This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

By Gareth Vaughan

The Reserve Bank has effectively given New Zealand's banks the green light to decouple their floating mortgage rate changes from Official Cash Rate (OCR) moves, as the ANZ Group has done in Australia, opening the door for out of cycle mortgage rate hikes or cuts smaller than any OCR cut.

In an article entitled 'Bank funding - the change in composition and pricing' in the June edition of the Reserve Bank Bulletin Jason Wong, the Reserve Bank's head of financial markets intelligence, says it's no longer appropriate to proxy bank funding costs through a simple observation of the 90-day bank bill rate for a floating mortgage or the 2-year swap rate for for a 2-year fixed rate mortgage.

Wong's comments follow Australia's ANZ Group, owner of New Zealand's ANZ and National banks, controversially "decoupling" its housing and small business floating interest rate reviews late last year by deciding to review them on the second Friday of every month, independent of what the Reserve Bank of Australia (RBA) does in its monthly rate setting meetings on the first Tuesday of the month.

Announcing its move in Australia, the ANZ Group said the new policy provides "a measure of predictability" for customers on when rate changes will occur and provides the bank with "the flexibility to reflect movements in funding costs across the full spectrum of funding sources," not solely in response to the OCR. The policy saw the ANZ Group increase its floating mortgage rates in February, and subsequently other banks, even though the RBA had left the OCR unchanged. Both retail and business customer satisfaction with the ANZ Group has been declining since the new policy was implemented.

'The game has changed'

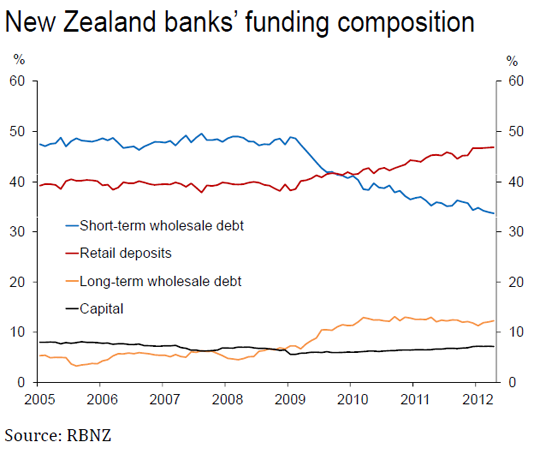

Wong, meanwhile, says the game changed as the global financial crisis (GFC) took a grip in 2008-09. He notes that before the GFC short-term wholesale debt - mostly from the US commercial paper market - was the biggest source of bank funding comprising about half total funding in the five years preceding the GFC. But from 49% of total funding in early 2009, short-term wholesale debt had dropped to 34% by April this year with banks stepping up their use of retail deposits (47% of total funding at the end of April this year) and long-term wholesale funding.

This has come about with the GFC highlighting the vulnerability banks faced when relying on short term wholesale market funding, pressure from investors and ratings agencies over the merits of a more stable funding base, and regulatory changes such as the introduction by the Reserve Bank of the Core Funding Ratio, says Wong.

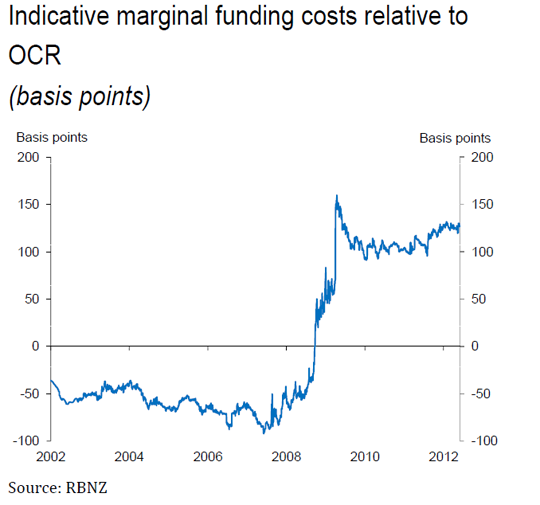

What all this means, he says, is pre-2008 banks could fund at a rate cheaper than the OCR but no longer can. Reserve Bank estimates suggest banks could fund at an average rate of 60 basis points below the OCR between 2002 and the Lehman Brothers collapse in September 2008.

