BNZ economists say the current inflationary pressures in the economy will be "a semi-permanent state of affairs".

In the bank's latest Markets Outlook publication, BNZ head of research Stephen Toplis says there are many who believe the current rise in cost pressures will be temporary.

"We accept there is a temporary element to some of the price increases but any relief for the current input price pressures will not be coming soon," he says.

"Furthermore, it looks increasingly likely that a post-Covid demand explosion in the developed world will result in a wide-spread rise in inflationary pressure as supply takes longer to be resurrected than demand requires. This process will be exacerbated by the fact that supply bottlenecks caused by Covid-afflictions in the low-cost production developing world are likely to take longer to resolve."

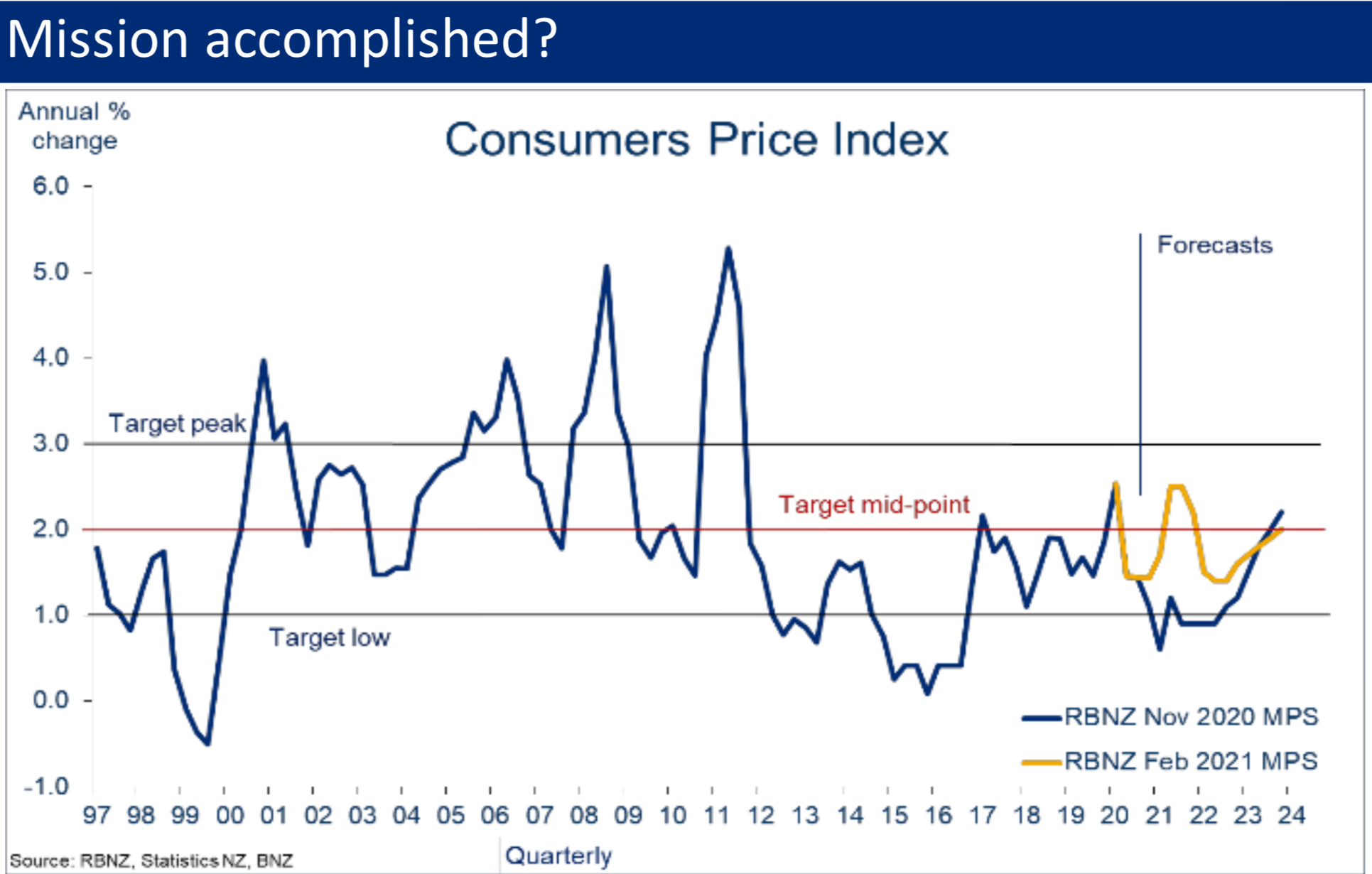

In New Zealand the Reserve Bank targets inflation of between 1% and 3% - with an explicit aim of 2%.

