Something pretty rare happened in this housing investment-obsessed country recently.

The stock of mortgages held by housing investors actually shrank in July. That's right, the amount of mortgage money owed by housing investors REDUCED. To give that fact some context, in the not-so-distant past we've seen the stock of housing mortgages held by investors at times increasing by well over $1 billion a month.

However, the Reserve Bank (RBNZ) monthly lending data for July showed that the pile of outstanding mortgages issued by the registered banks to investors fell by $11 million in the month to $89.631 billion.

Now that's not a huge fall obviously. But it is unusual.

The RBNZ's only been publishing this detailed mortgage data since late 2016.

But apart from April 2020 when everything was locked down, the latest month's figures are the only ones to show a fall for investors. And you have to think that such a fall would be rare in historic context - although it's easy to imagine there may well have been falls during the post Global Financial Crisis period from 2008 to say 2011.

In the seven months (up to July) of 2022 to date the pile of investor mortgages has grown by under $1 billion - and the rate of growth has been slowing.

Compare this with the first seven months of 2021 - then the investor mortgage pile grew by nearly $5.2 billion.

And in the six month period between September 2020 and March 2021, while investors celebrated the temporary removal of loan to value ratio (LVR) limits (from May of 2020), they filled their boots to the tune of an extra $6.7 billion as the investor mortgage pile grew at a rate of over $1 billon a month.

During that period the investor mortgage pile grew by nearly 9% to over $84 billion. Little wonder then that the RBNZ rushed the LVR limits back on.

This is all a far cry from what's happening now as the investors have copped the cold shower combo of the reintroduction of the LVRs, the tax changes on interest deductibility and the changes to the credit rules.

This year is shaping up to potentially see the slowest rate of growth in investor borrowing since the inception of the data in 2016. And it is worth remembering that the back end of 2016 saw a sharp drop-off in investor activity - which carried through to the 2019-20 period. That slowdown followed the somewhat desperate (it seemed to me at the time) imposition of Draconian 40% deposit rules for investors as the RBNZ looked to head off what was white-hot housing investor activity in the mid-2016 period.

It is going to be very interesting to see what the trend is for housing investment as we move into spring.

Of course, it's not just housing investors that have backed off.

The July data shows that registered bank mortgage stock for owner-occupiers increased by $763 million in the month (to $244.656 billion). If we exclude the April 2020 lockdown and also November 2021, in which the RBNZ reclassified a whole load of mortgages from owner-occupier to investor, we have to go back to July 2017 for a slower month of growth.

In the first seven months of the year owner-occupiers (and this category does include first home buyers) added nearly $7.4 billion to the total mortgage stock held by them.

That compares with a wild $14.75 billion (over $2 billion a month!) that was added to the mortgage tally during the first seven months of 2021.

Little wonder, of course, that the mortgage market is slowing precipitously this year, when we look at what has happened to house prices from the peak of the market in November 2021.

According to REINZ figures, between November 2021 and July 2022 the national median price has fallen by $115,000, or 12.5%, in that period to $810,000. Auckland, which is included in that national figure has fared somewhat worse, with a $200,000 median fall, or just under 15.5%, to $1.1 million.

Given these falling prices we could expect to see the average-sized mortgage reducing. It is - now - but that's been a slow process.

RBNZ figures show that the average-sized new mortgage commitment hit a high of $408,000 in May, eased to $406,000 in June and then fell somewhat more substantially to $379,000 in July. However, that July figure is down only around 7% from the peak average size - and it is still well above the $332,000 average-sized new mortgage commitment a year ago.

Theoretically, when we look at what mortgages are now costing, it could be anticipated that these mortgage sizes might reduce further.

