Summary of key points: -

- The NZ economy falters and new risk clouds gathering

- Stronger US dollar trend remains on track

The NZ economy falters and new risk clouds gathering

One of the factors that propelled the Kiwi dollar sharply upwards from 0.6500 to above 0.7000 in October and November last year was the landslide victory for PM Jacinda Ardern and the Labour Party in the General Election.

Amidst the “be kind” public euphoria from the Government’s handling of the Covid pandemic was an expectation and optimism that the economy was recovering strongly, and the new Government had a clear mandate to take bold policy initiatives to implement their manifesto.

Five months on, it feels like the public mood has changed from that positive optimism to one of doubt and frustration.

Not everything is within the Government’s control, however the only deliverables from the Government over this period have been a Climate Change Commission report and a knee-jerk tax change on residential property investment. Certainly, nothing ground-breaking and a myriad of unintended negative consequences stemming from the latter.

As the halo has signs of starting to slip off PM Jacinda’s head, the Kiwi dollar is also now slipping in value in the unforgiving theatre of global currency markets. Five months ago New Zealand stood out as beacon of the “V-shaped” economic recovery, today we a looking into a winter over coming months of below par economic performance for a variety of reasons.

Up until the dramatic change in tax policy on residential property investment two weeks ago, the NZD/USD exchange rate was trading in the 0.7100 to 0.7400 range and was being driven by US dollar movements against the major currencies. The tax policy announcement suddenly changed forward interest rate pricing in the market and that in turn slammed the Kiwi dollar down to below 0.7000.

There are now arguably three new local economic negatives for the NZ dollar sentiment and direction over coming months that should work to keep the NZD/USD rate below 0.7000: -

- Domestic economic data being released for the March and June quarters is trending to the weaker side with business and consumer confidence now falling away again. The much vaunted shovel ready infrastructure projects have not even started to replace the lost economic activity from foreign tourists. New building consents issued were less in February than in February 2020. Do not be surprised to see OE-starved young people heading off to work in Australia as soon as the trans-Tasman travel bubble is opened. Without immigration labour market skills shortages are going to be exacerbated. The residential construction industry is now constrained by timber shortages as too many sawmills have closed over the last 20 years. The Government failed to join the dots between their policy to build many more houses and the need to create greater sawmill capacity to supply the timber to build those houses. Was that not the role of the Provincial Growth Fund?

- Our export sector carried the economy to a rapid recovery last year. However, the current environment is presenting major challenges and hurdles for exporting companies. The shipping/freight crisis is now a serious impediment for the export economy with four week wait times for empty reefer containers and coldstores throughout New Zealand already “chocka”. As an exporter of fresh and frozen food, New Zealand is facing the prospect of dumping and severe financial loss. It was earlier projected that the shipping/container delays would right themselves by June. That now seems further away due to continuing international and local bottlenecks/blockages.

- It is not coincidental that the two strongest currencies in the world over recent weeks have been the USD and GBP as the US and UK are well ahead of other countries in rolling out the Covid vaccine. The vaccine allows for stronger economic performance and the FX markets reflect that. The Euro has been weakening as their vaccine distribution has been a disaster and the economy is back into partial lockdowns as a result of another wave of Covid infection. The correlation of the rate of vaccine injecting to exchange rate value does not bode well for the Kiwi dollar over coming months. Apart from NZ being well down the queue for global vaccine supply, the nationwide distribution of the vaccine is in the hands of the Ministry of Health and 20 District Health Boards. Expect delays and failures as two independent reports to the Government on the Ministry of Health’s handling of Covid breakouts last year have already confirmed. Strong governance oversight and robust management reporting systems is not something you can expect from bureaucratic Government departments. The politician’s PR spin on the progress of the vaccine rollout will not necessarily be what is actually happening on the ground.

Foreign investors and currency traders observing and rating New Zealand’s economic performance against others will be right to have some concerns as the aforementioned three negatives play out. Upcoming NZ economic data to watch out for includes March quarter CPI inflation on 21 April, RBNZ OCR review on 14 April and MPS on 26 May, Government budget day 20 May and dairy prices GST auction results on the mornings of 7th and 21st April.