Toplis says while "headline" inflation may only have reached 1.5% in the year to March 2021, the key "core" inflation measures are at or near 2.0%.

"Moreover, the -0.5% reported in the June quarter of 2020 will soon drop out of the annual calculation so any reading above zero for June 2021 will see annual headline inflation with a “2” fronting it.

It's already here

"We are forecasting a 0.6% increase for the quarter yielding 2.6% annual inflation. Another way of thinking about this is that CPI inflation for the three quarters to March 2021 was already 2.0%," he says.

"And we do think we are witnessing a semi-permanent state of affairs. Indeed, we are forecasting annual CPI inflation to rise to 3.0% by the end of this year and for it to stay above 2.0% for most of the foreseeable future. High business pricing intentions strongly support this view."

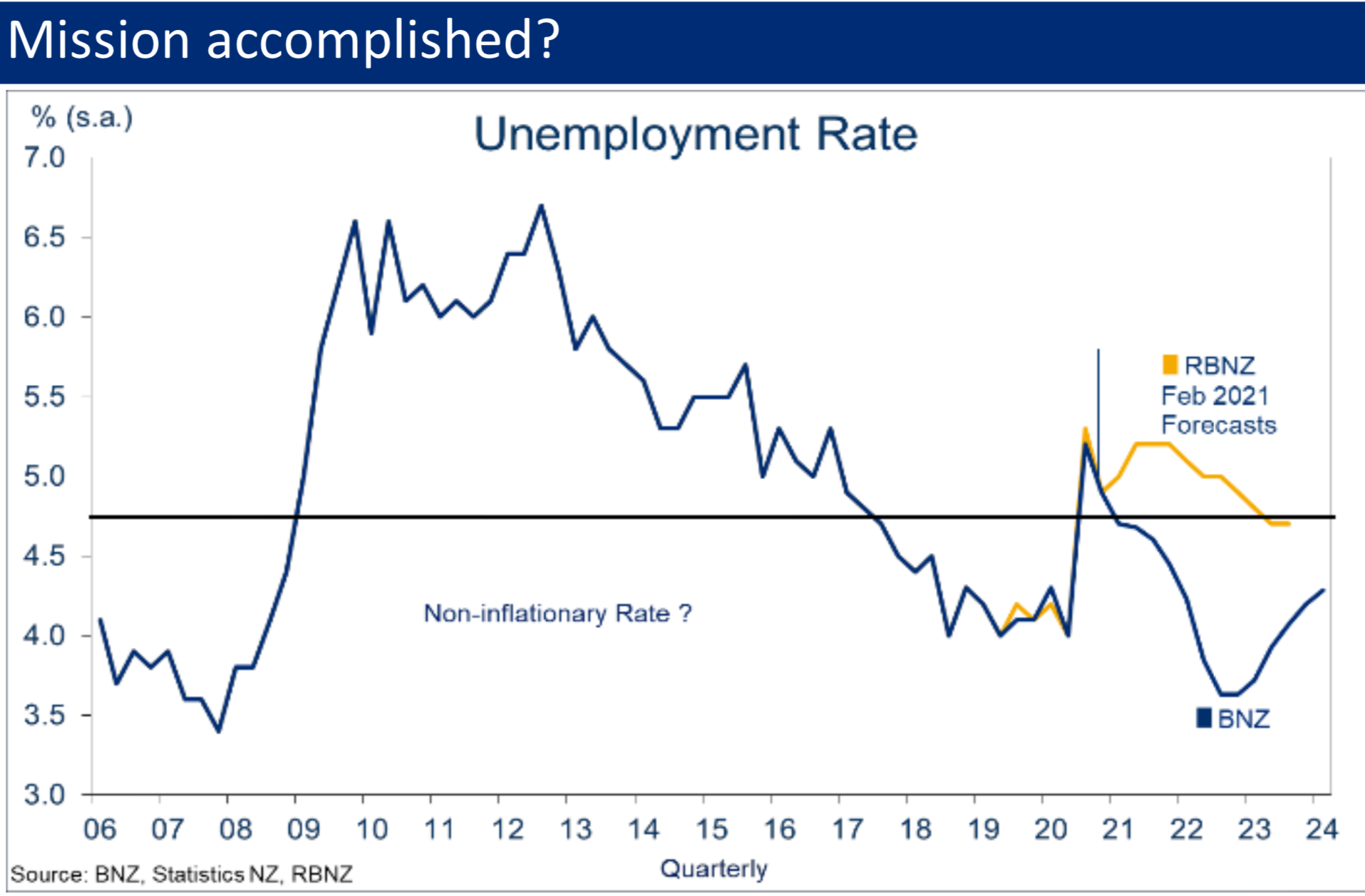

In terms of maximum sustainable employment (MSE), which the RBNZ also has to consider in its monetary policy, the unemployment rate has already fallen to 4.7%. This is well below the 5.0% the RBNZ was expecting.

"We can only see the current excess demand for labour growing further," Toplis says.

"Hiring intentions are consistent with annual employment growth in excess of 3.0%. This simply cannot happen as labour supply is insufficient. We are forecasting employment growth of just 1.5% but even this is enough to see the unemployment rate drop to below 4.0% within twelve months. The Reserve Bank’s latest forecasts have the unemployment rate above 5.0% until the end of next year. That is looking increasingly unlikely."

Toplis says the BNZ economists are "quick to point out" that current inflation is "more of the cost-push variety than demand pull".

"This is important as the RBNZ (as is the case with most central banks these days) wants to see evidence of rising wage inflation to confirm inflationary pressures are mounting.

"In doing this it may be looking in the wrong direction. Wage inflation may be muted but the cost of labour to businesses is rising sharply. This is squeezing margins and will, ultimately, result in further hikes in selling prices."

At the moment the Official Cash Rate set by the RBNZ is at 0.25%, which is where it has been since the central bank slashed it last March as the Covid crisis rapidly developed. For some considerable time it appeared we would see negative interest rates this year. But the situation has evolved quickly this year.

