The economy's grown again for the second consecutive quarter, picking up from last year's deep recession - but everybody will be wondering whether the growth can last or indeed whether it's already starting to cool.

Statistics NZ reports that GDP grew 0.8% in the March quarter. That's appreciably more than the 0.4% the Reserve Bank (RBNZ) was forecasting, and was slightly higher than major bank economists expected even after several of them had sharply revised their forecasts up in recent days.

The GDP figures will be a big consideration for the RBNZ when it Monetary Policy Committee next meets to consider the Official Cash Rate (OCR) on July 9.

The latest GDP figure follows a 0.5% rise in the December quarter, which has been revised down from a first-announced 0.7% rise.

Over the year to March 2025 GDP fell 1.1% compared with the year ended March 2024.

Westpac senior economist Michael Gordon said with the economy regaining its footing sooner than expected after last year’s sharp downturn, he continued to expect that the RBNZ will take the opportunity to "pause and assess the situation" at its July OCR review.

"However, that assessment will depend on how things are looking going forward," he said.

"The RBNZ has already factored in a soft 0.2% rise in GDP for the June quarter – partly adjusting for the residual seasonality that has crept into the GDP figures. Our forecast currently sits at 0.6%, but we will assess this in the next couple of weeks."

ASB economist Wesley Tanuvasa said repair of the economy is under way "but significant risks are apparent".

"Data since March suggest sizeable deceleration in economic activity. Geopolitical deterioration in the Middle East presents upside risks to inflation and therefore pricing behaviour," he said.

"We think the RBNZ will pause in July. Beyond that, it’s a tightrope walk of what seems to be stagflationary risks. We do not envy the hand our friends at 2 The Terrace have been dealt."

Finance Minister Nicola Willis said the latest GDP figures are "great news for workers, families and businesses".

"Inflation is down, interest rates are down, and many families have a little more money in their pockets," she said. "That money is flowing through to business tills aided by the steps the Government has taken to reduce red tape, incentivise investment and boost tourism, and the export records being set by New Zealand farmers and growers."