Stronger US dollar trend remains on track

Our previous forecast of the USD strengthening from $1.2300 to $1.1500 against the Euro is well on track with the EUR/USD now trading at $1.1760. The USD gains are by no means a straight line down, however the US March Non-Farm Payrolls employment increase of 916,000 jobs number released on Easter Friday was well above prior predictions and should deliver another positive impetus this week for the USD.

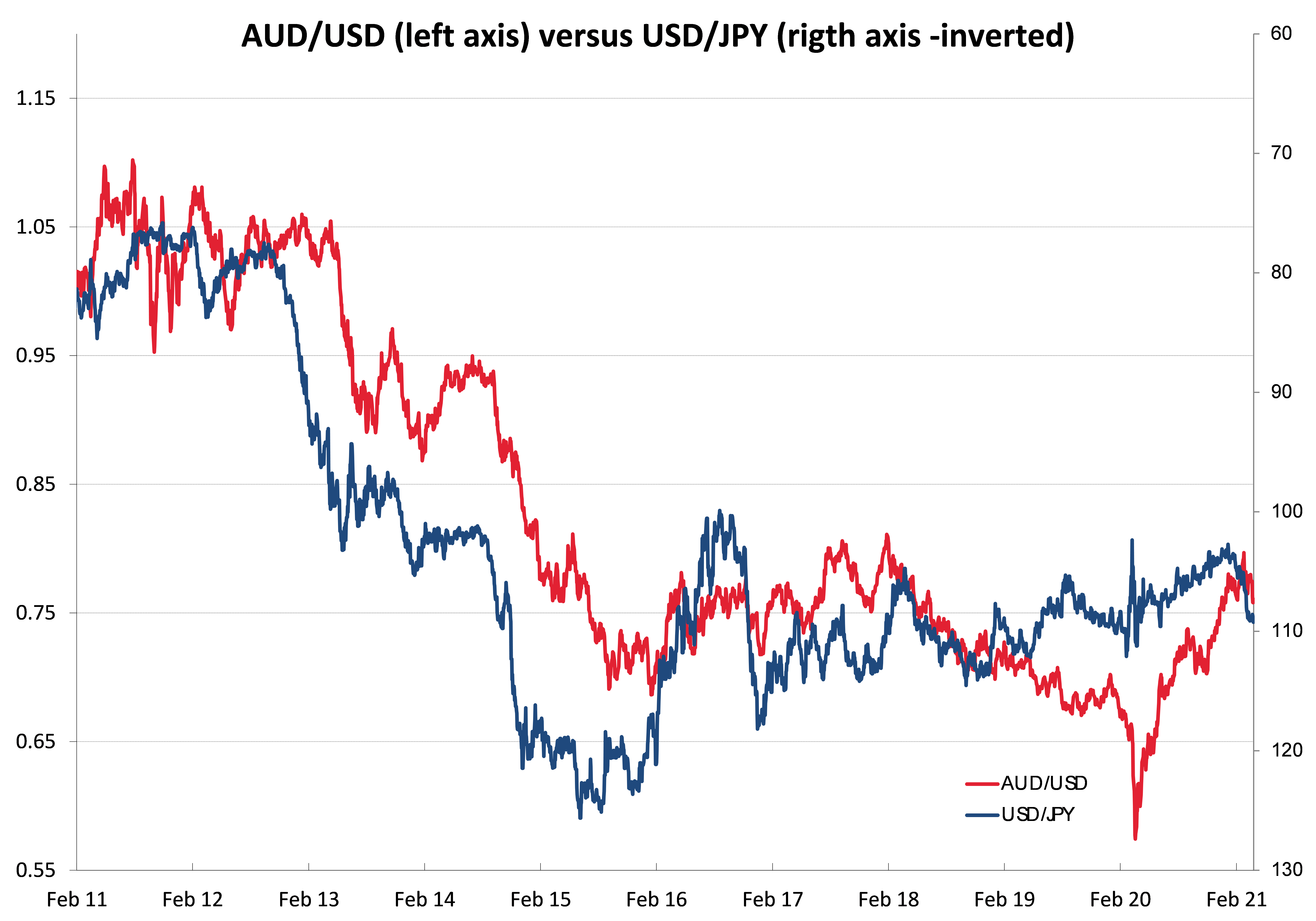

The Japanese Yen has been particularly weak against the USD, depreciating rapidly from 104 to near 111 over recent weeks. In the past there has been a good correlation between the USD/JPY and AUD/USD rates with the AUD following the Yen’s fortunes. That correlation has broken down over recent years with slashing of interest rates in Australia weakening the Aussie dollar over a period of stable USD/JPY movements. The current sharp depreciation of the Yen does point to sub- 0.7500 rates for the AUD/USD. The Kiwi dollar continues to mirror daily AUD movements.