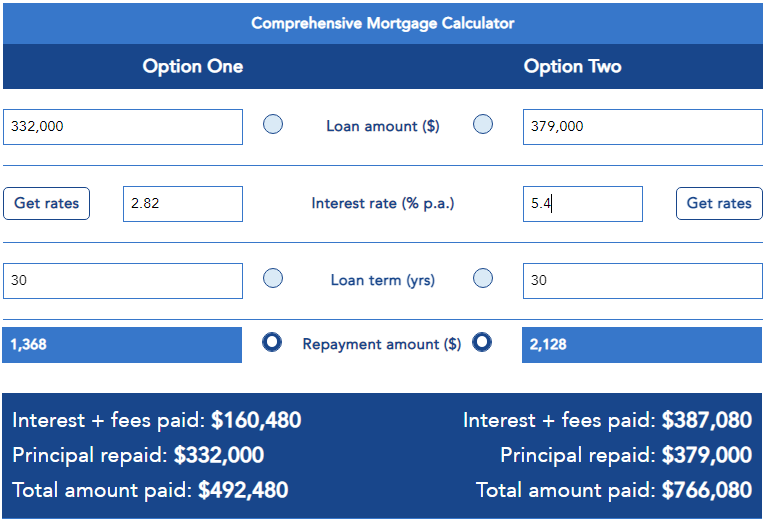

I did a quick comparison with the interest.co.nz calculator, comparing the average sized ($332,000) mortgage of a year ago with the $379,000 July 2022 average, looking at what the monthly repayments would be if someone had taken out a two-year fixed, 30 year mortgage at the prevailing interest rates of the day.

The RBNZ's monthly average of banks' 'special' rates, shows that in July 2021 the average two-year rate was 2.82%, while in July of this year it was 5.4%. The detail is shown below:

The upshot is that our 'average' mortgage holder would have borrowed $47,000 more (14% more) in July this year than in the corresponding month a year ago, but be paying $760 more - that's a whopping 56% more - in monthly payments.

To get back to paying the same monthly amount as our 'average' mortgage holder of a year ago, someone taking out a mortgage now, at 5.4% would need to take out a mortgage of just $244,000 - so a whole $88,000 less, or 26.5% less, than that $332,000 average of a year ago.

But of course, with the super low rates that were prevailing till the middle of last year, even really big mortgages were 'affordable'. So, it's a matter for debate how much the size of mortgages might want to reduce in order to be more 'affordable' now.

At the moment it doesn't appear as if fixed rate mortgages will get much higher than they are. But equally, current wholesale interest rate pricing would suggest the retail rates ain't going to come down that quickly either.

I guess we will find out over the next few months as spring becomes summer just what people are prepared to commit to for mortgages, and therefore what they can pay for houses.

In the meantime it doesn't look like we will be seeing mortgage money heading out of the doors of the banks at anything like the giddy rates of early 2021 any time soon.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

10 Comments

It was my dream, when growing up, to live in something akin to a pre-fab school classroom in a neighborhood with an uncanny resemblence to a trailer park.

I'm now giddy with excitement that our ever smarmy friends at Barfoot & Thompson are able to turn this dream into reality for a mere $900,000.

https://www.barfoot.co.nz/property/residential/waitakere-city/massey/ho…

Stunning vistas of future slums, punctuated by high voltage power lines and in close proximity to the prestigious Massey High School. The spacious landscaped backyard is perfect for the kids you'll never afford to have.

A real bargain. It brings together the rare combination of inner city claustrophobia with all the amenity of living in rural Aotearoa.

Be quick!

Oh my. That section isn't fit for a garage.

Nice sleepout... bit pricey though!

Flat Bush is not that bad......

"However, the Reserve Bank (RBNZ) monthly lending data for July showed that the pile of outstanding mortgages issued by the registered banks to investors fell by $11 million in the month to $89.631 billion. "

Does this say that some investors have sold some of their houses. Or just some clearing of old stock, to look for fresh stock.

it says to me some investors were lucky enough to get out - the rest are holding onto the hope the market will come back to 2021 levels .. newsflash - not going to happen. 11 million in mortgages .. in the grander scheme only represents a handful of houses anyways. So I think a lot of investors are holding out .. and putting back to rentals once they don't sell. which actually contributes to sales and price declines

NO !

CCFA still in place?

Yep.

Thawing coming?

Nope.

Pretty good indication that decisions made some ago are now being implemented, I wonder what decisions are currently being made for implementation closer to Oct 2023?

Little wonder then that the RBNZ rushed the LVR limits back on

I think you're giving too much credit there to RBNZ - they didnt react in a timely manner to what was happening. When they removed LVRs they signalled it would last at least a year - they also said they didnt think it would have much affect on lending. They were wrong, but didn't want to put restrictions back on until the 1 year period was up.

Will you be saying in Jan that RBNZ rushed to end FLP too?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.