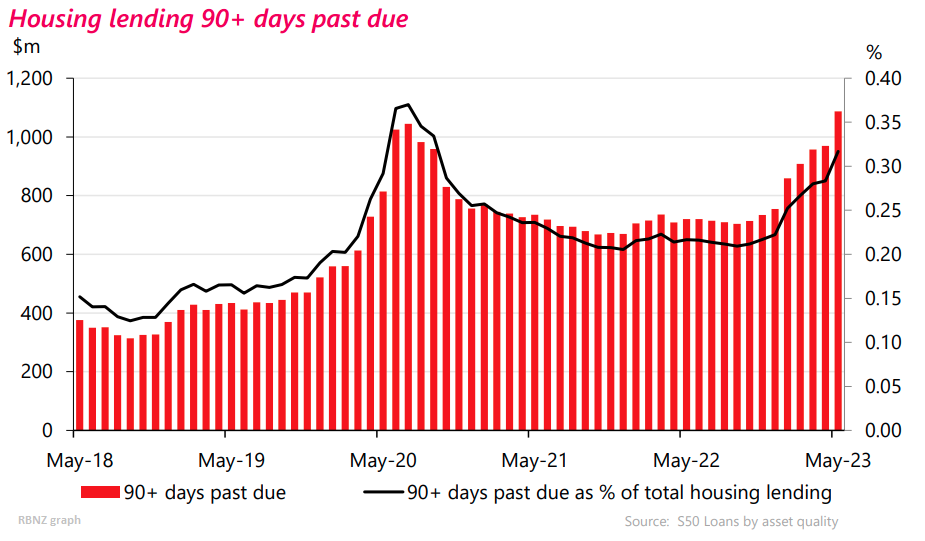

Mortgage arrears are now climbing quickly and approaching levels last seen about eight years ago.

New figures released by the Reserve Bank for the month of May 2023 show that non-performing housing loans rose by $131 million (nearly 12%) in the month to reach $1.236 billion.

That's now a higher non-performing loan figure than was seen at the peak of the sharp but brief rise in 2020 at the start of the pandemic. The RBNZ has previously indicated it expects to see more borrowers falling behind with their payments this year.

The non-performing loans are starting from a very low base - that needs to be stressed. But they are rising quickly, having jumped 45.5% since the start of 2023.

As of the end of May the total outstanding stock of bank mortgages was a little over $343 billion.

The RBNZ data shows that the non-performing loans make up just 0.4% of the total bank mortgage stock - but that's up from 0.3% in April and up from 0.2% as of November last year.

Detailed loan information as per the current data series has been published by the RBNZ since only 2018. However, a longer run series that gives the percentages of non-performing loans to the total shows that the current 0.4% figure was matched during 2020. But numerically, the peak of the pandemic surge was just under $1.2 billion of non-performing loans in July 2020.

So, the May 2023 figure exceeded that. And in terms of percentages of loan money that's not performing, the previous time we saw figures of 0.4% or higher was back in 2015 when the figures were still coming down after the stress of the Global Financial Crisis in 2008. The non-performing loan percentage figure actually peaked at some 1.2% in 2009 and hovered around at about that level till mid-20011.

We can say, therefore, that at the moment non-performing loans are running at levels last seen in 2015 - eight years ago.

In terms of the detail of the May 2023 figures, loans that have officially been described as 'impaired' rose $13 million - nearly 10% - to $148 million. Impaired loans are up some 56% so far this year.

During the pandemic (in August 2020) the impaired loans figure reached $149 million.

In terms of mortgages that are 90 days past due but not impaired, this figure rose by $117 million (12%) in May to $1.087 billion. That figure's up 44% since December 2022.

The pandemic peak for 90 days past due mortgages was $1.044 billion in July 2020.

It will be of vital interest to observe what happens with these figures in coming months. Substantial numbers of mortgage customers have still yet to roll over from reasonably favourable interest rates to the much higher rates now prevailing.

