By Gareth Vaughan

ASB CEO Barbara Chapman says she's not worried about a potential "boom-bust" scenario playing out in the Auckland housing market.

Speaking to interest.co.nz after ASB posted a 6% rise in annual net profit after tax to $913 million this week, Chapman said she wasn't concerned about the Auckland housing market.

"[But] I do think that at 9x income it is a stretch for people to get into the housing market in Auckland. It's no different from Melbourne and we're better off here than the people in Sydney are. That (Sydney's] at 12x income at the moment," said Chapman.

"If you look at the fundamental drivers...we're in a low interest rate environment, we've got very good employment, particularly in Auckland, and then you have to look at the impacts of migration and what that's having. So fundamentally I'm not concerned with the core drivers of the market as it stands at the moment."

Wednesday's Real Estate Institute of New Zealand figures show Auckland's Stratified Median House Price pushing ever closer to $1 million, rising 0.9% month-on-month in July to $996,550.

In terms of the Reserve Bank's plans to beef up its loan-to-value ratio (LVR) restrictions on home loans, notably through the introduction of a minimum 40% deposit for residential property investors nationwide, Chapman said it was too soon to tell what impact this would have.

"What has typically happened is some of these initiatives have cooled interest in the [housing] market for a while, and then it has come back. So it's really too early to call. [But] I imagine as these restrictions continue to increase then it must ultimately have a more sustainable cooling impact on the market, and I don't think that would be a bad thing at the moment," said Chapman.

'That's not going to happen'

The Reserve Bank's also looking at potentially introducing limits to high debt-to-income ratio lending, and/or making banks hold more capital against housing loans (a counter-cyclical capital buffer or capital overlay). Asked whether she thought such moves were necessary, and what impact they would have on ASB if introduced, Chapman said the question of whether they're necessary goes to a fundamental point of whether or not you think the housing market is going to correct sharply.

"All the economic indicators, and our economists, are saying to us that that's not going to happen. So will something like this cool the absolute increase in prices? Yes, they potentially will. So in itself it's not a bad thing. But if you're asking me whether I'm worried about a boom-bust kind of scenario, we're not," Chapman said.

"The view of our economists is by about 2019 some of the heat might be coming out of the market naturally in terms of the supply and demand factors, and then we might see a dip in prices. What they tell me in the last 20 years [is] there have been four relatively small dips in prices and then the market corrects. These sorts of scenarios going forward would not be unusual. So net-net I just think we'll take a cautious and measured approach through the market."

'We've been really, really conservative'

Chapman's counterpart at ANZ, David Hisco, recently publicly aired concerns about the heat in Auckland housing, telling interest.co.nz; ""What we believe is that clearly wages have not risen in pace with Auckland house prices. And so there comes a point when if we're not already close to it or there, where kiwis can't afford to get a loan and pay it off. This things going to come to an end somewhere, it has to because you can only borrow so much."

Asked about her take on Hisco's comments, and whether she saw any ANZ self interest in them, Chapman was coy.

"The best way for me to answer that is to look at the fundamentals inside our [ASB] book and the performance of our book in the market. We've been flat in [housing lending] marketshare over the last five years. You've heard me say, probably three years in a row, that we've been navigating quite carefully through the market cycle. So we've been quite measured. Our risk settings are very conservative. If you think about, for example, market's that have got into trouble around apartment lending in the past, ASB's very conservative around apartment lending. Less than 1% of our entire book is stand alone apartments where the customer doesn't have any other kind of lending security with us. So we've been really, really conservative," said Chapman.

"The buffers in our interest rates that we [use to] calculate the uncommitted monthly income for our customers, we add 2% onto the variable rate as a buffer, and if you end up with a fixed rate below the variable rate the buffer's obviously much higher. So if you think of all those settings that we have, I actually think ASB's well positioned in the market and we'll just carry on being conservative."

Asked where she thought Hisco was coming from, Chapman said the question was best addressed to him because she didn't have insight into ANZ's home loan book.

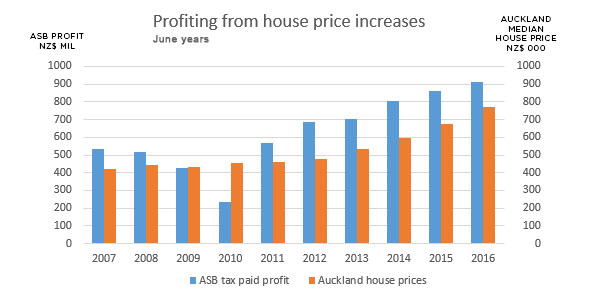

*The interest.co.nz chart below compares ASB's profit over the past decade to Auckland house prices.

*This article was first published in our email for paying subscribers early on Thursday morning. See here for more details and how to subscribe.

40 Comments

ANZ boss has a different say to ASB boss. Who is right.

