Summary of key points: -

- Kiwi dollar moves more on Fed announcements than RBNZ statements

- Local exporting companies enter currency hedging against risks of a weaker USD in 2022

- NZ Government failure in basic risk management

Kiwi dollar moves more on Fed announcements than RBNZ statements

It should come as no surprise to the readers of this column that the New Zealand dollar has (in value and direction of movement) reacted in a much more substantial way to announcements on US monetary policy strategy and settings by the Federal Reserve than monetary policy changes here at home from the RBNZ.

The RBNZ statement on 18th August was certainly hawkish in its tone and outlook, pointing to a relatively aggressive tightening in monetary conditions as the economy no longer needed the emergency stimulus of 2020 to reach inflation and employment objectives.

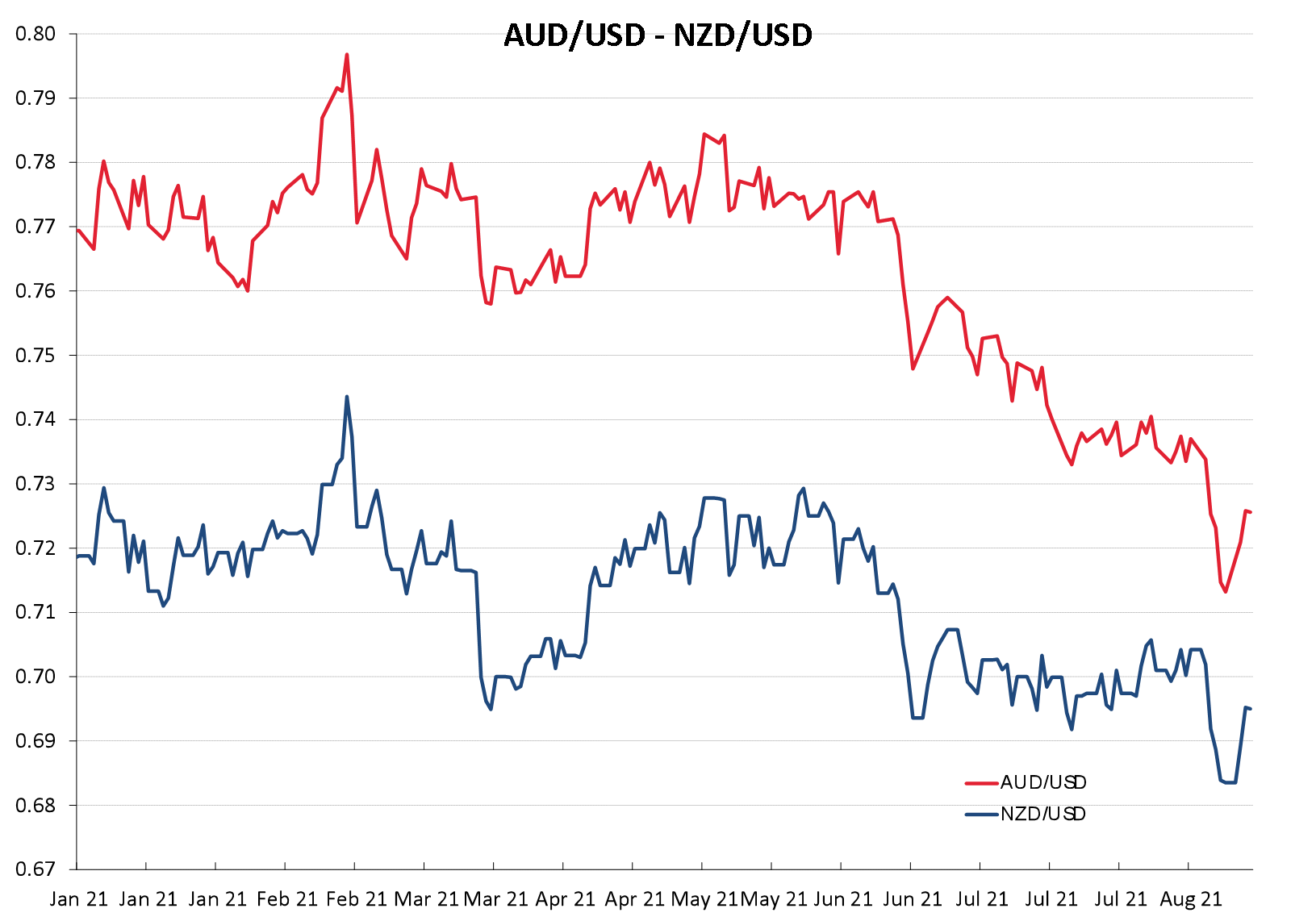

Despite the dramatic U-turn in the RBNZ’s view and outlook from only a few months earlier, the Kiwi dollar depreciated in value following the statement, in stark contrast to the normally anticipated appreciating Kiwi response.

Of course, the FX markets reflected the disappointment that the RBNZ postponed the expected OCR increases due to the Covid delta outbreak risk event on the same day. New Zealand’s much heralded and celebrated success around the world in handling the Covid pandemic in 2020 was reduced to a tardy and tattered reputation in one day in August 2021.

The immediate reaction by the FX markets that the delta strain was through our borders and in the community was to also sell the Kiwi dollar lower. The NZD/USD exchange rate fell away to a low of 0.6820 on August 20th on the local RBNZ and Covid delta news events.

