Summary of key points: -

- Federal Reserve hint and Chinese directive set to move NZ dollar direction

- Sudden change in NZ’s economic policy direction will impact on the NZ dollar

Federal Reserve hint and Chinese directive set to move NZ dollar direction

Rising uncertainties in global equities and cryptocurrency markets over this past week has pushed the NZD/USD exchange rate to the bottom end of its 0.7150 to 0.7300 trading range.

Growth and commodity linked currencies such as the NZ dollar and the Australian dollar typically suffer from speculative selling pressure when the investment markets move into a “risk-off” mode. The sentiment and direction in US equity markets has remained consistently positive over most of the last 12 months as massive monetary and fiscal stimulus measures have fuelled equities as a one-way bet. However, the prospect of the candy being removed now have the markets much more on edge and the up-down swings and volatility over recent weeks reflects that growing unease.

Two development have caused the latest elevation in uncertainty and volatility in investment markets: -

- Minutes from the last meeting of the US Federal Reserve meeting revealed that under certain conditions and eventualities the Fed will be looking at reducing their money printing volumes (i.e. taper back their monthly bond buying amounts). The equity, bond and FX markets had not been expecting this signal or hint from the Fed to come out this early. The US dollar had been sold off from $1.1800 to $1.2200 against the Euro through April and May on the strong expectation that it would be much later in the year before the Fed change their rhetoric and hinted at tapering.

- The Chinese Government authorities have clamped down on Bitcoin mining activities (that use enormous amounts of electricity to drive the computers) and also clamped down on speculation in not only cryptocurrencies, but also commodity futures markets that have seen metal/mining prices for iron ore and copper soar to fresh highs.

Time will tell as to whether these two events are gamebreakers to push US bond yields and the EUR/USD exchange rate out of their sideways movement patterns of the last few weeks. So far, there has only been a muted response by bond and FX markets to these developments, the EUR/USD exchange rate trading just under $1.2200 and the US 10-year Treasury Bond yield stable at 1.62%. However, over coming months as Americans return to their jobs and spend less time in front of the laptops at home punting shares and Bitcoin as a way to make some money on the side, the “risk-off” investment mode looks more likely than one-way bets to higher prices.

As always, US market participants will be dissecting upcoming economic data releases as confirmation that the economy is resurging across the board to the point that it will no longer need such high levels of monetary policy support from the Fed. There is considerable confidence from this side of the keyboard that future US employment, consumer confidence and inflation measures will provide that verification, resulting in higher bond yields, a stronger USD against the Euro to below $1.2000 and consequentially the NZD/USD exchange rate returning to below 0.7000.