For example, the low point of the historically low interest rate cycle we saw was May-June 2021. If someone took out a two-year fixed mortgage rate in July 2021, they might have been able to get a rate of about 2.8%, according to RBNZ figures. Assuming these people were to take out another two-year term when re-fixing this month, they might end up paying nearly 7%.

In its six-monthly Financial Stability Report issued at the start of May 2023, the RBNZ said that debt servicing costs "have risen significantly from historically low levels during the pandemic".

"For a household with a mortgage, the share of disposable income required to service the interest component of their mortgage debt will more than double from its recent low of 9% to around 22% by the end of this year," the RBNZ said.

The central bank said that despite the significant rise, "this would still be lower than the peak experienced in mid-2008".

"However, this increased debt servicing burden is distributed highly unevenly, with some borrowers, such as those who fixed at the low of mortgage rates in mid-2021, seeing far greater rises in their debt servicing costs than others."

When senior RBNZ staff appeared before Parliament's Finance and Expenditure Committee on May 4, 2023 to discuss that Financial Stability Report they conceded that about 25% of the country's outstanding mortgages by value were stress tested by banks at lower interest rates than are currently prevailing.

In the Financial Stability Report, the RBNZ said that although increasing debt servicing costs alongside high inflation will constrain mortgaged households’ budgets, "we expect most borrowers will be able to continue to service their debt obligations without significant stress, given the servicing test buffers that banks have applied when assessing borrowers’ loan affordability and the current strength in the labour market".

"However, for households that borrowed during the period of very low interest rates between late 2020 and late 2021, current interest rates exceed some of the test rates used by banks during this period. Therefore, some of these borrowers and other borrowers with high debt-to-income levels may begin to struggle to meet their repayment obligations as they reprice onto the higher rates."

The report said that banks have been proactively identifying borrowers who may face debt servicing challenges as they reprice to higher interest rates.

"So far they have reported relatively low numbers of customers encountering difficulties in meeting higher repayments. In part, this reflects the fact that many borrowers used the period of lower interest rates to make excess principal repayments ahead of their original schedules. These borrowers can now use this buffer to limit the rises in their repayments due to higher interest rates.

"However, we expect more borrowers to fall behind on their payments this year, given the ongoing repricing of mortgages and expected weakening in the labour market."

So, that was the RBNZ discussing the situation in early May. Clearly as the figures for the May month demonstrate, much of what was being discussed is now materialising and we will have to see in coming months how things develop.

62 Comments

Something to keep a close eye on but its not going to be panic yet for the vast majority of mortgage holders.

Agreed. Those with high equity and income no worries. Those over leveraged and interest only crews may be experiencing a wee squirt off FOOP down below.

Perhaps the banks will channel Cindy and "be kind". Or not. Imy bet is "or not"

If un-employment ramps up - which it will - even those with high equity will be in trouble without incomes.

Remember we've had 10+ years of lower interest rates and this has become the new normal, i.e. people will have adjusted their spending for this rate environment. (e.g. bought new cars, gone of revenge spending overseas trips, etc. using credit.)

While the retail interest rates aren't high in a historical sense (when everyone was used to them and another 1% made little difference) - they are now a massive shift from what is 'normal' and people will be devastated quite quickly.

It is not the current rate that hurts - it is the deviation from what is normal that hurts.

The RBNZ has created a wildly fluctuating environment that we've never seen before. Put simply: A useless crowd of over-reacting nincompoops!

When your mortgage loan is, say, $5,000, and you have a 16% mortgage, an additional 1% increase in interest to 17% is not a large increase in percentage terms for the amount that you need to pay. You're already paying a very large amount in interest, but the actual principal of the loan is relatively small.

Today, when house prices are easily 12 times the average wage, and saving even 25% of the value of the property is difficult, even a 4% loan would be difficult on a house worth $700,000.

Back in 1970 Q1 the equivalent value property would have cost $7,400. The equivalent house value today represented as wages in 1970 was $21,900.

An average wage today of, say $50,000 would have been $1,565 in 1970 Q1.

The wage in 1970 is 3.13% of today's wage in absolute (not real) terms.

