Spring may be on the way - but it's pretty darn chilly out there in housing land.

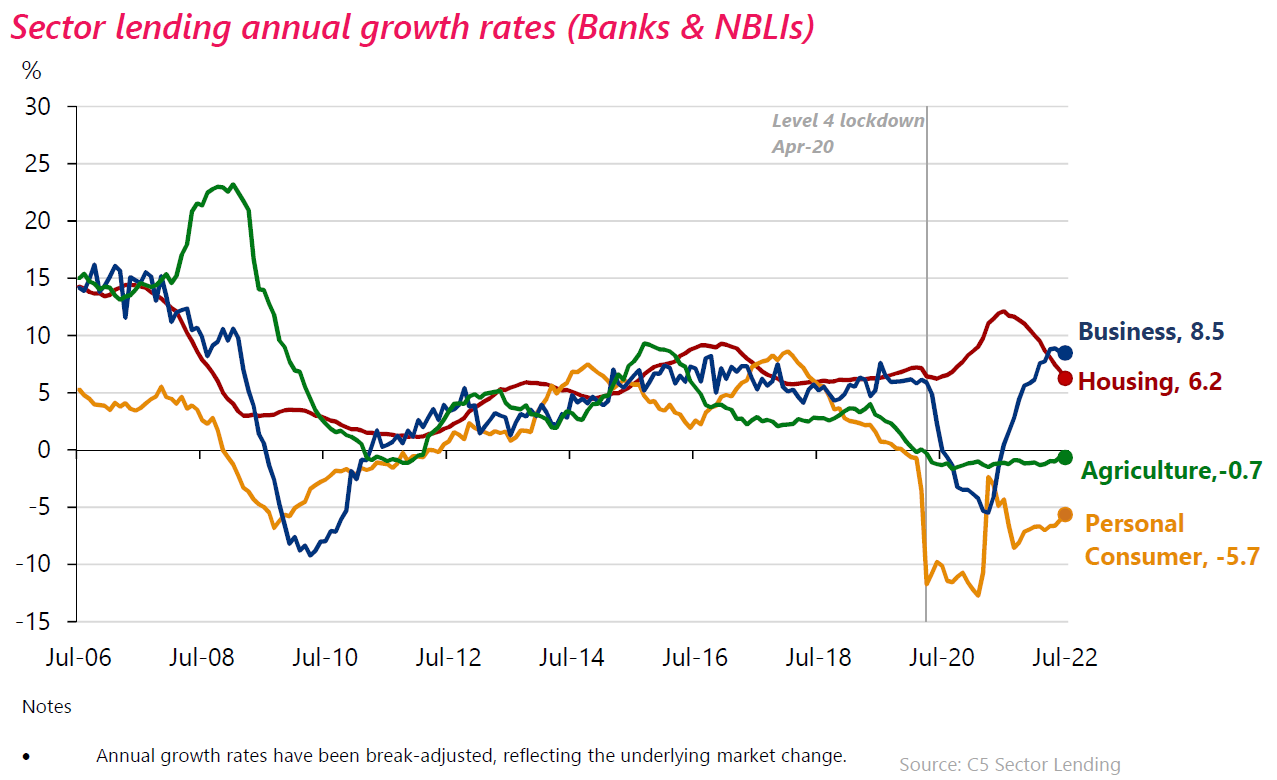

The latest sector lending figures from the Reserve Bank (RBNZ) show that - barring the April lockdown month of 2020 - we've just seen the slowest month for growth of the country's mortgage stock in five years. The RBNZ also provided this summary.

The total stock (this is for both banks and non-bank lenders) increased by just $848 million in July (to a little over $340 billion worth of outstanding mortgages).

And you have to go back exactly five years to 2017 to find a month with slower growth - barring the lockdown month.

And of course lending bounced back pretty quickly after the lockdown.

In fact by March 2021 we saw a peak monthly growth in the mortgage stock of over $3.7 billion.

Since then though things have been cooling rapidly.

The annual growth rate in the total amount of outstanding mortgages peaked at 12.1% in July last year - but since then has been declining each and every month.

The annual rate of growth as at July 2022 stood at 6.2%, a sharp drop from 6.9% just a month earlier.

In a separate breakdown of figures just for the banks, the RBNZ said that in July the total bank housing lending stock increased by $753 million.

Residential lending to investors was in total actually down by $10 million, highlighting the fact that investors have been heading for the sidelines.

Outside of residential lending, the RBNZ reported that total business lending stock increased by $221 million in July 2022, with its annual growth decreasing from 8.6% to 8.5%.

"Annual growth has been trending down from its peak in May, which was the highest annual growth rate since February 2009," the RBNZ said.

Total agriculture lending stock was up by $192 million in July 2022 but on an annual basis the stock decreased by 0.7%.

