Debt

Economist Brian Easton wonders whether we are evaluating the economy on the right criteria and says perhaps we should be paying more attention to rising overseas debt

4th Jul 23, 8:21am

8

Economist Brian Easton wonders whether we are evaluating the economy on the right criteria and says perhaps we should be paying more attention to rising overseas debt

Latest Reserve Bank figures show non-performing housing loans rose nearly 12% in May, climbing to levels last seen around eight years ago

3rd Jul 23, 1:40pm

62

Latest Reserve Bank figures show non-performing housing loans rose nearly 12% in May, climbing to levels last seen around eight years ago

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by 3.2% over the past 12 months, which is the slowest rate of annual growth since late 2012

31st May 23, 3:55pm

12

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by 3.2% over the past 12 months, which is the slowest rate of annual growth since late 2012

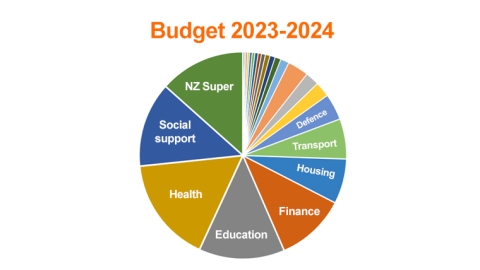

Budget 2023/24 - Summary of all spending plans

Latest Global Debt Monitor shows debt back near record highs, and at a fresh high in emerging markets

18th May 23, 10:04am

Latest Global Debt Monitor shows debt back near record highs, and at a fresh high in emerging markets

Sharp rise in number of people getting behind on buy now lay later payments as overall consumer arrears climb

2nd May 23, 5:00am

23

Sharp rise in number of people getting behind on buy now lay later payments as overall consumer arrears climb

Statistics New Zealand figures show falling property values trimmed $93 billion from household net worth, but in the December quarter rises in disposable income for household outstripped increases in spending

6th Apr 23, 12:23pm

41

Statistics New Zealand figures show falling property values trimmed $93 billion from household net worth, but in the December quarter rises in disposable income for household outstripped increases in spending

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 4.1% in the 12 months to January, the slowest annual rate of growth in exactly 10 years

28th Feb 23, 4:11pm

11

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 4.1% in the 12 months to January, the slowest annual rate of growth in exactly 10 years

Institute of International Finance sees key role for non-banks in climate fight, 'inflection point' in the fourth quarter of 2022

23rd Feb 23, 8:05am

2

Institute of International Finance sees key role for non-banks in climate fight, 'inflection point' in the fourth quarter of 2022

Retirement village operator Ryman says it has higher debt than it is comfortable with in current market conditions and is seeking to pay some down with money raised from shareholders

15th Feb 23, 9:48am

16

Retirement village operator Ryman says it has higher debt than it is comfortable with in current market conditions and is seeking to pay some down with money raised from shareholders

The next major challenge the Reserve Bank faces is convincing everyone that once interest rates hit peak highs they won't start falling rapidly again

12th Feb 23, 6:00am

128

The next major challenge the Reserve Bank faces is convincing everyone that once interest rates hit peak highs they won't start falling rapidly again

Only a decade ago more than half the country's mortgages were on floating rates, now the amounts on floating rates has dwindled to record lows

9th Feb 23, 12:38pm

7

Only a decade ago more than half the country's mortgages were on floating rates, now the amounts on floating rates has dwindled to record lows

David Hargreaves has a trawl through some of the RBNZ's mortgage data to see how homeowners are reacting to rising rates a year and a half into a rising mortgage rate environment

9th Feb 23, 9:33am

37

David Hargreaves has a trawl through some of the RBNZ's mortgage data to see how homeowners are reacting to rising rates a year and a half into a rising mortgage rate environment

[updated]

Credit bureau Centrix says loan arrears rates are rising but remain behind historic levels

1st Feb 23, 5:00am

20

Credit bureau Centrix says loan arrears rates are rising but remain behind historic levels

RBNZ figures show first home buyers might possibly be hitting the limits of their seemingly boundless enthusiasm, while investors may have just stirred slightly

31st Jan 23, 10:50am

35

RBNZ figures show first home buyers might possibly be hitting the limits of their seemingly boundless enthusiasm, while investors may have just stirred slightly

Statistics New Zealand says falling property values lopped $91.1 billion off the worth of Kiwis in the first nine months of 2022, while falling share and investment values took $78.6 billion away

19th Jan 23, 11:17am

19

Statistics New Zealand says falling property values lopped $91.1 billion off the worth of Kiwis in the first nine months of 2022, while falling share and investment values took $78.6 billion away

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 5.2% in the year to October, which compares with double digit growth seen at the same time a year ago, and is the slowest rate of growth since 2015

30th Nov 22, 3:45pm

10

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by just 5.2% in the year to October, which compares with double digit growth seen at the same time a year ago, and is the slowest rate of growth since 2015

RBNZ figures show first home buyers had their biggest share of the mortgage money advanced last month since the RBNZ started publishing the detailed information in 2014

24th Nov 22, 3:44pm

38

RBNZ figures show first home buyers had their biggest share of the mortgage money advanced last month since the RBNZ started publishing the detailed information in 2014

Debt drops thanks to tightening funding conditions and 'unexpected' inflation, the Institute of International Finance says

23rd Nov 22, 9:56am

Debt drops thanks to tightening funding conditions and 'unexpected' inflation, the Institute of International Finance says

We seem to be taking eye-watering rises in mortgage interest rates in our stride - but are we really? David Hargreaves tries to assess where we are with the rising interest rate 'cycle' and whether there is more trouble ahead

2nd Nov 22, 8:06am

37

We seem to be taking eye-watering rises in mortgage interest rates in our stride - but are we really? David Hargreaves tries to assess where we are with the rising interest rate 'cycle' and whether there is more trouble ahead

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by 5.7% in the year to September, which compares with double digit growth seen at the same time a year ago

31st Oct 22, 3:44pm

8

Latest RBNZ lending figures show the total stock of mortgage borrowing grew by 5.7% in the year to September, which compares with double digit growth seen at the same time a year ago

RBNZ figures show that the amount advanced for mortgages in September was the lowest this year so far apart from January, while the amount charged in interest during the quarter climbed to over $3 billion for the first time since 2017

27th Oct 22, 3:38pm

15

RBNZ figures show that the amount advanced for mortgages in September was the lowest this year so far apart from January, while the amount charged in interest during the quarter climbed to over $3 billion for the first time since 2017

Statistics New Zealand says household net worth fell by $129 billion, or over 5%, in the first half of the year - however household saving has picked up again

20th Oct 22, 11:40am

103

Statistics New Zealand says household net worth fell by $129 billion, or over 5%, in the first half of the year - however household saving has picked up again

Latest Kiwibank household spending data shows that the volume of cash withdrawals is 70% higher than a year ago

10th Oct 22, 11:50am

18

Latest Kiwibank household spending data shows that the volume of cash withdrawals is 70% higher than a year ago

RBNZ figures show that first home buyers took 20.8% of the mortgage money advanced last month - the highest share since this data began being compiled in 2013

27th Sep 22, 3:29pm

17

RBNZ figures show that first home buyers took 20.8% of the mortgage money advanced last month - the highest share since this data began being compiled in 2013