The house price in 1970 is 1.06% of today's house price in absolute (not real) terms.

the percentage of today's income divided by today's wage average property price is about 7.14%.

The percentage of a 1970 Q1 wage divided by the 1970 Q1 housing cost is 21.15%

You can see that wages vs houses were a very different value proposition back in 1970, with the capital cost of a house being on average about 5 years of gross wages.

Today the value proposition of a house is that it would cost 14 years of gross wages.

Either wages have fallen in real terms, or house prices have increased in real terms, or both.

I think it's both, the increase in house prices has been about 3 times greater than the increase in wages in absolute terms over the last 53 years.

Keep it up Zwifty.......the buckling and twisting Karkova Housing Dam needs many, many more props, I see you furiously working.

Just be out of it way- as it is going to burst.

The 30% leaks sofar are nothing, to whats coming!

The level of denial make Putin look saintly.

These “Green Shoots” we keep hearing about must be referring to the green grass at camping grounds seeing an increase in popularity from stressed mortgage holders moving into caravans.

The issue is most investors don't understand that real estate inherently is an illiquid asset. The good run house prices have had since the early to mid-2010s has been a direct result of NZ's banking system continually injecting billions of dollars in liquidity into the housing market.

Peak OCR or not, borrowing rates remaining higher for longer is what speculators should be wary of.

Markets are pricing in rate cuts too soon, IMF's Gopinath says (msn.com)

I made this comment yesterday

There are a number of contradictory statements by economists out there

On one hand some economists are saying there are green shoots in the housing market as we are in a recession and this will force interest rates down and when that happens housing will bounce back

Then other economists stating that the recession is already over and life will return to normal before we know it - obviously if this is the case then there will be no reduction in interest rates and no housing bounce back.

I'm not going to make any predictions myself, other than to say

1. Interest rates will only fall when inflation enters or gets close to the 1-3% band, anything over 4% and there will be no interest rate reduction.

2. In 2008 interest rates fell from 8.25% to 2.5% - housing prices fell 10% and it took until 2012 for house prices to see any growth - almost 4 years

3. The increase in house prices in 2012 - co-incided with unemployment falling from 6.75% following the GFC to under 6.00%. People only felt certain to buy houses when they felt secure in their employment. Hence any uncertainty in employment across NZ is likely to result in house prices being low for longer.

I could watch Gita talk economics all day, every day.

That's because 2 years ago the average 2yr mortgage rate was ~2.5%. A lot of people are yet to feel the pain

Not good at all and it will get worse for the rest of the year. On track for my prediction for something to break in the second half of 2023.

Yep, its looking like the real pain will start to set in second half of 2023 or sometime in 2024.

Adam - I predict second quarter 2024 as it takes time for the increased costs after refix for the debtor to exhaust savings and past increased payments, if unemployment takes off as likely it will Jan 2024 when retail sees sales insufficient to carry them through and other discretionary spending business see the same trend and follow suit. NZ is slightly better off as a food supplier but the pain will be a 8 not a 10 other countries will experience.

100%. Calendar year I presume? (I'm seeing stuff breaking all around me at the moment.)

Worst RBNZ MPC ever!

And so it begins.

The next step is margin call, aka more equity...now. Some will act, and some will continue to keep their heads in the sand. Then mortgagee. Interest rates rising again into the close of the year will likely be the trigger.

All this before DTi arrives early next year.

Popcorn.

We're still some way off mortgagee sales as the arrears are still really low. "The RBNZ data shows that the non-performing loans make up just 0.4% of the total bank mortgage stock - but that's up from 0.3% in April". But it's definitely a move in the wrong direction. Mortgageee sales will be a story for 2024.

I think there will be a huge amount of stress for those people who have opted to pay interest only for years and I mean years because they lived with the expectation that not only house prices would double but rates would remain low. Ultimately the banks know EXACTLY how many people are facing severe stress in the coming months, they have all the numbers to work it out. Expect a very sharp increase before Christmas, that line is going vertical for a bit.

Yep, and the cab paper prepared by Treasury to remove interest deductibility had some very scary stats. Half of all mortgage lending to investors in 2019 was interest only. That’s a pretty substantial figure. It’s going to be a wild time.

