By Roger J Kerr*

The Kiwi dollar has found its feet once again and is on the recovery path following the market sell-off that pushed the NZD/USD rate to a low of 0.6550 on 15 August.

As anticipated in recent columns, the US dollar could not sustain its gains on global FX markets and the EUR/USD exchange rate has bounced off $1.1300 to trade up to a weaker USD value of $1.1600. International exchange rate movements continue to dominate the Kiwi dollar’s short-term direction with no significant local factors influencing the forex market sentiment.

Here in New Zealand, “political risk” was identified by this columnist in early to mid-2017 as a potential negative variable for the NZ dollar exchange rate around the September/October 2017 general election period.

Whilst the incumbent National Government was comfortably ahead in the opinion polls at the time, the “Jacindamania” phenomenon subsequently delivered sufficient votes to the opposition Labour Party to allow Winnie to hold the balance of power and force a change of Government.

The Kiwi dollar depreciated from 0.7400 to a low of 0.6800 as a result.

Thankfully, there were not any immediate and dramatic changes in economic policy direction and the NZD/USD rate recovered back to 0.7400 earlier this year.

Since then, anti-foreign investment policy shifts from the new Government and falling business confidence have contributed to a weaker Kiwi dollar.

Business confidence has not recovered from its lows as many in the business community are still very uncertain about what potential new tax and employment law changes will mean for their operations and investment plans.

Unfortunately, policy changes seem a very long way away as the new Coalition Government bury decisive leadership in endless working groups, committees and enquiries.

Weak business confidence is no longer a negative for the Kiwi dollar as the markets are now looking ahead and it may well be good advice to business folk to get over their “left-wing government funk” and focus ahead as well.

The New Zealand economy has slowed up a little this year, however the still high export commodity prices continue to underpin positive economic growth and thus the NZ dollar exchange rate value.

Political risk certainly played a major part in causing a weaker Australian dollar over this past tumultuous week of political shenanigans across the ditch.

Observers outside of Australia could be excused for being totally confused as to how the Prime Minister could be toppled when the Aussie economy is performing so well.

Personal political utu and revenge sprung to mind as factions in the Australian Liberal Party battled for egos and power lusts.

The Aussie dollar was sold down on its own accord against the USD when it looked like PM Malcolm Turnbull would lose the support of his caucus.

However, the election of Treasurer Scott Morrison to the top job soon allayed FX market fears and the AUD recovered upwards. The NZD/AUD cross-rate increased to 0.9170 at one point on the weaker AUD, however it has since recoiled to 0.9120.

Looking ahead over coming months, political risk in the US of A seems likely to be a major factor in determining US dollar direction in the currency markets.

Ahead of the US mid-term elections for the House of Representatives and Senate in November, President Donald Trump is coming under increasing pressure in Washington as his former advisors take legal immunity and start to talk.

A desperate Donald Trump could be even more unpredictable in behaviour and attitude as his sleazy and shady background is fully revealed.

A change in the lower house to a Democratic Party majority would make life even more unpleasant for the Donald.

The US dollar weakened in late 2016/early-2017 after Trump was elected on political risk concerns, similar risks appear to be ahead of the US currency over coming months.

The outlook and drivers for the US dollar’s direction on global FX markets over the next 12 months, in my opinion, may be summed up in three short bullet points: -

- The foreign exchange markets have now fully priced-in the increase in US interest rates from 0% three years ago to the monetary policy neutral interest rate of 3.00% which will be reached in early 2019. Further gains for the USD on the back of rising interest rates should not be expected from here as the FX markets price-in everything 12 months in advance.

- President Trump’s economic policy gamble to cut corporate taxes, however still increase Federal Government spending at the same time may well come back to haunt him in the form of massive increases in the US budget deficit next year. History tells us that the US dollar has to weaken when they run large budget deficits as there is not sufficient domestic savings in the US economy to fund the shortfall, thus they must attract foreign capital inflows. To entice those offshore funds in, the US needs a lower dollar value as an entry point and higher interest rates. Trump’s policy relies on stronger GDP growth to increase tax revenues, unfortunately his anti-free trade/tariff policies look set to slow GDP growth.

- A poor performance by the Republican Party in the November mid-term elections will be seen by the financial and investment markets as negative for the USD on the political risk factor.

For the above external global FX market reasons, it would be dangerous for local USD importers and exporters to automatically assume that the NZD/USD exchange rate will continue to depreciate.

