By David Hargreaves

Fonterra's putting various aspects of its business - including the ill-starred investment in China's Beingmate Baby and Child Food Co - up for review after reporting an after-tax loss of $196 million for the financial year to July.

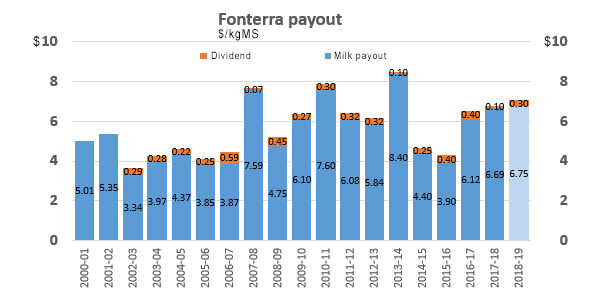

For the year ahead the dairy co-operative is sticking with its farmgate milk price forecast of $6.75 per kilogram of milk solids (which was reduced from $7 last month), while it is forecasting earnings per share for the financial year ahead of 25c-35c.

The final milk price in the year just finished was $6.69, which with a dividend of 10c (which has already been paid at the half-year mark), gives a return of $6.79.

Fonterra says it will re-evaluate all investments, major assets and partnerships to ensure they still meet the Co-operative’s needs today.

"This will involve a thorough analysis of whether they directly support the strategy, are hitting their target return on capital and whether it can scale them up and grow more value over the next two-three years.

"This will start with a strategic review of the Co-operative’s investment in Beingmate."

The events culminating in Thursday's results announcement have been graduallly building.

Last month Fonterra made a late cut to the milk price for the just finished season and slashed the dividend forecast.

Then a few days later the co-operative said it was putting the search for a new CEO on ice, and was appointing long-time Fonterra staffer Miles Hurrell as interim CEO. While the initial appointment of Hurrell described him as 'interim' CEO, all the materials released by Fonterra on Thursday, including the annual review, refer to him simply as 'CEO'.

The wide reaction to Fonterra's loss announcement was to be expected.

Fed Farmers 'disappointed'

Federated Farmers Dairy Chairperson Chris Lewis said Fonterra’s net loss after tax of $196 million was a very disappointing result.

"That’s the first full-year loss in their 18-year history. From a $745 million profit last financial year to a $200 million loss - that’s a big drop and they simply must do better. But I’m confident they’ll turn things around."

Feds Dairy Vice-Chair Wayne Langford said the forecast earnings per share for FY19 of 25-35 cents "should be considered a minimum, in my view".

Federated Farmers national board and Dairy executive members would continue to have regular meetings with Fonterra "and it’s more important than ever for us to push for improvements and keep them on their toes," Langford said.

The farmer shareholders are 'disappointed' too

Also "disappointed" with the Fonterra result was the Shareholders’ Council, which represents farmer shareholders of the co-operative.

“There’s no denying that our farmers are unhappy with current performance, and this year’s results,” Council Chairman Duncan Coull said.

“The underlying result and its impact on earnings, dividend and carrying value is totally unacceptable and one that our farming families will not want to see repeated. Moving forward, it is imperative that our business builds confidence through achievable targets and at levels that support a higher carrying value of our farmers’ investment.

“We have been encouraged in the recent short term by the willingness of the Board and Management to take an honest look at our position and make the necessary changes. We are looking forward to a continuation of more open and transparent discussions, and seeing those translate into long term results.”

Coull also noted the Co-op’s NZ$20 billion revenue resulting from the very strong milk price.

“The New Zealand public needs to recognise that out of that $20 billion revenue, a good portion remains in the New Zealand economy. That’s a real positive - no other New Zealand business delivers that,” he said.

In what might be interpreted as a pre-emptive strike against any calls to break-up or otherwise reorganise Fonterra, Coull said that despite Thursday's results announcement, the shareholders' council "remains firmly resolved that Fonterra as a strong co-op is the only model that serves to deliver a strong future for our farming families in New Zealand".

