Summary of key points: -

- Kiwi dollar dip provides lower hedge entry levels for local exporters

- Upcoming US economic data highly likely to be USD positive

- Slow Covid vaccination rate in New Zealand will hinder economic growth

Kiwi dollar dip provides lower hedge entry levels for local exporters

The rebound in the Kiwi dollar from the lows of 0.6935 against the US dollar on Friday 18th June to 0.7070 at the market close on Friday 25th June has been somewhat more pronounced than what typically would have been expected.

A correction back upwards on profit-taking after a four cent slide from 0.7335 to 0.6935 is a natural FX market occurrence, however the 1.5 cent climb suggests a higher level of NZD buying interest than just FX traders buying back their NZD shorts.

There is no question that both large and small local USD exporters had sizeable volumes of NZD buy orders placed in the market at staggered levels from 0.7000 downwards. Perhaps the exporter-trade related NZD buying was sufficient to propel the Kiwi higher in thin FX market conditions.

Exporters who have held off from replacing and adding to hedging levels whilst the spot rate has been above 0.7000 over the last five months have been well rewarded for their patience. Exporters who operate medium to long-term hedging horizons and hedgebooks were in a position to sit back and wait for the NZD correction down due to the quantum of hedging they entered when the NZD/USD exchange rate was around 0.6000 12 months ago. Exporters with shorter term hedging policies would have been forced to lock into rates in the 0.7200/0.73000 region over recent months.

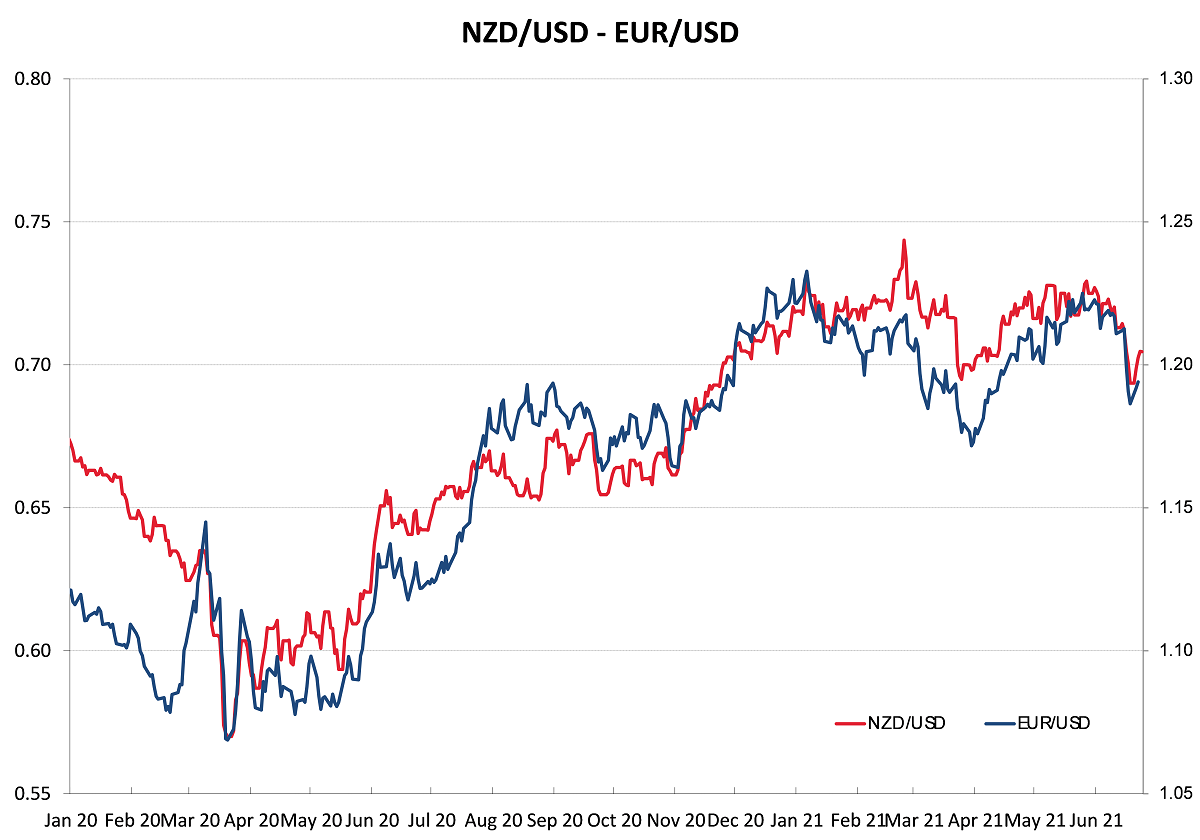

The NZD/USD rate traded to a high of 0.7096 on Friday 25th, however it retreated back to 0.7070 when the USD recovered against the Euro from $1.1975 to $1.1935.

There has been no positive New Zealand economic or investment news to support the NZ dollar outperforming other currencies against the USD at this time. However, the NZD cross-rates against the GBP and EUR, in particular, have moved sharply higher since their lows of a week ago. The NZD/GBP cross-rate jumping up from 0.5010 to 0.5090 and the NZD/EUR cross-rate rebounding upwards from 0.5845 to 0.5925. Again, local GBP and EUR exporters with staggered orders pre-placed with banks to buy NZD’s forward have secured excellent hedging entry levels.

