Mortgage rates

The mortgage war takes interest rates down to levels never seen before for fixed home loans with Kiwibank the latest to offer a market leading rate

16th Aug 19, 12:02am

44

The mortgage war takes interest rates down to levels never seen before for fixed home loans with Kiwibank the latest to offer a market leading rate

ASB cuts all its fixed mortgage rates again, taking market leading positions for many terms, after raising some very cheap funding. It cuts term deposit rates too

15th Aug 19, 9:14am

48

ASB cuts all its fixed mortgage rates again, taking market leading positions for many terms, after raising some very cheap funding. It cuts term deposit rates too

Another major home loan bank joins ANZ at a market-leading level for a key mortgage rate, dropping it by 16 bps. It also cut some key term deposit rates by 20 bps

13th Aug 19, 10:42am

16

Another major home loan bank joins ANZ at a market-leading level for a key mortgage rate, dropping it by 16 bps. It also cut some key term deposit rates by 20 bps

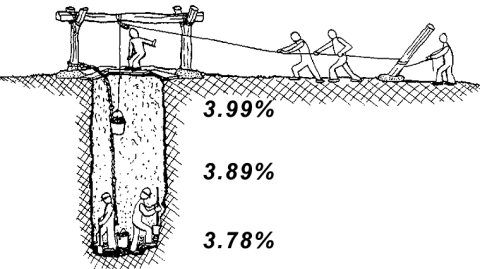

Latest cuts to interest rates may only reduce mortgage payments by a dollar or two a week

7th Aug 19, 4:26pm

23

Latest cuts to interest rates may only reduce mortgage payments by a dollar or two a week

ASB is first out of the blocks with a rate cut for floating home loans. A small fixed rate change as well. This is where we summarise the rate cuts from all banks

7th Aug 19, 2:19pm

50

ASB is first out of the blocks with a rate cut for floating home loans. A small fixed rate change as well. This is where we summarise the rate cuts from all banks

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

3rd Aug 19, 10:21am

8

SBS Bank makes a small trim to its key mortgage rate offers, taking two of them down to market-leading levels. However, the whole home loan market is awaiting an RBNZ rate cut and assessing the impact of sharp swap rate drops

The Cooperative Bank cuts home loan rates to remain a good option in the fiercely competitive mortgage market. But they also have trimmed term deposit and savings rates to allow that

30th Jul 19, 4:51pm

1

The Cooperative Bank cuts home loan rates to remain a good option in the fiercely competitive mortgage market. But they also have trimmed term deposit and savings rates to allow that

By matching HSBC Premier, Kiwibank brings the new lower home loan rates to the one year term option as the whole mortgage market settles in to a new normal

26th Jul 19, 2:23pm

2

By matching HSBC Premier, Kiwibank brings the new lower home loan rates to the one year term option as the whole mortgage market settles in to a new normal

Another bank adopts the lower home loan rate set. Borrowers may be smiling but pressures are building for banks to protect their margins and savers should beware

26th Jul 19, 10:31am

6

Another bank adopts the lower home loan rate set. Borrowers may be smiling but pressures are building for banks to protect their margins and savers should beware

Westpac quickly follows BNZ with a 3.79% two year 'special', taking rate competitiveness to a new lower level, even before the Spring season starts. ANZ also follows

23rd Jul 19, 4:31pm

33

Westpac quickly follows BNZ with a 3.79% two year 'special', taking rate competitiveness to a new lower level, even before the Spring season starts. ANZ also follows

BNZ drops two-year mortgage interest rate for owner-occupiers to lowest of the major banks, cuts a couple of savings rates

22nd Jul 19, 10:48am

49

BNZ drops two-year mortgage interest rate for owner-occupiers to lowest of the major banks, cuts a couple of savings rates

Rodney Dickens says understanding how our local long term interest rates are influenced has huge implications for how much they will move in response to RBNZ and Government pro-growth and pro-inflation policies