Spierings still got an 'incentive' payment

Theo Spierings, who stood down as CEO during the year, attracted a reasonable level of controversy regarding his salary. His total remuneration generated in 2017 was given as $8.3 million. This included short and long term incentives that would not have been paid in the 2017 financial year.

For the 2018 financial year, the annual review gives Spierings' fixed salary as just under $2.463 million (same as previous year), with 'benefits' of $103,275 (down from $242,340). Interestingly, in a year in which the business he was running lost $196 million, Spierings was granted $979,702 in 'short term incentive' payments (down from $1,182,144).

In what is much fuller disclosure of the CEO's salary this year, Fonterra says: "The STI value of the CEO’s remuneration is set at 60% of fixed remuneration if all targets are achieved. For the 2018 Financial year, the CEO realised a total STI payment of $979,702 ($1,182,144 in 2017 Financial Year). This is against a target of $1,477,680. The board has approved this STI outcome and payment will be made in October 2018."

There was no long term incentive earnings achieved in the past year.

All this means in terms of earnings, Spierings generated just under $3.546 million in the 2018 year. There's no mention of termination benefits, which would presumably be paid in the next financial year.

'More accurate forecasting'

Monaghan has only been in the hot seat as chairman since late July, replacing John Wilson, who stood down after a health scare but whose suitability to stay in the job had been questioned after the numerous Fonterra misadventures over particularly the past 12 months.

Monaghan says at $6.75 per kgMS the forecast Farmgate Milk Price for the 2018/19 season is the third consecutive year of strong milk prices.

"That’s good for farmers and for rural economies where farmers spend 46 cents of every dollar they earn."

One of the co-operative's main priorities for the coming year is "ensuring more accurate forecasting"

Fonterra says the business "will be run on more realistic forecasts" with a clear line of sight on potential opportunities as well as the risks. It will also be clear on its assumptions, so farmers and unitholders know exactly where they stand and can make the decisions that are right for them and their businesses.

In terms of the detail of the financial performance in the past year, the net loss after tax was $196 million (compared with a profit of $745 million last year), while "normalised" earnings before interest and tax were $902 million, down 22%, the co-operative’s gearing ratio blipped up sharply from 44.3% last year to 48.4% and return on capital was 6.3%, down from 8.3%.

'Business performance must improve'

Fonterra's recent trim to the milk price payout for the year gone was in order to shore up the balance sheet.

CEO Miles Hurrell says Fonterra's business performance must improve.

“There’s no two ways about it, these results don’t meet the standards we need to live up to. In FY18, we did not meet the promises we made to farmers and unitholders,” says Mr Hurrell.

“At our interim results, we expected our performance to be weighted to the second half of the year. We needed to deliver an outstanding third and fourth quarter, after an extremely strong second quarter for sales and earnings – but that didn’t happen.”

Hurrell says that in addition to the previously reported $232 million payment to Danone relating to the arbitration, and $439 million write down on Fonterra’s Beingmate investment, there were four main reasons for the Co-operative’s poor earnings performance.

“First, forecasting is never easy but ours proved to be too optimistic.

"Second, butter prices didn’t come down as we anticipated, which impacted our sales volumes and margins.

"Third, the increase in the forecast Farmgate Milk Price late in the season, while good for farmers, put pressure on our margins.

"And fourth, operating expenses were up in some parts of the business and, while this was planned, it was also based on delivering higher earnings than we achieved.

“Even allowing for the payment to Danone and the write down on Beingmate, which collectively account for 3.2% of the increase in the gearing ratio, our performance is still down on last year.”

'Being clear with farmers and unitholders'

Monaghan says Fonterra is being clear with farmers and unitholders on what it will take for the co-operative to achieve the forecast earnings guidance.

“For the first time we are sharing some business unit specific forecasts. Among others, these see the Ingredients and Consumer and Foodservice businesses achieving an EBIT of between $850 million and $950 million, and between $540 million and $590 million, respectively.”

“FY19 is about lifting the performance of our co-operative.

“We are taking a close look at the Co-operative’s current portfolio and direction to see where change is needed to do things faster, reduce costs and deliver higher returns on our capital investments.

“This includes an assessment of all of the Co-operative’s investments, major assets and partnerships against our strategy and target return on capital.