It shows no one is an expert and it all depends upon individual perception at that time which again may be influenced by personal interest.

Nothing to see here. Go back to sleep.

As long as foreigners are allowed carte blanche in NZs housing market, NOTHING will change. And when you are counting up foreigners, please INCLUDE students who are currently being lumped in with NZers, unlike in Canada and Australia, who have now taken steps to do the right thing with their housing markets, understanding that first and foremost, a county's housing stock is for the people of that country.

Government intransigence and downright stupidity has now quite possibly left this situation to develop to a point where doing the right thing will have a serious effect. It should never have come to this.

Canada & Australia ? Yes they both are way ahead of John Key in creating law for housing purchased by foreigners but it hasnt done a lot of good ! As the article states above Melboune 9XA/I and Sydney 12XA/I

and forget Vancouver Canada its in a bubble all its own due to opo same as Toronto which is Condo High rise Heaven & Hell.

So no legislation in AU or CA has done little and expect the same in NZ.

Of course, if we get a government that puts kiwis first in 2017 all bets are off.

Pocket aces welcome to the club mate

. also don't forget foreign buyers also includes temp visa workers in australia and Canada

So the only buyers who are not foreign.buyers are CITIZENS * PERMANENT residents

So for the avoidance of doubt

Foreign buyers = offshore foreigners + foreign students + temp visa workers

Why does nz media (including interest.Co. nz) and govt have a different definition of foreign buyer than our peers ?

Write to your edititors/ reporters and MP'S. Ask what the agenda is for miss reporting foreign buyers

Per LINZ report students + temp bought 13,500 houses which is about 13billion dollars worth give or take . 1 billion dollars a month. 250 million a week. Assuming most in Auckland at average price.

Although this isn't news worthy for nz media.

"So for the avoidance of doubt

Foreign buyers = offshore foreigners + foreign students + temp visa workers"

It's simpler than that. Foreign Buyers = Not NZ Citizens.

"Of course, if we get a government that puts kiwis first in 2017 all bets are off."

You mean if we get a government that puts all kiwi 'non-home owners' first...as certainly no current home owners want foreigners banned from buying in NZ.

Some home owners with children or those who have sympathy for those without a home may. Only people who benefit are investors.

If you give you will get more back

Dream on. Plenty of people who own homes are disgusted at the state of affairs.

So disgusted that they will vote National in 2017!

Disagree keywest (keywest - great place by the way) - I own a home (and a very long term rental) and life is pretty good - BUT I think it's abhorrent what has been allowed to happen.

In fact the party that addresses the absolute rort of foreign buyers being covered up and rampant FOMO driven speculation head-on will get my vote (have been a -Nat voter..)

But then again I'm a weirdo, I like money (quite alot actually) but not by screwing someone else over - I believe capitalism and a social conscience are not mutually exclusive but are in fact essential for a functioning society.

I want the most valuable (yet often most poorly paid professions like Teachers, firemen, police, ambulance drivers, nurses.. etc etc) to also be able to participate in fully in their country - or are we simply going to "import" those too?

Because a cop and a nurse couldn't afford to buy in Auckland now, and I would bet the farm that their contributions to society are far greater than yours or mine....

Seriously what sort of traitorous, greed driven monster wouldn't?

My .2c worth............

2 thumbs up if i could... hit the nail on the head. Great post

Agree... Your comment about cops & nurses' contributions to society makes me think of a recent view I was exposed to that attempts to explain why professions such as these are paid so much lower than a banker or marketing exec.

If you think professions are rewarded based on their contribution to society things make no sense at all.

However, if you rank professions based on how much they contribute to maintaining the status quo of societal power and wealth distribution, then it makes more sense... A good teacher trains youths to question things... this can be a risk to the status quo, so they are paid much less than a banker or lawyer who's profession helps a lot with maintaining current wealth distribution.

"I want the most valuable (yet often most poorly paid professions like Teachers, firemen, police, ambulance drivers, nurses.. etc etc) to also be able to participate in fully in their country - or are we simply going to "import" those too?"

I think that is a very valid statement. Eventually people will drop out of these professions (if they are not already) due to the sheer lack of pay. They then go on the skills shortage and we import the labour.

It is becoming clearer by the day, we do not have a skills shortage in NZ - we have a shortage of fair pay.

