Summary of key points: -

- Expect the unexpected from the RBNZ this week

- Forward-looking US economic information suggests a stronger USD

Expect the unexpected from the RBNZ this week

The movements in the NZD/USD exchange rate over the next three days may well determine its overall value and direction over coming months.

Having raced back up to its previous early January high of 0.7300 late last week due to speculative buying of the AUD against the USD, the Reserve Bank of New Zealand Monetary Policy Statement on Wednesday 24th February stands as the pivot point for the currency’s trading range over coming months.

An economic and monetary policy prognosis from the RBNZ that confirms current FX market pricing and expectations of interest rate hikes next year will send the NZ dollar higher and set a likely 0.7000 to 0.7500 trading range for the rest of the year.

A statement that effectively rebukes local economists’ and commentators’ expectations that the RBNZ will signal a dialling of the super loose monetary stimulus will send the Kiwi dollar lower and increase the probability of a correction back to the 0.6800/0.6900 area.

The writer anticipates the latter for the reasons below and as outlined in last week’s column.

The sudden surge upwards in the Kiwi dollar on Friday 19th February from 0.7200 to 0.7300 was nothing to do with some positive New Zealand economic news or market positioning ahead of the RBNZ statement.

It appeared to be new speculative buying by Asian FX market players who were anticipating the “risk-on” investment mode in equity markets to be given another boost from the US Federal Reserve meeting this week.

The AUD and GBP were also bought aggressively, moving sharply up to three-year highs against the US dollar at 0.7870 and $1.4015, respectively.

The short-term speculative buying of the NZD, AUD and GBP will be rapidly unwound if the US dollar does not weaken over coming days/weeks as these punters expect.

There has certainly been no particular positive New Zealand, Australian or UK economic news to justify these recent stronger currency values. New Zealand and Australian commodity prices are at higher levels that support higher currency values; however the GBP buying is based on the Covid-vaccine roll-out returning the UK economy to a stronger growth trajectory.

Post-Brexit cross-border trade disruptions, a weak European economy and talk of the Bank of England going to negative interest rates are all factors that suggest the opposite, a weaker Pound Sterling value. The GBP is unlikely to hold above $1.4000 against the USD if the Euro is going the other way and moving to below the $1.2000 level against the USD.

RBNZ Governor, Adrian Orr does like to pull surprises on the financial markets as the flip-flopping tones in his monetary policy statements over the last two years show.

Market expectations that the RBNZ will provide a signal that the current monetary stimulus will be reduced sometime this year (or next year) are misplaced in my view.

Having attempted to hold the NZD/USD rate below 0.6500 for much of last year as they saw it damaging an export-led economic recovery, the RBNZ are certainly not likely to deliver a signal this week that sends the NZD/USD rate from 0.7300 to 0.7500. Therefore, Wednesday’s announcement is likely to be more “dovish” than the markets expect and thus it will send the NZ dollar sharply down as all the recent speculative NZD buying is rapidly unwound.

The issues the RBNZ are likely to highlight as justifying a continuation of their extraordinary monetary stimulus with no indication as to when it will end, include: -

- Current increases in the inflation rate will be “looked through” as short-term in nature (supply chain disruptions), therefore not requiring a monetary policy response. The RBNZ has repeatedly stated in the past that they will happily take the risk of inflation going out the top end of their target range.

- The exchange rate TWI Index at near to 75.00 has monetary conditions in the economy considerably tighter than the 71.50 TWI level currently assumed by the RBNZ.

- The surprise move lower in the HLFS unemployment rate in the December quarter will be ignored by the RBNZ as a statistical quirk, as many other measures of the labour market do not reconcile with such a rapid improvement (e.g. those on the unemployment benefit increased significantly).

- Local and global economic risks due to Covid related lockdowns remain elevated and therefore it is premature to signal any timing or quantum of tapering the quantitative easing (QE) amounts.

As New Zealand’s long-term bond interest rates follow the movements of the currently rising US Treasury Bond yields, the RBNZ could surprise the markets with an increased QE amount to give them some additional ammunition to “flatten” the interest rate yield curve. The Reserve Bank of Australia did exactly this two weeks ago.

Forward-looking US economic information suggests a stronger USD

Then fledgling US dollar rally against the Euro to below $1.2000 in January was temporarily stymied by the weaker than expected January jobs number released in early February. Like employment figures in all economies, US jobs lag economic conditions and are backward-looking in nature and thus not a good lead-indicator for future economic performance and thus exchange rate values.