“You can expect to see strict discipline around cost control and respect for farmers’ and unitholders’ invested capital. That’s our priority.”

Here's the financial highlights as given by Fonterra:

• Total Cash Payout for 2017/18 season: $6.79

o Farmgate Milk Price $6.69 per kgMS

o Dividend of 10 cents per share

• New Zealand milk collections: 1,505 million kgMS, down 1%

• Sales volumes: 22.2 billion Liquid Milk Equivalents (LME), down 3%

• Normalised sales revenue: $20.4 billion, up 6%

• Net loss after tax: $196 million

• Normalised EBIT: $902 million, down 22%

• Normalised gross margin: 15.4%, down from 16.9%

• Return on capital: 6.3%, down from 8.3%

• Normalised earnings per share: 24 cents

• Gearing ratio: 48.4%, up from 44.3%

• FY19 forecast Farmgate Milk Price: $6.75 per kgMS

• FY19 forecast earnings per share range: 25-35 cents

See here for the full dairy industry payout history.

27 Comments

"It's the $5 million a year job that no-one wants.

Several top Kiwi chief executives have been approached for the top job at Fonterra, New Zealand's largest company...It is understood one came close to inking the deal but at the last minute had misgivings and spurned the dairy giant's advances."

I will take the Job for two months.......I think it will pay for my House....if I start soon.

If not will have to play catch-up and work another month.

I will not take NO for an answer.

I am sure in 3 months I could turn around the losses.

I would tell all Farmers to build Workers Houses, then fire all the overpaid Fonterror Management shirkers, employ new staff, give em free accommodation for life, on the Farms. Capital Gains, no sweat.

All this as part of the package.

Will give a tax deduction to Farmers, A tax incentive for the Government...OH and a free bottle of Milk per Citizen each week to repay em for being milked the past 40 years....that I know about.

Poor Farmers, Poor Fonterror, Poor Cows, Poor Management, Poor me......Poor didums.

I get a Free House...which is all I want...for my troubles...,,

The word HUBRIS comes to mind

( $196,000,000.00 )............ with a red bracket around it !

How is it that New Zealand's equivalent of BHP or Anglo American PLC or Ford Motor Co , that collects and bottles something as simple as milk , is in control of the entire supply chain from the cows udder to the human stomach and is effectively a monopoly , can lose so much money ?

The executives sitting in their over-the -top waterfront offices are too far removed from the farmer ( owner ) for starters .

They speculate ( or I dare say gamble ) with money that is not theirs in high-risk ventures that if they came off would see spectacular executive bonuses ............ and maybe thats what is wrong ?

I would suggest that some of those gambles were driven by the executive remuneration formula, which possibly rewards super-profits instead of steady stable generic growth and long term on-shore asset growth

The business decisions they have made offshore have been massive gambles , when they should have been doing value -add production in cheese, UHT , yogurts , base products for pharmaceuticals and milk powder right here at home .

And importantly , those value add jobs could easily be located in the provinces ensuring employment for the folk out there

The executive clearly dont have the foggiest understanding of business ethics in places like China and elsewhere in Asia , and are clearly not cut out to make high risk investments in places like China , South Africa , Sri Lanka or Indonesia .

Layered on top of this is a corporate culture of secrecy that even the Cosa Nostra would be impressed with.

I dont know what the way out of this mess is , when the executives are so well ensconced in the entity , real meaningful change in this organization is unlikely

Some very sound comments Boatman.

I'd like to see Theo's performance bonus clause. You know the one that sees the company lose $196,000,000 and gives him a big fat bonus. What a bunch of mugs for hiring him and agreeing to bonuses for making huge losses.

Sri Lanka is not high risk. It is arguably the most successful market for the Anchor band. The guy who was leading in SL there has jumped ship to Synlait.

this is a company that has had bad ceo after ceo and a weak shareholder structure to turf them out ,

moving all the office to the most expensive city in NZ and locating it in one of the most expensive places to lease space is just plain bad decision making.

by rights they should be in Hamilton 1/2 way between the two ports they use, cheaper place, can hire cheaper staff and closer to there main north island manufacturing and distribution.

and why did they come to Auckland, did that have anything to do with the ceo that lived on waiheke island and wanted to commute each day by ferry to his downtown office?

the attitude of Fonterra management seems one of we know whats best shareholders (your just a farmer keep your nose out of it) dont worry.

