responsible lending

Commerce Commission and Co-operative Bank reach settlement over unreasonable fees self reported by the bank

25th Nov 25, 1:47pm

Commerce Commission and Co-operative Bank reach settlement over unreasonable fees self reported by the bank

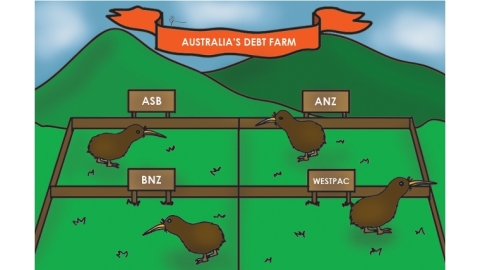

As the Commerce Commission's banking market study gets underway, Gareth Vaughan looks at the impact of regulation on competition

14th Jul 23, 8:32am

3

As the Commerce Commission's banking market study gets underway, Gareth Vaughan looks at the impact of regulation on competition

The Government's had another go at fixing problematic credit rules it first implemented nearly 18 months ago, but the bankers are still not thrilled

12th Apr 23, 1:57pm

6

The Government's had another go at fixing problematic credit rules it first implemented nearly 18 months ago, but the bankers are still not thrilled

Financial Services Federation unimpressed with National Party proposal to favour banks over its finance company, building society & credit union members

26th Sep 22, 10:12am

6

Financial Services Federation unimpressed with National Party proposal to favour banks over its finance company, building society & credit union members

[updated]

Amendments to the troubled credit rule changes last year will come into force on July 7, but the NZ Bankers' Association says the 'rushed' attempt to fix the problems won't make things easier for would-be borrowers

9th Jun 22, 10:31am

34

Amendments to the troubled credit rule changes last year will come into force on July 7, but the NZ Bankers' Association says the 'rushed' attempt to fix the problems won't make things easier for would-be borrowers

Gareth Vaughan looks at how and why a risk-off mindset is dominating at NZ's major banks

18th May 22, 1:52pm

1

Gareth Vaughan looks at how and why a risk-off mindset is dominating at NZ's major banks

CEO Dan Huggins says despite the weaker housing market, BNZ retains the appetite to grow lending; - responsibly

6th May 22, 10:35am

9

CEO Dan Huggins says despite the weaker housing market, BNZ retains the appetite to grow lending; - responsibly

CCCFA changes 'narrow refinements to specific aspects of regulations, rather than wholesale changes'

MBIE highlights where it sees lenders' interpretation and implementation of credit contracts and consumer finance regulations as too onerous and restrictive

8th Apr 22, 9:38am

MBIE highlights where it sees lenders' interpretation and implementation of credit contracts and consumer finance regulations as too onerous and restrictive

Opinion divided over how much more easily borrowers will be able to access credit under proposed changes to the CCCFA

11th Mar 22, 4:36pm

10

Opinion divided over how much more easily borrowers will be able to access credit under proposed changes to the CCCFA

David Clark unveils changes to responsible lending rules aimed at curbing unintended consequences of the Credit Contracts & Consumer Finance Act

11th Mar 22, 6:55am

116

David Clark unveils changes to responsible lending rules aimed at curbing unintended consequences of the Credit Contracts & Consumer Finance Act

Simon Jensen probes how financial regulations are put together in New Zealand, asking whether it's parliamentary democracy at work or benign dictatorship by officials

23rd Feb 22, 11:50am

27

Simon Jensen probes how financial regulations are put together in New Zealand, asking whether it's parliamentary democracy at work or benign dictatorship by officials

ASB's Vittoria Shortt sees 'clear' impact from credit contracts & consumer finance law changes, says there's no moral attachment to lending decisions

10th Feb 22, 8:12am

88

ASB's Vittoria Shortt sees 'clear' impact from credit contracts & consumer finance law changes, says there's no moral attachment to lending decisions

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

8th Feb 22, 1:21pm

155

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

Will changes to credit contracts and consumer finance laws lead to a government-induced credit crunch or protect borrowers from predatory lending?

16th Dec 21, 5:00am

69

Will changes to credit contracts and consumer finance laws lead to a government-induced credit crunch or protect borrowers from predatory lending?

Government consultation paper floats three options for addressing financial hardship caused by the buy now, pay later sector

9th Nov 21, 6:35pm

17

Government consultation paper floats three options for addressing financial hardship caused by the buy now, pay later sector