the moon with NZD currency devaluation.

.

minksy moment ?

Who would have borrowed for a business heading into the pandemic?

The anti-business government were prepared to lock businesses down over a single COVID case and showed zero f**king urgency in getting people vaccinated until it was clear the Delta outbreak wasn't going away. Not exactly the time to bet the house.

Now that companies can see a way forward that doesn't consist of HRH giving 1pm pressers people are starting to think long term again.

Perhaps businesses badly impacted from covid have been taking on debt to cover their losses.....just a possible theory.

Be interesting to see if that is the case....otherwise it appears strange that business lending has jumped so much recently.

Would banks be willing to do that?

I'd say borrowing to fund extra stock to cover for supply chain issues.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.