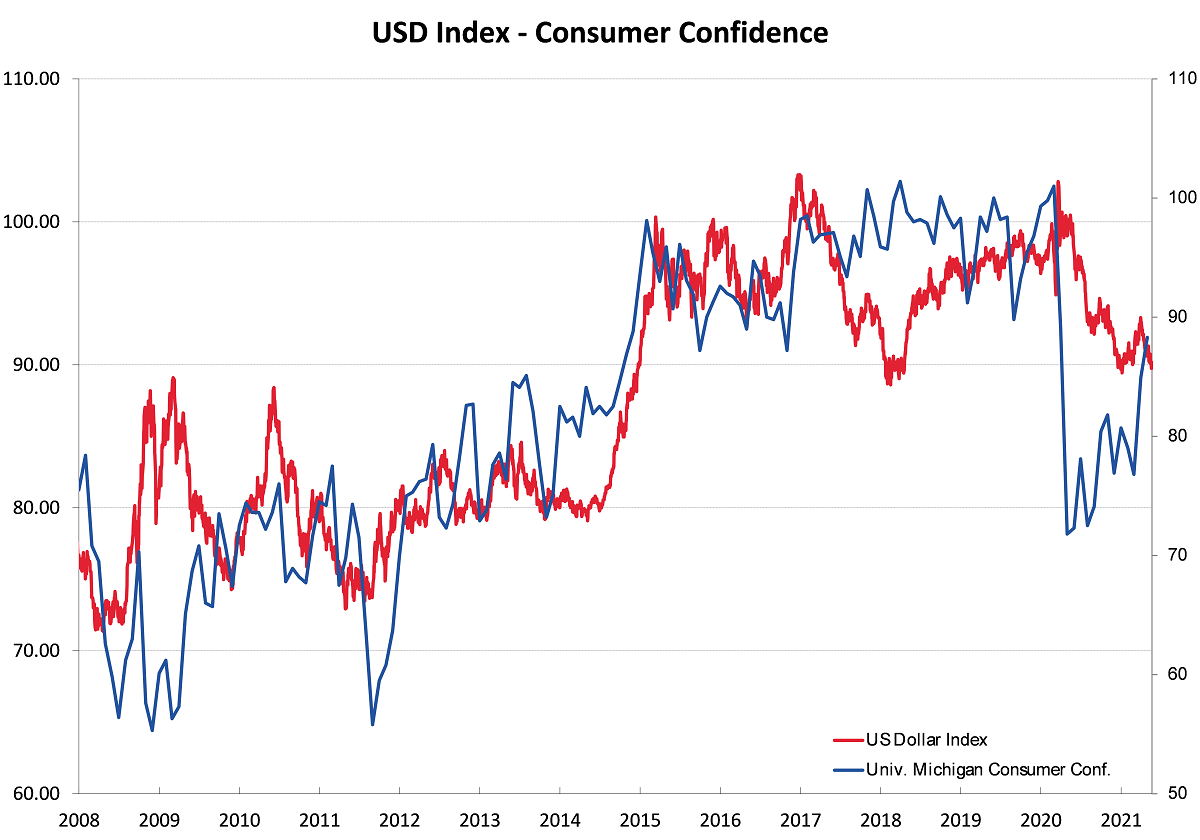

US consumer confidence figures this Wednesday should be sharply higher again as they return in droves to their shopping malls. The US dollar value has a high historical correlation to consumer sentiment trends (both up and down) and the current trajectory of consumer confidence is one of rapid increases (refer chart below) Also confirmation of more permanent increase in US inflation should come though the Personal Consumption Index (PCE) inflation gauge being released for April on Friday 28th May.

Sudden change in NZ’s economic policy direction will impact on the NZ dollar

As anticipated, there was absolutely no FX market reaction to Finance Minister Grant Robertson’s budget last week as there were no new economic policy initiatives that would change the dial for the economy or business investment.

The Treasury GDP growth forecasts for the NZ economy, which the budget numbers are based upon, are at risk of being overly optimistic at +3.20% for the year the June 2022 and 4.40% to June 2023. It would only need residential property, dairy and log prices to come back from lofty highs over coming years to render those GDP growth forecasts considerably short of reality.

Finance Minister Grant’s constant claims that “the economy is doing much better than expected” is becoming pretty tiresome as he compares current trends against the doomsday (and woefully out of date) economic forecasts of last June.

The Minister also claims that the NZ economy will outperform Australia this year with GDP growth and a lower unemployment rate. He may well be in for a rude shock when our GDP data is released for the March quarter on 17th June. A recent Infometrics regional growth survey concluded that the NZ economy contracted by 0.30% in the March quarter. Coming on top of the 0.60% contraction in the December 2020 quarter, the double-dip economic recession 12 months on from when PM Jacinda told us that the “best health outcome is the best economic outcome” from the Covid shock, should be an economic reality check for the borrow, spend and tax Labour Government.

Instead of recognising and mitigating the several risks facing the NZ economy at this time and supporting an environment for strong business investment, the Ardern Government continue on their “Fortress New Zealand” economic policy pathway. They are no longer constrained by a minority coalition partner as they were from 2017 to 2020. Economic and social policy settings in New Zealand are currently taking a “hard left turn” as the majority Labour Government implements their ideological programmes without any real understanding of the drivers at the coalface of the economy. Collective bargaining employment laws and centralised/compulsory wage arbitration is just one example of the direction.

Since the economic reforms of the late 1980’s and 1990’s the benefits to the NZ economy of being more internationally competitive, flexible and responsiveness to the world have been evident in higher GDP growth rates and lower unemployment. International observers and investors have lauded praise on our achievements, particularly our disciplined monetary and fiscal policy frameworks. Over the last 20 years global investor confidence in New Zealand has remained high as the successive Clark and Key governments did not alter those successful settings. Over the last 10 years our previous “brain drain” of educated young people reversed. The current Ardern Government immigration, employment and investment policies (oil and gas exploration, livestock export, tax, water, carbon etc) are reversing all the previous gains.

Due to the Covid shock, the previous economic control and guidance from the disciplined monetary and fiscal policies no longer apply. International investors into New Zealand are already reducing their allocations in the local bond and equities market as they recognise the sudden change in New Zealand’s economic policy direction. It seems that it is only a matter of time before the global currency markets vote with their feet and reduce their NZ dollar exposures/positions as well. The observation today is that the global players have not as yet fully recognised or understood the seismic economic policy shift taking place in New Zealand, however inevitably they will.

