By Roger J Kerr*

Crude oil prices are starting to dominate the headlines in global financial and investment markets, resulting in direct implications for currency values.

The OPEC oil producing nations are hesitant to increase oil production volumes at this time as they are concerned about over- supplying the market (causing oil price falls) under the assumption that underlying world demand will weaken back next year because of trade wars/lower economic growth.

There is speculation that crude oil prices could spiral higher to US$100/barrel over coming months from the current WTI level of US$72/barrel.

US President Donald Trump is complaining to the Saudis about the rising oil price, however he only has himself to blame with his policies of sanctions preventing Iranian oil supplying the global market and tariff protectionism slowing US and world economic growth (causing OPEC to take their current stance).

Everything Trump does is for his own political purposes, however rising gasoline prices at the pumps throughout the US will not be helping the Republicans chances at next month’s mid-term US elections.

Should the Democrats gain majority control of the House of Representatives and the Senate is a close result, it will be more difficult for Trump to push through his agenda and thus the resulting political risk will be negative for the US dollar’s value.

Back in 2014/2015 when crude oil prices crashed from US$100/barrel to below US$30/barrel on Iran re-entering as suppliers to the global market, the US dollar’s value increased from around 80 on the USD Index to over 100.

As oil prices increase, the oil producing countries need to sell an increased amount of USD’s back into their home currencies, hence the inverse relationship between oil prices and the US dollar value.

In the New Zealand context, the increase in oil prices over recent months has occurred at the same time as a lower NZD/USD exchange rate. A double-whammy impact that will certainly standout in the September quarter’s CPI inflation figures when they are released on October 16.

The RBNZ have stated that they will “look through” any first-round impacts of higher oil prices on NZ inflation (i.e. not change their current marginally dovish monetary policy position).

However, coupled with the lower currency value increasing all imported raw material and product prices, the fuel price increases look set to feed through into more general (second-round) prices across the economy.

As transport, air-fares and freight costs are lifted, goods and services prices need to be increased to maintain business profit margins. There is a risk that the RBNZ may be a little complacent on these future inflation risks at this time as there have been so many false starts on rising inflation in the past.

The difference today is that we are no longer importing global deflation and oil prices are moving the other way.

The RBNZ are currently forecasting +0.4% for the September quarter CPI and +0.3% for the December quarter CPI (released mid-January). Based on recent and likely future pricing behaviour across the economy from cost increases due to currency, oil and wages, there is a certainly a risk that the RBNZ are currently underestimating inflationary pressures and they are therefore forced to adjust their monetary policy stance abruptly i.e. positive for the NZD.

Picking the actual timing of when the RBNZ may be forced to change their tune is always difficult, however as the economic evidence comes through the local FX market will start to price-in the next OCR change being an increase and this will support the Kiwi dollar. The CPI inflation numbers released on 16 October are therefore looking likely to be positive for the Kiwi if the quarterly increase is well above +0.4%.

New Zealand posted a record highest monthly trade deficit (imports greater than exports) of $1.5 billion in the month of August. The increase in imports was largely due to crude oil prices increasing and over the last 12 months the crude oil prices increased 60%.

Many FX market commentators and analysts are predicting further depreciation of the Kiwi dollar to the low 0.6000s due to the interest rate differential between the US and NZ now being negative.

These lower Kiwi forecasts are based on the theory that “hot money” that came into the NZ dollar on carry-trade deals is now set to depart (sending the Kiwi lower) as there is no longer any interest yield pick-up in NZ.

Unfortunately for the Kiwi dollar doomsayers, there has not been any offshore hot money attracted into New Zealand over recent years, therefore there is none to exit. There is a greater probability of Kiwi dollar buying from offshore hedge funds unwinding their “short-sold” NZD positions and local fund managers increasing their currency hedging percentages on overseas equity portfolios.

There is unlikely to be any direct fallout for the AUD and NZD currencies from the Australian Government’s Royal Commission interim report into the conduct of banks and financial service providers. However, it is not a good look internationally in terms of reputation and credibility. One implication for companies with foreign exchange risks is that it will be pointless asking your friendly bank dealer for a view or opinion on future currency direction, as they will not be allowed to give one!

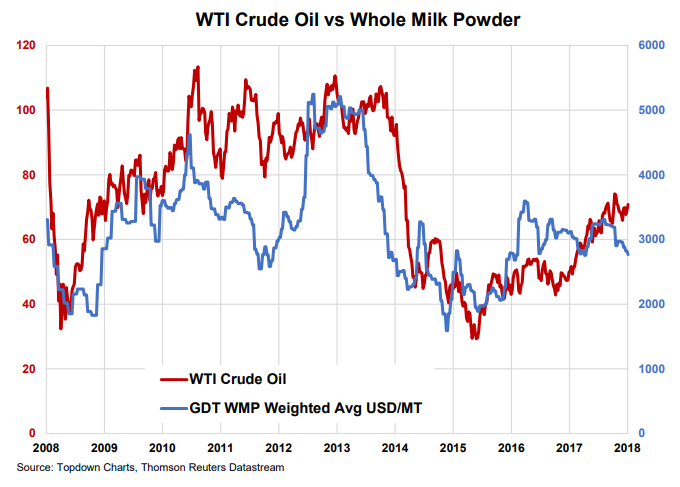

If crude oil prices do increase further towards US$100/barrel, whole milk powder prices (and thus the Kiwi dollar) seem likely to follow them higher.

