ANZ

In the second of a series of articles on bank fees, Matt Skinner looks at credit card fees the major banks charge

8th Nov 22, 10:12am

1

In the second of a series of articles on bank fees, Matt Skinner looks at credit card fees the major banks charge

PM says banks not demonstrating 'social license' by repeatedly making very high profits, but does not have policy options; instead says banks 'should take a long hard look at themselves'

7th Nov 22, 6:11pm

74

PM says banks not demonstrating 'social license' by repeatedly making very high profits, but does not have policy options; instead says banks 'should take a long hard look at themselves'

In the first of a series of articles on bank fees, Matt Skinner looks at the business borrowing fees the major banks charge

4th Nov 22, 11:38am

1

In the first of a series of articles on bank fees, Matt Skinner looks at the business borrowing fees the major banks charge

[updated]

Statistics New Zealand says the unemployment rate has remained at 3.3%; but private sector hourly wages have risen more than anybody forecast - which could have big ramifications for interest rate rises; RBNZ says employment situation 'not sustainable'

2nd Nov 22, 11:00am

178

Statistics New Zealand says the unemployment rate has remained at 3.3%; but private sector hourly wages have risen more than anybody forecast - which could have big ramifications for interest rate rises; RBNZ says employment situation 'not sustainable'

Reserve Bank's bank stress testing, modelling stagflation scenario, features high interest rates for first time since 2014 & includes cyber-attack for first time

1st Nov 22, 2:02pm

1

Reserve Bank's bank stress testing, modelling stagflation scenario, features high interest rates for first time since 2014 & includes cyber-attack for first time

Following some unwise comments by its Group CEO as it announced a record giant profit, ANZ NZ has moved to ensure its term deposit offers are back at the top on the range in the local market

31st Oct 22, 7:54pm

40

Following some unwise comments by its Group CEO as it announced a record giant profit, ANZ NZ has moved to ensure its term deposit offers are back at the top on the range in the local market

ANZ NZ probing whether sufficient demand exists for government's proposed Business Growth Fund

31st Oct 22, 11:56am

ANZ NZ probing whether sufficient demand exists for government's proposed Business Growth Fund

ANZ Group CEO Shayne Elliott says ANZ NZ doesn't have to offer the best deposit rates so it doesn't

29th Oct 22, 6:00am

65

ANZ Group CEO Shayne Elliott says ANZ NZ doesn't have to offer the best deposit rates so it doesn't

[updated]

ANZ NZ CEO Antonia Watson says bank's monitoring mortgage borrowers whose ability to repay was tested at 5.8% last year

27th Oct 22, 2:47pm

137

ANZ NZ CEO Antonia Watson says bank's monitoring mortgage borrowers whose ability to repay was tested at 5.8% last year

[updated]

ANZ NZ annual profit surges 20% boosted by rising income and hedging gains

ANZ warns 'this is going to hurt' as it revises interest rate forecast higher

26th Oct 22, 3:51pm

23

ANZ warns 'this is going to hurt' as it revises interest rate forecast higher

Latest ANZ Business Outlook Survey shows a drop in business confidence and activity levels - but inflation expectations have risen again

26th Oct 22, 1:33pm

60

Latest ANZ Business Outlook Survey shows a drop in business confidence and activity levels - but inflation expectations have risen again

[updated]

ASB and HSBC are the next to raise fixed home loan rates. A feature is the steepness of their hikes for terms of 4 and 5 years. Both raised TD rates too, with ASB matching Kiwibank with a 4.5% one year offer. BNZ raises rates too

26th Oct 22, 8:46am

25

ASB and HSBC are the next to raise fixed home loan rates. A feature is the steepness of their hikes for terms of 4 and 5 years. Both raised TD rates too, with ASB matching Kiwibank with a 4.5% one year offer. BNZ raises rates too

Eyes on net interest margins as ANZ, Westpac and NAB/BNZ annual results swing into focus

26th Oct 22, 8:00am

Eyes on net interest margins as ANZ, Westpac and NAB/BNZ annual results swing into focus