The work, value and rewards system has been totally screwed up in Capitalistic countries, thanks not by a small measure to greedy bankers, politicians and lobbyists. The US seems to have exported an evil plague to the rest of the world, especially in the making of and treating the GFC.

what they're saying is they really dont know. This is is confirmed when BC says that "our economists say" blah blah blah. Who would stake their livelihood on what an economist says? nice one

what theyre saying is that we are confident that the Key govt will continue to support policy that will keep prices up. Policy changes could fix this ponzi overnight...but they just dont want to. B##gger the young, its all about the boomers.

yeah no one has a magic ball to peak into, Economists can tell you where in a cycle we are, how metrics compare with previous cycles etc, but not when the bubble will pop or how hard the pullback will be, they can;t model the global interconnections as they are new and they don't have enough empirical evidence...

this is a well written article, I think the RBNZ missed a chance to cut 50

http://www.zerohedge.com/news/2016-08-11/rising-recession-risks-tears-a…

what she's saying is that if the boom continues, they'll make a lot of money, if the bubble bursts, the depositors will bail them out. Nothing to lose, easy 3mil salary thanks very much.

With 2.5% of a Real Estate loan being ASB capital and the other 97.5% being "other peoples money" a margin call could get interesting fast

Re boom/bust cycles

Give or take the extreme level of immigration here, much of the rest of the world seems to suffer from similar problems (except perhaps Germany). One therefore has to suspect that there is a common cause and that must lie somewhere in the accepted "wisdom" of how to manage an economy. What is Germany, and if any other countries that do not have this problem, doing that is different?

@ Chris M, Actually the Germans do have housing affordability issues. And most people there would like to afford their own home. It's just more acceptable to them to rent as they've become more conditioned to renting since the last World War. And more recent the GFC helped to reinforce the rental condition.

But now that rents, and in many cases, property values, are rising, Germans are increasingly looking to buy property.

See that's the downside of renting; as a Tenant YOU have no control over rental increases!

And then there's the bottom line: In a world lacking in secure investment opportunities, the appeal of property investments is never as great as it is today.

But in this day and age, nothing is guaranteed.

Recent article from Handelsblatt: https://global.handelsblatt.com/edition/382/ressort/finance/article/ger…

Thanks CJ

If I'd thought a bit more about it, it is not surprising that Germany was free of the property hysteria. Most do rent, so not the same public involvement in property. Now that this is changing it suggests that the problem must be pretty much universal adding weight to the argument that it has a common systematic cause.

You're very welcome Chris. And to be honest I wish there was some better investment opportunities that would help Investors move away from property and in to something more rewarding.

That would take the heat out of the global property markets and give everyone less frustrating lives.

There's an idea; David how about giving a comparison article on other investment areas, such as: Arts, Precious metals, Wine, Science and tech industries. I know this is kinda of covered in some of your article areas but it would be good to see if these smaller investment areas can give good financial rewards?

This is the most realistic analysis and view I have heard so far and Ms Chapman is known to be an astute CEO ... so we are just like Melbourne and much better than Sydney income multiples - no wonder why wise kiwis and Aussies are moving and settling here !!

What she is saying is well known to everyone who has put hopes and prayers aside and is getting on with his daily life and looking after improving his financial position to catch up with the train when it slows down a bit.

-- a quick look at the curve above tells us that Auckland house prices have never really stopped increasing for the last 8 years ...it has just accelerated a bit faster in the last 3 or 4 years....and will take a breather by 2019 ... most certainly will take off again a bit later on.

I have posted the comment below in another thread yesterday and I repeat it here because of its relevance:

" What ever Loan to income limitation is designed to do ... the actual facts on the ground are that it will sweep almost all FHB and most of the new little property investors and mum and pops who are attempting to join the game now out of the property market ... making property investment limited to the big boys in this business ( and immigrants obviously) who can afford all the combined new rules and then some. For them its party time and buying season... I just heard from friends in real estate agencies that markets will go crazy until the end of the year and all their big clients are busy re-valuing their properties getting ready to borrow more and buy more before Loan to income limitation kicks in ....they would even take commercial loan rates to buy residential property even on Principle + Interest loans.. go figure!

The property market doesn't work on hopes and assumptions ... every investor is now certain that prices will not drop and if they ever did in 2 -3 years, it will only be 5 -10% at most after gaining another 20-30% ... history proves this fact ... and holding long term always wins - whether we like it or not,

We can have this debate in 3 months and prove each other wrong , but it is Time to take the heads out of the sand and survive in the current economy and markets instead of contemplating what's going to happen.... that's what I do."

Today i realised that ASB's CEO and Economists share the same views..

based on what prices will take a breath by 2019 and continue increasing later on?

Most bank economists' comments to date are inclined to 5-10 % average pa increase for the next 18 - 36 months or some say until 2019 ... so it is fair to assume that Auckland house prices will rise another 20 - 30 % from 2016 -2019.

We remain hopeful that they are WRONG ...

Slap INVESTORS and FOREIGN BUYERS with a 15% stamp duty and then you can sweep them under the mat and give FHB a fighting chance.

Yes, but it looks like FHB have very limited chance&choice and their hopes of house prices going back is diminishing every day ... the new built are getting more expensive , the income multiple will kill their chances -- the Unitary Plan is being tweaked and ACC threw away building affordable housing yesterday ..see the link below:

https://www.youtube.com/watch?v=Y9TSBlMl-do&ab_channel=RNZ

hmmm!!

