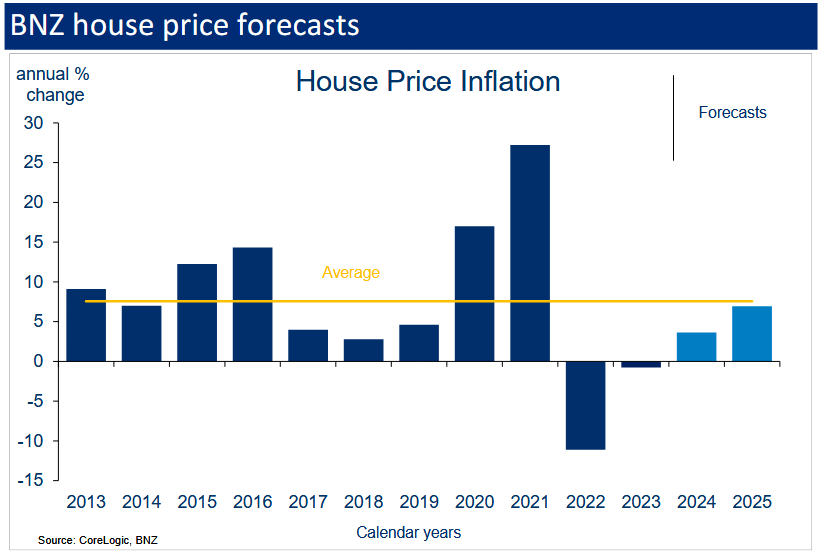

BNZ economists are now expecting house prices to rise just 2% in this calendar year after earlier forecasting a 5% gain.

And they say even the new, lower, 2% forecast has "downside" risk.

In his latest Property Pulse publication, BNZ chief economist Mike Jones says last year’s "short string" of monthly house price gains "now look like a false start".

"And we think current scratchy momentum will stick around for longer amid high mortgage rates, a deteriorating economic and labour market backdrop, and a jump in unsold inventory," Jones said.

He still expects a more obvious upswing next year and is forecasting that house prices will rise 7% in calendar year 2025.

Jones said the latest Real Estate Institute of NZ (REINZ) housing data had showed the House Price index (HPI) recording "essentially no growth" from January to April (adjusted for seasonality).

"That leaves house prices holding about 3% above the February 2023 cycle low."

He noted the elevated level of activity among first home buyers (FHBs), but investors, by contrast, "are less interested".

"New investor lending diverged noticeably from that of FHB in 2022 and has tracked down to about 16% of total. In absolute terms, it has yet to substantively recover from the lows struck around the start of 2023.

"Any positive impact on investor demand from the new government’s change in investor tax policies, so far, seems to be being offset by the cash flow hit from high interest rates and soaring insurance, rates, and maintenance bills.

"The anecdote points to investors remaining on the sidelines in the short-term. It’s possible we see a lift in investor selling intentions once the Brightline Test shifts back to two years in July, but we’d expect this impact to be small."

Weighing up all the various pros and cons, Jones says house price fundamentals "are overall less supportive than at the time of our last update".

"Economic and labour market conditions have deteriorated, mortgage rates are set to stay higher for longer, and the jump in unsold inventory will take time to work off.

"We’ve shaved back our 2024 house price inflation expectations as a consequence.

"Further ahead, we remain of the view the current period of house price stasis will eventually give way to a clearer upswing in prices.

"Most important in this regard is our view that mortgage rates will start trending lower next year. More demand-friendly housing policies and a recovering economy will add support.

"Acting in the other direction, affordability and cash flow constraints will cap the magnitude of the upturn."

83 Comments

head in sand ...lol .. if I don't see it it's not happening

Still selling the price rise narrative, morons….

House prices seem destined to continue falling for the rest of the year - at least to me.

Some key economic determinants have changed over the last few months - so the banks (and other forecasters) have to review their outlooks.

I think the BNZ is still a bit optimistic. Market sentiment is low and won't be helped by the yesterday's OCR result - though I firmly believe RBNZ made the right decision.

TTP

Wow.

Tothepoint's now admitting his recent misguided sentiment/predictions for house prices has become the subject of comic entertainment. Good to see he's finally reading the correct memo...

Next cab - Zwifter?

FHB's were wise to wait all along, there is/always was no hurry to buy and most importantly, August to October 2023 being the last viable opportunity to enter the market predictably turned out to be a complete CROCK.

I see Tony Alexander has a new article out. Basically saying the housing market is going down the shitter. Maybe that is where the green shoots are we well.

