Is it a stall? Or a full-blown slump? And is it a short run thing? Or something that threatens the hoped for economic recovery?

Some, but possibly not all of the above questions will be answered when Statistics NZ releases the GDP figures for the June quarter this coming Thursday, September 18.

And, yes, these (GDP) figures are, as is always the case, coming out a long time after the quarter in question has finished.

Indeed the June quarter GDP figures are already seeming to be a bit like one of those meals that you've over-prepared and by the time you get to eating it, feel like you've already had it. I think we need to keep stressing the fact that, particularly our GDP information, is not timely enough - in the hope that at some stage we will get a more timely data information series on our economy.

But timely or not, the latest GDP figures will be important nevertheless and will be a key influence on what the Reserve Bank (RBNZ) decides to do with interest rates between now and the end of the year - given that it's still got two Official Cash Rate (OCR) reviews to go, on October 8 and November 26.

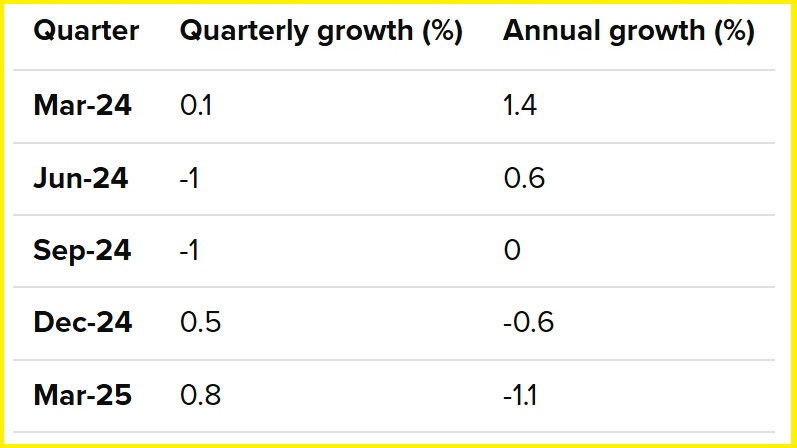

If we recall, the March quarter GDP figures (released in June) showed a rise of 0.8%, following a 0.5% gain in the December quarter. But these rises had followed 1.0% drops in both the June and September 2024 quarters.

Following the decision of the RBNZ to start progressively dropping the OCR from August 2024 onwards down from its 5.5% cycle high, there was obviously keen interest in how quickly the economy could start to bounce back from a recession the RBNZ earlier conceded it had set out to cause - all in order to bring inflation back into the targeted 1% to 3% range.

And those December and March quarter GDP outcomes, while not brilliant, offered some encouragement. However, as early as June even before the March quarter GDP figures had been released, there came indications from some of the lower level high frequency data that the economy had run up against a brick wall. Uncertainty around tariffs would appear to have been a big part of this.

The RBNZ took all the signs that the economy was stalling again on board - eventually - and at its last OCR Review/Monetary Policy Statement release on August 20, it cut the OCR to 3.00% from 3.25%. But, more significantly, it suggested it may take the OCR down to 2.5% before the end of the year. Undoubtedly a key driver for this 'dovish pivot' was the RBNZ's forecast that GDP will have fallen 0.3% in the June quarter. And the central bank's therefore now decided more encouragement is needed for the economy to get going again.

As mentioned above, a glance back at our quarterly GDP performances over the past year or so reveals a pretty 'spotty' performance:

What comes next then? Well, as we said above, the RBNZ's most recent (August) forecast was for a 0.3% drop in GDP for the June quarter, which was a big change from the previous forecast in May of a +0.3% figure. Without having seen all of the major bank economists' picks at time of writing, it appears predictions are coming out in a -0.2% to -0.5% range.

What clues have we had so far as to where the figure may land? Well, we've had the release of some so-called 'partial indicators', IE component parts of GDP.

And this has backed up the idea that the economy did indeed go back into stall mode in the June quarter.

The volume of total manufacturing sales fell 2.9% in the June quarter, following a 2.4% rise in the March 2025 quarter. Wholesale trade sales fell a seasonally adjusted 0.1% after a 3.4% rise in the March quarter.

The seasonally adjusted volume of building work done in the June quarter fell 1.8%, which was a bit weaker than expected after an upwardly revised 1.3% rise in the March quarter. Separate construction sales data released at the same as the manufacturing sales figures showed a 3.1% drop in sales after a 0.7% rise in the March quarter.