The BNZ economists have previously forecast that the RBNZ will start raising the OCR next year. Earlier in the year, independent economic researchers Capital Economics forecast OCR hikes would start next year. And economists at the country's largest bank ANZ have changed their call and they now see OCR hikes beginning next year.

Watching the language

The RBNZ has its latest review of rates coming up next week, on Wednesday, May 26. There will be no changes in settings as such, but any change in language will be closely watched.

Toplis says it’s hard to see how the RBNZ’s May Monetary Statement could be more dovish than its February equivalent.

"It could, however, display a distinct tilt to the less dovish side. In our opinion, the labour market is turning out to be tighter than the RBNZ had expected and the outlook for CPI inflation higher. If the Reserve Bank has come to the same conclusion then it would also be consistent to conclude monetary conditions don’t need to be as easy as previously assumed.

"This is all well and good but, even if the RBNZ has moved towards our camp, it has three big questions to answer: - Are the more hawkish economic conditions threatening to become permanent or are they transitory? - How much time does the Bank have to convince itself? - How does it acknowledge the changing environment without creating a market over-reaction?"

Toplis says the RBNZ will feel it has time on its side.

The big test for the RBNZ

"While inflationary pressures might rise to levels that make the Bank uncomfortable, they are not likely to do so outrageously. For example, annual CPI inflation could, say, jump over 4.0% relatively quickly but that would not exactly be miles away from target. It’s hardly the double-digit inflation of yesteryear. Moreover, with households highly leveraged, the RBNZ will be reassured that it should only require a modest increase in interest rates to rein in any excesses that might develop.

"The big test for the RBNZ is how does it acknowledge the evolution we are witnessing without scaring markets.

"We completely understand why the RBNZ would not want rates to rise yet, nor the NZD for that matter. But, at the same time, the Bank’s credibility would be threatened if it didn’t acknowledge price pressures have risen.

"Somehow it needs to find a way to prevent a market over-reaction while still signalling that the possibility of tighter conditions has increased.

"We will watch this tightrope walking with interest."

35 Comments

'Current excess demand for labour' = 135,000 people actively looking for work and another 225,000 wanting to work more.