More dirty secrets for the dirtiest industry in NZ

"New Zealand, stubbornly, has continued to trade in phosphate, despite legal and reputational threats. While other global multinational companies bowed to ethical pressure from investors, the New Zealand companies are co-operatives, with no outside investors."

https://www.stuff.co.nz/business/farming/106331549/refugees-in-the-saha…

"The only two co-operatives involved in this entire sector, owned by the farmers of New Zealand, seem untouchable," says Erik Hagen of Western Sahara Resource Watch.

Yes, read about that the other day.

We really have lost our way with all this dairy expansion and its corresponding debt.

We really need that phosphate, look at the trouble we are going to to get it, you wouldn't do that unless you really needed it. Im already trying to think what the farms going to look like without it, Im hoping smarter minds can find a solution.

Not yours to take Andrew - my solution give up dairy cows and plant something...dirty dairy.

And of course due to the cadmium build up, food cropping in future will be a no-go on much of the land which has had this continual treatment in the past;.

https://www.radionz.co.nz/news/regional/290690/the-toxic-legacy-of-supe…

But, yes, we have good agricultural research scientists out there and to my mind we need to elevate their work in importance.

We could of course use our own rock phosphate, but mining is verboten in NZ. Why do we prefer to poison our soils?

http://www.rockphosphate.co.nz/news/

The dirtiest industry in NZ is industrial society of which Dairy is but a part. Human footprint.

or ...

We really have lost our way with all this ... Auckland housing expansion/Christchurch earthquake build / road network expansion / student loan ponzi etc etc .... and its corresponding debt....

Townies and their ignorance about where stuff comes from are but hypocrites ... CITIES are the consumption centres which drive this exploitation of resources...

https://www.theglobeandmail.com/opinion/article-the-coming-concrete-cri…

Everyone who had any nous in the industry new the Chinese brand was a lemon. Beingmate had no value and was a complete rip off. Why didn't Fonterra know this ? Where are the answers and has the board been held to account ? Chinese must have laughed all the way to the bank.

Fonterra is unmanageable. It is why it has these results and why no credible CEO wants the job. The company doesn't know what it is. At one end it is a farm tractor, somewhere else a line-haul lorry, here and there a white van, and parts of it have the ambition to be a convertible. What kind of petrol should it have? No-one cares. Who'd be best to drive such a vehicle? No-one knows. It runs as a Chrysler Valiant might in a Formula One race.

The Herald is climbing in with a headline saying 6000 staff on at least $100k. Good grief granny herald this might have been a headline back in the 1980’s but in 2018 a $100k salary is just average.

True. It's barely over 10% of the median house price.

But what did the last census say....4.5% earn over $100,000. Looks like they all work for Fonterra.

Seem to be a lot of parallels with Auckland council. Bloated payroll, inefficient, poor governance, ripping off its customers and losing money hand over fist.

Why limit it to Auckland Council?

Seems like standard business practice for most large organisations in New Zealand, to me.

Fair point. Although most large corporates are in the black. The fact that AKL council is always crying poor, burns through an enormous payroll, yet on the face of it underperforms, and keeps lobbying central government for more ways to tax its ratepayers, all suggests incompetence.

Not sure what all the teeth nashing is about. Simply put they paid much for the milk. Given the vast majority of shareholders are suppliers the money is in right pockets anyway. I personally don't mind it when my meat coop loses money as it means I haven't been ripped off.

I think you are struggling with numbers here.

Where profit is concerned, bigger numbers are better.

You actually want your company to make money, not give it away to the Chinese.

Interestingly, in a year in which the business he was running lost $196 million, Spierings was granted $979,702 in 'short term incentive' payments (down from $1,182,144).

Wow.

Must have had some pretty easy KPIs.

Not long now, I'd say a certain other country is thinking, this is going to plan.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.