Separate RBNZ figures released for bank deposits showed that household term deposits continued their resurgence - in line with the rising interest rates.

The total amount on term deposit increased by $2.7 billion in July to a total of $93.8 billion and this tally has risen by over $10.5 billion so far this calendar year.

However, transaction and savings balances that thrived during the Covid lockdown days are now out of favour.

In July household transaction balances were down by $1.2 billion (to $50.4 billion), while savings balances dropped $676 million (to $79 billion).

There was though an overall growth in total household deposits of $815 million. The RBNZ provided this summary of deposit data.

25 Comments

An amazing turn around in lending between business and housing over the last few years.

Could it possibly be that we are about to witness the first period of negative growth towards housing in recent history? Even during the GFC it remained positive, limiting the impact of price falls. Things will really get interesting here if a feedback loop of deteriorating confidence begins over the coming months - banks really cold shut up shop as the economy contracts.

(and on a separate topic..... isn't it clear that to fix our housing affordability crisis, all we need to do was limit immigration and reduce the amount of credit we were extending to housing?....its not entirely difficult to work out and with a few quick changes in policy.....bingo, problem solved. But of course, a problem that politically doesn't want to be solved, won't be solved)

Yep. This aligns with the narrative that I've kinda believed. The housing bubble is not just for the wealth effect, but the capital base for many SMEs. I've mentioned before about how a slowdown in consumer spending creates a neg feedback loop. I cannot prove it empirically. It's just my reckon.

Even during the GFC it remained positive

Valuations went backwards in some areas during/just after the GFC. Hastings DC catchment values dropped by around 12% for the 2010/11 revaluation. The house we bought in March 2008 (for $15K below RV) was technically in negative equity for a number of years, with the RV not rising above what we'd paid for the house until the 2017/2018 valuations.

We were a young couple with a baby, and another on the way, so we've lived what some recent FHB are going through, or about to. It wasn't at all pleasant, but we hung in there and it got better eventually. Hopefully it works out for the current generation too.

No no no, I have it on good authority that the price of a house is completely dictated by the cost to build. There's no way house prices can continue to fall, have you seen the price of GIB?

It's irrelevant if borrowing power is down 30% in a year, people will find a way. There's thousands of cashed up returning ex-pats and the borders are fully open as of beginning of this month. According to Customs, there were 2792 additional arrivals over departures for August.

Can't tell if sarcasm or not.

'Grinding to a halt' has a quite different meaning to slowest monthly growth in 5 years

Click click..

This is the economy killer. As a debtor nation, increasing mortgage debt is financed offshore. This represents huge injections of capital into the NZ economy. This money is associated with a property/ building boom. With large amounts of this money cycled into vehicles, boats, new kitchens, household furniture etc. As soon as the rate of growth in mortgage debt slows, GDP will take a hit. As present GDP, is predicated on these offshore capital injections continuing. With perpetually increasing mortgage debt at the present percentage increase or better. So even a slowing in the percentage increase in debt per annum, will subtract from GDP, eg mortgage growth slowing from $30 to $20 billion per annum, will subtract $10 billion from GDP. Even static growth of $30 billion, is negative for GDP as interest on the newly accrued debt subtracts from GDP.

Think of NZ like a household that earns a 100K per annum, but for 5 years spends 200K per annum by borrowing 100K per annum. Their household economy during the 5 years to observers looks great, new cars, lots of money for clothes and entertainment. But, at the end of the 5 years, if you stop borrowing your household GDP halves (not withstanding having to pay interest on the debt, even if principal not paid down).

This is the economy killer. As a debtor nation, increasing mortgage debt is financed offshore

Not sure what you mean by this. All mortgage debt is 'created' within NZ. Aussie banks used to rely on wholesale funding, but really that was for cheap credit (borrow low, lend higher). The narrative during the 00s was that Aussie was overreliant on this funding and it could rip into the property bubble. That narrative has disappeared.

Think of it this way if everyone in NZ borrowed a 100K per annum and spent it in that 12 months, GDP would be through the roof. If the next year everyone only borrowed 50K and spent it in the economy GDP would contract. It doesn't really matter where the debt comes from, though offshore is the worst scenario as interest and principal repayments are sent overseas.

This is why property busts (particularly in debtor nations), lead to very severe recessions. Economists do not appreciate this fact, and hence fail to anticipate the depth of a downturn.

Growth via capital inflows from debt expansion is immediate and easy, but ultimately dangerous. Compared with increasing productivity and innovation.

Debt expansion is free GDP growth, but it needs to keep expanding at, at least the same rate or you immediately start subtracting from GDP.

I still don't understand. The abiliity of the retail banks to create mortgage debt is unrelated to capital inflows. Where is this capital coming from? Is it flowing into banks?