"Our model suggests that from mid 2009 until May 2012, indicative marginal funding costs have averaged 110 basis points above the OCR, or an increase of 170 basis points from the pre-GFC days," Wong says. "Our estimate as at the end of May for overall indicative marginal funding costs was about 130 basis points over the OCR."

Breaking down the three major forms of bank borrowing, Wong estimates that at the end of May this year the cost of short-term wholesale debt was about 20 basis points over the OCR, the cost of retail deposits was about 120 basis points above the OCR, and the cost of issuing long-term debt domestically or in the United States was about 240 basis points over the OCR. Wong does note, however, that bank funding is a "highly technical and intensive process" meaning the Reserve Bank calculations should be seen as indicative of the trends rather than as a true and accurate measure of actual bank funding costs.

Wong also points out that when banks issue long-term debt, such as covered bonds, overseas, the cross currency basis swap agreements they reach in order to convert the money into the New Zealand dollar, effectively adds another 100 basis points to the cost of the money borrowed.

Despite the increases to funding costs, in its latest Financial Stability Report the Reserve Bank said the recent round of fixed-term mortgage interest rate cuts was evidence banks are currently well funded and "reasonably comfortable" with funding cost pressures.

'Higher bank funding costs mean the OCR has been lower than it might otherwise have been'

Wong says that in implementing monetary policy, the Reserve Bank has attempted to take higher bank funding costs into account.

"Thus the OCR over this period has been lower than would have been the case if previous interest rate relationships had persisted," says Wong.

So far none of the New Zealand banks have moved to emulate the ANZ Group's decoupling in Australia. In March ANZ NZ CEO David Hisco told interest.co.nz the subsidiary's funding profile was different to that of its parent. And an ANZ NZ spokeswoman said the bank had no plans to move to monthly floating interest rate pricing announcements. ASB CEO Barbara Chapman told interest.co.nz in February: "I’m not saying we’re going to decouple like they have, but it’s certainly an interesting twist to the market, I believe."

However, BNZ CEO Andrew Thorburn told interest.co.nz last October that even with the OCR at its record low of 2.5% for an extended period, floating mortgage rates would probably rise because banks' cost of funding was increasing.

Floating mortgages have gained in popularity over the past couple of years with NZ$108.816 billion worth, or 63%, of the total NZ$172.571 billion worth of mortgages floating as of the end of April. This is the highest percentage, by value, floating since the Reserve Bank started tracking floating versus fixed-term mortgages in 1998.

16 Comments

Certainly saw that one coming.

They have a red light?

So, is there any point in having an OCR anymore?

Were the rates ever really coupled or did it just suit the banks at the time to follow it?

More to the point - is there any justice in having a central bank?

Not if they're incompetent in carrying out their entire role.

Could apply that to both central and local govt. :)

yes, though I think personally the Govn should be taking the flak, its a policy failure more than anything IMHO. To me Govns write the policy (law) RB's execute it....

regards

More to the point - is there any justice in having a central bank?

Not at all except for regulatory oversight. - the market should be setting the rates, not some tired ex-Treasury hack returning from sabbatical leave, absent from any real world commercial trading experience.

Yes, RB's are meant to provide stability in the banking system. Now whether they achieve that is another matter, but since the fed for instance came into being its only had one big failure, the 1930s....its going to have one now, but really thats because of de-regulation and lack of will, really lay taht at Greenspan's feet.....reaping as they sewed...

regards

I believe one or more of the banks CEOs has said this year? that it suited them to follow the OCR and let the RB take the flak.

OCR any more, from my perspective ie that of peak oil, no......

regards

It's Bolly's little departure moment ......Kate.....an I've just been thinking, I'd like to them to let me do something moment.....would it be O K for me to turn on the big green light Billy Bob...?

Sure thing Bolly, go ahead give it the old flickaroo, you been a good boy and I'd like to think we're gonna miss you around here, but to be honest, we hardly even knew you were there...ha...go figure eh..?..............it's a little financial humour there Bolly Bib.....um you'll catch up.

Please let me know what the immediate reaction of the Australian banks was in respect to deposit rates when the RBA recently cut the base rate. The answer will confirm this article from the RBNZ, while containing some fact, is far from an honest review of reality where the OCR is concerned.