Daily exchange rates

Select chart tabs

*Roger J Kerr is an independent treasury Management advisor. He has written commentaries on the NZ Dollar since 1981.

8 Comments

Hi Roger.

Firstly, the rising Oil prices and general climate sound more like 2007 to me than 2014.

I'm glad however that you are finally recognising that inflation may require a move up in the Reserve bank rate to support the dollar and also that there is only so long you can 'look through' inflation. The trouble is that you still don't factor in domestic demand and debt levels to you thoughts on the reserve bank policy and once again there is a neglect of how a higher RBNZ rate would impact on heavily leveraged households spending ability. Mr Chaston shared last week that 60% of NZ mortgages come up for a rate renewal within the next 12 months. If rates were to go up before Q3 of 2019 (which is my prediction) that would place a very heavy burden on household spending ability almost immediately. (Given average mortgage is $400k and average investor mortgage $666K). Let's not forget that the banks and their margins are quite exposed too if rates rise to support the NZ dollar and a couple of our larger businesses are also heavily indebted.

I would argue that it is more likely that the RBNZ will let inflation play longer, the dollar to fall further to offer further short term assistance to exporters, before input costs get too out of control, but more importantly to buy time for households to get their debt positions in order over the next 12 months. It's just a view and I'd be keen to understand your thoughts. I still see a much lower NZ dollar over the next 12 months before rates are forced to rise. The household risk is just too great at present with so many renewing debt over such a short timeframe and the banks need to tempt people to spread that risk so that that doesn't happen again 12 months from now? I would offer the view that that is why the 3-5 year mortgage rates are starting to look quite attractive, as an attempt to try and tempt a spread of the mortgage risk the banks carry when 60% of the market come off fixed rates in a single year.

It's just my opinion but I'd keen to hear your thoughts on my views.

These lower Kiwi forecasts are based on the theory that “hot money” that came into the NZ dollar on carry-trade deals is now set to depart (sending the Kiwi lower) as there is no longer any interest yield pick-up in NZ.

Unfortunately for the Kiwi dollar doomsayers, there has not been any offshore hot money attracted into New Zealand over recent years, therefore there is none to exit.

Sorry Roger but the yield spread is still massively important. Even if there haven't been hot money flows (and there certainly has been hot money flowing into real estate), who's to say that Kiwis (and their Kiwisaver funds and cash funds and bond funds) won't go chasing higher yields offshore? It's wrong to say yield spread doesn't matter, it does.

Can the RBNZ move into a tightening cycle if you import inflation via Oil in todays world?

If the RBNZ did move to tighten and with business confidence tracking down - tightening or indicating rates are going to tighten could have a very negative affect on the economy. And by tightening rates - how exactly does that offset the inflation driven by something you have no control over - namely the price of oil.

If the RBNZ did move to a tightening bias or even hike rates - you would expect the $ to rise - export incomes reduced (with commodity prices already tracking down) and heavily indebted households having to potentially reduce spending due to higher interest rate costs - easy to imagine how quickly the economy could flip into a nasty downtrend.

Don't forget Oil is sold in US $ but we need to convert NZ$ to buy it. If our currency keeps weakening at a time the price of oil rises as well its a double whammy on inflation. be prepared for $2.50 per litre pretty soon.

Exactly, Nic, That's why I quote the Pollyanna Budget assumptions every Friday: TWI and WTI. If TWI sinks and WTI embiggens, then the inflation attributable to imports (which, too, y'all will recall, are carried here not by sunbeams and breezes but by jet fuel and bunker oil) is only gonna go one way.

The other factor to bear in mind is timing. With an Interesting election looming in 2020, and lags of 6 months to 2 years in most 'economic levers' (a delightfully mechanical analogy....) effects, the RBNZ will likely come under considerable pressure to not 'Influence Fings' as the fateful day approaches.

Or, bob each way, and donning the Pixie Dust and Unicorn Grease hat, All will be Well......

In 1967, the US (and the rest of us) was insulated from oil-tap turnoffs. In 1973 (post the US Peak) that had changed and all hell broke loose. It proved one thing - Kissinger knew what he was about linking the USD to oil. Since then discoveries have decreased sequentially, the only blip being the US Bakken/Eagle Ford shale plays - piss-poor EROEI but a card you can play - once - at a time which might suit you strategically. Whether they are playing strategically or just blundering along in business fashion, is an interesting question.

But it seem that above about 80US/barrel, 'economies' move into 'recession' - although because GDP is a blindsided measure it hard to measure the measure. Infrastructure lack-of-maintenance seems to have been the fudge-factor, an increasing stress on CG's and LG's everywhere - particularly the US. That deferred maintenance requires ever-more energy per year deferred, so the potential for the bidding to get frantic, is there.

The joke being that the bidding is with debt which can never be repaid due to lack of future energy (quality being the issue, sometimes reflected in Capex and therefore in price - presuming the extractor expects to break even at least). What happens when the unrepayable-ness of the debt outstanding becomes apparent to the masses, is the interesting question of our times. The worry isn't about relative currencies - it's about whether any currency will be trusted/believed. We went close in 2008 - we've been draining the reserves at record pace since then, betting ever-more on tomorrow. Interesting times.

This is only a matter of time: why is China so keen on alternative energy? Because it is working towards a date in the near future when they were no longer be dependent on oil. If we transition our car fleet, this will no longer be such a big problem.

My question is where is Iran's oil going? My guess is Russia or China, and they are not paying $72 , and not paying in USD.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.