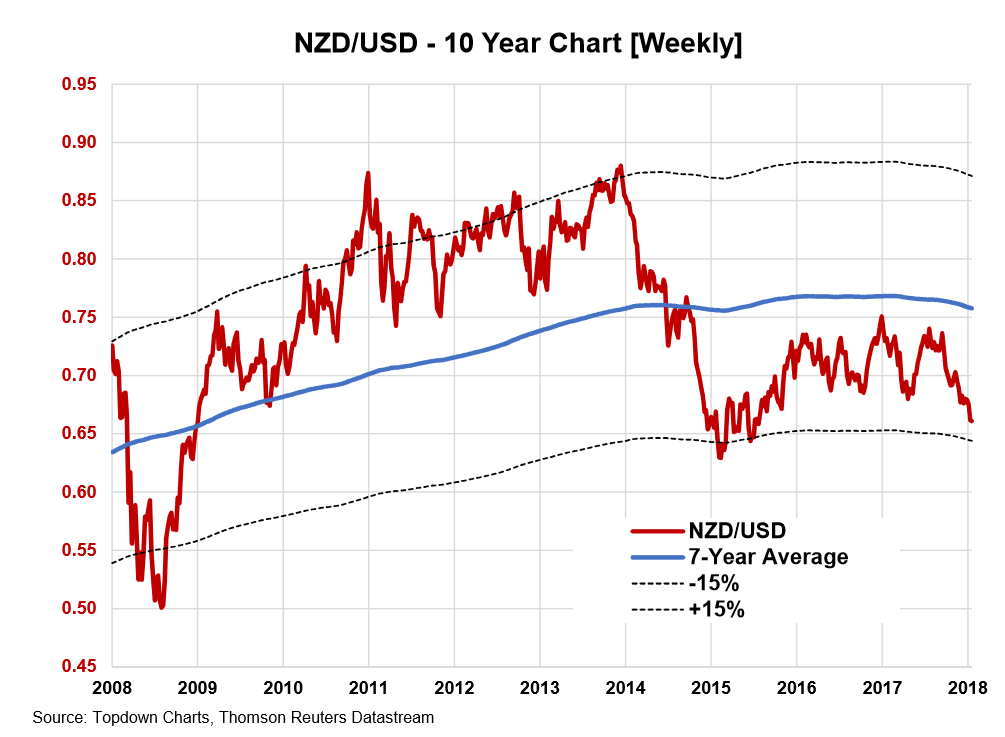

The fall in the rate to below 0.6600 over recent weeks provided the opportunity for USD exporters to lock-in long-term, two to four year forward hedging based on the Kiwi being well below its long-term average (refer chart below).

A decision to not hedge a decent percentage of future USD forecast receipts at these levels could only be interpreted as speculating with the export company’s profits and shareholder’s funds.

Daily exchange rates

Select chart tabs

*Roger J Kerr is an independent treasury Management advisor. He has written commentaries on the NZ Dollar since 1981.

2 Comments

On a more speculative note, what if the US neutral rate is actually 2.5% and Trump wins big time, replacing blood lusting traditional republicans with his own supporters? As to Trump, I have no idea what that would mean, but the lower neutral rate seems plausible to me.

My guess as to the neutral rate is based on Libor and the 2 year Treasury having plateaued at about that level. For a scary chart just expand the Libor chart out to see what follows previous plateaus.

https://fred.stlouisfed.org/series/DGS2

https://fred.stlouisfed.org/series/USD3MTD156N

My thinking come from this article, that the market is better at guessing the neutral rate than central bankers are:

https://www.mcoscillator.com/learning_center/weekly_chart/fed_is_behind…

We live in interesting times.

Trying to second guess, by the minute, what will happen in nanoseconds, can waste hours when and where the debt clock will end up overseas in time to ensure the rapid expansion of fractional reserve issues, based on sheer speculation, since time began, or cash defaults.

That Houses have gone beyond the means, means that a lifetime of debt and drudgery will jump in a linear fashion, based on footage, per square meter whatever the meter-age is, being used.

I have tried exponential measures to quantify, whether I am rich, poor, or just down right, stupid, with left wing leanings.

Please take this with the pinch of salt, that used to be used as money, by traders from the East to the West and vice versa.. We shall always be in debt one way or the other depending on ones measured swing between right, wrong and splitting what one or the other fancies as a safe bleedin bet.

Governments may not be able to count, but a knighthood will be available to whoever can screw us the most....and I think the turn is a left screw, with right hand nuts on top....this turn......World Wide.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.