The NZD/USD exchange rate has rebounded back up from 0.6950 on two occasions recently (26 March and 1 April). However, the stronger US dollar in global FX markets and the independent NZ-specific negatives listed above suggest that any minor movement upwards in the NZD/USD rate will be met with keen NZD selling interest over the coming period.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

18 Comments

I will go against the halo slipping rhetoric in this article.

I think the halo started slipping a kong time ago, and it's fall has actually been steadied somewhat by the recent housing announcements.

For me, at least, the coming budget is critical to how I view Ardern and her government.

Will she redeem herself with a bold housing plan, or not???

How will she be remembered? I suspect this year's budget is a key juncture in terms of her legacy.

I predict big announcements, no deadlines (or "by 2030" kind of deadlines), wishy-washy detail and how they care so much about NZers they will graciously give us back some of the tax money they took from us. Thank you so so much.

The changes on residential investment were not "kneejerk" Roger. The government had to be dragged kicking and screaming into doing something minimal, years late.

Very Good!

Now we can put up interest rates where they should be. If property drops, so be it. Win some lose some.

Mirrors my thoughts when reading it exactly.

Looks like bending over for Xi Jinping worked out well for us. Can't even supply our own needs for timber anymore. Fortunately we got an army of mandarin speaking real estate agents in exchange.

It was entirely predictable that the vaccinated northern hemisphere would boom as they roll into summer while fortress New Zealand got left behind. The days of feeling smug and special about "covid free" are about to end.

Nothing knee-jerk about taking a decade to do something meaningful about the housing ponzi. The leeches are only temporarily stunned.

If you have the time this is interesting - recent Waikato Uni forum. Includes NZ covid response analysed - the huge cost (well in excess of any other country) and the likelihood we have just kicked the can down the road a little.

Now we have no herd immunity and low vac rates. No wonder the bubble is slow in coming.

Professor John Gibson – Economic policy, productivity and the global economy

https://www.youtube.com/watch?v=xhi0NsJ5yxY

That bird called the Dodo was also isolated on an island largely by itself for a really long time. When foreign capital invaded, the Dodo just walked up to them and said Hi. The Dodo doesn't exist anymore.

Thanks for link... very interesting presentation.. what an indictment on the lack of good governance!

Scary thing is you can also see the same playbook being used just around the corner

I suspect that the FX markets are slowly waking up to the fact that the majority of NZ economic activity has been an illusion (i.e. a housing ponzi).

Dutch Disease

The Labour government does not have a clue. Who will be their next target? The farmers. Over time the current government will run down the NZ economy, and no matter the money printing from the Fed, the RBNZ will have to print more to fund the expensive programmes that will mostly end in failure. The U.S. dollar will trump the NZ dollar.

Are you seriously comparing farmers with property specuvestors? Our producers with our leeches?

If you want to see the future, it looks like Caracas.

Hi Roger my old chum. I am shorting the NZD, I bloody hate Jacinda, and me and the wife are pretty leveraged up on our rentals (you've got to go all in when the going is good old boy!)

Could you write me one of those thinly-veiled attack articles please? You know, one of those where you throw in a few facts to give a veneer of credibility, but mainly just connect a few half-truths to convince people that our world is collapsing and it's the all the fault of the bloody lefties and their interference in the profiteering of the gentry? Thanks mate - I owe you one.

Looks like every time someone kicks the housing market, the national economy went limping to the doctor.

It'll be interesting to see how FHDs get to buy a house without a loan or a job in a downturn- no matter how much the prices has moved.

100% deposit. Which means the income or equity needs to be sufficiently large to raise 100% of market price in a really short space in time. The main ones who could do that though are existing investors holding portfolios with significant equity (even with no homes in existing assets hence still FH)... hence part of the reason why LVRs were as useful as tts on a bull.

Well this aged badly.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.