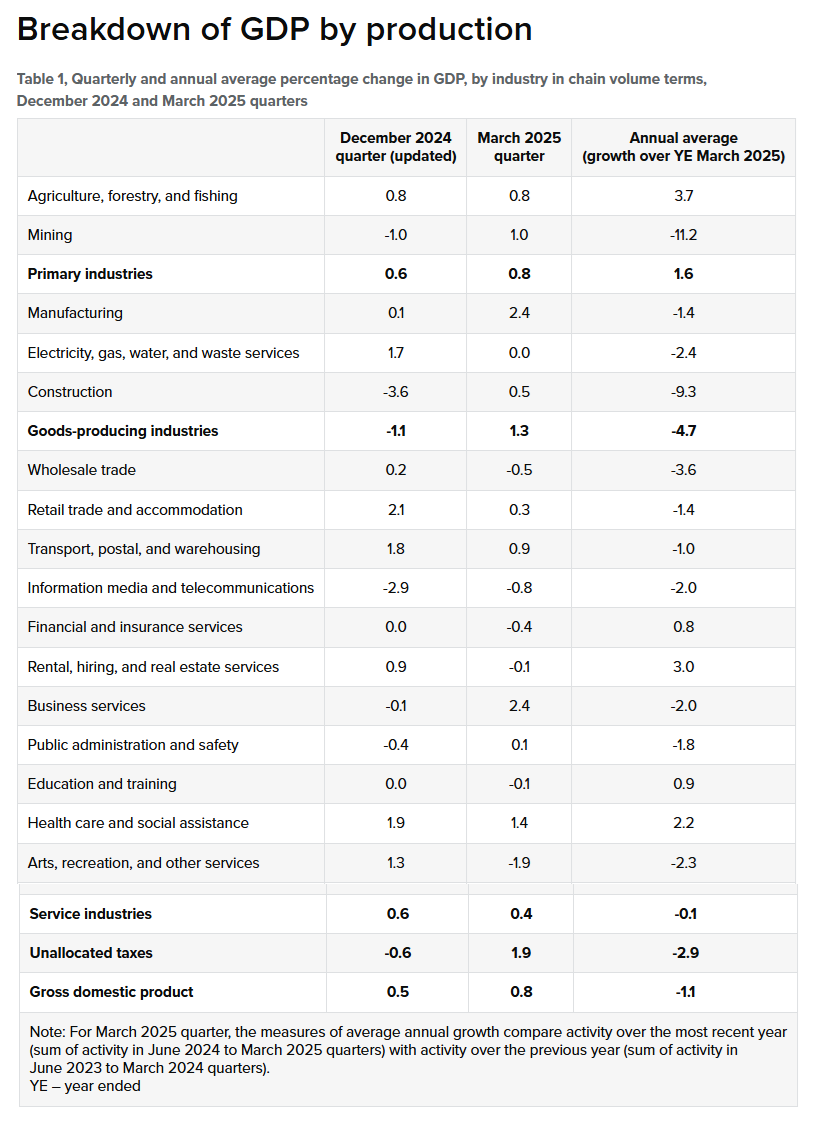

Stats NZ said activity increased in the March 2025 quarter across all three high-level industry groups: primary industries, goods-producing industries, and services industries.

“At a more detailed industry level, nine of the 16 industries increased, with the largest rises in business services and manufacturing,” Stats NZ's economic growth spokesperson Katrina Dewbery said.

The rise in manufacturing was led by an increase in the production of machinery and equipment. This was reflected in increases for components of both investment and exports associated with this type of manufacturing output.

The largest decreases were seen in arts and recreation services, and information, media, and telecommunications.

GDP per capita rose 0.5% during the March 2025 quarter.

The expenditure measure of GDP rose 0.9% during the March 2025 quarter, following a 0.6% rise in the December 2024 quarter.

Household consumption expenditure rose 1.4% this quarter, with expenditure on services, durables, and non-durables all up. The increased spending on services was driven by rises in cultural services, other digital services imports, and accommodation services.

However, while the GDP figures for the past two quarters represent a recovery when placed against the dire -1.0% GDP outturns (Stats NZ revised these up from the originally stated -1.1% figures) reported for both the June and September quarters, last year, enthusiasm is likely to be tempered by recent 'high frequency indicators' suggesting that the economy might have frozen up again in the June 2025 quarter.

The BNZ-BusinessNZ' Performance of Manufacturing Index released at the end of last week and Performance of Services Index released at the beginning of this week both slumped sharply last month, with BNZ economists saying the combined data "look nothing short of disastrous" and those results "are consistent with the economy returning to recession".

The big downturn in the economy, which culminated in the recession last year, came after the Reserve Bank (RBNZ) had hiked the Official Cash Rate (OCR) up all the way from just 0.25% to 5.5% in order to stamp out a wave of price hikes that saw inflation surge to 7.3% by mid-2022.

Inflation's now back within the targeted 1% to 3% range, at 2.5%. Unemployment's risen, having hit 5.1%, after at one point being as low as just 3.2%.

The RBNZ's now pushing the OCR down, having dropped it in a series of cuts since August 2024 to the current 3.25%. The big question now is whether it will cut again at the next review on July 9, or will pause. At face value Thursday's GDP outcome might suggest a 'hold', but the RBNZ may be more minded to look more at the more recent 'high frequency' economic data pointing to the economy slowing again after the March quarter.

9 Comments

Risk of stagflation sounds bad…

N Willis says we are booming due to her great management....

Does not feel that Boomie

Well we all know both services and manufacturing have tanked since this data was collected, so what do we have to cheer about apart from a bit of dairy farming?

The red meat sector is, beef and sheep meat doing very well.

Also fruit such as kiwifruit and apples.

All commodities. The more things change the more they stay the same.

‘’ apart from a bit of Dairy farming “

Did you mean the $27 billion worth of exports dairy sector ?

Agriculture forestry + fishing, Real estate, and healthcare carrying the economy. Certain age brackets downsizing and needing greater private healthcare one could propose.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.