One real measure of how well an economy is travelling is the trend in private sector fixed capital formation i.e. business investment. Sadly, business investment levels in New Zealand have been steadily declining since 2018. Both Covid related uncertainties and Government policy direction are contributing to that downward trend continuing in 2021 and 2022. Corporate New Zealand is hesitant to approve new capital investment and business expansion, whether funded by equity or debt. The result is that the banks are awash with cash they cannot lend. Offshore companies will not be investing in New Zealand if they observe that we do not have the confidence to invest in ourselves. There is a strong correlation between business investment and GDP growth, New Zealand’s current trend in this respect has to be worrying.

You will not see any analysis of the “hard left turn” in economic policy and its implications outlined above in this week’s RBNZ Monetary Policy Statement. The RBNZ’s updated prognosis for the economy will guarded with global risks still elevated and thus the impact on the NZD/USD exchange rate should be fairly neutral.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

26 Comments

In conversations over the last 3 days ( to be fair a small population poll of roughly 40 people) not one person I spoke to was happy with the budget. It's fair to say the mainstream media were falling over themselves to say it was a great budget - but for the average taxpayer they all seemed to think it was a fail and wouldn't move the dial on either poverty or growing NZ.

You spoke with approx. 40 people, who disliked the budget. I have also had conversations with almost the same number of people, who also dislike the budget. It comes as no surprise that I read that a large percentage of people don't believe what they see or hear in the media.

to be fair, giving people in poverty more money does tend to move the dial on poverty.

They are going to have to increase the weighting of alcohol in the CPI

The reforms of the 80s and 90s led to increases in wealth for sure - but this was:

(a) achieved through the ever more rampant exploitation of natural resources;

(b) reliant on importing skilled workers trained at the expense of other countries (and slave labour from the islands); and

(c) accompanied by changes to economic settings that ensured that the extra 'wealth' created flowed ever more directly to wealthy people

The impact of these changes are now very real - we have a rotting public infrastructure, public services that have fallen way behind other developed countries, entrenched inequalities that create misery and waste human talent and productive potential, dead rivers, a reliance on extractive industries that are strategically stupid, and I could go on.

And, the answer is... freeing up oil and gas exploration, restarting livestock export, an end to all of this fluffy bunny carbon reduction nonsense. Just wow.

Well put

"Hard left turn"???

So, like "Militant" in UK in early 80s for Labour (out of office at time)?

Debt at 30% of GDP when rest of top 10 in OECD are over 80% roughly, or more?

Business lending by banks as a % of lending was so much higher in 2006-16 was it?

You say it is corporates do not want to borrow, not banks do not want to lend? Prove it.

Agree with you on GDP however, usual hopeless jam tomorrow stuff.

GDP going to be higher after Cv19 than in 2 years prior eh? V likely

Lol - I must have missed the “hard left” turn by the Labour government

Yeah, what a load of garbage.

It's an ever so gentle shift from the centre of the centre lane towards the left of the centre lane.

I call “cobblers” on Kerr’s claim of Labour’s “hard left” - only from the perspective of a right wing commentator. Read some wider 20th century history. “Hard left” is Soviet-style or Maoist communism. We don’t have gulags or Red Guards to ruthlessly enforce the party line by force in New Zealand. There is no collectivisation or “Great Leap Forward” equivalent here. There is no attempt to censor critics in New Zealand, otherwise this site would not exist. Rather budget decisions are minor adjustments of economic policy, responding to the inequalities caused by policies over the last 30 years that Kerr enthusiastically promoted. And don’t conflate communism with socialism. Communism is a revolutionary undemocratic version of socialism. Democratic socialism functions well in other parts of the world such as Scandinavia.

"policies over the last 30 years that Kerr enthusiastically promoted."

When it comes to this government, their record on housing, tax policy, infrastructure and migration is exactly the same as the 30 years previous that was apparently such a failure. Yet here the cheerleaders are celebrating a top-up for beneficiaries years after the Working Group Report with almost nothing for working-class people like it's the f**king October Revolution. Let me know when our brand of democratic socialism isn't doing what it pissed and moaned about National doing for nine years, then we can start to talk about Scandanavian social democracies in the same breath.

Yes.

If right wingers want to call centre-left policies 'socialism' then they should also call their beloved centre right policies 'fascism'. That would be logically consistent.

> hard left turn

lol

To me the Budget was very unbalanced, have no objection to increasing benefits but there was no economic plan to strengthen our economy just a Labour Lolly scramble.

Much is said about the 80's Roger Douglas reforms, they were 100% necessary to avoid NZ going broke through very similar policy direction Labour is taking us now !

I am certainly centre left and I totally agree with your first paragraph.

Benefit increases were necessary but only really a band aid. Much deeper structural and policy reform is required. But they don't have what it takes.

$3 bil on beneficiaries and only $200 mil on Pharmac.

