There's still no obvious sign of a 'spring bounce' yet for mortgage lending, with the latest sector lending figures from the Reserve Bank (RBNZ) showing that the increase in total mortgage stock in September was exactly the same as that seen in August - and well under a billion dollars.

The fact that the rise in the mortgage stock in September was exactly the same as the low level of increase seen in August meant the annual growth rate of the mortgage pile continued slow following the massive growth during the previous two years.

The September rise of $950 million in the total mortgage stock (this is for both banks and non-bank deposit lending institutions) took the total to $342.236 billion.

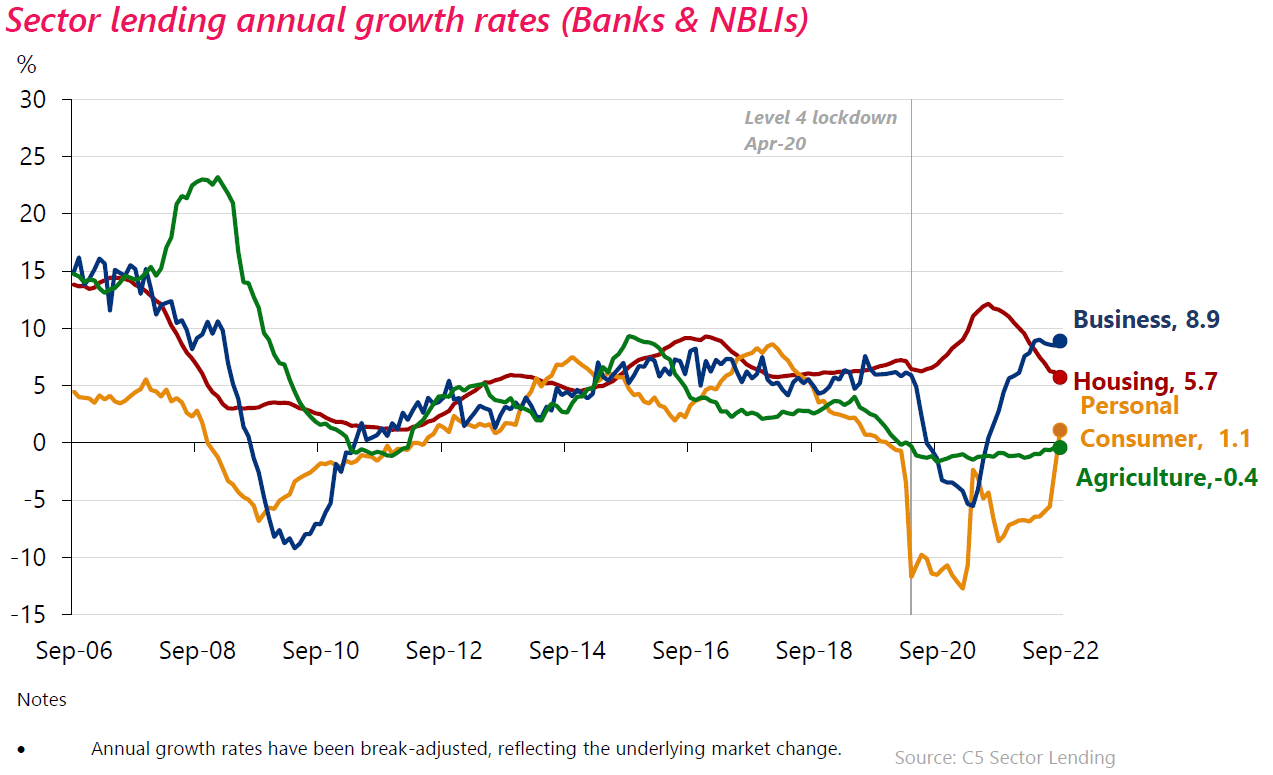

But the annual growth rate slowed to just 5.7%, from 6.2% a month earlier.

This is the slowest rate of increase seen since February 2018 and compares with an annual growth rate of 11.6% as of September 2021.

Running counter to the mortgage figures, however was an $88 million increase in consumer borrowing, taking the stock of consumer lending (again both banks and non-bank lending institutions are included) to $13.346 billion.

It's the first monthly increase since late 2021, but more significantly, sees annual positive growth in the consumer debt pile of 1.1%. This is the first time in nearly three years there has been an annual increase in the consumer debt pile.

The RBNZ reports that in September total business lending stock increased by $1.6 billion to $131.259 billion, which was up on the $776 million increase reported last month. Annual growth in the business lending pile has increased from 8.5% to 8.9%, which is close to a recent peak seen in May 2022 of 9%.

Total agriculture lending stock decreased by $210 million (-0.3%) to $62.035 billion. Annual growth rate remains unchanged at -0.4%.

On the bank deposits front, there were perhaps some signs of savers looking to stash the cash a little more again. The $1.1 billion rise in total deposits to just under $225 billion was numerically the largest rise in three months, although annual growth at 7.7% continued a recent pattern of slowing.

Term deposits befitting the somewhat higher interest rates now on offer hit their highest level in two years, at around $98 billion, up over $1.6 billion in the past month and approaching $15 billion higher than at the start of the year.

8 Comments

"This is the slowest rate of increase seen since February 2018 and compares with an annual growth rate of 11.6% as of September 2021"

The teachings of St Landers of Cheaper Tomorrow are sweeping across the nation.

Good news!

It's good to see business lending growth overtake housing.

Hopefully its for new machinery and jobs as opposed to borrowing just to pay wages, rent.

That would depend. The idea that banks can shift their model towards lending for productive purposes overnight is a bit of a pipedream at this stage.

I know this may not be in the scrolls but once house prices record some more double digit (annual) declines over the next few years, maybe then we shall see double digit growth in mortgage lending. This would be subject to the banks remaining well capitalized and still willing to lend after such a brutal adjustment. At current interest rate settings and even after the decline in prices over the last year, prices are still unaffordable for many and unsupported by investor/Landlords on a noteworthy scale. Interest rates are still heading higher from here!

Rental yields don't reflect the risk involved when stacked against the relative risk free term deposits of 5%pa. Then there's the loss of the effortless capital gain factor that was once upon a time was the honeypot to the whole deal.

Potentially, if there's an overshoot, the coming decline in pricing could take us back to pre GFC (2007) levels.

Another Ireland.

No worries according to Kaumatua Orr's team. They have stress tested the banks and everything's sweet up to 49% price declines and 9% unemployment.

O ye of little faith.

Um, stating the obvious a bit here. That’s generally what happens when there is a major credit crunch on. Doesn’t just impact mortgage lending either.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.