Retailers have been struggling as we know, but retail trade volumes rose 0.5% in the June quarter - wrong footing most economists who had picked a fall. The June quarter rise in retail sales activity, followed on from a 0.8% rise in the March quarter. These figures are arguably a bright spot among the various GDP components - but it has to be stressed that retail trading is coming off a VERY low base.

All in all then, it's looking like we may see a drop in GDP of 0.2% to 0.5% for the quarter. Does this have any immediate ramifications?

Well, not really. A result of that magnitude is going to be very much in line with what the RBNZ was seeing when it made its OCR decision and forecasts last month. So, the RBNZ is not likely to be 'blown off course'.

A 0.2%-0.5% GDP drop therefore could be expected to lead us to another OCR cut (to 2.75%) next month.

We won't see the September quarter GDP results till mid December - after the RBNZ has made its final OCR decision for 2025. What we will see between the October OCR decision and the November OCR decision is the September quarter inflation figures (October 20) and the September quarter labour market figures (November 5).

The RBNZ's already mentally prepared itself for the next annual inflation rate figure to be up around the top of the targeted 1% to 3% zone, if indeed not actually above it, so, it's unlikely to be spooked by what it sees.

Perhaps the only thing between now and the end of the year that could prompt the RBNZ to rethink the basic supposition that it will drop the OCR to 2.5% before Christmas would be significant signs of a recovery in the labour market. But while the unemployment rate looks somewhere close to the top of the cycle at the current 5.2%, there seems little sign of an imminent sudden improvement.

So, to go back to the questions posed at the top of this article, and addressing particularly the key one; is the expected drop in GDP during the June quarter going to be a short-run stall?

Well, probably. The most recent high frequency data, including that about manufacturing, services and retail, has suggested signs of life. The RBNZ people were adamant at the press conference after the August OCR announcement that the June quarter would prove to be the nadir.

Whatever ailed us during the second quarter, whether it be tariff concerns and the like, appears to be passing. The interest rate drops we've seen so far are working through. The thought then is that the third quarter will be better - not roaring away, by any means, but better. And indeed, the RBNZ's most recent forecast is for a 0.3% rise in the September quarter and then a stronger, 0.8% lift in the December quarter.

Any signs that future growth is looking weaker than that will start conjecture that the OCR might need to be lower than 2.5% next year - but equally, any sign that inflation may head north of 3% and not look like coming down soon could push against that.

For now though, what we can say is it seems a given that the economy did sag again in the second quarter of this year - but that the pick up is now under way again - and the RBNZ is going to continue helping that with further OCR reductions before the end of 2025. Onwards and upwards. Eventually.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

21 Comments

Good article David

So by the Nov 26 OCR decision the RB will already have an early read on GDP for Sept.

They don't have to, and they shouldn't keep dropping interest rates if the Sept qtr GDP is looking up

Lower and lower int rates will only cause another overshoot... who needs it

Yes, an overshoot looks likely, with real estate going crazy again. That's the last thing we need. Consistent asset growth that keeps pace with inflation would be ideal, otherwise another bubble could develop.

We've had many false dawns like this before. One quarter shows promising numbers only to dive again in the next quarter. If we're not going to have another property boom, what's going to take its place as the "feel good" driver?

Kiwisaver balances trending up perhaps, as a growing % of the working population see this as their retirement savings rather than the house.

Yes but on the other side of the ledger is possibility of falling equity based wealth, and related mood , stocks are at record high forward valuations.

Depends how close to retirement one is, although the FHB withdrawal provision has messed things up a bit.

At least people aren't generally still indebted to their equity based wealth, I'd also hope there's a growing % that aren't phased by short term paper losses that will DCA through anyway.

Presume the majority that are on default low risk schemes giving consistent meager returns will be happy as they don't know any better.

You can project ahead really easily.

Measure the amount of energy going into the system.

Measure the materials going into the system.

Add an entropy factor, per materials accumulation, per time.

And then instead of waffling about 'in the hope that at some stage we will get a more timely data information series on our economy', maybe we could plot the curve as we peak, then decline. That is unarguable at global level - this being a finite planet and we hoeing into it best-first in all things - but who gets what portion of the remaining planet is up for contention.

Which is why geopolitics is looking uglier. Which is why myopically fixating on an already-artificial number, is akin to tea-leaf-reading.

For those who don't understand the above, try not eating, and every morning check your output on an exercycle. You'll need an assistant to record the final days - entropy wins. And society, as constructed, is just a bigger organism; the same science applies. Wanna grow? Gotta eat. Measure the food.