Forward-looking economic information such as the manufacturing ISM survey and consumer/business confidence surveys provide more intelligence on future and relative economic performance.

The forward-looking indicators in the US are all now very positive. According to economists at JP Morgan Chase & Co “the US economic recovery is accelerating, putting it on course to outperform China’s V-shaped rebound”.

Readers of this column will recall the repeated viewpoint expressed through the second half of 2020 that the NZD and AUD would appreciate against the USD as we were aligned with China’s earlier economic recovery from the Covid shock, well ahead in timing to the US and Europe.

The NZ dollar appreciated from below 0.6000 to above 0.7000 by the end of 2020 as a response. Now it is the turn of the USD to strengthen as US economic data outperforms all others. The US$1.9 trillion Biden fiscal stimulus aiding stronger economic data means that the Federal Reserve will soon be able to hint at reducing their level of QE. When that happens, equities correct down as the candy is removed and the US dollar strengthens. The global FX markets will start to price this change now, even though the Fed may not give that QE tapering signal until sometime in 2022.

The under-performance of the NZ share market so far 2021, compared to its stellar 2020 performance, suggests that foreign investors into our equities are now starting to take their profits and are exiting. The disinvestment must at some point hit the Kiwi dollar as they sell their NZ shares and also sell the NZD to take their funds home.