Nothing on promoting growth, innovation and productivity increase.

An utter fail, a shambolic Budget out of a 19th century mentality.

Whatever gets given to beneficiaries is 100% recycled back into the economy immediately. So effectively that $3 billion is a gigantic economic stimulant that will supercharge growth over the next 2 years.

Nonsense. You are taking cash off those that could invest and generate wealth that would make NZ a better place to live for all.

Instead you are giving the cash to no hopers to invest - where it is spent on disposables, one offs and pure waste.

rastus,

"You are taking cash off those that could invest and generate wealth that would make NZ a better place to live for all". Really? By invest you presumably mean buying more rentals, doing the minimum to them and screwing the tenants(the no-hopers) down on rents.

I know some of these no-hopers through voluntary work and I would rather have them as neighbours than arrogant ignorant oafs like you.

It’s been proven many times - all money given to the poor gets recycled into the economy immediately, whereas money given to people who can afford to save some or all of it is invariably not injected into the economy at the same rate as the poor spend it. The trickle down theory has of course also been proven to be utter nonsense.

Excellent analysis. The major concern is that after Labour and the Greens have ruined the economy, there may be no Roger Douglas type economist to turn around the damage. It may be already too late for NZ.

Roger Douglas was our problem and not the solution to anything. We have nothing left that can now be sold off apart from Air NZ and the railways which both had to be bought back after private ownership destroyed them.Financialisation of our economy is the problem and with the banks now draining our life blood away.

Roger seems to want the 90s back.

But what worked then won't work now.

We don't have any SOE's left to sell. We're tapped out on immigration. There are few impediments to foreign investment left to remove. We can't intensify agriculture further without breaking our own environmental rules. And young people can't start businesses, because banks are disincentivised to lend on anything except housing and young people can't afford houses (which are seemingly the only valuable collateral).

I agree that this is a largely directionless Budget, but Roger's solutions all involve sacrificing environmental standards or public safety -- precisely the *last* things we should sacrifice -- for the sake of a notional short-term gain. There's an irony here; neither Labour nor National have any good ideas on how to generate growth or productivity, and those ideas are only likely to appear when we stop obsessing about growth and productivity and focus on the observable reality of communities, jobs, and ecosystems.

Biden is doing a good job, rolling out the vaccines, putting budgets out that bolster US state govts, increasing childcare subsidies, increasing support for US new industry and infrastructure. It's working - the US economy is bouncing back.

Australia is putting out a expansionary budget and people here are afraid that Australia will now boom and NZ will be left behind.

Roger Kerr points out that these countries are doing well and then savages the NZ govt for taking a hard left turn for giving small increases for beneficiaries and some funding for housing (will that construction actually happen?) while they talk about the need to pay down debt.

From my viewpoint it looks like the US and Australia are doing some Keynesian spending while NZ is stuck in Austerity-lite land. If it was a National govt doing what Labour is doing Roger Kerr would be saying how wonderful they were for being prudent financial managers.

New Zealand should be doing what the US and Australia are doing - some expansionary spending on housing and infrastructure.

I don't agree with shutting down future oil and gas supplies if no money is spent on setting up alternative energy sources. But here again we have right wing thinking, don't let the govt spend money on R & D or future industry subsidies. Add the Green thinking of close every non green thing down and you grind to a halt. With no future industry happening, elite interest groups will start fighting over what little is left, poverty will increase and then society starts coming apart.

When gas is not used to transition to future energy sources then either you set up the green energy sources now or you go back to burning coal.

Neoliberal thinking + Greens = stagnation.

Govt investment in future energy sources = sustainable growth

Live animal exports don't add value to our meat exports they just help other countries set up in competition to our exporters.

To increase productivity, increase the value added component to our exports. To increase the value added component NZ needs to spend more money on R & D. The way to increase R & D is for the govt to spend more on R & D itself and encourage the private sector to do likewise.

Going back to the neoliberal policies of the1990's will just mean a repeat of the last 30 years at a lower economic base. We will be poorer still.

Roger Kerr's neoliberal thinking is a dead end.

Bang on. You can't criticise our profligacy and then praise the likes of Australia and the US, who are undergoing huge debt-funded expansion.

Also agree totally about the energy impasse we're in. We can't really increase production from any source. It'll probably end up with us relying on coal for another 50 years because we were too paralysed to act on alternatives.

If I recall correctly - the last time this author posted about the NZ government and the NZ Dollar was after the housing policy changes a couple of months ago, at which point he said the NZD would not be able to move above 70c US. Shortly thereafter the NZD in fact moved up above 72c and has stayed close to that since. Why should I believe what he says this time when he was 100% wrong on the same subject previously?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.