Banks' non-performing housing loans - perhaps surprisingly - were not much changed in September, and that's now the third month in a row of relatively flat figures.

This is of course at a time when customers may be dealing with interest rate rises of say from around 3% to over 7%.

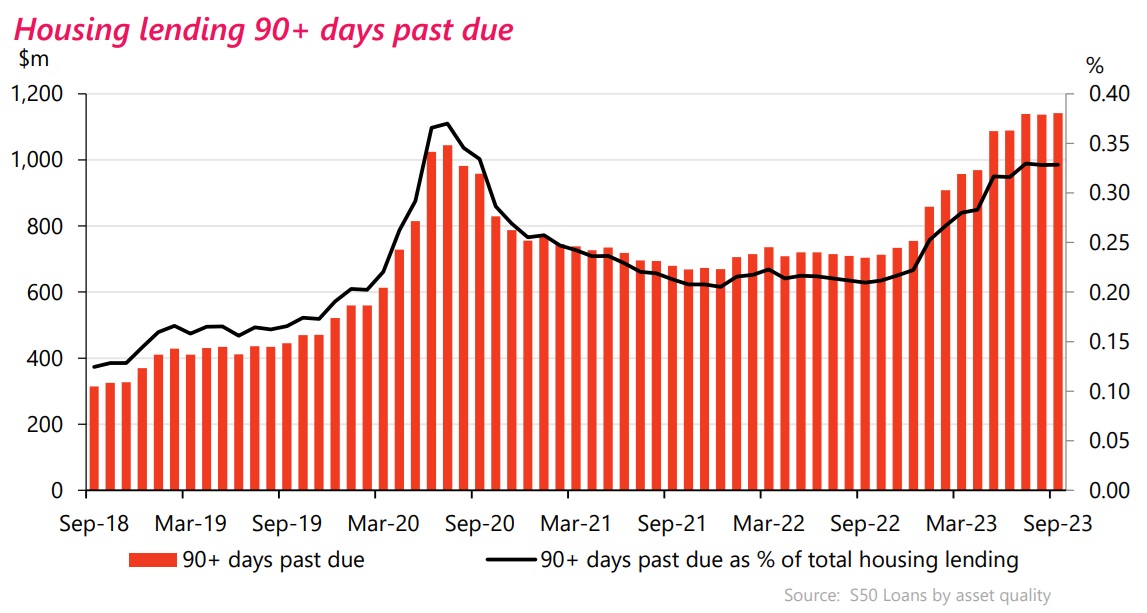

There was a fairly sharp rise in non-performing housing loans in the early part of this year, but it has levelled off more recently, to leave the percentage of non-performing loans making up only around 0.4% of the banks’ books - much less than the circa 1.2% levels seen after the Global Financial Crisis.

Reserve Bank loans by asset quality figures for September show that total non-performing housing loans rose by $13 million in the month to $1.338 billion.

That is up from $796 million a year ago - but the figures were previously running at very low levels.

The 90 days past due, but not impaired, figure stood at $1.141 billion in September, just up very slightly from August.

Specific impaired loans rose to $196 million in September from $188 million in August. A year ago the impaired loans figure was at just $92 million. Total bank housing loans - to give this perspective - stood at $347.346 billion as of September 2023.

Across the banking system as a whole, according to the RBNZ System non-performing loans rose by $81 million (2.7%), with the non-performing loan (NPL) ratio ticking up to 0.56%. The total is now $3.098 billion. But to again apply perspective, the total banking system loans as of September stood at $552.496 billion.

Separately, the RBNZ's latest sector lending data for September shows there's been an increased recent appetite for consumer lending, both from banks and non-banking lenders.

According to the RBNZ's summary of the latest data the $103 million increase in the personal consumer lending stock (both bank and non-bank lending) in September is the largest monthly increase this year.

Within this, the amount borrowed from the non-bank lenders rose by $50 million (0.8%) to $6.399 million, while the amount borrowed from the banks for personal consumer loans rose by $54 million (0.7%) to $7.585 billion. (There may be a small rounding difference in those figures.)

The total amount outstanding as of September for both the banks and non-bank lenders for consumer borrowing is $13.984 billion, up from $13.346 billion a year ago.

The RBNZ notes that despite the increase, the annual growth rate slipped from 5.4% to 4.8% - but this does remain the highest growth rate among the major lending sectors.

Mortgage borrowing, so often the star turn, is still not showing convincing signs of coming out of the doldrums. And its annual growth rate remained static in September at 3%. A year ago it was running at 5.7%, while two years ago the annual growth rate was 11.6%.

The RBNZ said housing lending stock increased by $877 million (0.2%) in September 2023, which was slightly down on the $951 million increase that had been reported for the same month in 2022.

Business lending stock increased by $383m (0.3%) in September 2023.

Interestingly, bank business lending is down $934m (break adjusted) since the start of the year, while non-bank business lending is up $397m over the same period.

However, annual growth continues to approach the negatives, down from 1.8% to 0.9%.

Agriculture lending stock decreased by $282 million (-0.4%) in September 2023. The annual growth rate dipped further from 1.5% to 1.4%.

6 Comments

That's because the banks are hiding them.

Like ASB with there bad book farmed out to blackrock.

Well there's no uptick in interest only lending, I assume a switch from P & I to Interest Only is reported in RBNZ C32.

So either people are making their repayments, or the banks are working with stressed mortgagors by providing special interest rates tailored to suit what they can afford to prevent loan impairments. Making a small cashflow loss on a few precarious loans in the short term is better than ramping up mortgagee sales.

Thanks B&W, it's good to know that you know better than David Hargreaves and the team at Interest!

Distressed loan rates are skyrocketing (behind the scenes) ......with more rope is being fed out, in the forlorn hope people can set anchor before the rocks are struck.

No bank wants this news publicised! The back office is shisting hard bricks.

When it's this bad.....they just have to lie,

https://www.roymorgan.com/findings/mortgage-stress-risk-october-2023?ut…

Over 1.57 million Australians are now ‘At Risk’ of ‘mortgage stress’ representing 30.3% of mortgage holders

Australia don't put up with the BS like Kiwis do.

Most kiwis are naive like Yvil.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.