However, the Kiwi weakness was short-lived as there was no follow-through NZD selling interest and since this time the NZD/USD rate has reversed back upwards sharply to above 0.7000 again entirely due to developments with the Federal Reserve and movements in the US dollar itself.

The much anticipated speech by Fed Chairman, Jerome Powell on Friday 27th August at the Jackson Hole gathering (virtually!) of the world’s central bankers at Jackson Hole on how he would message their unwinding of 2020 monetary stimulus was always going to have an impact on the US dollar value, one way or the other.

As it transpired, Chairman Powell adopted a slower approach to tapering the QE (bond buying) and eventual raising of interest rates than what the FX markets were anticipating. In response, the USD weakened back against Euro to $1.1800 from below $1.1700 previously.

The Australian dollar which has had an appearance of being heavily oversold against the USD over recent weeks, bounced back to above 0.7300 from a position close to 0.7100. As a consequence of the AUD snap-back, the NZD/USD rate followed and has returned to 0.7010.

Powell’s personal stance continues to be that recent sharp increases in US inflation will subside quickly, therefore he sees no rush to withdraw stimulus and tighten policy.

However, there is no guarantee that the USD will continue to weaken as Chairman Powell’s view that inflation increases are all transitory is not shared by a growing chorus of other Federal Reserve Governors (who vote on the FOMC committee).

A showdown (or stand-off!) at the Fed seems likely on 21 and 22 September where economic projections are updated, and the individual Governors enter their own forecasts on where interest rates need to be going forward (the “dot plot”).

The analysis and arguments that inflation increases are more permanent are based around house rental increases and wage increases from a tightening labour market. The passing-on of significant increases in freight/shipping/transport costs across the supply chain by US businesses also suggests that inflation increases are more permanent than temporary.

The US dollar may stage a recovery (pulling the Kiwi lower) before that Fed meeting with the US Nonfarm Payrolls jobs number due for release on Friday 3rd September. Consensus forecasts are for an increase in new jobs of 725,000 over the month of August, lowering the unemployment rate to 5.2% from 5.4%. An outcome above the 725,000 forecast level would result in USD gains as the hawks at the Fed gain more ammunition to tighten sooner rather than later.

Local exporting companies enter currency hedging against risks of a weaker USD in 2022

Local USD exporters who had FX orders placed down to 0.6800 to increase hedging percentages towards maximums of policy have been well-rewarded on their risk management strategy with the hedge entry-tactics working like a dream.

Stronger economic data in the US over coming weeks can still produce a stronger USD against the EUR to $1.1600 again (which would have the Kiwi back at 0.6800).

However, the view remains that the global FX markets by September/October time would have fully priced-in Fed tapering in 2021 and interest rates increases in 2022 into the US dollar value.

Once all the good USD news is fully-priced, the currency markets will bias towards a depreciation in the USD based on the weak US economic fundamentals of a large internal budget deficit and external Current Account deficit. A weaker currency value will be needed to attract in the foreign capital to fund those massive US deficits and associated debt issuance.

NZ Government failure in basic risk management

There is also a growing chorus of discontentment (and outright anger in some quarters) at the New Zealand Government’s lack of urgency and preparedness against the risk of the Covid delta strain coming into the country.

The Government’s lack of action on numerous fronts and complacency due to the apparent success in keeping Covid out last year, has come back to bite them in the bum (as we thought it would).

It is interesting to pontificate whether New Zealand would be in the position that it is in today with extended periods of level 4 lockdowns 18 months after the pandemic hit, if there had been a different Government leadership regime over this time.

Had Sir John Key and Sir William English still been at the head of the Government, would they have done anything different to Jacinda and Grant?

From business backgrounds in financial/investment markets and farming respectively, John and Bill have risk and contingency management experiences and competencies running in the DNA.

Therefore, they would have instituted solid risk management principles of “what if” scenarios, plans B, C and D ready to be implemented if plan A is not working and several fallback contingencies in place. In simple terms, would John Key have spent an extra $40 million to get higher up the Pfizer vaccination supply priority? Too right he would have, he would have viewed that as a relatively cheap call option (like a financial derivative on our health and economy).

The current Ardern cabinet of ex lawyers, academics, trade unionists, schoolteachers and political researchers have no background or understanding of business and financial risk management. Therefore, their understandably reactive responses to all developments as they occur and very little in the way of forward planning.

As a consequence, New Zealand is still reacting to and attempting to contain Covid outbreaks today in the same way that was used 18 months ago.

Finance Minister, Grant Robertson will claim that the NZ economy has performed much better than others, therefore his Government should be applauded for the approach they have adopted.

What he is not adding to the economic picture is that most of the economic growth has come from housing and consumer spending, which is all debt financed through either the Government’s fiscal packages or household mortgages/lower interest rates (monetary stimulus).

New Zealand’s future economic outlook may not look as rosy with the fiscal/monetary supports now reducing and the borders remaining shut with no way out due to the Government’s doomed Covid elimination strategy.

The current Ardern Government is also not keen in providing targets, objectives and milestones on re-opening the economy to the world so that businesses can plan ahead based on some guidelines.

Why any group of people shy away from quantitative targets and objectives is that they do not like having to be accountable for the actual outcomes against those goals. A fear of being seen as failing. New Zealand’s health and economic management requires leaders a standard above such fear of failure.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.