Time to polish the lens of the "look through" telescope Mr Orr. Let me know what you see on the other side.

Ooh look there Adrian. Its Uranus.

Does the RBNZ have credibility to lose?

Oh let’s just wait till the next review end of this month. They will pull the same rhetoric if “wait and watch” and “won’t hesitate going into negative OCR territory”. Absolutely mind bogglingly useless. My 2 year old will make much better financial decisions than the lot in RBNZ. Shameless.

"Without scaring markets"

Ah poor dears, no more sweeties... taper tantrum to follow.

Numbers are good aren't they?

Some inflation numbers for the USA.

The first four monthly inflation figures are in order. 0.2%, 0.4%, 0.6%, 0.8%.

4 month total 2%.

If they manage to hold it at that 4 month figure, annual inflation will be 6%

If they manage to keep the following monthly figures to no more than April, 8.4%

If the following monthly figures continue on the same arithmetic progression, 15.6% inflation.

Any body care to guess where this is headed?

What will the FED do? Let it run or stop printing money and put up interest rates?

If they stop the loose money what would happen? I somehow doubt that they will tighten significantly.

If things carry on :-

What happen in their bond market?

What will happen to their share market?

What will happen to their currency?

What will happen to the, is it trillions, of dollar denominated debt that China and others hold. Sure the USA will pay it back with USA$, they can print as many as they like. Will they be worth anything?

Will any body ever lend them money again?

Will they have to sell most of their productive assets and beg foreign countries to invest in the USA so that they can create real industry that will provide real jobs producing real products so that the USA can work it's way out of the mess.

What will happen to USA politics? Trump?

Hint.

Think Germany after first world war. Argentina, Venezuela, Zimbabwe.

The States are at a point now where all their crazy economic management may well catch up with them and they are going to be dealt a good dose of reality. Our turn is coming too.

How will the geopolitics with China and Russia pan out

How will this affect us?

Are we headed down the same track?

What can we do insulate ourselves?

Are we headed down the same track? i'd say so as Mr Orr seems to be following orders from the Fed.

As for 'temporary' cost pressures..give us a break. Once inflation is unleashed it's all on. They have spent billions trying to create inflation...do they really believe they can just turn it on and off like a switch?

.

The criminal and totally immoral effect of that is that savers will be crucified and the property speculators will receive their long hoped for reward yet again. Inflation will pay off their mortgage and first home house buyers will be once again totally screwed by this kind and caring government.

already looking grim, in real terms (ignoring CPI), the reduced purchasing power of the USD is astonishing

https://wolfstreet.com/2021/05/12/its-getting-serious-dollars-purchasin…

Well, at least Orr will be in good company when history looks back at his tenure.

Greenspan didn’t understand what was really going on at the time either.

In the end the markets weren’t scared - they were obliterated.

Macroeconomists are still taking pages out of their industrial age playbooks.

RBNZ's decisions would've led to somewhat better outcomes in the context of a more industrialised or innovative economy.

Did they really believe making capital cheaper in a national economy heavily reliant on capital-shallow, labour-intensive sectors and unimaginative business practices produce anything but asset inflation?

> "Somehow it needs to find a way to prevent a market over-reaction while still signalling that the possibility of tighter conditions has increased."

I'm waiting with baited breath/popcorn to see how they thread that needle. Seems mutually exclusive to me.

... The length, depth, and scope of the recession can depend on the size of the initial expansionary policy and on any (ultimately futile) attempts to ease the recession in ways that prop up unproductive investments or prevent labor, capital, and financial markets from adjusting.

https://www.investopedia.com/terms/a/austrian_school.asp

With the QE expansionary policy having been in action now for 10+ years I'll take odds on length, depth, and scope of the incoming recession below.

Someone needs to change what's in the CPI basket and fast because the overshoot in inflation is simply not being measured. A couple of percent inflation is a joke and we all know it. Just wait for the new RV's and your new rates bill to come in. Tauranga is getting the new wheelie bin service starting 1st July which is great but that's another couple of hundred bucks a year on its own. Our rates are going to skyrocket on the back of everyone's "Feel good" vibe about how much their house is now worth, perfect timing with the recent massive gains to slip that one in under the radar.

True. Sounds like councils are having a gala time with this housing frenzy.