She's wrong about an average house in Auckland costing 9 x the average wage.

Policeman, nurses and school teachers etc are all earning around $50,000 a year.

that puts an average Auckland home at about 20 x average wage.

I think people constantly confuse median and average also, and what is happening is that the equation is done on average "household" incomes, where it used to be that the equation was done on one income. If you had 2 incomes coming in back in the day of higher interest rates, you were still onto a far better thing than today. Just little tweaks to the language used can change the whole meaning of what is being said. And yes, if we did compare apples with apples, we would still do the equation on the one income, and yes that does make it look seriously frightening.

eco bird no reason that they would stop while 1/3rd of the houses or more are brought by foreign buyers and as the Hoegarden website article pointed out prices are still cheap compared to shanghai etc

Price rises will continue until the government takes the problem seriously and acts.

National won't do this so the only hope is for the opposition to win next year's election.

If Greens, Labour or NZ First propose a 15% stamp duty on foreign buyers they will take a good chunk of the votes off National and enough to win a coalition government next year. Just need to ensure they use the international definition of foreign buyers which includes students + temp visa workers.

It comes out of the dark and it hits you when you arent looking its called a GFC and very few economists and Bank CEO's picked it last time.

Last year we had an influx of 60500 immigrants - and not enough houses for the people already here......

I have no idea what rationale was used to allow such numbers in.....

Can someone explain?

Hell it was 69500 no 60500.....

Agreed Joe, I believe that we need to slow down the Foreign Buyers ( whether the 15% will make a huge difference will be seen when applied) ...

I think this is another chicken and egg story - the property market , regardless of who is buying, is the only show in town ( and you know it is world wide) .... { commercial too BTW } This will see little change until such time when Economy starts Growing Stronger and businesses start investing more and attracting / creating other forms of investment opportunities ... the current available investment options are forcing anyone with a bit of extra cash toward the housing market ( especially that he can borrow against it) because the alternatives are either too risky, too dodgy, or have poor ROI.

PPP and other projects initiated by Gov to attract retail investments and employ people in infrastructure etc will absorb a lot of cash that is scattered around - look at the over - subscriptions for Bonds and Notes !! it is ridiculous ...

Without tangling this issue in political debate - as that could lead us away from objectivity at times ... I am not sure ( Thus Far) that L/G coalition will deliver the goods everyone is hoping for ... their position on this matter is so far very cagey and they talk about very debatable macro policies which can evaporate fast when put in practice - Labour is known for such blunders ! -- so far they are alleging to do things full of contradictions without actual detail analysis or credible studies ( sounds a bit like daydreaming ) , they also chose to evade answers about implementation .. and that is obvious when they selectively pick numbers from stats and research and play on the nerve wrecking stories like homelessness etc .... Personally, I need to see solid convincing arguments about practical solutions on this matter rather than knee jerk headlines and broad policies which currently do not hold a lot of water and only serve as political football in a kindergarten.

I am not saying that the alternative or status quo is better on this issue - making a decision when you are in power is very different when you are out of it.

All political parties need to respect the electors' intelligence who can / will clearly see through bogus claims and actions ... however, Auckland housing price will not be the ONLY decision making criteria in selecting the next government .... I guess there is a lot of water to flow under the bridge until then ...

Ppl are moving from auckland and wellington to 2nd tier cities Hamilton tauranga hawks Bay NP and Palmy. Cities of decent size with good schools that are still affordable are seeing a big influx. This will only show up in census data, but reviewing the 2003-2009 census period during the last housing boom cities like Palmy grew over 1.1% pa which was not short of what auckland did (closer to 1.5) even though immigration is all into auckland.

Simon,

I live in Mt. Maunganui and according to one agent, my home has been rising in value by around $2000pw for the past couple of years. That may be so,but I don't feel any richer and all it does is make property increasingly unaffordable for other locals. It also puts huge pressure on our infrastructure

It makes for good dinner party conversation,but I don't think it's healthy and it's bad news for many tenants. They are either being forced out by landlords selling into the market, or seeing substantial rent increases.

This government has failed abjectly and I would love to see them booted out of office,but I am not confident that will happen.

Simon,

I live in Mt. Maunganui and according to one agent, my home has been rising in value by around $2000pw for the past couple of years. That may be so,but I don't feel any richer and all it does is make property increasingly unaffordable for other locals. It also puts huge pressure on our infrastructure

It makes for good dinner party conversation,but I don't think it's healthy and it's bad news for many tenants. They are either being forced out by landlords selling into the market, or seeing substantial rent increases.

This government has failed abjectly and I would love to see them booted out of office,but I am not confident that will happen.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.