Kiwibank is the next major bank to raised interest rates for both borrowers and savers, but because we are in the middle of a sharp global shift higher, New Zealand banks may have to move up again in the coming week or so

21st Oct 22, 9:31am

49

Kiwibank is the next major bank to raised interest rates for both borrowers and savers, but because we are in the middle of a sharp global shift higher, New Zealand banks may have to move up again in the coming week or so

[updated]

Fixed home loan rate rises are spreading with another major mortgage lender pushing through big increases. But in the background the causes are rising even further, meaning this won't end soon

20th Oct 22, 3:51pm

43

Fixed home loan rate rises are spreading with another major mortgage lender pushing through big increases. But in the background the causes are rising even further, meaning this won't end soon

[updated]

ANZ first to react to the much higher wholesale swap rates flowing from the surprise CPI data. Bank raises fixed home loan rates by about +45 bps and term deposit rates by about +30 bps

19th Oct 22, 4:11pm

155

ANZ first to react to the much higher wholesale swap rates flowing from the surprise CPI data. Bank raises fixed home loan rates by about +45 bps and term deposit rates by about +30 bps

All the wholesale signals point to a new round of fixed mortgage rate increases soon, even in a real estate market that's failing to fire this spring

18th Oct 22, 9:34am

60

All the wholesale signals point to a new round of fixed mortgage rate increases soon, even in a real estate market that's failing to fire this spring

Positive real rates across the curve is a key drag for gold says ANZ's gold analysts, with investment outflows, and rising geopolitical and economic risks are having a surprisingly limited impact on haven buying

15th Oct 22, 10:22am

11

Positive real rates across the curve is a key drag for gold says ANZ's gold analysts, with investment outflows, and rising geopolitical and economic risks are having a surprisingly limited impact on haven buying

[updated]

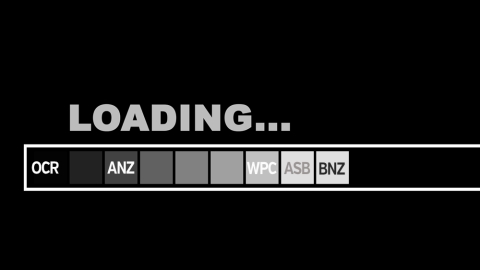

Most banks have been slow to respond to the October 5 RBNZ +50 bps hike to the OCR. They are only now getting around to making floating rate adjustments with Westpac, and now ASB & BNZ seven days after the OCR change

11th Oct 22, 4:31pm

21

Most banks have been slow to respond to the October 5 RBNZ +50 bps hike to the OCR. They are only now getting around to making floating rate adjustments with Westpac, and now ASB & BNZ seven days after the OCR change

[updated]

Banks start reining in credit card loyalty and rewards schemes as regulation of merchant service fees nears

5th Oct 22, 8:06am

47

Banks start reining in credit card loyalty and rewards schemes as regulation of merchant service fees nears

How keen are NZ's major banks to cough up for a Business Growth Fund to support SMEs in partnership with the Government?

3rd Oct 22, 9:36am

How keen are NZ's major banks to cough up for a Business Growth Fund to support SMEs in partnership with the Government?

Latest ANZ Business Outlook Survey shows an overall lift in business sentiment - but activity indicators in residential construction have hit a fresh low

29th Sep 22, 1:30pm

45

Latest ANZ Business Outlook Survey shows an overall lift in business sentiment - but activity indicators in residential construction have hit a fresh low

BNZ and Kiwibank raise fixed home loan rates in a restrained way, and join Westpac with a flatter rate card than both ANZ and ASB. The mortgage market now awaits the next RBNZ rate review

29th Sep 22, 9:36am

10

BNZ and Kiwibank raise fixed home loan rates in a restrained way, and join Westpac with a flatter rate card than both ANZ and ASB. The mortgage market now awaits the next RBNZ rate review

When the two year swap rate was last at Monday's level, that was back in May 2010 and the two year fixed mortgage rate was 7.30%. Who says it won't go back to that level?

26th Sep 22, 4:42pm

59

When the two year swap rate was last at Monday's level, that was back in May 2010 and the two year fixed mortgage rate was 7.30%. Who says it won't go back to that level?