Collecting rates at higher percentages on higher RVs from a rapidly growing pool of ratepayers (subdivisions, denser housing, etc.). The Crown has earmarked billions in local council grants for water and housing infrastructure.

Higher RVs don't mean higher rates unless your RV has gone up/down disproportionately compared to other properties in your city.

RVs could go down and rates go up for example. It is the council budgets that set the absolute value of rates needed and then RVs are used to share that out among the properties.

Oh the councils will answer that your rates are not calculated on the value of your property, it is the total rates requirement for which your property will be assessed pro rata on its value. Which is mealy mouthed obfuscation, saying the same thing. And yes of course that huge escalation in their ratepayers house values in turn means that that total rates requirement can be raised accordingly. Councils speak with forked tongue.

Not going to happen. The govt has promised not to introduce any new taxes. So how do they pay for their increase in spending? Though an inflation tax. A tax that doesn't exist as far as the govt is concerned (aka CPI), but does exist as far as reality is concerned (aka actual price increases).

I feel bad for young kiwi's saving to buy a house. Inflation is going to erode that deposit away faster than they can save. Not that anyone over 40 in this country cares about people under 40.

I do.

Inflation is simply a redistribution of money. If someone is paying more, someone is getting more. A smart Govt would therefore be looking beneath the headline indicators and asking...

(a) what is causing prices to increase for specific goods / sectors / services?

(b) are the redistribution effects of this inflation desirable or not? if not, then what action can we take?

(c) is there a risk of widespread and long-term inflation across the economy? if so, what are the specific drivers of this inflation and what can we do about it?

So, let's say minimum wage for evening workers goes up $5 / hour and restaurants have to put up their prices. We have inflation in a particular sector [check]. We have redistribution of money from reasonably wealthy restaurant go-ers to people on minimum wage [all good]. There is little risk of a spiral of inflation as the people going to most restaurants are in jobs where the wages are very sticky [nothing to see here]

Now run increased cost of tobacco through the same checklist.

I have come to the conclusion that for you to get more, someone else has to get less. That person may not even be in this country but the effect is getting worse and worse as the population grows and the world resources diminish.

It's called getting ahead.

A religion to some and as with many religions it requires zero peripheral vision.

No, inflation is a tax, not a redistribution.

Auckland rates continue to increase at 3.5%, above the rate of inflation. Add a special one off 5% from feckless Phil to cover their reckless spending and climate change.

Tell me thats not inflationary.

Tauranga CC are putting rates up by 12%. Good grief.

Wow. But rates in TGA have be to low for way to long thanks to all the retired that vote for that. Add in a massive wave of ecocomic refugees from the s@#t show in Awkland....and vola. Today's mess.

This is actually really interesting. Effectively Stephen Toplis is saying the RBNZ will tolerate an increase in the CPI above the 3% upper band so long as the believe the increase is temporary. It is a incredibly risk-on statement.

Anybody here who thought that if the RBNZ was going to knee jerk raise interest rates ( which would crash the housing market) if the CPI went above 3% should now be disappointed. I think unless the RBNZ comes out & denies what Mr Toplis has said then we can assume this is the case.

And imagine how high they will have to jerk them if they are wrong and have to play a game of catch-up

Exactly if they wait too long to act the steps required to stop the feedback loop become more and more extreme.

But what happens if they make their move too late? What are the follow on consequences - I thought their mandate was price stability not managing house prices (upwards...)

"I thought their mandate was price stability not managing house prices".

I thought so to. But here we are. Its pretty disappointing really, that the govt has tried to use the means of exchange in our society (the NZD) to drive the real economy though a wealth effect property ponzi. Don't really know how this plays out. We probably wind up with an inflationary currency nobody wants to hold. This forces people to store their wealth in real/other assets (property, classic cars, shares, bitcoin, vintage stamps, gold, manuka honey), which is a pain in the ass.

Hmmm that's the second bank that openly (although politely) says that the RBNZ is wrong with its low OCR forecast

The RBNZ should watch some of their own videos from before the clowns took over.

https://www.youtube.com/watch?v=ntjU7GmaN8E

The rates need to be raised, pronto.

The economy looks like a gigantic pimple with inflation kicking in everywhere. Yet the RBNZ refuses to pop it. Looks like Orr is determined to let it swell to the size that it's going to crush its host (NZ tax payers).

Whose interest does he represent again...?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.