Co-operative Bank

[updated]

ASB now offers the Kāinga Ora low deposit First Home Loan, boosted with a cashback. But borrowers face a hefty Lenders Mortgage Insurance

18th Feb 26, 9:08am

ASB now offers the Kāinga Ora low deposit First Home Loan, boosted with a cashback. But borrowers face a hefty Lenders Mortgage Insurance

The Co-operative Bank says a planned core system upgrade could allow it to grow personal banking

11th Aug 25, 1:00pm

The Co-operative Bank says a planned core system upgrade could allow it to grow personal banking

S&P Global Ratings raises its issuer credit rating on Liberty Financial by one notch to BBB, matching a trio of challenger banks

31st May 24, 11:01am

1

S&P Global Ratings raises its issuer credit rating on Liberty Financial by one notch to BBB, matching a trio of challenger banks

With open banking threatening to finally gather some pace in New Zealand, Worldline with Online EFTPOS has been one of the early movers

27th May 24, 12:33pm

4

With open banking threatening to finally gather some pace in New Zealand, Worldline with Online EFTPOS has been one of the early movers

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

1st Jul 21, 10:59am

29

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

The Coop Bank drops its fixed one year first-home buyer special by -10 bps to 1.99%. It has cut other short rates, but raised most longer fixed rates

16th Jun 21, 1:42pm

9

The Coop Bank drops its fixed one year first-home buyer special by -10 bps to 1.99%. It has cut other short rates, but raised most longer fixed rates

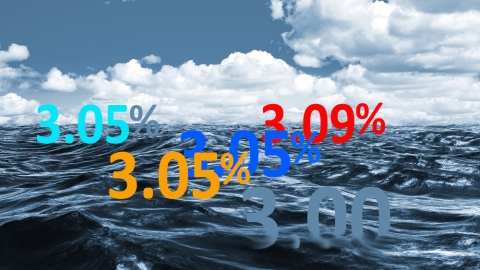

It is becoming a 2% world in the home loan sector as markets and regulators actively open up the space to cut rates further, and savers focus on 'safety' rather than 'return' for their nest eggs

13th May 20, 5:42pm

64

It is becoming a 2% world in the home loan sector as markets and regulators actively open up the space to cut rates further, and savers focus on 'safety' rather than 'return' for their nest eggs

Rapid fire breaks out in the mortgage wars as combatants each aim at marginally different territory. Borrowers watch as the landscape becomes very fluid very quickly

12th May 20, 4:21pm

15

Rapid fire breaks out in the mortgage wars as combatants each aim at marginally different territory. Borrowers watch as the landscape becomes very fluid very quickly

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

26th Mar 20, 8:57am

3

Fixed mortgage rate offers below 3% arrive with HSBC's Premier new one year and eighteen month rates. They cut all other fixed rates too

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

25th Mar 20, 10:42am

28

More banks make fixed home loan rate cuts and match them with steep term deposit rate cuts and the overall level of interest rates sink lower

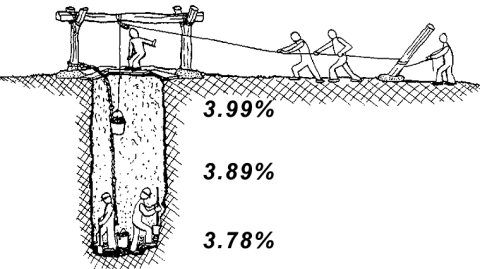

The Co-operative Bank dives into the fixed home loan rate pool, going lower for five fixed terms and making a splash with 6 month and one year fixed rates

8th Oct 19, 4:06pm

16

The Co-operative Bank dives into the fixed home loan rate pool, going lower for five fixed terms and making a splash with 6 month and one year fixed rates

Challenger bank SBS trims its key home loan rates to current levels to stay in touch with a falling market, with more evidence that most banks will match the lowest rate on offer, provided your financials are good

24th Aug 19, 11:12am

3

Challenger bank SBS trims its key home loan rates to current levels to stay in touch with a falling market, with more evidence that most banks will match the lowest rate on offer, provided your financials are good

The Co-operative Bank cuts most of their home loan rates with three of them now market-leading. They also made matching term deposit rate cuts

20th Aug 19, 7:04pm

15

The Co-operative Bank cuts most of their home loan rates with three of them now market-leading. They also made matching term deposit rate cuts

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

3rd Aug 19, 10:21am

8

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

In a falling mortgage rate market, a major lender shifts a key rate higher, putting it back in the middle of the pack

24th Jun 19, 12:06am

7

In a falling mortgage rate market, a major lender shifts a key rate higher, putting it back in the middle of the pack