Sometimes it seems the only methodology around a recovery is basically “what goes down must come back up.” There’s a myriad of more structural events that have taken place over the last 20 years that, because house prices have largely risen, complacency has allowed them to become negatives. We may get a bounce but I can’t help thinking we need a positive shock to shake us out of this PCDD ( Post Covid Depression Disorder) and I’m not sure what it is right now. I’m hoping the agricultural sector will continue to grow and farmers will get their wallets out but think we need another 12 months before this happens. The guys I know are still paying down the bank debt. Substantially lower rates work but only to kick the can down the road.

If past commodity booms are anything to go by, dairy farmers aren't the economic saviors many like to think they are. They know all too well that rainy day funds are essential over the long run.

Marginal farms still turning to forestry, it does not consume services compared to sheep. AKL and WGTN will not pickup on the back of Agri, not like Fielding or Gisborne etc. The cities are still being hit by off shoring, right sizing and now AI. Rate rises stretch into the distance, high power prices, insurance premiums consuming any gains from OCR reduction.

Our young 20 somethings renting simply see the delta of income growth to cost of living, and are attracted to the 10% aussie workers get in employer contributions, plus the average income in aussie being 102k vs 75k here.

For the 20 years before 2021 our houses often earned an entire salary of tax free capital gains, accessed via top up mortgages, Its no wonder we feel we are going nowhere now, even if we can just pay the bills. Many that did use equity to buy a rental are now wondering about a strategy involving top up payments out of tax paid wages. We are both grieving the end free capital gains and searching to replace their feel good effect. Some think back on track means returning to tax free capital gains, where sustainability indicates housing long term can only grown with income growth ie rate of inflation....

With so much profit from banking, insurance and large corporates flowing off shore to shareholders, there is little investment going back into NZ to produce jobs. Our success stories like Xero and RocketLab have to look offshore to grow, and take our talent with them.

There is simply no easy growth story or we would already be doing it, The growth stories we had were leveraged by credit, now its the part of the cycle where over bid assets fall back to yield based valuations free of significant capital gains. Deflation stories now. Not much exciting here to invest in, little beef calves look interesting , but not really an option for most Auckland townhouse owners.

We're doomed! We're doomed, Captain Manwaring sir. If only everybody did their bit eh. I like what the govt is doing with building regulation, Chris Penk was on the wireless today with the eminently sensible Peter Wolfkamp

Classic.

Shoot the messenger, to shoot the otherwise unshootable message.

Very common around here...

Everyone did there bit too well, hence so many own overvalued houses...

What's the answer, 80sqm Granny flats. I assume Granny has sold her own home.

Land and housing has been a retirement fund for generations since the settlers came.

Where once one could sell the farm and retire well, these got gobbled up by multinational conglomerates and investors. Some slice pieces off the farm and sell off or build on that to downsize, and it continues if zoning allows.

Others slowly over generations have sliced up and sold off pieces of sections in towns and cities, which seems to be the main trend in property I see. Move the house to the back (or front) with a crane, subdivide and build 2 other houses then rent out or sell these. This will go on as able until we have greater intensification, however granny flats will make it harder for future owners to do this.

How many times can one slice an apple before it won't be enough to fill one's belly.

There always seems to be buy and flick types trying to make a fast dollar. Our family has been the longterm hold type

But yes with more people in the land of the long cloud than ever before we have to live closer and closer to each other if we don't want extended commuting times. I'll hazard a guess that PDK agrees

I actually think 2 days a week WFH means people will accept a longer commute the other three days. More people are happier to live in say Matakana or even commute from Omaha or Waiheke, prices have held up better in rural lifestyle areas then inner suburbs.

The computer says yes and no.

1. Not All Rural Areas Are Resilient. The strength of lifestyle markets depends on:

Proximity to a major city

Access to fast broadband and reliable transport

Flood/storm risk and insurance availability

Far-flung or poorly connected rural areas haven’t performed as well.

2. Inner Suburbs Still Have a Floor

While inner suburbs may have softened due to high interest rates and migration to the outer belt, they still benefit from:

Access to amenities, public transport, and schools

Rental demand:

Some have seen a recovery in Q2–Q3 2025, especially where urban regeneration is occurring.

Not doomed...but indications are we wont change track until forced by circumstance....all too late.

Our future is France if we do not change our structural deficit.

The Fitch agency downgraded France’s credit rating on Friday, as President Emmanuel Macron struggles with political instability and disagreements on how to put the country’s strained public finances in order.

The US rating agency, one of the top global institutions gauging the financial solidity of sovereign borrowers, downgraded France on its ability to pay back debts, from “AA-” to “A+”, the country’s lowest level on record at a major credit rating agency.

A lowering of the retirement age?

Indeed..everywhere

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.