17th Jul 19, 9:17am

6

Rodney Dickens says understanding how our local long term interest rates are influenced has huge implications for how much they will move in response to RBNZ and Government pro-growth and pro-inflation policies

Rodney Dickens says current official forecasts are tainted by wishful thinking and take no account of policies that will boost wage inflation. OCR cuts and fiscal stimulus will boost growth so that the labour market will be tighter next year than now

10th Jul 19, 2:04pm

12

Rodney Dickens says current official forecasts are tainted by wishful thinking and take no account of policies that will boost wage inflation. OCR cuts and fiscal stimulus will boost growth so that the labour market will be tighter next year than now

Background wholesale money costs are changing lower, but not at the durations that will have much influence on fixed mortgage rates

21st Mar 19, 1:10pm

Background wholesale money costs are changing lower, but not at the durations that will have much influence on fixed mortgage rates

Westpac economists challenge their ANZ counterparts, downplaying the effect higher proposed bank capital requirements will have on interest rates

16th Jan 19, 9:23am

11

Westpac economists challenge their ANZ counterparts, downplaying the effect higher proposed bank capital requirements will have on interest rates

First home buyers being squeezed between rising lower quartile housing prices & higher mortgage interest rates, putting a dampener on their home ownership hopes

19th Dec 18, 5:00am

52

First home buyers being squeezed between rising lower quartile housing prices & higher mortgage interest rates, putting a dampener on their home ownership hopes

As Shane Jones pushes for a bank levy to support regional NZ banking services, ACCC report says Aussie bank levy costs not being passed on to mortgage borrowers

13th Dec 18, 10:38am

As Shane Jones pushes for a bank levy to support regional NZ banking services, ACCC report says Aussie bank levy costs not being passed on to mortgage borrowers

Co-operative Bank CEO David Cunningham says sub-4% home loan rates unsustainable unless deposit rates fall about 50 basis points

6th Dec 18, 10:09am

29

Co-operative Bank CEO David Cunningham says sub-4% home loan rates unsustainable unless deposit rates fall about 50 basis points

Rising house prices have more than offset falling interest rates in 11 of 12 regions over the last six months - Home loan Affordability Reports

21st Nov 18, 11:46am

182

Rising house prices have more than offset falling interest rates in 11 of 12 regions over the last six months - Home loan Affordability Reports

Falling interest rates, easing house prices and rising incomes have improved the lot of typical first home buyers in Auckland by nearly $90 a week since March 2017

26th Oct 18, 11:04am

79

Falling interest rates, easing house prices and rising incomes have improved the lot of typical first home buyers in Auckland by nearly $90 a week since March 2017

Slightly lower prices, falling interest rates and slowly rising incomes are all helping to improve affordability for first home buyers - but not by much

26th Sep 18, 10:22am

110

Slightly lower prices, falling interest rates and slowly rising incomes are all helping to improve affordability for first home buyers - but not by much

David Chaston probes current bank margins to swap rates to check whether banks are using the latest falling interest rate environment to fatten their margins

8th Sep 18, 9:31am

4

David Chaston probes current bank margins to swap rates to check whether banks are using the latest falling interest rate environment to fatten their margins

Brad Olsen of Infometrics argues there are clear reasons for the Reserve Bank to leave the Official Cash Rate unchanged over the next year

6th Sep 18, 1:25pm

8

Brad Olsen of Infometrics argues there are clear reasons for the Reserve Bank to leave the Official Cash Rate unchanged over the next year

Housing mortgage rates are more likely to go down rather than up despite increased US dollar funding costs for New Zealand banks

12th May 18, 9:22am

58

Housing mortgage rates are more likely to go down rather than up despite increased US dollar funding costs for New Zealand banks

Gareth Vaughan takes a look at the interest rate environment for borrowers after receiving a surprise offer from his bank

27th Mar 18, 7:59am

35

Gareth Vaughan takes a look at the interest rate environment for borrowers after receiving a surprise offer from his bank