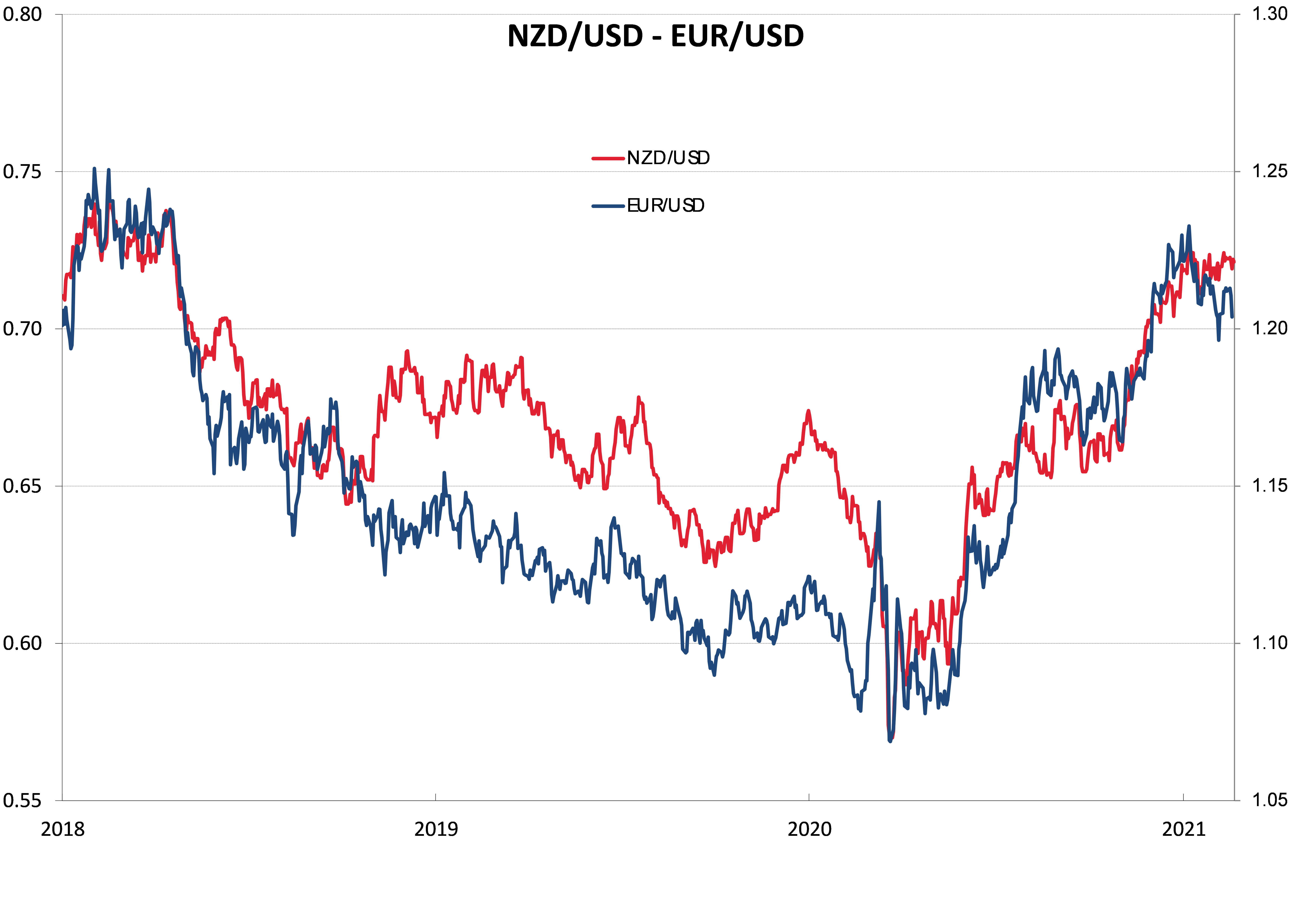

In summary, the NZD jump up to 0.7300 appears to be a false break higher from its “converging wedge” trading pattern of the last six weeks. The FX markets reaction to Wednesday’s RBNZ statement has a greater probability of sending it below the bottom support levels at 0.7150 and 0.7050. The movements of the USD in global FX market continues to dominate NZD/USD direction. A stronger USD to $1.1600 against the Euro over coming weeks/months would lower the NZD/USD rate to 0.67000.6800 given the close alignment of the currencies (refer chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

7 Comments

"The surprise move lower in the HLFS unemployment rate in the December quarter will be ignored by the RBNZ as a statistical quirk, as many other measures of the labour market do not reconcile with such a rapid improvement (e.g. those on the unemployment benefit increased significantly)."

Indeed...a fact most commentators are studiously ignoring

Awesome, guess it's back to $2.40 petrol again, with no one mentioning the PM's 'we're getting ripped off' comments because nothing has happened since then, or the fact that during the late 2000s oil shock, oil was at $145 USD+ a barrel - and today it's under half that. But as we've learned, higher petrol prices = unmeasured inflation but also higher government revenue through GST and excises - so not a huge incentive to do too much about it, is there?

But I'm sure we'll get told a lower NZD is a great thing for our exporters and most journalists will assume there are no downsides, despite the fact they are consumers in a high cost, low-wage economy themselves.

Excellent analysis by Roger Kerr. In the longer term, the New Zealand economy will be severely impacted by the enormous "Green" regulations that will be imposed by Labour and the Greens on our primary sector. Its impact is already beginning to become evident, but Kiwis seem blind to the consequences. While some regulation is necessary, the extent and kinds of regulation developing will undermine most of the incentive to invest in NZ agriculture. This is going to have a big hit on the Kiwi dollar over the longer term, but within 3 years.

Well. RBNZ wants to keep NZD under 70 at least and doesn't want to take one good thing from NZ exporters.

On the other hand, have to signal for higher OCR and reducing QE to put some kind of shackle to the crazy real estate market.

Orr has no choice but to do nothing, and Wed will be the dullest event.

1. Keep inflation rate in check

2. OCR remains at least for the second quarter.

3 QE remains the same but be more reluctant exercising.

Fun fact, if you zoom out the graph further from 2018 you can tell the NZD is far from being high in historical terms (0.88 USD in 2014)

Yeah - Would it be far fetched to look at how the NZ-USD rate dipped in 2009, where we faired better than most economies, before it rallied high over the following 5 years. Last year we had a dip again, and it looks like the rate is creeping back up...

Let's forget about manipulating our currency and other red herrings and start worrying about the ever growing property bubble & how to start getting to grips with this 800 pound Gorilla. It is ridiculous to talk about supply or any other factor when - at the first sign that prices may drop - the central bank and government launch 'shock & awe' intervention involving slashing interest rates & money printing. This should bring an immediate realisation that the government & central bank is intimately involved in running the ponzi, and that taxpayers are underwriting the whole debacle. You cannot have the poacher acting as the gamekeeper & expect any other outcome than rocketing house prices. If you buy a house you will have your absolute right to enjoy permanent and ongoing stellar wealth gains enshrined by the state, if you are on the outside looking in you may get a government hand-out and be treated as some sort of beggar - but moreover you are rapidly being locked out. I am struggling with this concept, as it seems to go against all notions of fairness.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.