Oh - the many instances when TA's views/predictions were published on Sunday, TTP then mirrored them on Monday....

Talk about blind leading the blind.

So they are going to increase!

Obviously 10% Tony has run out of cannon fodder, that prediction miss will be hilarious come the end of the year.

Always surprising when you speak to 'property investors' that say they get their 'information' from his phantom surveys.. really goes a long way to explaining why the nz housing markets in the state its in.

If TA is saying it, we have juuust about to hit the panic stage of the economic cycle

Yep. Next phase is fear and capitulation.

4 to 5% gains this year in Tauranga. Who really wants to live in Auckland these days ?

Zwifter is Tauranga your market of interest? Whilst the national figures look unlikely to be positive, I do agree that some location specific markets may indeed be more positive due to the unique dynamics and demographics at play.

…things must be bad!

As a salesman this is the best pitch he can offer to protect his loan collateral and to keep selling debt obligations to people. It's not meant to be taken seriously although it's packaged by media as actual information.

110% agree!

Hi Palmtree,

Clearly, you're no stranger to sales-speak.

TTP

"Mike Jones says last year’s "short string" of monthly house price gains "now look like a false start"."

More like a Bull Trap

A dead cat boune

Hahaha ..... come to jesus....

"All your base are belong to us"

LOL.. why are they always late to the party..

2% growth with downside risks.. come clean and state your model shows price declines

The rbnz and bank economists are an absolute joke with their consistently wrong predictions and reading of the market. Orr should be sacked and the banks shouldn’t be be given any oxygen

Still bullish though.

With job losses mounting? Inflation - as it relates to residential property ownership - still rampant? A glut of stock? We'll see. But 2% in the major centers looks optimistic to me.

And below inflation so still falling in real terms. Prices now down more than 30% after adjusting for inflation.

Very true Speedy. NZ down circa -30%

But worst still .....Auckland down -40% and WellyTank down -48% in REAL terms since 2021. Wow....biggest bust in NZ housing history- and it's no where near done yet!

As we all, know if housing is not at least appreciating at the rate of inflation - IT IS GOING BACKWARDS IN VALUE......

It's the worst inflation hedge asset class, in a high inflation world!

Yawn

I can smell the Spruiker vapors coming from your breath!

Sorry to hear your plans of housing market domination/untold, untaxed riches is not going to plan......:)

Lets look at the facts. I purchased late 2020 for $850K the house is currently valued at $980K and I have saved over $100K in dead rent money over that period so I am UP about $250K in only 3 years. As long as you purchased a house outside of the RBNZ induced Covid madness period you are laughing, but that's why we all come here right ? for decent financial advice and not to listen to the clowns.

Fair enough. I won't tell you my housing gains......or just dumb good luck, as it would be, as it would make you Very Jealous.|

I really don't mind giving up 500k....if NZ is a fairer and more equal place, giving young families the Kiwi dream of owning their own home, without selling their souls and first born to the REA industry gouls.

Nevertheless, we are headed back to the valuations of the period 2015 to 2018. This is the best advice on this site, period.

I just hope the soggy leaking dam holds there??....otherwise we are in major financial trouble and serious uncharted rocky and mine riddled waters!

I don't get jealous mate, I have the life I always wanted and quit working full time before the age of 50. Get to wake up each day and decide what to do based on the weather and no longer have some asshole boss telling me what to do. Life is as good as it gets.

I think you'll be spot on provided no 'big shock' to current settlings.

But, don't forget the record withdrawls we are seeing from Chinese bank accounts. Overseas RE is still seen as a safe haven, I suspect. Not sure how easy it is to get capital out these days.

But all Luxon needs to do is get rid of the ban and we could have RE tourism back on by the plane loads!

And, I can very much see Luxon and co. making this move. I think Seymour pitched it in their coalition discussions, but I can't recall whether it was mentioned in the agreement - given at that time, National were talking about their foreign-buyer tax.

The only positive might come from the excessive immigration. It seems To be the only thing keeping prices from going off a cliff at the moment.

He still expects a more obvious upswing next year and is forecasting that house prices will rise 7% in calendar year 2025.

Sure. And these numbers won't be that difficult to forecast when it's fed in to a model. I don't know what the formula is but it includes: volume demand (that means demand for debt); volume supply (mortgages - more or less unlimited because it comes from thin air); market supply (some airy fairy approx of a representative price for the marginal buyer).

