Summary of key points: -

- Timely reality check on the NZ economic outlook.

- Looking beyond the US jobs headline number.

- Crikey! - We finally agree with Winston.

- Business confidence would lift if we had a clear plan

Timely reality check on the NZ economic outlook

Currency markets have a deserved reputation for delivering swift, telling and often chilling verdicts in response to both favourable and adverse economic news, events and developments.

Foreign exchange markets are highly liquid, easily accessible, trade 24/7 and as relative prices they continuously build-in the future conditions and expectations into today’s price.

By the time you read about an economic change in the newspaper (or on-line these days) the fast-moving FX markets have already fully factored it in. The contest of views from both buyers and sellers of a particular currency as to what the future holds is settled in instantaneous price discovery and movement.

Last week’s response by the New Zealand dollar forex market to the first RBNZ OCR interest rate hike since 2014 was not as most would have expected.

Even though the 0.25% increase was widely anticipated, the vast majority would have expected Kiwi dollar appreciation in response. Mild depreciation from 0.6970 to a low of 0.6870 was the result, the opposite to the conventional wisdom for two prime reasons: -

- The old classic FX market reaction of “buy the rumour, sell the fact” appeared to be well in play here. When the final few sentences of the RBNZ statement added in some caution to the economic outlook, the NZ dollar bulls seeking a rising Kiwi would have been disappointed and they “turned-on-a-dime” to become immediate NZD sellers.

- The long/fat tail to the Covid delta outbreak is prolonging and spreading the lockdown, and this in turn is damaging New Zealand’s reputation for adequately managing the pandemic and resulting in negative economic consequences.

The FX markets in marking the NZ dollar to a lower value are signalling that the performance of the NZ economy over the next 12 months is likely to be inferior to peers and competitors.

That verdict from the currency markets is at odds to the Finance Minister Grant Robertson’s claim that our economy is outperforming others.

Looking backwards, there may be some truth in Robertson’s claim (we did better last year than others). However, FX markets do not look behind too much and the forward outlook now appears to be much more of a tough grind.

When your largest and dominant city in an economic sense is in a restricted lockdown for eight weeks, the negative economic consequences are inevitable.

The previous gung-ho GDP growth forecasts for the second half of 2021 and 2022 from the RBNZ, Standard & Poor’s, NZIER, Infometrics and all the bank economists are now all being hastily revised downwards as they realise that their previous forecasts were predicated on a short/sharp lockdown period and a rapid bounce back in economic activity.

They all fell into the trap that the NZ Government has been seized in for some time, they failed to apply adequate “risk” contingencies into their planning and outlook. The risk was that the Delta outbreak would be much more difficult to contain, and the lockdowns would be extended, which is exactly as it has transpired.

The irony of New Zealand being the last country in the world to abandon “Zero-Covid” and the first economy to increase interest rates after the pandemic economic shock may tell you something about our Government and RBNZ timing/management! We were not actually the first to lift interest rates, Norway, Sri Lanka and South Korea all moved before us.

In addition to the negative impact of the extended Auckland lockdown paring back GDP growth, the shortages of labour, shipping space and materials continue to hamper output increases in the productive economy. The total lack of certainty for business, as the Government continually fails to produce a forward plan for re-opening the borders, is also hampering business investment at this time.

Question: What does a lower than previous forecast GDP growth outlook for the NZ economy mean for the NZD/USD exchange rate?

Answer: As is always the case with FX analysis there is more than one straight answer!

- A forecast 10% depreciation of the US dollar against major currencies in 2022 due to the US of A’s dual deficit problem would suggest an increasing NZD/USD exchange rate up to 0.7600 (nothing to do with New Zealand).

- Local economic factors such as under-performing GDP growth and potential for our commodity prices to decline will temper that USD-driven NZD increase.

- The RBNZ being forced by the weaker economic data to increase interest rates at a slower pace than what most still expect, will also be a specific impediment to the NZD and a generally weaker USD FX market environment.

Looking beyond the US jobs headline number

The headline US employment increase for the month of September of only 194,000 (well below prior consensus forecasts of +475,000) on the surface, would appear to delay the Federal Reserve’s tapering (reducing monetary stimulus) plans and thus be a negative for the US dollar value.

However, it pays to look behind the headlines and dig into the detailed analysis: -

- The big disappointment in the jobs numbers was the surprising reduction in Government employment. All other industry sectors were steady to strong. Basically, the strong seasonal re-hiring of schoolteachers in September did not happen this year as Delta worries held back schools re-opening. Looks like a timing issue only, the teachers will be re-hired in October.

- Wages increased sharply again in September, average hourly earnings rose 0.60%, lifting the annual increase to 4.50%. The shortages of workers causing these significant increases.

- The US unemployment rate decreased from 5.20% to 4.80% as the numbers of people actively looking for a job reduced.

The wage increases is further evidence that US inflation increases are much more permanent than transitory, therefore there will be no change to the Fed’s plan to commence tapering next month. For this reason the US dollar did not weaken against the Euro on the headline 194,000 jobs increase being below expectations.

The EUR/USD exchange rate has reached our previous forecast target rate of $1.1500/$1.1600. We do not believe the USD has much further to go on its strengthening trend until it fully prices-in the tapering and interest rate increase next year.

However, picking the timing of the reversal in trend for the US dollar is fraught with difficulty, best estimate is sometime over the coming three months.