The pricing of RP and other commercial instruments is tightly regulated by the OCR - lets get real here.

As I understand it this wad of government cash - NZD 8.974bn as of May 2012 is lent by the RBNZ to our local banks at around 25 basis points(bps) over OCR. Yes @ ~ 2.74% the last time I was informed.

Yes who is working for who

Swings and roundabouts...Some people swing both ways.

When you prostitute yerselves for munny and turn tricks around the World, what else would would they need but a red light from Government. They is in cahoots, but not in public.

Almost any will turn a trick in private......they all have very few convictions....when it comes to turning tricks.

But...

The mere fact that the ladies of the night are not making enough munny, because the banks are turning tricks instead, is food for thought.

This feast or a famine lurk is getting some retailers down, including the ladies aforementioned.

Some are actually bending over backwards to save their customers from being shafted, albeit to keep their custom.

But I do not think they are borrowing ahead before selling their ass-ets.

Like a certain bunch of diss-honourabble...dicks .......and sleepless knights, wot rule the roost, scalp the public and send em the bill.

Sum are even giving freebies and cheap rates to pork some more porkers and pokies.

I hear some have a slush fund of up to 2 million....but screw me...where would they get munny like that from........must have turned summer salts and had a whip around, that night.

Buy the way.....

Talking of sleepless knights, with little conviction, but big rewards, wot ever happened to that Financial whizz who sent all his customers broke and ended up with knight hood.

Another key figure in this saga wos gonna hope that like all things in Government that hit us in the pocket, that it would all blow over.

Butt I have a long memory, unlike sum.....here today who think we all have dementia...and a frontal lobotomy..

Well blow me down, tis Friday, so I was gonna tell ye a joke about another blown over jobbie..

But I will screw this one for all it is worth...

This one take the biscuit..., the free lunch and a room and board...and charges by the knight, but never by the hour.

Almost like a male figure of the knight, as ladies of the night are not the only ones to benefit from a little prostitution.

As a rule I used to think otherwise. I thought honesty was the best policy.

Be true to ones wife, ones country, ones creed, ones liberty, fraternity and other tosh.

How wrong can one be.

But now I know better.......a wee fat burgher will always get off scott free.....especially when he has some bent mates to blow away the cobwebs, polish his nibs and give him....an honour-rabble....discharge.

Cos once a knight, always a knight, but that once a knight, will not let those shafted by him....pay their bills, with his hard earned...munny.. (They use someones elses...YOURS)

Sorry for the long sentences......I will keep em short in the future.....once they make me a knight too...I will do anything it takes.

PS...don't tell the wife......she thinks I am a clean living lad....with no conviction.

I didn't know ye could get away with murder, screw a country, polish off the gold and Finance Companies, Screw the Kids, Paper boys included, Ma n Pa too, and then come up smelling of PORK and take a royalty.

butt the Skies the limit......

As well ye know.

I thought we was all short of cash...............butt seems not...when turning tricks, flogging orf the family jewels and burghgering around with yer mates.

Where do I join...........I have a few tricks up my sleeve...even at my age...

I want a few sleepless knights......and a few pokies....

Why should just the big boys have all the perks.

Butt do not, repeat do not....joke about it ever on Friday.....and tell the wife.

That wouldbe...virgin-g on the RIDICULOUS.

Heads - that last post shows that you actually know very little about interest rates in NZ. Tell me, do you think that the banks fund at the OCR and bank bill rates ?

I'd suggest that you try to speak with authority on something you actually know something about, because on this one, you clearly don't. What should worry you is that many people on this site are very well informed and actually do know how things work, but haven't bothered to tell you so suggesting they've given up ?

Grant A - couldn't agree more. Heads has shown time and time again that he has only one side of the equation - a position mainstream media seem to also push.

Heads - take a look at deposit rates and how far they fell following falls in the OCR. Going by your story we should expect to see TD rates around 2.25%. Ask yourself why they're not at that level and then ask yourself why lending rates didn't fall in line with the OCR.

No - it was an end of quarter woohoo courtesy of the Fed. I am surprised you didn't get the nod - I am sure the RBNZ did, along with other worthy notables. After all Brian Sack withdrew his resignation from the NY FED.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.