Wouldn't it be great if they were required by law to show their workings to the public. Obvious response is that it's none of the business of the general public how they forecast. What they fail to recognize though is that they have an exalted place in society where they're able to create money of thin air. Would be good if more people understood the privilege they have.

JC A well known economist once confided that

Many economic models are like sausages if you saw what went into them, you would not consume them.

This is the public "We still need to sell mortgages" prediction.

Im certain they will have their internal prediction which will look nothing like this one.

Mate, tell 'em they're dreaming

"Gareth Kiernan, chief forecaster at Infometrics, said he expected house prices to be at 2023 levels in mid-2026.

"Our forecast horizon is mid-2029 and we still think house prices will be below the 2021 peak at that point"

https://www.rnz.co.nz/news/national/517687/house-prices-won-t-return-to…

"Our forecast horizon is mid-2029 and we still think house prices will be below the 2021 peak at that point"

If that forecast proves to be correct, then the buyers of 2020 - 2022 period would have been better off renting and saving the difference. They would have a vastly smaller mortgage if they had waited.

"Most important in this regard is our view that mortgage rates will start trending lower next year. More demand-friendly housing policies and a recovering economy will add support.

Look how long it's taking for higher mortgage rates to have an effect. If he thinks as soon as rates start to drop it'll have an immediate effect the other way, well I'm not so sure.

Also, does anyone put any credence in the yield curves reverting to normal and the historical aftermath as far as recessions go? Seems we've got a lot of water to go under the bridge before anyone starts talking about a recovery (and acting like our current economic situation is going to be the low point).

Well I think his forecasts need to be "shaved" even further...

I think a 2-5%pa downward glide for the next couple of years is probably a best case middle-ground scenario for NZ overall.

Buyers can bide their time and build up deposits, sellers can learn to deal with the fact it was a rollercoaster and not a rocket ride, and those not doing either can come to terms with the new "normal" level of mortgage payments. Incomes will rise to meet the increased outgoings*, even if it doesn't return things to the "good old days", but everyone will have learned that just because you can (borrow it) doesn't mean you should.

* Yes, I'm ignoring imminent redundancies, yes I know that's a big thing to ignore.

The “new normal level of mortgage payments” - agree! The new normal won’t be much different to the old normal (ie pre GFC, since 2008 to 2022 was completely abnormal), ie around 6%. https://teara.govt.nz/en/graph/23100/interest-rates-1966-2008

There seems to be a pervasive underestimate of what normal rates look like as most don’t realise that central banks applied emergency rates in 2008 to rescue the global financial system, and before they were normalised Covid came and they bent over even further. Many have forgotten or didn’t experience pre 2008 normal and have been fooled into thinking that we will return to typical 2009-2019 rates (or even 2020-21 rates). Won’t happen. I think it will be a fair while before we see <5% mortgages

Models are always crap when there are major system instability, human psychology, or tipping points involved

That is so, so true.

Pre-pandemic models are being reworked everywhere as they are not giving sensible predictions - as has been born out when the RBNZ was predicting decades of low rates during the pandemic. (And seemed paranoid about deflation before that which was ludicris.)

It took them till now to realise late last year was a dead cat bounce?

7% next year? Lol

I think a safer bet would be -7% with the current outlook.

Auckland is still crashing. Would be good to see his breakdown by region/city. I wouldn't be surprised if the 2% gains are being held up by the regions not following as quickly. I can't see any trends that would indicate Auckland will not fall further at this stage.

Equally, I'm interested in the Chch component. National forecasting is a little too generalistic

Sold in March, now renting and slightly nervous we're not buying and selling "in the same market" however all indicators are we won't be burnt, and potentially better off (Christchurch however, which is stubborn vs other main centres)

In the same boat but not nervous at all. A leisurely few months ahead viewing properties will be my winter hobby! Make the most of your situation.

COMPLETE AND UTTER BANSTERS BOLLICKS!

This NZ Housing Market has another -20% to fall minimum! It's Guaranteed by RBNZ itself!

This once in a generation crashing housing market will be written of in the history books, alongside the epic South Seas and Dutch Tulip Bubbles.....

Seems like Tony Alexander has finally cottoned on to reality ...

https://www.oneroof.co.nz/news/tony-alexander-in-the-most-dangerous-par…

"I’m no expert in behavioural economics"

There's an understatement if there ever were.

Lol

From the article:

Cash flow pressures will be felt across most sectors of the economy but particularly hospitality, retailing, and the widely defined home building sector with concentration on developers of multi-unit buildings. Many businesses will not survive to 2025 and when I get to this point in my presentations, I strongly emphasise this following point.