The overleveraged speculators (and there are many THOUSANDS of them) will be burnt beyond crispy, once this long overdue, epic crash of our lifetime, BOTTOMS out, later this DECADE.

I trust this will teach many thousands the lesson of a lifetime and houses will become homes again and not TraderThings for Spruikers.

are you sure it'll just be 'speculators' got burnt?

I'd wait and read some data to decide on that.

I'm sure the Speculators will take some poor FHBs with them to the pyre. Shameless.

$13b in lending across 36k investors. Half of that is 18k @ $6.5b which is $360k average. Assume 50% of those opted for the maximum of a 5 year IO, they'll be coming off next year.

- The 5 year rate was 4.8% - 5% in 2019 so $350 per week.

- P & I @ 25 year remaining = $561 per week @ 6.5%

- P & I @ 20 year remaining = $619 per week @ 6.5%

Combined with 25% of interest being deductible from 1 April (unless National are elected and reverse).

Still less than average rent, so I don't expect to see anyone distressed at those levels - unless they have multiple mortgages and/or low income.

Anecdotal but in the past I used to see 15 - 20 mortgagee listed properties in NZ on trademe, this morning it was 45 of which 7 were listed on Today or just this past Friday.

October 22 trademe search "Mortagee" = 22

Today = 45

The mortgagee sales are a most massive iceberg.

These are the the result of years of many letters, phone calls and legal visits.......then long periods of "extend and pretend" feeding out much more rope, payment restructuring.......then this trapdoor in finally tripped.

For every mortgagee, expect that 1000+ ( Nearly theres) are hidden beneath the exposed and icy cold tip.

Centrix reported 144,000 NZ active credit accounts in arrears some 5-6 weeks ago and my guess is Auto and consumer loans will be the leading indicator mortgage will lag 3-6 months.

Being familiar with how the Australian banks operated during the GFC, home owners with investment properties and holiday houses can expect a phone call from the bank with the demand that they sell that second property, and all funds from the sale will be appropriated by the bank and used to pay down the home owners mortgage. That's the modern form of mortgagee sale.

Agreed. Your example assumes reasonable equity realizable from sale. In the interest knly tax rinse all the rquirt was in the family home with little elsewhere. In a weakening market that paper equity is evaporating.

Lets remember that income supporting debt requires much much lower prices and values. Those with decent deposits keep building them. Good money on deposit now with better days coming.

Can you smell the paper equity burning yet...

Amazing how few people are unfamiliar with the bank's right to set off. It's in the Terms and Conditions.

https://www.stuff.co.nz/business/better-business/127677246/more-cases-e…

And there lies the real problem - I would love to buy your holiday home/family home but the Bank won't lend even though I have 50% equity, my income is insufficient and the expected rent discounted 50% due to rising unemployment so I it on my TD and use the interest to pay off my home loan and so the velocity of money slows to a trickle and you know what follows next!!

Wait and watch. This time it will pass 3-4% mark.

The individuals are highly leveraged and a lot of then have no real cash but have used equity to buy more.

They cannot service their mortgages at current interest rates. The stupidity will end sooner than later and recovery of RE prices will take decades. The carnage has started.

How many recent permanent residents will simply choose to abandon NZ and return home, leaving the bank to deal with the house and the financier to pick up the car left in the airport long term parking lot.

To answer your question: zero.

How many of these arrears are people who may have already done just that...

Again, zero. NZ laws are very different to the USA, where people can just walk away from their houses.

Unless your name is Yuan and you were the MD for Mainzeal. For others abandonment is just a name change and a new passport away.

If people are moving overseas, and simply walk away from their debt, it will not follow them. It will stay on their credit history in NZ for 7 years. Then *poof* gone.

O h - and your NZ credit history means nothing in the northern hemisphere.

I saw it happen in Bay of Plenty pre GFC. Yes the car was left at the airport and the bank was left with the baby ( both baby and bank in the bath!). Many attempts to find them, but it’s a big world out there.