Upcoming US economic data highly likely to be USD positive

Results of the monthly NZ business confidence survey on 30th June and May building permits on 1 July will not be economic releases to move the NZ dollar this week. Developments and changes in the New Zealand economy continue to have absolutely no bearing on the direction of the NZD/USD exchange rate. The US dollar sides continues to dominate, and that situation will continue until such time as the US dollar falls out of favour with global investors.

The next big FX market focus will be on the upcoming US Nonfarm Payroll jobs numbers for June on Friday 2nd July (Saturday morning NZT). Consensus forecasts are for 675,000 new jobs over the month. An actual result well above that number will be positive for the USD and negative for the NZD. A surprise to the upside seems more likely following the weaker than expected outcomes over April and May. Falling weekly numbers of jobless claims (unemployment benefits) does point to strong jobs increases over coming months, precisely as the Federal Reserve has highlighted.

There was a muted FX market reaction last Friday to the Fed’s preferred measure of US inflation, the PCE Price Index, which recorded an increase in the Core Index of 0.50% for the month of May against prior forecasts of +0.60%. The annual Core PCE Price Index is now at +3.40%. No evidence of inflation running away considerably above consensus forecasts, however also no evidence that all price increases in the US are merely “transitory” (i.e. temporary and will quickly reverse).

There will be no immediate and clear answer over coming months to the massive debate in economic and financial market circles around the world as to whether the current steep increases in US inflation are temporary or more permanent in nature. Whilst sharp spikes upwards in lumber and use car prices in the US certainly appear to be shot-lived, oil price increases and shortages of micro-chips for the manufacture of just about everything you can think of point to more fundamental supply bottlenecks and therefore continuing upward pressure on prices from the “supply” side. As both employment and consumer spending increase in the US over coming months, the impact of the “demand” side on the inflation equation will also come into focus.

The risk is that the inflation increases will turn out to be somewhat stickier than what a lot of FX market participants currently anticipate. Therefore, our view on the US dollar value remains the same, it will appreciate against all currencies over coming months as the jobs and inflation data prints stronger.

Last week we highlighted the fact that US hedge funds and investment banks had been forecasting a weaker USD in 2021 and they had entered large “short-sold” USD speculative positions to back their predictions. The Fed’s less dovish message a week ago forced an initial unwinding of those positions (i.e. USD buying) with Chicago futures contracts reducing from US$19 billion short-sold USD to US$13 billion over the week. Watch out for USD buying from further unwinding of these USD short-sold positions ahead of, and after this Friday’s US jobs numbers.

Slow Covid vaccination rate in New Zealand will hinder economic growth

The view expressed in this column several months ago was that New Zealand’s vaccine roll-out would be shambolic as we were relying on just one supplier (Pfizer) and Ministry of Health’s bureaucratic organisation of a nationwide vaccination programme would be well short of expectations.

Whilst there are mixed reports of how well the vaccine roll-out is progressing (depending on where in New Zealand you live), the writer’s own personal experience of telephoning the 0800 number for an appointment to get the jab aroused immediate suspicions. The call centre gentleman stating; “bear with me Roger, this takes a while as I need to check two databases!” What private sector business that you have a consumer or business relationship with has you listed in two separate databases? Recipe for a disaster.

Just 13% of New Zealand’s population have had their first dose, compared to 23% in Australia, 45% in China, 66% in the UK, 54% in the US and 53% in Germany (Source: New York Times 26 June 2021). We often compare our economy to that of Chile (like us, a largely commodity exporter), the people of Chile are 65% vaccinated.

The relevance of these comparisons is that we are going to be a long way behind the rest of the world in becoming fully functional again with international business and tourism travel. Therefore, the recovery rate for the economy and business investment will seriously lag others. From a position of being lauded around the world last year for keeping Covid out, our subsequent health (and thus economic) response has lacked urgency, delivery and organisation.

It is no coincidence that the currencies of highly vaccinated countries are outperforming others (e.g. the UK Pound Sterling) as the FX markets foresee their economies returning to full noise much earlier.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Our vaccination program is trickling along, it appears Wairarapa and Auckland (Metro) DHBs might need some oversight but everyone else is on target: https://www.health.govt.nz/our-work/diseases-and-conditions/covid-19-no…

The government appears at sixes and sevens about what to do at the moment. The UK shows that the vaccine is effective against all forms of Coronavirus in terms of preventing deaths and seems to detach deaths from cases at around 50% of the adult population fully vaccinated. The vaccine works, the science is delivering and leading us towards normalisation. Scientists, and not politicians, should call the shots on the earliest available reopening window to begin border normalisation.

The government seem to be pulling out the old Telecom marketing play book when it comes to the vaccination role out. Using confusion as its chief marketing tool. Drip feeding information. Sometimes conflicting. Every time we get an update the daily vaccination rates required at peak (to meet end of year full vaccination target) get more and more absurd. 30k to 50k to 70k. Right now we struggle to do 10k per day. No one knows or wants to say how much vaccine we have or any sort of delivery schedule.

Even family with Pfizer are tight lipped and that is a bad sign. But family with the DHB got news the original patient contact spreadsheet was lost at one point and then when I picked my jaw up the lack of thought in vaccination points, or contacting those in group 1, 2, and 3 all made sense. Many in group 2 have not been notified yet in this region and high risk group 2 & 3 families have had no contact or word when they can plan for transit to vaccination points as GPs offices, vaccination helplines and the DHB & medical companies have not yet got the info. It seems push and find the right person with a back office code is the way to go and then get a few false email addresses and a techie to work the site (and fix form bugs along the way).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.