The decline of sufficient cash flows for many businesses will initially be accepted as temporary. But as the owner trims costs, perhaps sells off assets to shore things up, there comes a point where it will be clear that continuation of the business is not possible.

The problem is that the owner is probably not going to acknowledge this situation until it is too late to save some capital, their home, their marriage and maybe their health. My recommendation thus becomes this:

For those of us who have been around for a while and seen the ups and downs, watched the rash purchases of golden Ford Rangers and seen the forcing of families to live with relatives, there is a duty. One of us needs to sidle up to our relative, friend, club mate running the business and say perhaps you need to call it quits. Not everyone wins every time and sometimes you’ve got to stop what you’re doing before things get legal at the behest of your bank, your creditors, or the IRD.

'He still expects a more obvious upswing next year and is forecasting that house prices will rise 7% in calendar year 2025.'

Just my opinion, but if you are selling debt for a Property Ponzi, the last thing you want to do is spook the prospective target customer.

The lesson is, always never say never, at least give yourself the option, leave that door open, of that 'one in a million' chance of being right.

Hope springs eternal.

And they are smoking a lot of hopeium now.

Precisely… such a BS prediction to calm the sheeple.

Auckland median was down 1.9% in April alone

We could easily see record quarterly falls over winter

What a surprise.

I used to wonder if these bank economists are incompetent, or simply salespersons. Perhaps a bit of both.

Agree, but the real clowns are the media who hold them up as high priests proclaiming the nation’s future economic outcomes, instead of offering critical analysis and perspective….

Yep you are so right. I’m sick to death of stupid comments from the dreadfully well informed Katie Bradford and the like on One News on the state of the housing market and the economy in general. Painful, unpleasant and unhelpful.

A bank economist is just another name for a salesperson. Add inflation & we're sliding slowing but surely. But remember Tony Robbins advice, everything comes in cycles. The next little while will be tricky, but after that there will be a new season.

Quietly, inside , I am doing a Dilbert engineers victory dance ……

Whatever you do please dont talk up the market, rbnz is making notes.

All I can hear is crickets

"Harder. For Longer!"🤭🤣😂

No, definitely not. Down for 2024. The trend is clear. It might be time for a random drug testing at BNZ.

J. Powell US Fed Chairman. "2020 Jackson Hole I said. 'Higher for Longer'.

In 2024 it's going to be 'Harder for Longer baby!"

I'm curious, has a bank economist ever predicted a price drop?

Thay are not allowed to utter such heresy.......these economc prests and soothsayers must maintain the bank/company line and in turn cajolle the stretched market to further line the "fat to spill" pockets of the banking industry.

One major problem, the general market now know, the veneer has lifted and the overbaked and still helleshly overpriced NZ HOUSING market is a balloon that is midpop.

Deflating bigtime cuŕrently...... buyers today will be the underwater, negative equity bag holders of tomorrow.

BE CAREFULL OUT THERE!!!

Around GFC yes

I think ANZ will issue a fall prediction soon, just a little fall though ;^)

Inflation is not over. Here is what's happening to regional Hawkes bay rates:

Over the last 10 years rates have quadrupled 2014-2024.

The council is proposing a rejig of the rates and a new rating valuation system for 2025, which happens to be exactly a 100% increase from this year.

For example, this is what it looks like in round numbers:

Rates 2014 - $1,000

Rates 2024 - $4,000

Rates 2025 - $8,000

Yet another reason why prices will trend downwards… less money available to service borrowing.

Interesting Starry!

Its effectively an LVT without saying it. No actually it is an LVTax - just not a national one....yet.

8k, its now like leasehold land?

Is that filtering through to increased rents like it is in Auckland?

I'd be rounding up the towns folk, marching down to the local council offices and collectively telling them to f**k off.

Also, how many councils do you actually need in Hawkes Bay?

I would say, looking at all the negative comments here, now's a great time to buy. You can get very rich making good bets on property.

After you.

I’ll be waiting for msm narrative to be full throttle negative.

September quarter inflation is set to be big with council rates increases a major driver. RB will not be happy. An unhappy RB is not good for interest rates, even though the economy is floundering. another RB rate rise will hurt.

When everyone's saying the sky is falling, it's probably time to buy property. Picking the absolute bottom is almost impossible, but the last year has been as good a time as any to dip your toes in the water.

Nathan Rothschild allegedly said, "buy on the cannons, sell on the trumpets".

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.