Crikey! - We finally agree with Winston!

Over the many years of this FX column there has never been any agreement with the views of veteran politician, Winston Peters in respect to the NZ economy and the NZ dollar value.

However, one should never say never. Now that he sits outside of Government, Winston may have finally seen the light, as we totally agree with and endorse his reported comments last week: -

- He currently has concerns about the outlook for the NZ economy – “how serious our economic circumstances are as a country”

- “Good people we need in New Zealand are leaving, particularly in IT”

- “Commodity prices were good at the moment, but they won’t always be great”.

- “Huge transportation problems hindering the wealth-creating export sector”.

- “Every week the Government are whacking up billions of dollars in more debt”.

A voice of reason that the current Government should stop and listen to.

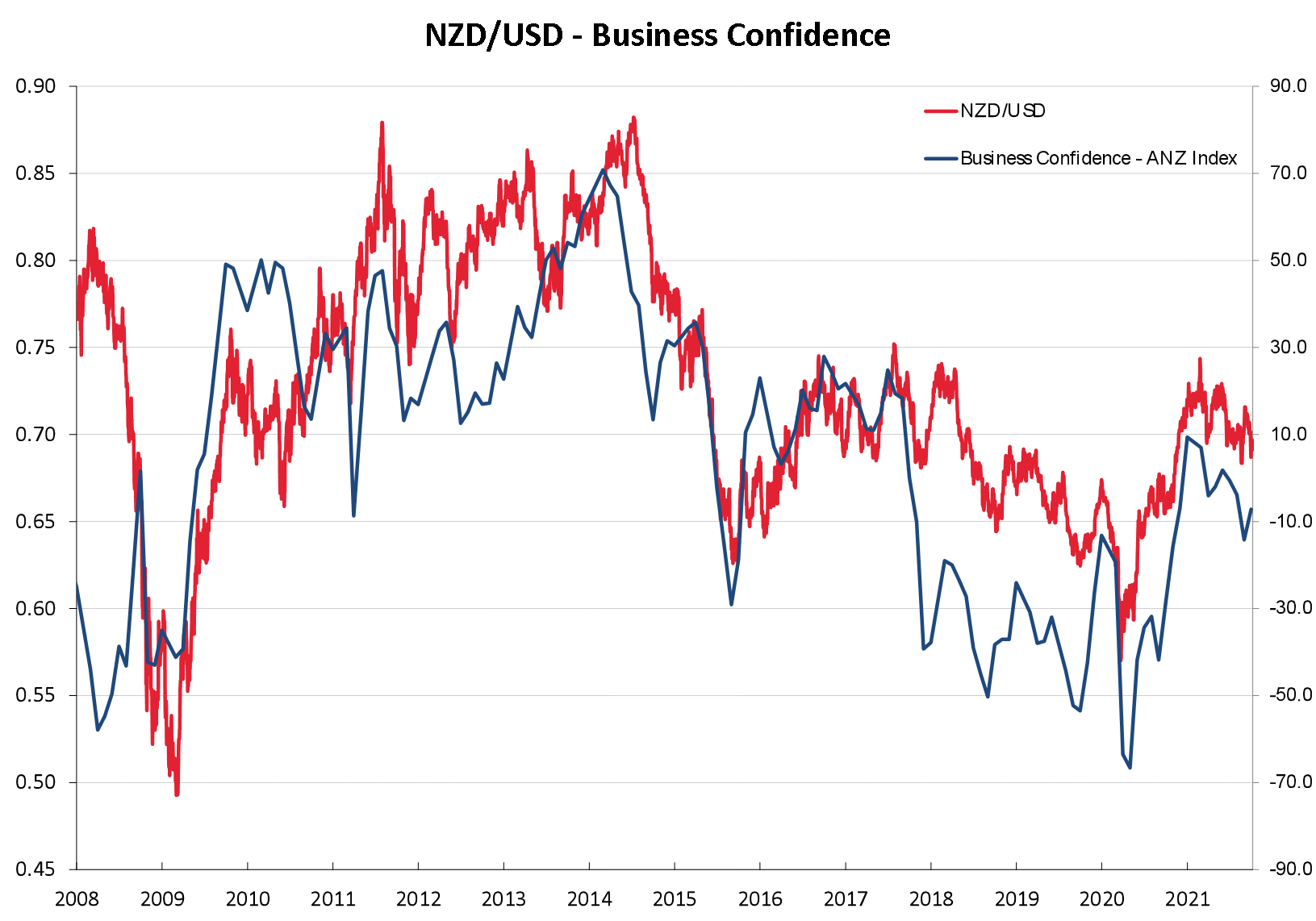

Business confidence would lift if we had a clear plan

Business confidence levels between -10 and +10 would suggests that the NZD/USD exchange rate is reasonably valued at 0.6900. If the Government had a plan for getting out of the current muddled mess with milestones and targets, business confidence would certainly lift.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Another excellent piece.

Stagflation will be the invincible force against RBNZ and OCR.

So which part of the Monetary Policy Mandate would they focus on to fix? Inflation or Full employment?

Yeah good work Roger. I've gone from being critical of your articles as they had a different outlook to mine, to realising that you're pretty on the money and have called everything pretty well over the last 3 years or so.

I am a convert, I don't know if Roger has changed or I have, or a bit of both. I used to have issues with his work.

But I have found quite a lot of insight in his pieces over the past few months.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.