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/20…

This article explains how the majority of money in the modern economy is created by commercial banks making loans.

Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

This article explains how the majority of money in the modern economy is created by commercial banks making loans.

Yep. That's how it works.

If everyone borrowed $100k per annum, consumer inflation would be through the roof. But instead we had a sustained $20b per year (RBNZ C32) increased "borrowing" for our housing market, which resulted in house price inflation through the roof (excuse the pun).

By the time we give $5b per year in profits to the banks, and I reckon $15b per year (or more) in Multi-national Corporate profits then that $20b is effectively cancelled out.

Anecdotally the mainstream media only started shouting about the property downturn at around April (in part because of the lazy bias to core logic and the stagnant data). There is now a more general belief that the property market is dropping nationally and I feel this will be borne out in the HPI in a couple of weeks which I speculate will show a slight steepening of the drop. This mortgage data supports my hunch to a degree.

Looking at the tulip price index of 1636-7 and aligning it to the many stages of a bubble where greed is reinforced by delusions which then set record breaking values (peak) before trending downward into a denial phase , I note there is a brief upward slope ,an attempt to return to normal (some call this the dead cat bounce) before fear followed by capitulation ultimately results in a trough of despair which I note produces prices below the mean period of the actual bubbles take off.. Heres hoping history does/doesnt repeat itself (depending on where you sit)... Tulip anyone ?

Yes, a debt expansion scheme gives the illusion of wealth creation, until you run out of other people's money to spend. We are in an unstable equilibrium at the moment, if downside momentum takes hold it could all get very nasty, very fast.

Change happens slowly and then all at once. The tidal flow stops at slack water, slowly reverses and then picks up speed.

Talking with the many rent slavers I know.......they are just now out of denial stage and into the fear (anger at the Govt for stealing their tax rinse lollies) or really anger stage.

I'm telling some to capitulate early, not late when the stampede bolts for the exit.....sadly they think the spring "Rebound of flush buyers" will pickup their debt grenades....still a bit of silly denial at play it seems!

A spring rebound is as likely as ......a Russian sportsman being cheered on in Kyiv.

Yes, not so much fun paying 40k interest for those 700k loans...........

And being asked to pay the principal back too...theres another $25K you gotta find, and the rates, insurance, fees.

Im really scratching my head wondering how on earth the banks were allowed to lend money knowing the rent didn't cover costs.

Royal commission time when's its all over??

Oh there'll be a Govt. group thingee done for sure. I just need to find out how to get in on these gravy trains. Super jealous of Anne Tolley @ $400k at the moment. Just buy some nice clothes and pretend to be ethical. Smile and wave. Cha ching !

Anne Tolley totally rocks. Who wouldnt want to get paid $400k a year to spend $100's of millions of dollars of other peoples money (and borrow hundreds of millions on their behalf and unknown interest rates) on whatever she can dream up, and be able to totally ignore any democratic process in dealing with objections.

Best of all (i am reliably informed) is that she doesnt even live here. So for her its kind of like a virtual game where she gets to play god with everyones money and infrastructure, roadworks and so on.. and then if it all goes wrong she goes home and watches the aftermath with popcorn and continues to pay her lower local rates and drive on traffic free roads, and probably have another game somewhere else a few years later and try to beat her score. Nice :)

People can see huge downturn coming, every country you look at has issues. One of New Zealand largest issues is around housing debt compared to income with interest rates climbing and inflation running high people just can’t afford more debt. House price’s are already falling at rapid rate and if defaults start to grow a major housing crash is likely.

The problem with predictions is the Black Swan event. While the last 40 years has been relatively stable, it seems everywhere you look black swans are circling. It looks like the people of Europe will literally freeze this winter, with heating energy being scarce. Pile on a recession and New Zealand might look quite good for many to return home. Although I do realise Australia has far greater appeal than New Zealand under it's current management.

UK Inflation Could Top 22% Next Year, Warns Goldman Sachs - Ouch!

This is right on the money, i would only add that a black swan event is roughly defined as 'an extremely rare event with severe consequences that cannot be predicted beforehand' but we have so many events that have severe consequences and that CAN be predicted

In this case we should be factoring in the probablility of known events for example of: China invading Taiwaan, of Trump being re-elected and causing a worse trade war, of another pandemic (known likely), of a major hack taking down supply chains (more and more likely as tech accelerates), of climate change (massive food shortage, water shortage, floods etc in europe) I am pretty sure given the number of possible 'bad' events that are known to be possible that at least one will happen in the next year.

I am pretty sure any of these events will cause massive economic carnage given our current precarious state. Thus (as has happened with the pandemic, ukraine, heat wave, tawian so far and inflation) we should all probably be extremely conservative with risk for a while - ESPECIALLY reserve banks.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.