I know of two families that moved to NZ but recently returned home (USA & UK). They did not abandon anything as you mention but their reasons for leaving were unsurprising, the main ones being cost of living, crime and employment opportunities.

It could be a silver lining depends on the destination home - fill in the destination you think tops the list.

The wheels are slowly starting to fall off.. first it was just a puncture, now the unraveling starts..

Just wait until the job losses start..

They already have, the employment statistics are lagged, but again many who lose their jobs will pick another up soon after still.

The NZ Housing market is made up of thousands of toxic, now unpayable loans.

WORSE THAN THE USA triggered GFC. Much worse, in every measure....if you care to look!!

It will collapse.

100% rinse and repeat of this:

https://www.youtube.com/watch?v=vgqG3ITMv1Q&t=1s

Just call me Dr NZGecko Burry!

PS.....Yes I am right!

A while ago there was a comment in this thread, I believe it was from pa1nter but can't be sure...

Anyway, someone suggested this coming recession will be GFC all over again, to which the response was (paraphrased, memory isn't picture perfect);

How can you be sure it ever ended?

Look at the boom in NZ.

Look at the boom in Australia.

Look at the boom in UK.

Look at the boom in Canada.

Compare to the current housing boom in the US. We sold out to bail them out. The western world devalued it's dollar, juiced the economy on lowering rates to save the reserve currency via exchange over the last 15 years. Is there a day of reckoning coming or are we too far down this rabbit hole?

Good discussion point.

If the US continues to print to mask its financjal sins, the BRICs currency will simply expand futher doom the USD.. One should note, l...this alt currency is not a concept anymore, its a fully fledged operating alternative international settlement option.

The BRICs members continue to hoard/aquire gold, further underling that alt currencies foundation.

Whatever they come up with is going to sink like bric. Absolute clown car of a group of countries. Two of them probably won’t even exist in a few decades (that one’s left as an exercise to the reader). The US dollar is untouchable.

Not to forget about the farming loans that are coming under pressure as interest rates there are even higher than in housing market.

90% of home loan must go into default to fix inflation. 15% home loan must be reached by end of this year. Go!! RBNZ

who could see this coming?

Off topic but within banking. Haven't seen anything on the chattering MSM class about Nigel Farage's closure of bank accounts. More worrying is this.

A local Vicar who criticised trans identity in the uk also had his accounts closed by his building society. I suspect that questioning net zero may also leave you without bank accounts in the future.

This really is dystopian.

This is why bud lite

Speak out and get cancelled is one thing, speak out and get a bank account shut down is a clear indication that this mentality has been taken to an unnecessary extreme. All the conspiracy theorists claimed communism and were shunned, and now elements of communism where freedom of speech and opinion are being forcibly put under the thumb. I really hope society has a good reflection on how we got to this point and makes a cultural shift back to understanding that disagreement is not hate, it is a necessary part of society at large.

I have a string of AKL friends with decent mortgages, one with 2 properties, and all have young families, most only one decent income.

I've not been that popular at BBQs for a few years with my "Gosh, balance of payments looks ominous, ooh and those rates sneaking up" rubbish.

About half are nervously ignorant and saying "All I want is interest rates to drop soon, thanks. Reckon they will cause folks can't afford them to stay up and banks said". The others fall into a spectrum through to "Goodness knows, I have little control, will just try to keep my job and maybe we'll be lucky, or not".

Another prime example of willful ignorance by them with their heads in the sand as opposed to taking ownership and action. Nobody want;s to fess up and say they should have done more or chosen differently, they would prefer to excuse it away to themselves. Anyone else notice that since covid 2020 this has been a growing sentiment?

No, nor do I agree free speech has been curtailed by "communist" elements - as some of society's loudest voices like to claim.

Realestate.co.nz showing 43 ads with "mortgagee" in the text. This is up from 30 about 3 months ago.

This is statistically significant as mortgagee sales run to a fixed timeline and are sold quickly relative to other properties that can just sit there for months on end.

Any predictions for what the number will be in another 3 months? 50? 55? 60?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.